EstateGuru Review Summary

Our community has voted EstateGuru the worst crowdlending platform of year due to numerous delayed and defaulted loans. This surge in problematic loans has severely impacted investor confidence and overshadowed the platform's previous reputation.

Main takeaways from our EstateGuru review:

- Worst-rated platform by our community

- Mortgage-backed investments

- Poor risk assessment

- More than 50% of loans are in recovery

Not sure about EstateGuru? Try some suitable EstateGuru alternatives.

What is EstateGuru?

EstateGuru is an Estonian crowdlending platform that offers investments in mortgage-backed loans. The platform offers attractive yield, however, due to its aggressive expansion strategy, the advertised return isn't realistic for broadly diversified portfolios.

As of month year, over 50% of the platform's outstanding portfolio is in default. Learn more about EstateGuru in our EstateGuru review.

Pros

- Well-developed crowdlending platform

- Individual bank account from Lemonway

Cons

- 3% secondary market fee

- 0.05% AUM fee

- €3 withdrawal fee

- €10 / month inactivity fee for investors who have not invested in the past 12 months

- High default rate

Our Opinion of EstateGuru

We have been investing in EstateGuru for several years and have even met with the team in Tallinn twice to visit some real estate projects and discuss the management.

While EstateGuru is a licensed crowdlending platform, its issues are mainly connected to risk management. The platform's quick expansion has backfired. As of month year, over half of the outstanding portfolio is in default.

In the past, EstateGuru has always managed to retrieve the outstanding balance with a positive return for investors. It's not clear whether the platform will be able to recover investors' funds this time.

You can review our P2P lending comparison page to analyze EstateGuru's portfolio quality compared to other P2P lending platforms.

Requirements

To sign up on EstateGuru and invest in property-backed loans, you need to pass the following new user requirements:

- Be over 18 years old

- Have a European bank account

- Pass the investor suitability test

No EUR bank account? No problem

- 💳

- 💳

You can invest on EstateGuru even if you reside outside of Europe as long as you have a European Bank account which is required to deposit funds to your new Lemonway bank account offered by EstateGuru. This increases the safety of your uninvested funds on the platform.

🧾 Is EstateGuru withholding taxes?

EstateGuru does not withhold taxes. You must declare your earnings in the country where you are a tax resident. EstateGuru lets you download tax statements to add to your annual tax report.

Risk & Return

Are you wondering whether investing on EstateGuru is safe? Let's have a look at the securities.

Secured Investments

The key advantage of investing on EstateGuru is the security provided by a mortgage-backed structure. This collateral-based protection, in theory, offers more substantial assurance than buyback guarantees commonly found on platforms like Mintos, Esketit, or Lendermarket.

However, even with a first-rank mortgage in place, there is no absolute guarantee against potential losses. Investing in high-yield loans is not equivalent to the safety of a savings account. EstateGuru’s risk team conducts thorough due diligence for each project, assessing the profitability of the real estate deal, analyzing the borrower's exit plan, and evaluating their ability to repay both principal and interest.

Most EstateGuru borrowers are seasoned developers engaged in purchasing, building, or renovating properties for resale at a profit. Conversations with EstateGuru’s co-founder and head of risk and innovation revealed that, under favorable market conditions, developers can achieve an annual profit of up to 30% on real estate projects.

Typically, borrowers finance only about 50% of the required funds through EstateGuru, keeping their effective borrowing cost at around 5% per year, given a 10% interest rate. The anticipated profits from completed projects generally cover these financing costs comfortably.

Despite the collateral-backed structure, EstateGuru has experienced significant defaults, locking up over €130 million of investor funds—currently the highest defaulted loan portfolio in the industry.

As of month year, several loans have been in default for over two years with no significant loan updates.

Assess the Risk Yourself

If you are cautious about money, you want to invest on EstateGuru and inspect every project before investing manually. It's not required, but it's good practice for those ready to become serious about investing on EstateGuru.

Risk Management

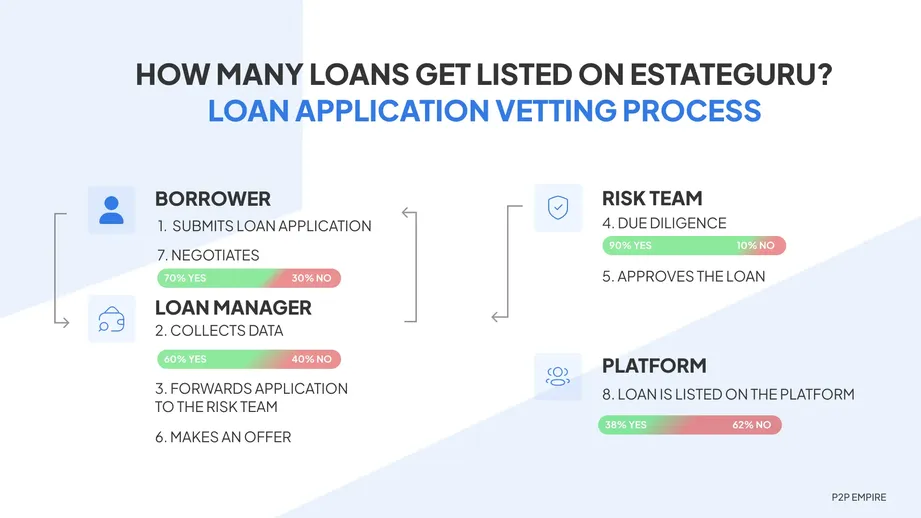

EstateGuru strives to become the most professional crowdfunding platform in Europe, following a structured risk management process for every listed project.

Each project undergoes a valuation from certified real estate appraisers, and multiple team members review all relevant documents before the credit risk committee grants approval.

However, real-world results reveal that this process is far from foolproof, as EstateGuru currently holds the industry’s highest rate of defaulted loans.

Despite its rigorous approach, EstateGuru’s performance underscores the limitations of its risk management practices.

Inactivity Fee

Effective immediately, an inactive account fee will be applied to accounts with no new investments within 12 months. Here's what you need to know:

- A €10 fee will be charged after 12 months of inactivity.

- A €50 fee will be charged after 24 months of inactivity.

- Before any fee deductions, investors will receive an email notification.

- Investors can avoid the fee by withdrawing their available balance free of charge before the fee is applied.

- Fees will not be deducted from accounts that have made small investments or withdrawn available funds.

- Accounts will not be overdrawn, and no invoices will be issued for these fees.

This policy encourages investors to stay active or withdraw their funds. EstateGuru provides the means to do this free of charge.

Is EstateGuru Safe?

Are you wondering who's behind the platform and whether the terms and conditions are legitimate? We have done the homework for you. Check out our results.

Who runs the company?

EstateGuru is founded by Marek Pärtel and Kaspar Kaljuvee. Mr. Pärtel is currently the board chairman, and Mr. Kaljuve is leading the department of Risk Innovations and Risk projects.

EstateGuru’s CEO is Mihkel Stamm, who has been with the company since its inception.

Who is the company’s legal owner?

CEO and Co-founder Marek is joined by Mr. Kristjan-Thor Vähi, who currently acts as a passive co-founder within the platform.

Other partners and co-founders also include Mr. Marko Arro (responsible for the financial side) and Mr. Kaspar Kaljuvee (who takes care of the risk side).

Are there any suspicious terms and conditions?

Are you ready to read through 25 pages of fine print? No? We thought you’d say that, so we’ve done it for you, and here’s what we found.

Clause 12 - Debt Collection Explained

During our investment journey on EstateGuru, we talked to various management people, including Andres Luts, the Chief Risk Manager at EstateGuru. If you want to learn more about debt collection, you can watch our interview here.

It’s good to see that this process is also mentioned in EstateGuru’s terms and conditions.

Here is one of the funded projects we have had the chance to visit during our on-site due diligence in Tallinn.

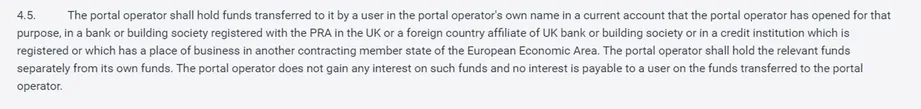

Clause 4.5 - Storage of Funds

EstateGuru currently stores your funds in EstateGuru's bank account, which is separated from other companies' business accounts.

EstateGuru confirmed that it's currently working to introduce dedicated IBAN accounts in partnership with its partner Lemon Way. Most investors have already received a new IBAN account, which increases the safety of uninvested funds.

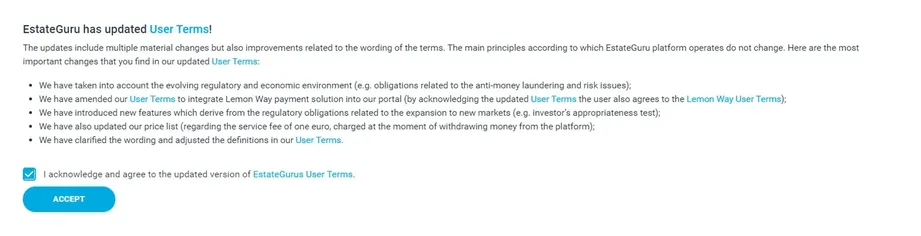

Clause 15.1 - Amendments

EstateGuru can amend the terms and conditions without prior notice.

This is one of the few things we dislike about EstateGuru.

Fortunately, EstateGuru listened to our suggestions, and from now on, you will be notified about any changes when logging into your account.

While EstateGuru won't notify you in advance, it's certainly a good step towards being even more transparent with you.

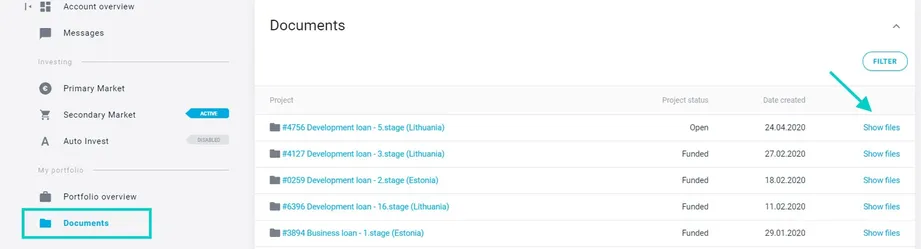

Do Investors Have Access to Individual Loan Agreements?

Investors on EstateGuru do have access to individual loan agreements. You can view them in the Documents section of your investor’s account.

In our due diligence review of EstateGuru, we did not find anything unusual or suspicious regarding the team members. However, given the platform’s poor loan performance, we would not consider EstateGuru a safe investment option.

Usability

Whether you're new to investing or already active on other platforms, EstateGuru offers a straightforward and user-friendly experience. You can choose to invest manually, selecting each opportunity yourself, or set up an Automated Strategy to let the platform handle your investments for you.

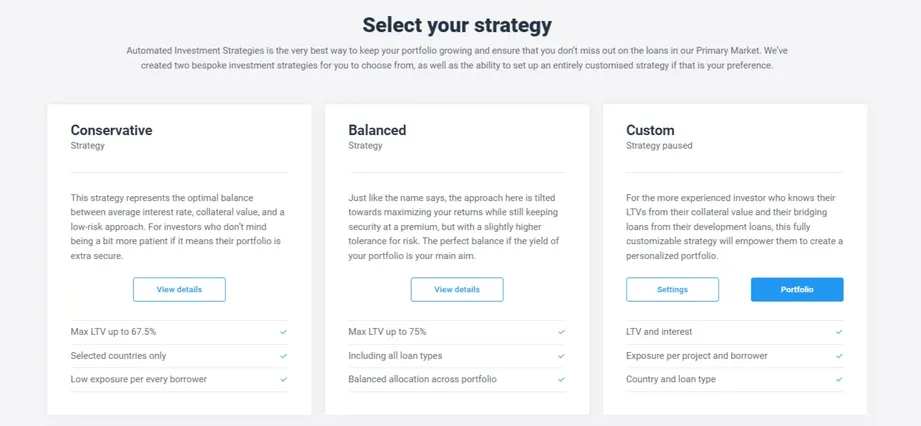

Automated Investment Strategies

EstateGuru has recently upgraded its Auto Invest and introduced a new way to diversify your portfolio with Automated Investment Strategies.

You can choose between three strategies:

- Conservative

- Balanced

- Custom

Conservative Strategy

The pre-defined conservative strategy will diversify your portfolio across loans with the following characteristics:

- LTV up to 67.5%

- Only Bullet (incl. Annuity) Loans

- No Stage Loans

- Only bridge loans, business loans and development loans

- Only Loans from Estonia, Germany, Finland, Lithuania, Latvia

- Max. exposure per loan can be customized

- Only first-rank mortgages

- Up to 18 months

Balanced Strategy

The balanced strategy suits investors who prioritize higher returns and lower cash drag. It comes with the following pre-defined settings:

- LTV up to 75%

- Stage Loans are included

- All Countries are included

- Max. exposure per loan can be customized

- Any loan securities are accepted

- Up to 60 months

Custom Strategy

The custom strategy is the improved Auto Invest with new settings that let you define the exposure to a single project and individual borrowers.

The most significant benefit of all strategies is that you can use them with minimum exposure to a loan from €50.

It's important to note that, regardless of the chosen strategy, EstateGuru’s loans carry a risk of default. Even loans within the "Conservative" strategy have defaulted, resulting in millions of investors' funds being locked up.

EstateGuru’s automated strategies primarily serve as a tool for the platform to allocate uninvested funds from users who may not actively monitor their accounts or prefer not to invest manually.

Investing On EstateGuru Manually

When investing smaller amounts on EstateGuru, the basic Auto Invest feature offers limited control over your investment criteria. To tailor your portfolio more precisely, consider the following factors when selecting loans manually:

- Loan Period: Opt for loans with shorter durations to maintain portfolio liquidity. Many investors prefer loans with terms up to 12 months, though extending to 24 months can be acceptable.

- Interest Rate: Aim for loans offering annual interest rates between 10% and 11%. While higher rates are attractive, they may come with increased risk.

- Loan-to-Value (LTV) Ratio: A lower LTV indicates a higher collateral value relative to the loan amount, reducing risk. Consider loans with an LTV of 65% or lower.

- Repayment Schedule: Prefer loans with annuity or bullet repayment schedules, which provide regular payments and early indicators of borrower reliability.

- Mortgage Rank: First-charge mortgages offer greater security, as they prioritize repayment in case of borrower default.

- Borrower Background: Research the borrower's history and financial health. A strong track record can indicate a lower risk of default.

- Collateral Details: Assess the nature and location of the collateral. Properties in high-demand areas are generally more liquid and retain value better.

- Valuation Reports: Review third-party valuation reports to verify the collateral's market value.

- Loan Purpose: Understand how the borrower intends to use the funds, as certain purposes may carry different risk levels.

- Diversification: Spread your investments across multiple loans to mitigate the impact of any single default.

Even with a thorough evaluation of projects on EstateGuru, there is always a risk of loan defaults.

Most loans come with terms of at least 12 months, and since repayment typically occurs at the end of the loan term, the borrower’s financial situation may shift significantly compared to the initial risk assessment.

This time gap means that even a well-evaluated loan can face unexpected challenges, leading to potential delays or defaults by the end of the term.

Liquidity

With EstateGuru, your funds are generally committed for a minimum of 12 months. However, you have the option to use the secondary market to exit your investment before the term ends.

Keep in mind that if your portfolio has a high default rate, the liquidity of your investments is limited. A higher number of defaulted loans reduces your ability to sell assets, impacting liquidity. Given that a substantial portion of EstateGuru’s loan portfolio is in default, we assess the platform as largely illiquid.

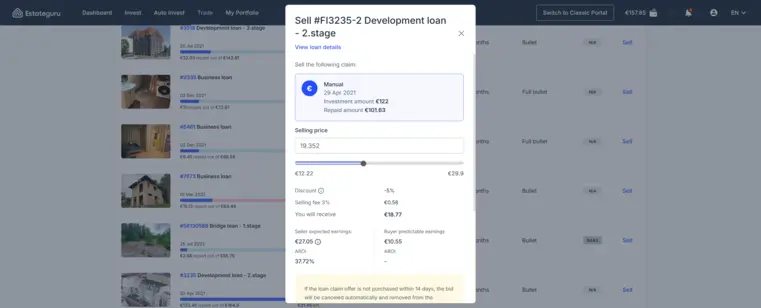

Selling on the Secondary Market - Trade

On EstateGuru's secondary market, you can list your investments at a premium or discount. However, despite being labeled "Trade," this is not a true trading platform.

Sellers incur a 3% fee when selling investments, and buyers should note that they cannot resell any claim within the first 30 days of purchase.

To sell your claims, navigate to "Trade" and select "Sell your loan claims." You can then list loans for sale, setting a price that remains valid for 14 days. If the loan doesn’t sell within this period, the listing is automatically canceled.

It’s also worth noting that selling defaulted loans can be challenging. Investors tend to avoid purchasing defaulted loans, so you may have to hold these assets until they’re recovered.

As of month year, there are hundreds of defaulted loans offered on EstateGuru's secondary market with a 40% discount. Selling non-performing loans may be difficult.

Do you enjoy this review? Invite us for a coffee ☕

Support

When we reached out to EstateGuru for clarification or further details on specific features, they were able to provide answers to all our inquiries.

However, it’s important to note that EstateGuru tends to be unreceptive to critical feedback, and specific information is frequently withheld from the investor community.

While EstateGuru’s CEO is generally open to interviews and willing to address challenging questions, his responses often lack depth, and proposed plans have frequently proven ineffective or inaccurate.

EstateGuru Alternatives

In year EstateGuru is experiencing many defaulted loans, so investors often look for alternative platforms that provide a better return on investment. Here are three EstateGuru alternatives worth considering.

LANDE

While EstateGuru offers investments in real estate loans, LANDE offers up to 12% on agricultural loans. Investing in agricultural loans funds European farmers who produce essential crops for the food industry. LANDE's loan portfolio performance has been excellent, which is why it's also one of the highest-rated platforms on P2P Empire. Learn more about how to earn passive income in our LANDE review.

Crowdpear

If you like investing in real estate loans but prefer to earn interest on a platform that takes a more conservative approach on risk assessment, Crowdpear might be a good fit for you. This regulated crowdfunding platform from Lithuania offers investments in real estate loans in and around Vilnius. Learn more about how to earn up to 11% interest in our Crowdpear review.

Fintown

If you don't want to bear the borrower risk you must consider when investing in real estate loans, then Fintown might be worth considering. This newly launched Prague-based platform offers investments in rental properties with high occupancy.

Your funds will fund short-term rental units in Prague's city center. You don't bear any risk that the borrower won't repay the loan, as the income is generated directly from the rental yield. Learn how to make 12% on Fintown in our Fintown review.