Esketit Review Summary

Esketit is widely regarded as one of the most reliable P2P lending platforms in Europe, delivering an average return of around 11%. Since its launch in 2020, the platform has maintained a strong portfolio performance with minimal disruptions.

One of Esketit’s standout features has long been its automated investment strategies, which provided quick liquidity under normal market conditions, a key advantage for many investors.

However, following the platform’s migration to Croatia, investors who remain under the Irish entity have lost access to the secondary market and the cash-out option, effectively locking them into their existing long-term loans until repayment.

Combined with the ongoing changes in portfolio composition and the recent exit of Esketit’s primary partners, Avafin and Money For Finance, these developments make it increasingly important for investors to reassess their position and carefully evaluate the risk–return balance of the remaining loan originators.

Main Takeaways From Our Esketit Review:

- 60-day buyback obligation on most loans

- Higher interest rates

- Operating from Latvia

What is Esketit?

Esketit is a P2P lending platform owned by the founders of the international lending group AvaFin (formerly CreamFinance). On Esketit, you can invest in loans mainly in business loans from Latvia, Spain, and the UAE, with an average annual return of 11%.

Is Esketit worth your investment? Find out in our in-depth Esketit review.

Pros

- Reliable buyback guarantee

- High interest rates

- Modern P2P lending platform

- No fees

Cons

- Not regulated

- Limited loan availability

- Limited financial reports for many of Esketit's lending partners

- No liquidity due to the recent move to Croatia

Learn more about the recent events on Esketit in our video review.

Our Opinion Of Esketit

Esketit has long been considered one of the most reliable P2P lending platforms in Europe, earning a strong reputation among investors thanks to its stable performance, user-friendly features, and consistent returns, even during periods of geopolitical uncertainty.

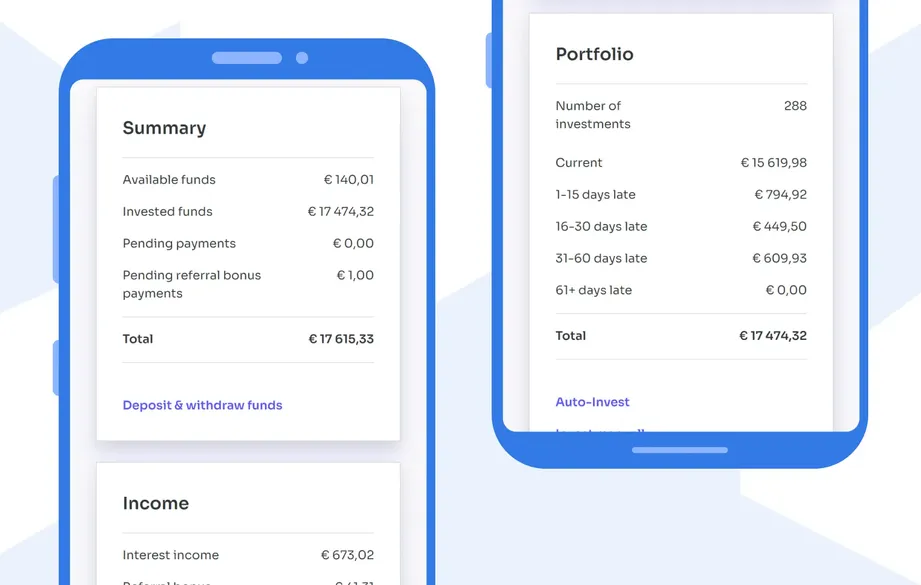

We’ve been actively investing on Esketit since April 2022, and our experience has been mostly positive. The Auto Invest function, in particular, has done a good job of deploying funds quickly, with limited downtime during normal market conditions.

However, recent changes warrant a more cautious perspective. With Avafin and Money for Finance no longer listing new loans, Esketit has lost two of its most compelling loan originators. Avafin consistently offered the strongest risk-return profile on the platform, backed by regular financial disclosures and a solid track record.

Its departure has noticeably shifted the platform’s overall offering. The remaining loan originators currently present some uncertainties.

Mojo Capital remains relatively opaque, Spanda Capital is still establishing itself in the Spanish market, and there’s limited financial transparency from MDI Finance, which serves as a funding vehicle for the Sri Lankan lender Loanme.lk. At this stage, we believe it’s essential for investors to reassess the platform’s evolving loan book carefully.

Esketit’s main advantages now lie in its strong track record in honoring the promises to investors. Investors should, however, be informed that the liquidity may be limited for Esketit's automated strategies and that most of the lenders are fintech start-ups with longer loan terms and limited financial track records.

We’re approaching new investments on Esketit with greater caution, because long-term confidence requires more than just past performance.

You can review our current Esketit exposure on our P2P portfolio page.

As of month year, Esketit remains one of Europe’s best-performing P2P lending platforms, and our loan performance has been outstanding.

Esketit Bonus

Esketit offers an optional Esketit promo code, which you can type in during registration. However, this is not required to get a cashback bonus. We have negotiated a 0.5% referral bonus for our readers on P2P Empire.

Signing up with our link will give you a 0.5% cashback bonus from your invested amount during the first 90 days after your registration.

Loyalty Bonus

If you are keen to invest a higher amount, you can benefit from Esketit's loyalty program, where you can increase your return by +1%.

If you invest more than €25,000, you will get +0.5% interest in addition to your annual return. If you invest more than €50,000, you will get +1% on top of the standard rate.

Remember that the loyalty bonus is only applied to your investment in the following lenders: MDI Finance, Spanda Capital and Mojo Capital.

Requirements

To be able to invest on Esketit, you need to fulfill specific requirements:

- Be over 18 years old

- Pass the KYC

- Verify your identity

- Verify your bank account (IBAN)

If you don’t have a euro bank account with a dedicated IBAN, you can open a free N26 account, as explained in our N26 review, or a Wise account with a dedicated Wise Card.

Risk & Return

Investing in loans is risky, and you might lose your money. Esketit offers a 60-day buyback obligation for selected loans.

Buyback Obligation

The buyback obligation is the lending company's commitment to repurchase a loan if the borrower is more than 60 days late in repayment.

The buyback obligation depends heavily on the financial health of the lenders or the finance group backing them. As of month year, the following lenders on Esketit offer a buyback obligation.

| Lender | Interest | Loan Type | Period |

|---|---|---|---|

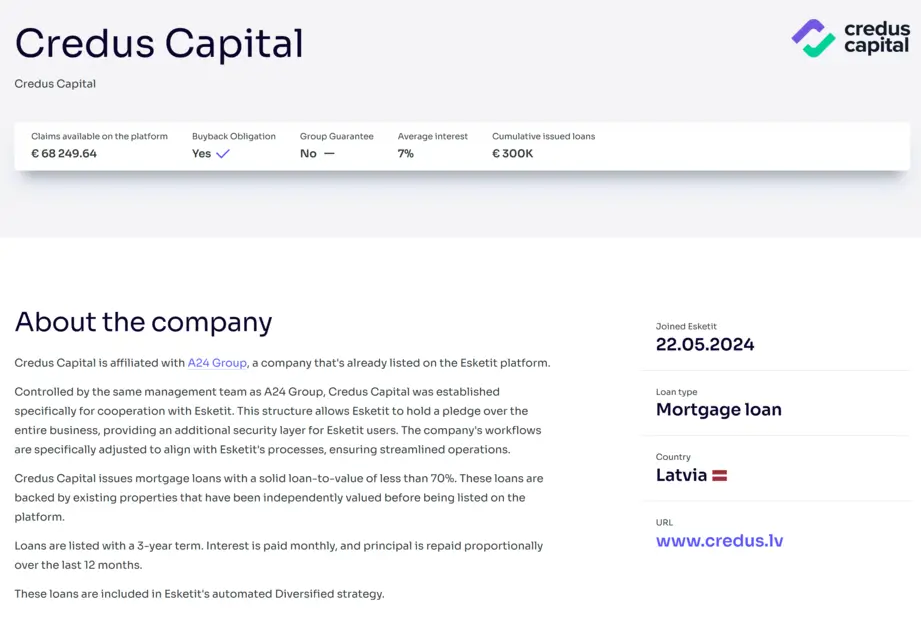

| Credus Capital | 7% | Mortgage loan | 36 months |

| Mojo Capital | 12% | Business loan | 24 months |

| Spanda Capital | 10% | Defaulted debts in Spain | 24 months |

| JMD Investments | 10% | Business loan | 12 - 24 months |

| MDI Finance | 12% | Business loan | 12 - 24 months |

Please note that Credus Capital, MojoCapital, Spanda Capital, MDI Finance, and JMD Investments are all companies owned by Esketit’s founders. Keep in mind that the frequency of interest payments may vary depending on the individual lending company.

Investing in defaulted loans from Spain

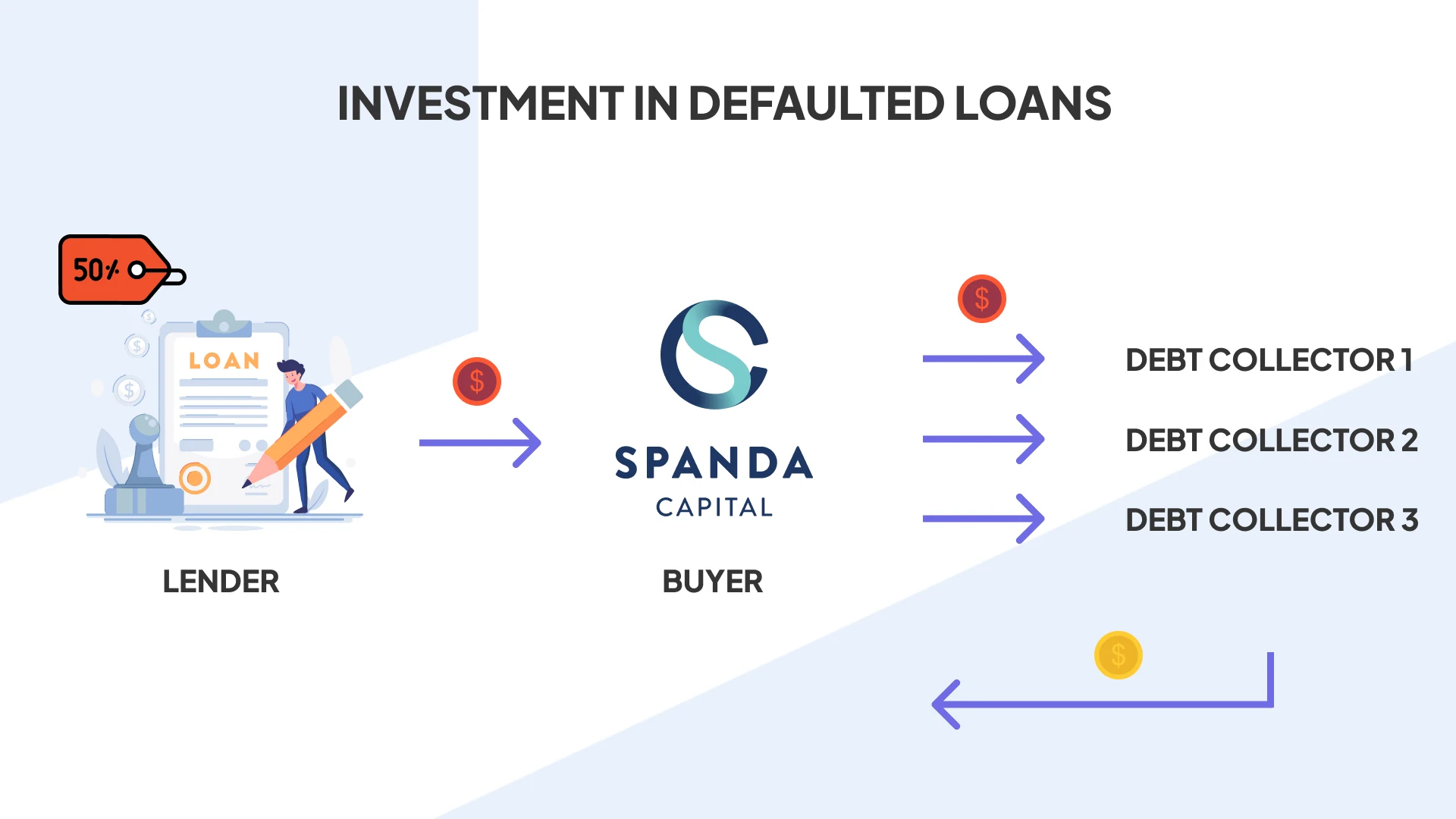

Esketit’s founders have recently launched a new venture offering investments in discounted defaulted loan portfolios in Spain.

The loan originator, Spanda Capital, is raising funds from investors on Esketit with a 24-month loan term and an attractive 12% annual yield (APY). For the first six months, investors will receive only interest payments, followed by proportional principal repayments over the remaining 18 months.

This is how the business model of Spanda Capital works:

- Spanda Capital buys a bad lending portfolio at a discount (50% - 60%)

- The company then forwards a portion of the bad portfolio for recovery to a debt collection agency

- The debt collection agency recovers the bad portfolio with additional fees

- Spanda Capital takes a cut and returns the principal with accrued interest to investors

On average, it takes two years to recover a defaulted portfolio in Spain, which is why Spanda Capital offers a 2-year loan term, providing investors the opportunity to earn 12% interest over the 24-month period. You can learn more about the performance of Spanda Capital in its latest report.

Investing in fintech companies

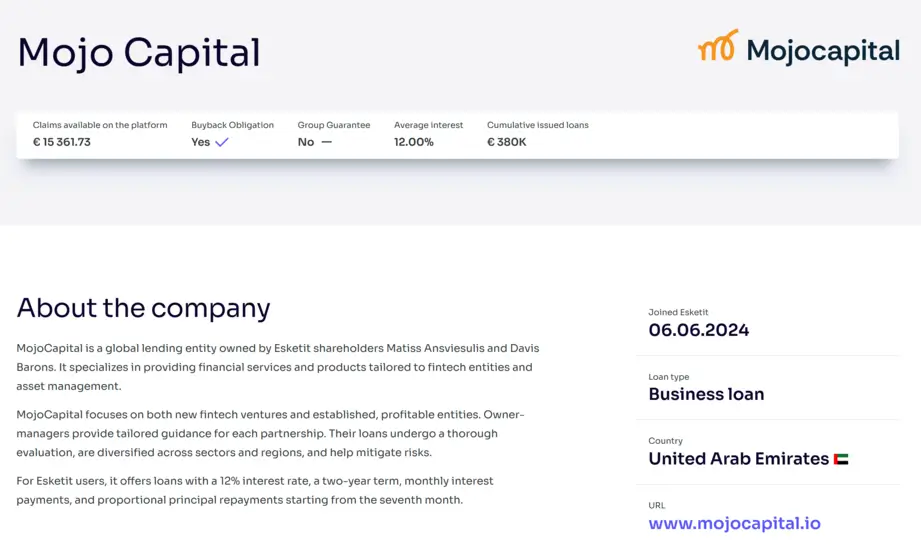

Esketit introduces an exclusive new opportunity through MojoCapital, a global lending entity owned by Esketit shareholders Matiss Ansviesulis and Davis Barons. MojoCapital specializes in business-to-business loans targeting fintech and asset management companies.

MojoCapital offers a diversified portfolio consisting of both emerging and established fintech ventures, providing investors with broad exposure to the financial technology sector.

The platform employs thorough risk management by spreading loans across various industries and geographic regions, helping to reduce potential defaults.

Investors benefit from attractive loan terms, including a 12% annual interest rate, a 2-year duration, monthly interest payments, and a structured repayment plan in which the principal is returned proportionally starting from the seventh month.

Investing in Sri Lanka

MDI Finance is the parent company of Sri Lanka’s digital lending platform Loanme.lk, founded by Matīss Ansviesulis and Dāvis Barons. An experienced team leads the company with a dedicated focus on the Sri Lankan market, while its top management operates from Riga, Latvia, overseeing key decision-making, supervision, and reporting.

By investing in business loans from MDI Finance, you are indirectly investing in the Sri Lankans' lending business. The lender currently offers investors a 12% interest rate.

Based on our country risk score model, we classify Sri Lanka as a high-risk market for investors. You can learn more about this assessment on our dedicated country risk page.

Investing in external loan originators

As demand for investments on Esketit grows, the platform has started onboarding external loan originators to diversify offerings.

The first external partner is Aksioma 24, which provides Latvian mortgage loans with a 7% interest rate and a 36-month term.

The loan-to-value (LTV) ratio for these loans ranges from 45% to 60%, and each loan is backed by a mortgage. Interest payments are made monthly, with principal repayments starting in the second year and spread proportionally over the remaining term.

You can invest in those loans via the entity Credus Capital, which Esketit owns.

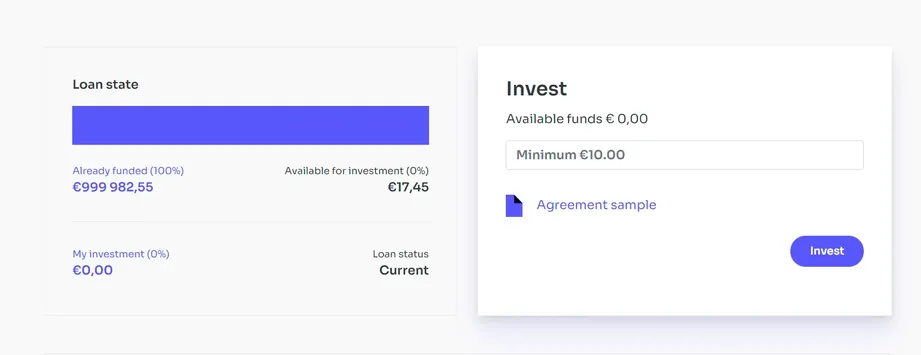

Investing on the Secondary Market

Due to the low loan availability on the Primary Market, many investors are exploring investment opportunities on the Secondary Market. While those investments can be lucrative, many of the listed loans are offered at a premium price, which can lead to a negative return. You can learn more about the impact of the premium on the IRR on Esketit in our academy.

Is Esketit Safe?

Esketit has been operating since 2021 without any capital loss for investors. Let's explore the risks and safety features that you must consider before investing in Esketit.

Get insights about the Esketit operation here:

Who Leads the Team?

Ieva Grigaļūne is the CEO of Esketit and, therefore, in charge of the platform's operations. She has previous experience working at Mintos.

Who Owns the Platform?

Esketit is owned by the co-founders of the AvaFin Group, Davis Barons, and Matiss Ansviesulis. Both gentlemen have an impressive track record of growing their companies.

Are There Any Suspicious Terms and Conditions?

When using a P2P lending platform, you should always review the terms and conditions to understand your rights and obligations.

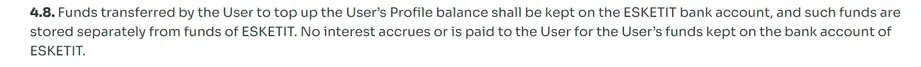

Storage of Funds

Using Esketit, you must send your funds to Esketit’s bank account. The platform doesn’t provide you with individual IBAN accounts. According to the T&C’s, your funds on Esketit are stored separately from the platform's funds.

Amendments

Esketit reserves the right to amend the terms and conditions at any time. The platform will inform you about any changes via email; however, it does not state the time frame you have to accept or decline those amendments.

Access to Loan and Assignment Agreements

The assignment agreement is unavailable for unregistered users; however, if you sign up, you can review a sample agreement by navigating to it on the primary market.

Usability

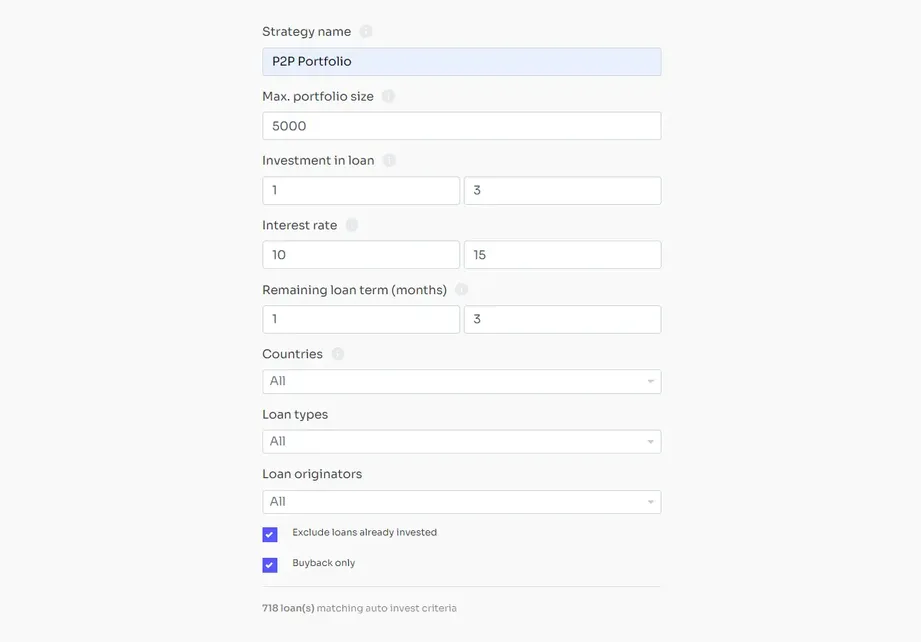

Esketit offers an Auto Invest feature that streamlines the investing process, saving you time by automatically allocating funds according to your chosen criteria.

Auto Invest

The Auto Invest feature lets you customize key loan parameters, including loan amount, interest rate, loan term, countries, loan types, and loan originators.

Keep in mind that only Esketit's automated strategies offer "instant cash-out" under normal market conditions. If you invest using a custom Auto Invest strategy, you'll need to use the secondary market to sell your investments.

Are you wondering how Esketit compares to PeerBerry? Check out our comparison Esketit vs PeerBerry.

If you have invested on other P2P lending sites, investing on Esketit will be very straightforward. The platform also allows you to invest in the primary or secondary market.

🧾Does Esketit deduct taxes?

Esketit doesn't tax your earnings. However, you can download income statements for tax purposes in your dashboard, which you may submit to your tax authorities when you file your taxes in the nation where you are a tax resident. For more info, visit our article about how to tax income from P2P loans.

Liquidity

Esketit offers a secondary market to enhance the liquidity of your investments. The time it takes to sell depends on the discount you offer and current market conditions.

By applying discounts, you can accelerate the sale of your investments on the secondary market.

During our Esketit review, we observed that a wide range of loans are available on the secondary market, providing investors with ample opportunities for liquidity.

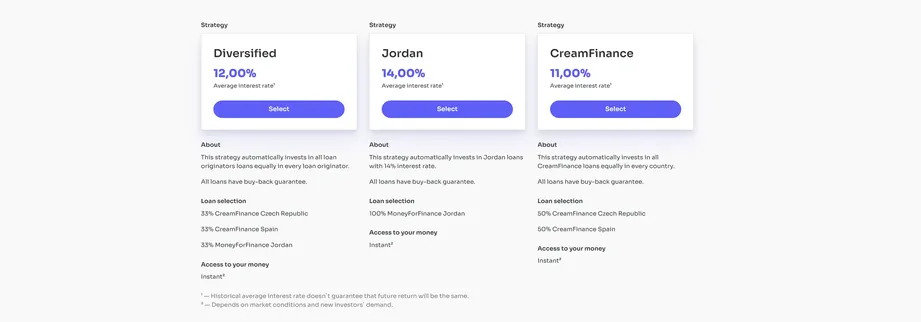

Esketit Automated Strategies & Instant Exit

Esketit offers two automated, pre-defined investment strategies that help you diversify your portfolio with just one click.

- The Diversified strategy allows you to distribute your investments to all available loan originators.

The strategy offers an instant exit option. To withdraw funds, you can create a strategy, click on “edit,” and use the “cash-out” option.

Keep in mind that the “cash-out” option is designed to function primarily under normal market conditions.

For it to work, other investors must be using the same strategy. When you activate the “cash-out” option, other investors will take over your loan investments.

Note: The CreamFinance strategy is no longer available as the Avafin group stopped listing loans on Esketit. The Jordan strategy is also no longer available as MFF has exited the platform.

Conditional Liquidity

While Esketit’s liquidity currently looks strong and withdrawals are being processed quickly, investors should remember that these features ultimately depend on management decisions rather than contractual guarantees.

This became clear in late 2025, when Esketit migrated its structure from Ireland to Croatia. During the transition, the platform locked all investments under the Irish entity, effectively disabling liquidity tools such as Auto Cash-Out and the secondary market. Investors had little opportunity to exit before these changes took effect.

This episode highlights an important structural risk: liquidity on the platform is operational, not guaranteed. If management can suspend core features during corporate or regulatory changes, the availability of liquidity may shift at any time. That is particularly relevant for investors allocating larger amounts or planning longer holding periods.

Some investors view the event as a one-off situation linked to jurisdictional restructuring. However, our information suggests Esketit has also been in discussions with the Latvian regulator, which could imply further structural changes ahead. When asked whether a future move — for example to Latvia — could again lead to temporary liquidity restrictions, the founder did not provide a clear answer.

For investors, the takeaway is simple: Esketit may currently offer fast withdrawals, but liquidity should be treated as conditional rather than permanent.

Support

Our experience with Esketit’s support has worsened notably since the company moved its jurisdiction to Croatia. Response times have increased significantly, and the overall quality of support has declined. In several cases, the management was unable to provide clear or timely answers to even basic questions.

Previously, Esketit’s support was known for fast and helpful replies, typically within one business day, and the CEO engaged actively with investors via the official Telegram group. However, this level of responsiveness and transparency has deteriorated in recent months.

Esketit Alternatives

Esketit is among the best P2P lending platforms in year, so the number of suitable alternatives is relatively low. If you prioritize diversification and wish to expose your portfolio to various loan types in different regions, these alternatives might be a good fit for you.

Income Marketplace

Income Marketplace is an Estonian P2P lending marketplace that enables investors to invest in multiple lending companies in Europe, Asia, and America.

A buyback guarantee backs all the loans, and many lenders pledge their loan books to increase the safety of your investments. The platform offers loans with a yield of up to 15% per year. To learn more about this investment platform, read our Income Marketplace review.

LANDE

LANDE is a Latvian platform that offers investments in agricultural loans backed by grain, insurance, or other types of collateral.

The platform is headquartered in Riga, just a few minutes from Esketit's headquarters. Like Esketit, LANDE has an excellent track record in protecting investors' interests. If you want to invest in secured loans, LANDE is one of the best options in year. Read our LANDE review to learn more about the platform.

Fintown

Fintown is a newly launched platform from the Czech Republic. This crowdfunding site offers investments in rental properties in Prague's city center. You can earn between 10% and 12% interest per year, which is paid out from the revenue generated by the short-term rental apartments.

Fintown was co-founded by the Managing Director of Creamfinance CZ, which also funded loans on Esketit. The platform offers exciting terms and pays out interest every month. Learn more about Fintown in our Fintown review.