LANDE Review Summary

LANDE Finance, a Latvian crowdlending platform, specializes in agricultural loans backed by collateral like land and machinery. Offering up to 14% annual returns with a low 44% LTV, LANDE ensures security through robust risk assessments and agreements with grain buyers.

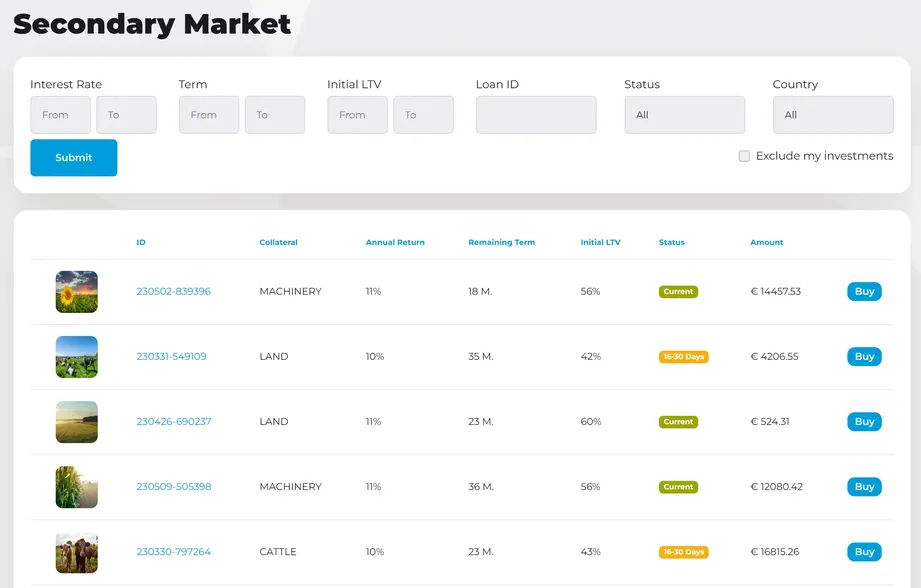

LANDE stands out for its transparency, user-friendly interface, and the availability of a secondary market, allowing investors to buy and sell loans. This feature enhances liquidity, giving investors flexibility in managing their portfolios. With options like virtual IBAN accounts for secure fund management and a straightforward onboarding process, the P2P platform caters to European investors seeking stable, high-yield opportunities in agriculture.

We have been investing in LANDE since July 2023, and our experience with the platform has been positive.

Overall, LANDE Finance is a strong option for those seeking a balance of higher returns with relatively lower risk.

Main takeaways from our LANDE review:

- VIBAN accounts for increased protection

- Secured agricultural loans

- Unique protection mechanism

- No cash drag and good loan availability

If you're looking to invest in high-yield, secured P2P loans from Latvia, Lithuania, or Romania, sign up now, start investing, and enjoy a 3% bonus on your investments made within the first 30 days.

What is LANDE?

LANDE Finance (formerly LendSecured) is a crowdlending platform offering the opportunity to invest in agricultural loans backed by grain and other assets. With potential returns of up to 13% annually on secured loans, it presents an attractive option for investors.

In this LANDE review, we’ll dive into the key aspects of investing in agricultural loans, helping you assess whether LANDE is the right platform for your portfolio.

Pros

- Secured investments

- Reasonable risk and return ratio

- Virtual IBAN accounts

- Low average LTV of 44%

- One of the best-performing P2P lending platforms in year

- Good loan availability

Cons

- Limited diversification

- Stock images for listed projects

Are you wondering how LANDE works? Watch our LANDE review.

Our Opinion Of LANDE

LANDE excels in transparency and investor support. Its dedicated statistics page provides performance-driven insights, allowing users to make informed decisions with confidence.

As a Latvian crowdfunding platform, LANDE surpasses many of its Baltic competitors by combining fair terms with high yields of up to 14% annually. A standout feature is the introduction of virtual IBAN accounts, ensuring uninvested funds are securely separated from the company’s accounts, significantly reducing the risk of mismanagement.

Investing in loans secured by insured crops offers a compelling risk-to-reward ratio, distinguishing LANDE from platforms focused on higher-risk payday loans. The added security of three-way agreements with crop buyers ensures that loan repayments are directly tied to the sale of agricultural produce, further safeguarding investors' capital.

An area for improvement is the use of stock images in project listings. Incorporating real photos would enhance the platform’s credibility and the authenticity of investment opportunities.

Despite this minor drawback, LANDE has firmly established itself as a leader in the crowdlending sector. During our visit to their office in Latvia, the professionalism and commitment of the CEO and team were evident, reinforcing our trust in the platform.

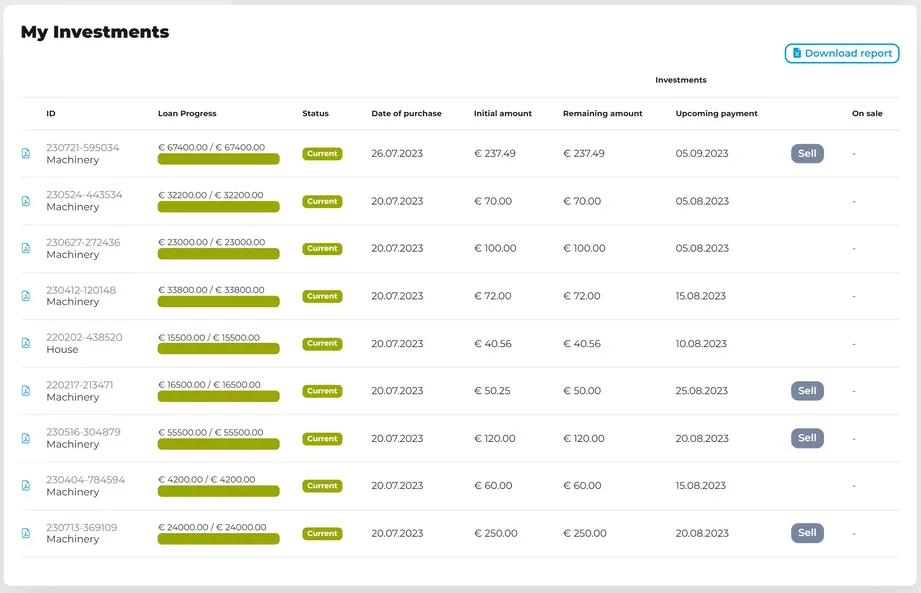

LANDE’s ability to address common industry issues like cash drag while maintaining competitive returns makes it an appealing choice for investors. This confidence is reflected in our own portfolio, where we have invested in multiple projects secured by machinery and land.

Here is a screenshot from our portfolio on LANDE. The interest is paid monthly, increasing the cash income from our P2P lending portfolio.

LANDE Referral Code

You don't need to enter an optional LANDE referral code to redeem your bonus when signing up to LANDE. Simply sign up with our exclusive partner link to receive a 3% Bonus on your investments within the first 30 days from registration.

Requirements

To invest in agricultural loans, you must have citizenship in one of the European Economic Area (EEA) countries. Another requirement is to have a SEPA bank account.

Further requirements are:

- Be over 18 years old

- Fill in the KYC questionnaire

- Provide a photocopy of your passport or driving license

- Reside in Europe

The verification process on LANDE is simple and typically takes less than 24 hours.

You'll need to verify your email, provide contact details, and upload a copy of your ID, along with a passport or driving license.

Once your account is verified, you can transfer funds to your virtual IBAN account with Lemonway. This transfer usually takes between one and three business days.

Risk & Return

Investing in agricultural loans carries inherent risks. These loans are typically secured by heavy machinery, land, or crops, providing a measure of protection for investors.

Initially, LANDE focused on grain-backed loans from Latvia but has since expanded to offer agricultural loans in Lithuania and Romania.

The loans on LANDE are relatively modest, ranging from €4,000 to €60,000, with terms of 4 to 36 months and Loan-to-Value (LTV) ratios between 14% and 58%. The average LTV is approximately 44%.

LANDE assesses the credit risk of individual loans by following internal guidelines that evaluate several key factors, ensuring a thorough risk assessment process.

The creditworthiness of the borrower

- Reputation on the grain market

- Farming experience

- Credit history

- Tax debt

- AML & KYC

- Registered commercial pledges

- Ability to repay the loan according to financial ratios (liquidity, leverage, profitability, capital)

Collateral

- Planned harvest

- Previous harvest

- Grain price

- LTV

LANDE carefully evaluates several factors when assessing loans, ensuring that the loan’s purpose is directly relevant to the farming business, whether it’s for working capital, machinery purchases, or land acquisition.

For loans backed by land or real estate, LANDE provides an appraisal report from an independent evaluation company. However, similar to many platforms, these reports are not translated into English.

LANDE has also shared that it currently receives between 700 and 1,000 loan applications each month, but only 5% to 6% are accepted. These selected projects then undergo further evaluation, and only if they meet LANDE's criteria are they listed on the platform for investors.

Grain Buyers

Grain buyers are essential in safeguarding investors' funds. LANDE establishes a three-way agreement between the borrower, the grain buyer, and the platform, where the quantity and price of the crop are agreed upon in advance.

This setup ensures that the proceeds from the grain sale are first used to repay the loan, with the farmer receiving any remaining funds afterward.

LANDE reassures investors that these agreements are only made with reputable grain buyers who have a proven track record of over five years.

Insurance

In addition to the protection provided by grain buyers, 92% of the crops are insured against risks like storms, hail, or heavy rainfall, which further strengthens the quality of the collateral.

In terms of returns, most loans on LANDE offer an annual yield of 11% to 12%, depending on the borrower's credit risk.

The majority of these loans are structured as bullet loans, meaning the borrower pays interest monthly, while the loan principal is repaid at the end of the term, once the harvest is sold to the crop buyer.

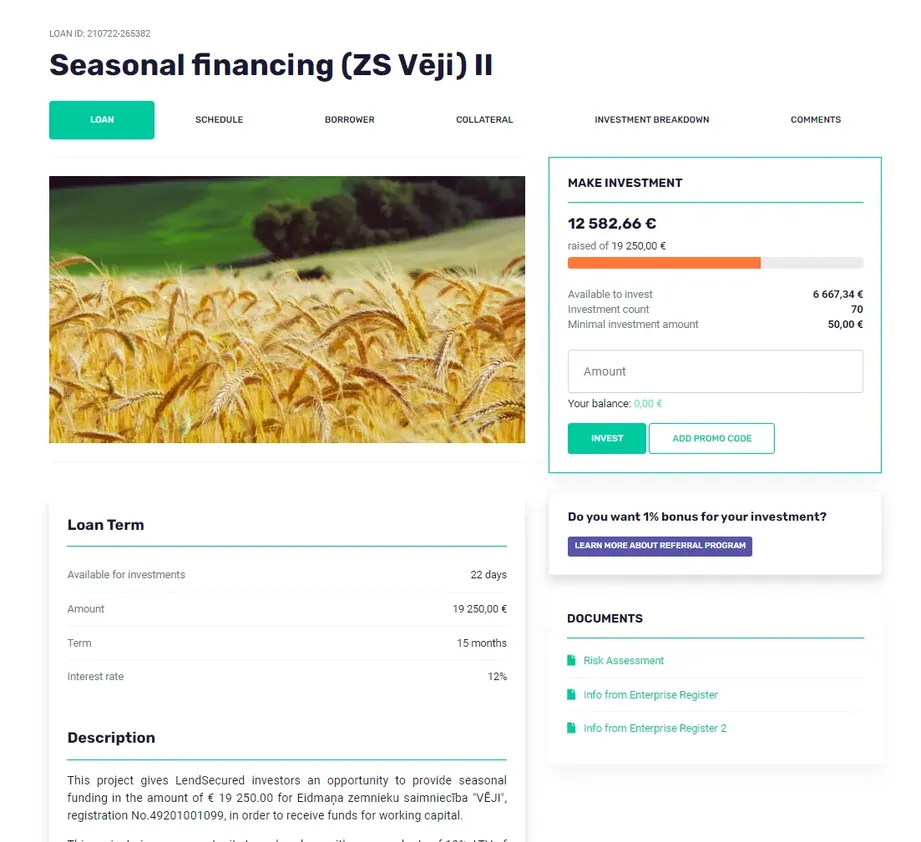

Project Overview

Each project description on LANDE provides key details about the loan, including the amount, term, and interest rate.

You’ll also find information about the borrower, the loan's purpose, and the value of the collateral.

While LANDE doesn’t provide specific risk evaluation reports for grain-backed loans, you do have access to some of the data they use to assess risk and determine the loan pricing.

Default Rate

We continuously monitor LANDE’s default rate, which you can find in the statistics section above. As a true crowdlending platform, LANDE does not offer features like a buyback guarantee, commonly seen on P2P marketplaces.

This means that some loans may eventually default. However, unlike platforms such as EstateGuru—where debt recovery can take several years—LANDE demonstrates a significantly faster recovery process. Most defaulted loans are resolved within a few months, thanks to the high liquidity of the collateral accepted from borrowers.

Is LANDE Safe?

When investing on any P2P lending platform, reviewing the background and experience of those who run the company is crucial.

Watch our visit to LANDE'S headquarters in Riga, Latvia, to learn more about who runs the organization.

Who Runs the Company?

LANDE is a brand of Secured Finance MGMT that Ņikita Gončars and Edgars Tālums own.

Nikita is also the co-owner of SIA Latvijas Hipotēka, which has received bad press in some of the media outlets in Latvia. The company was accused of unfair practices. We have reached out to Nikita for a comment. The company used the service to restructure high-interest payday loans and was successful in 90% of the deals. In cases where clients could not repurchase their houses, fair compensation was paid out. The service has not been provided since 2018 and is not planned for the future. The media coverage is a result of organized competitor blackmail.

The CEO expanded on that topic and provided more clarification during our visit to LANDE's office in Riga.

Are there any suspicious Terms and Conditions?

Reviewing and understanding the terms and conditions and evaluating your risk using a dedicated P2P platform is essential.

Storage of Funds

LANDE offers a personal Virtual IBAN for every user who signs up on LANDE.

These accounts are stored at BNP Paribas and operated by the payment institution LemonWay. The beneficiary of all payments is LemonWay which executes the payments between investors and borrowers.

This is a better setup than transferring money to the platform's accounts which is then allocated to the investors' accounts.

Amendments

LANDE does not specify in their T&Cs the number of days before which you are notified about upcoming changes to terms and conditions.

LANDE informed us that you will receive an automatic email once the terms change.

Loan Agreements

LANDE allows you to review a loan agreement template before registering on the platform. As soon as you invest in a project, the loan agreement is generated automatically, and you can review it in your "Portfolio" section.

Usability

LANDE is a user-friendly platform that offers essential information such as earned interest and portfolio performance, enabling you to quickly evaluate the overall performance of your investments.

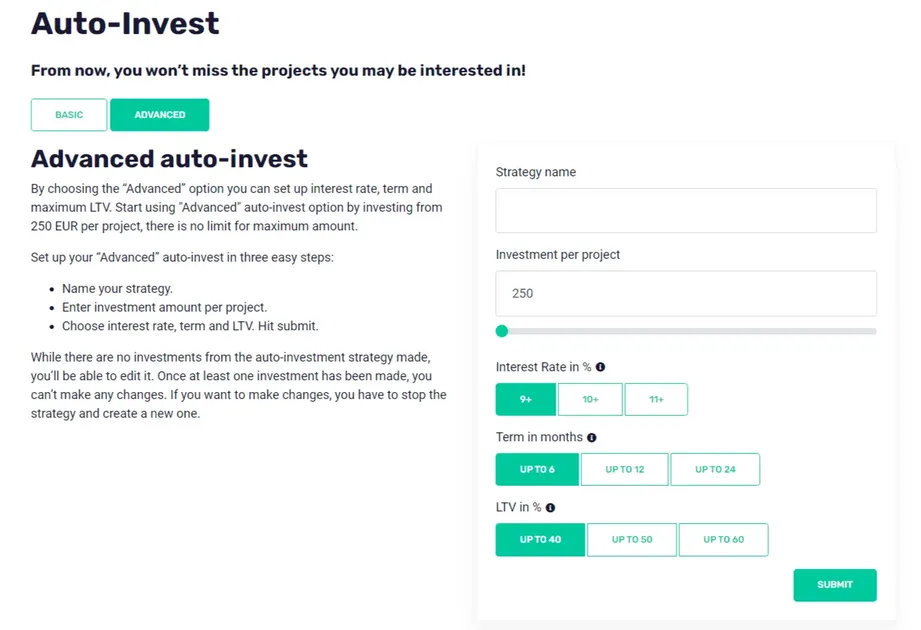

Auto Invest

LANDE has introduced an Auto Invest feature, enabling you to automate your investments according to your preferences.

You can choose the "basic" Auto Invest, where you simply set the minimum investment amount, or opt for the "advanced" Auto Invest, which offers more customization options for your investments.

The minimum investment for LANDE's advanced Auto Invest is €100. This feature allows you to customize your investments by setting criteria such as interest rates, loan terms, LTV, collateral type, country, and payment schedule.

If you're new to LANDE, it's a good idea to manually invest in a few loans first to get a feel for how the platform operates. This also gives you the opportunity to review detailed information about the borrower, loan terms, and collateral.

One area for improvement is the use of stock photos in some project descriptions. Replacing these with real images would better represent the actual collateral securing the loans.

🧾Does LANDE deduct taxes?

LANDE does not tax your profits in Latvia. When you file your taxes in the country where you are a tax resident, you can download income statements from your dashboard, which you may submit to your tax authorities as required. Go to "Balance" in the menu and download the income statement.

Liquidity

Liquidity is a key consideration when investing in loans. LANDE offers a range of loan terms, with longer-term loans generally providing higher interest rates.

The platform also features a secondary market to enhance flexibility, allowing you to buy and sell loans based on your specific criteria, giving you more control over your investment strategy.

- You can only sell a loan in its full amount if you want to sell a loan with a value of less than €100.

- For purchases of loans with a principal value of more than €100, investors can invest from €50.

- The resale of loans purchased on the secondary market is available only for current loans (no delays).

- Loans cannot be sold on the secondary market before being issued (during the funding phase).

- The sale of defaulted loans is not supported.

- Full bullet loans with interest and principal repayment at the end of the loan period cannot be sold on the secondary market.

As you can see, there are a few requirements that you must consider if you plan to use the secondary market on LANDE. As of month year, LANDE doesn't charge investors any fees for trading on the secondary market.

Support

We’ve been in contact with LANDE since its launch in 2019, exchanging several emails and visiting their office in Riga in the spring of 2022.

In mid-2023, we conducted another interview with the CEO to discuss the platform’s latest developments, and the responses were consistently thorough. We continue to maintain active communication with the CEO throughout year.

For any questions, you can reach LANDE directly at info@lande.finance.

LANDE Alternatives

LANDE Finance is an established platform with an impressive track record. Should you, however, seek better diversification or invest in loans from different regions, you can explore the following LANDE alternatives.

Indemo

Indemo is a regulated crowdlending platform from Latvia offering high-yield investments. It acquires discounted Spanish mortgage-backed debts and resells them at a profit, typically over two years, with expected annual returns above 15%. Learn more in our full Indemo review.

Crowdpear

Crowddear is a regulated crowdfunding platform offering investments in vetted real estate loans in Vilnius, Lithuania. Crowdpear currently has one of the best-performing portfolios under management, meaning investors can earn passive income without dealing with payment delays or cash drag. Learn more about Crowdpear in our Crowdpear review.

InRento

InRento is another regulated crowdfunding platform from Lithuania that offers attractive investments in rental properties. A fixed monthly rental yield from well-secured investments is why InRento is one of the best-performing platforms in year. Learn more about InRento in our InRento review.