Robocash Review Summary

Robocash, a Croatian P2P lending platform, specializes in short-term consumer loans backed by a 30-day buyback guarantee and annual returns of up to 10.5%. Operated by UnaFinancial, a reputable financial group, the platform has maintained a strong track record since its launch in 2017, with no reported losses for investors.

Key features include Auto Invest for portfolio automation, a secondary market for liquidity, and commercial loans funding its expansion in Southeast Asia. Robocash offers stability and reliable returns, making it ideal for investors seeking consistent performance over rapid portfolio deployment.

Key takeaways from our Robocash Review:

- Easy-to-use platform

- 30-day-buyback guarantee

- Backed by an established finance group

- Limited diversification

- Occasional cash drag

The loan availability on Robocash is currently limited, which means you may not be able to invest your deposited funds right away. If you're considering using Robocash, be prepared to wait several days or even weeks until your funds are fully invested.

Our Opinion of Robocash

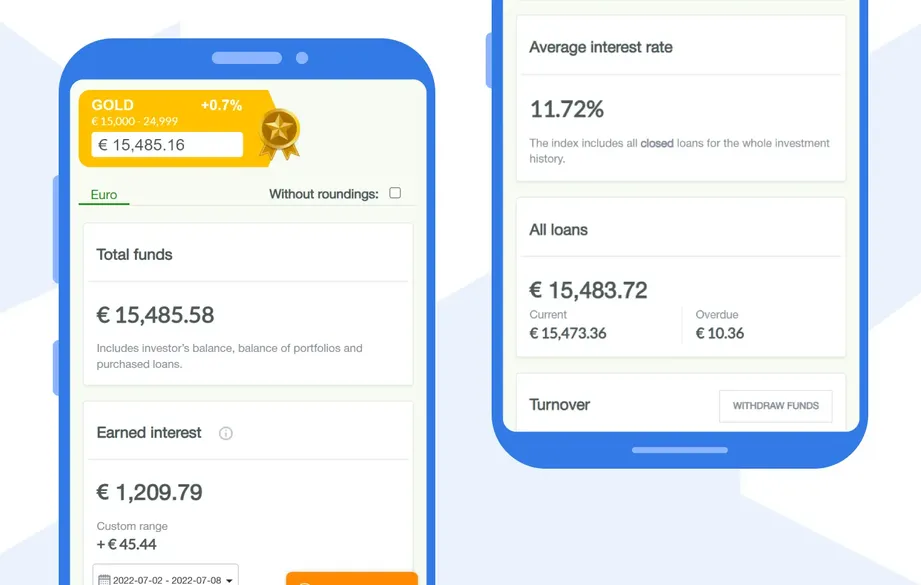

Our experience with Robocash since 2018 has been largely positive. Backed by UnaFinancial, the platform has delivered consistent returns and operational stability across various market cycles. At times, our portfolio exceeded €20,000, generating an average return of 11.72%.

The platform has built a solid reputation for reliability. Notably, no investor capital losses have been reported as of month year. Robocash also distinguishes itself through transparency, regularly publishing UnaFinancial’s audited consolidated report, which is rare in the P2P sector.

However, our latest risk assessment takes a more cautious stance. UnaFinancial’s recent financials highlight several structural weaknesses:

- Extreme Leverage: The debt-to-equity ratio has surged from ~11.3x in 2023 to ~25.1x in 2024, significantly increasing financial fragility.

- Rapid Equity Erosion: UnaFinancial lost over half of its equity within a year, leaving just $4.25M to absorb potential losses, which is barely enough to withstand even a short period of underperformance.

According to UnaFinancial’s CFO, the asset decline in 2024 was driven by the group’s exit from Vietnam. Currency fluctuations further amplified losses, as consolidated results are reported in USD while lending operations run in local currencies such as the Kazakhstani tenge and the Philippine peso.

While Robocash has historically provided strong returns and a smooth user experience, the deteriorating financial condition of its parent company raises serious concerns.

We now classify Robocash-linked investments as high risk. Most of Robocash’s loans are funded via a business loan in Singapore, yet there is no transparency regarding how these funds are allocated.

The management shared with us that a portion of the funds from the business loan in Singapore is used to finance the early-stage growth of Una Moliya's loan portfolio in Uzbekistan and expansion in the Philippines. Greater visibility into the financials of individual lending entities is not planned.

Without major restructuring or a fresh equity injection, UnaFinancial’s outlook remains uncertain. Since the group does not offer a genuine guarantee for its lending subsidiaries, investors should proceed with caution. We continue to monitor the situation closely and recommend reviewing your exposure in light of these developments.

Are you ready to earn passive income on Robocash?

What is Robocash?

Robocash is a (peer-to-peer) P2P lending platform registered in Croatia. The platform's primary focus is to fund short-term loans secured by its 30-day buyback guarantee and an annual yield of up to 10.5%.

Robocash was founded in 2017, and since then, it has paid more than €33 M to more than 40,000 investors. Is Robocash safe? Let's find out more about this platform in our Robocash review.

Pros

- Reliable buyback guarantee

- Secondary market

- Best performing platform in year

- High liquidity (typically within 24 hours)

Cons

- Manual investments are not supported

- Limited diversification and loan availability

- Suspended lending license in the Philippines

- No insight into the group's portfolio distribution

- No group guarantee

Do you prefer to watch a video? Here is all you need to know about Robocash.

Robocash Referral Code

Many P2P lending platforms offer a sign-up bonus, special promos, or cashback for new investors. Robocash used to provide a 1% cashback bonus during the first 30 days after your registration.

As the company doesn't need to acquire additional investors, Robocash has removed the bonus for new investors for the time being. Should the platform reintroduce a reward for our readers, we will update this review to reflect the new terms.

There is no need to type in any Robocash Referral Code as the company has paused the referral program.

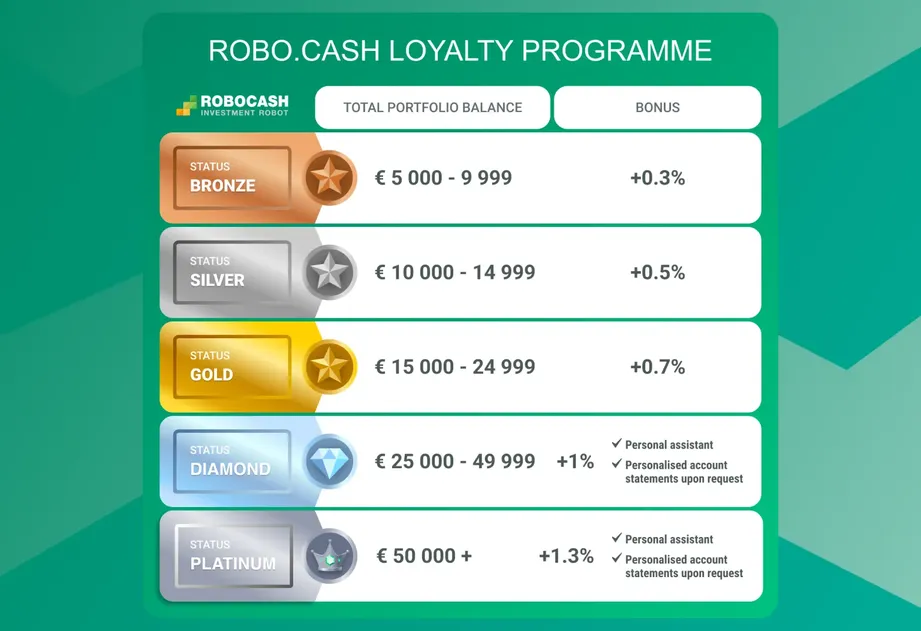

Robocash's Loyalty Bonus

All Robo.cash investors can earn up to 0.8% in addition to the current rate of 9% to 12%. You will receive 0.5%, 0.8% to the basic interest rate when your total portfolio balance reaches €20,000 and €50,000 accordingly.

Get up to 12% interest on Robocash

Requirements

To be able to invest in Robocash, you'll need to meet the following requirements:

- Be over 18 years old

- Have a European bank account in your name

- Reside within Europe

If you don't have a bank account, we suggest opening a free Wise account, which is further explained in our Wise card review. Alternatively, you can also read the N26 review to learn how to use the N26 bank to transfer funds to Robocash.

If you don't have a bank account in euros, your deposit will be exchanged for euros at the current exchange rate. Please ensure you send your money from your EUR account for Robocash to accept.

🧾Does Robocash deduct taxes?

Robocash does not charge taxes on your profits. You can download account statements from your dashboard, which you may submit to the tax authorities where you are a tax resident when you file taxes.

Risk & Returns

When investing in P2P lending, you want to protect your investment. To do this, you need to evaluate the ratio between the risks and the returns.

So, let's examine the risks and returns to determine whether Robocash is the right platform for you.

Like most peer-to-peer lending platforms that list microloans, Robocash also offers a buyback guarantee.

Let's determine how much interest you will earn based on your deposits with our Robocash calculator.

Buyback Guarantee

The buyback guarantee on Robocash differs from that of many other P2P lending platforms. While platforms like Esketit and PeerBerry offer a 60-day buyback guarantee, Robocash's period is only 30 days.

You don't have to wait two months for the buyback guarantee to activate before receiving your money back.

Another benefit of this feature is that the loan originator pays back the outstanding amount, including interest for the delayed period.

This is exceptional - most loan originators on Mintos don't cover both.

This means your money on Robocash is continuously earning interest, even though the borrower is late with its payments.

Interest Rates

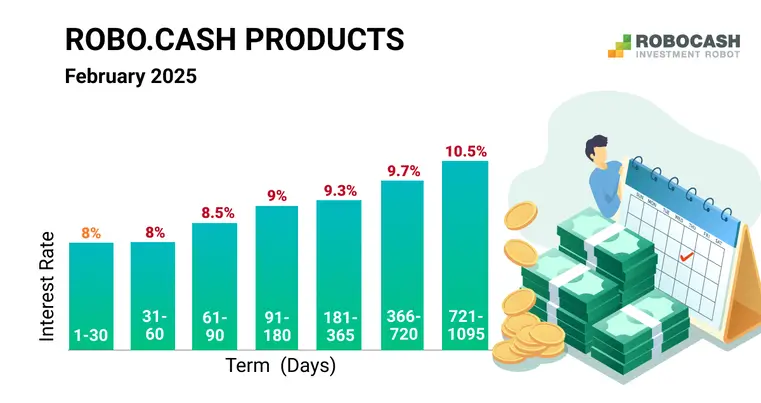

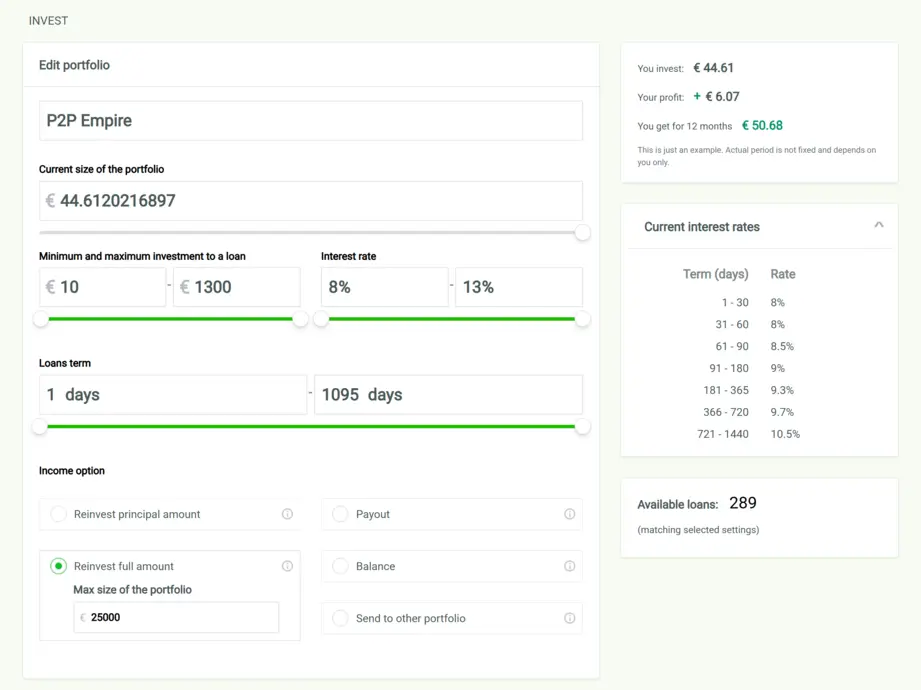

Robocash offers interest rates that depend on the loan period of your investment. Currently, Robocash has increased the interest rates by up to 10.5% per year.

Is Robocash Safe?

Many P2P investors ask whether their investment in a specific platform is safe.

In 2020, several seemingly legitimate platforms ceased operations, resulting in millions of euros in losses for investors. In year, there are still scams that you should avoid.

There is no guarantee that this cannot happen with any platform.

However, conducting due diligence on the platform you plan to invest in can increase your chances of making the right investment decision.

Let's have a look at our background check of Robocash.

Who Runs the Company?

Sergey Sedov founded the Robocash investment platform and is currently the CEO. He took over from the previous CEO Natalya Ischenko, who was promoted from COO.

Ready to get personal with Robocash? Watch the latest business update to understand the UnaFinancial Group better.

Who is the Company's Legal Owner?

Sergey Sedov is the legal owner of seven companies within the UnaFinancial Group, including the Robocash Investment Robot, where you can invest in consumer loans from Robocash's loan originators.

Are There Any Suspicious Terms and Conditions?

We always read through the terms and conditions to decrease the chance of fraudulent behavior. We look mainly at the following clauses:

- Are the user's funds segregated from the company's funds?

- Does the platform inform the users about changes in T&C in advance?

- Are there any other T&C worth mentioning

Let's look at what we found in Robocash's T&C.

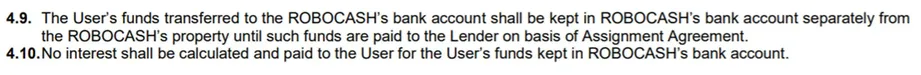

Clause 4.9 - Storage of Your Funds

In section 4.9, Robocash informs you that all your funds are in a bank account separate from Robocash's property. It's also worth noting that you won't earn any interest if you do not invest your funds.

This clause gives you good legal ground if the platform decides to disable withdrawals or introduce limits to withdrawing and depositing funds. However, a dedicated IBAN account like you get on EstateGuru would increase the safety of your funds even more.

Robocash processes your deposits and withdrawals using the 3 S Money payment provider. While Robocash has ties to its operations in Russia, investors' funds don't transact through this country; they are directly transferred to Robocash's headquarters in Singapore.

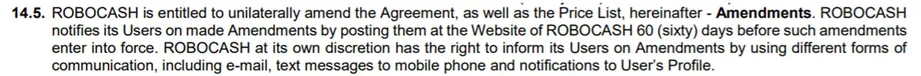

Clause 14.5 - Amendments

In section 14.5, you learn that Robocash reserves the right to change T&C with prior notice of 60 days.

This is excellent news, as many P2P platforms don't notify users before changing the terms and conditions.

Do Investors Have Access to Individual Loan Agreements?

While most investors ignore the assignment agreements, they give you excellent legal ground in the worst-case scenario, where the platform goes out of business.

You can download all assignment agreements under My Investments → Investment number. All agreements are available as Microsoft Word Documents rather than PDF files.

Robocash also allows you to download the entire loan book.

Usability

Robocash is very easy to navigate, and even if you are starting out with P2P lending, you won't have a problem getting around.

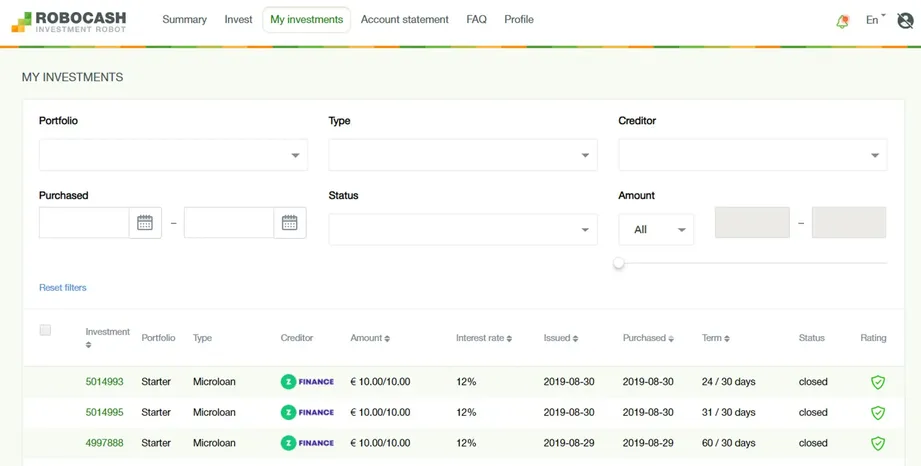

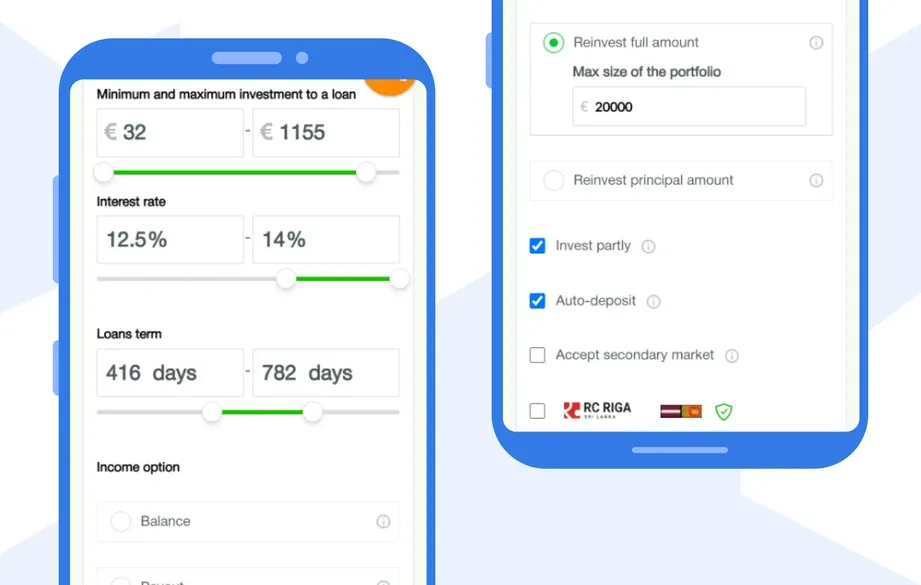

Auto Invest

Robocash doesn't allow you to invest manually. Before investing in loans, you must deposit your money and set up your Auto Invest.

The minimum investment amount per loan is only €1, making diversifying your portfolio much easier.

What you should keep in mind, however, is the availability of loans from individual lenders.

You can define which loans you prefer to invest in your portfolio settings.

Robocash's Auto Invest allows you to define your:

- portfolio size

- minimum and maximum investment amount

- interest rate

- investment period

- loan originator

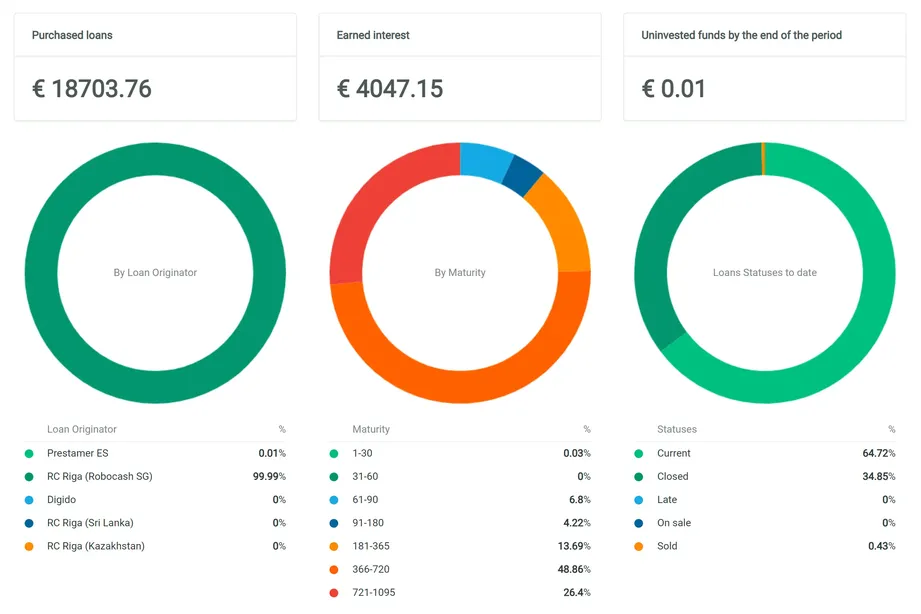

Our Robocash Auto Invest portfolio allows us to invest in all lending companies that list loans with a predefined loan duration. We are currently only invested in loans from Singapore. We have also extended our investment term to increase the return of our portfolio on Robocash.

Commercial Loans From Singapore

Experienced investors have likely noticed that Robocash's loans from Singapore are never delayed. The reason for this is the loan type. By investing in Robocash's commercial loans in Singapore, you are investing in Robocash's development in Southeast Asia. You are lending money directly to Robocash instead of funding borrowers' loans. The cash is partially used to support Robocash's loan book in various countries. You can review the specific country risk here.

When The Auto Invest Is Not Working

The loan availability on Robocash is limited. If you want to invest your money fast and don't have a diversification strategy in mind, we suggest including all lenders and broadening the auto invest criteria to maximize the number of eligible loans.

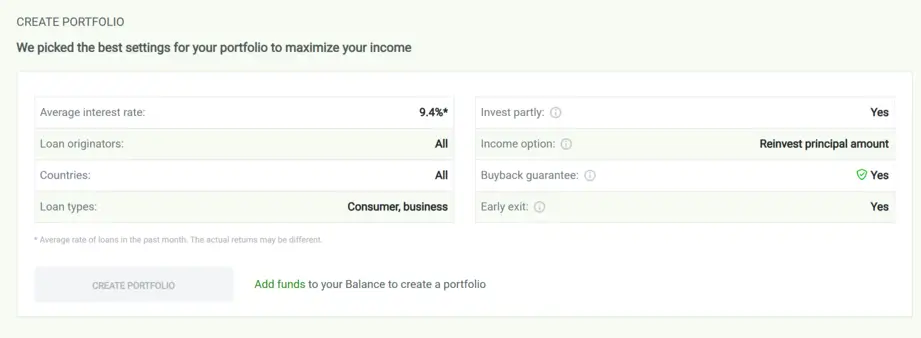

Alternatively, you can also set up a "One-click" portfolio, which means that Robocash will define the auto-invest settings for you to maximize diversification and deploy as many funds as possible.

You can access this view by clicking on Invest -> Create Portfolio and selecting the One-click portfolio.

If you're hesitant to invest with a specific lender or find yourself unable to deploy your uninvested funds, exploring alternative platforms to Robocash may be a smarter choice.

Portfolio Overview

Although Robocash doesn't frequently develop new features, the company has recently introduced portfolio statistics, enabling you to visualize your current investment portfolio.

Liquidity

Liquidity is another factor you probably don't think about, but it's essential.

We never know when there will be a financial downturn or other investment opportunities you're interested in, but we know that you'll want quick access to your capital when these times occur.

Robocash offers a secondary market for all its investments, meaning you can sell your investments and exit the platform within a few days.

Investing in P2P marketplaces or P2P lending sites that fund short-term loans makes your investments more accessible.

So far, Robocash has always fulfilled its obligations, and there are no reports of investors who have had terrible experiences with Robocash's liquidity. You don't need to pay attention to pending payments, suspended lenders, or funds in recovery.

Robocash was also one of the platforms that did not struggle during the COVID-19 outbreak in 2020. The group made over $20 M in profits that year while fulfilling all obligations toward investors. In 2021, the finance group made a profit of $28 M. Even in year, the platform still manages to fulfill its commitment to investors despite the economic challenges caused by the conflict in Ukraine.

Support

The customer support is quite responsive.

Any queries we've had have been answered within 48 hours. You can contact them via email (support@robo.cash) or give them a call at +385 1344-58-18. You can also fill out their contact form; the team will reply as soon as possible.

Even though Robocash is a small P2P platform registered in Croatia, it provides decent support most of the time.

The best way to connect is to use Robocash's Live Chat function directly on the website.

While the loan availability on Robocash is relatively low, it is still one of the sites' most reliable P2P lending platforms.

Robocash Alternatives

Robocash is a reliable platform, but investing in month year can be challenging due to the low availability of loans. If you are considering financing a larger amount of money, it's impossible now. Instead, consider exploring some Robocash alternatives that won't suffer from cash drag.

Esketit

If you appreciate the reliability of Robocash, you should look into Esketit, which offers up to 11% interest and a reliable buyback guarantee.

The platform funds loans only from lenders founded by the owners of Esketit, which decreases the risk as the management has complete control over the risk management. Esketit is one of the most popular platforms in month year. Learn more about how the platform works in our Esketit review.

Fintown

Fintown is a Czech-based crowdlending platform raising funds to develop and rent properties in Prague. The platform pays monthly interest if you invest in the available rental units.

Fintown offers between 8% and 13% interest on your investments, depending on the length of the lock-up period. If you're seeking a reliable platform to deploy your funds quickly without cash drag, Fintown could be a suitable option.

Learn more about how to earn passive income in our Fintown review.

LANDE

LANDE might be a good fit for you if you want to diversify your investments across various loan types. The platform has an excellent track record in funding agricultural loans from Latvia.

Crops, insurance, and other types of collateral back all your investments. Instead of funding payday loans on Robocash, you are financing loans to farmers who use the money to produce food. Learn more about how to earn a sustainable income of up to 11% per year in our LANDE review.