Fintown Review Summary

Fintown is a niche crowdfunding platform offering investors access to rental properties with yields of up to 12% and development loans reaching 15% annually. Based on our experience since March 2023, the platform has proven to be reliable, with prompt monthly interest payouts and zero delays so far.

What makes Fintown unique is its focus on already operational, high-occupancy short-term rentals in Prague, allowing investors to benefit from immediate cash flow. Instead of funding raw developments, most investments involve refinancing property equity, which is then reinvested into new projects, supporting a sustainable growth model.

Fintown offers a strong value proposition for P2P investors seeking geographic and asset-class diversification—especially in a market where many platforms face cash drag and limited loan availability. Learn more about this platform in our Fintown review.

Key Takeaways:

- Attractive risk-return profile

- Exposure to already operating rental units

- High occupancy and excellent guest ratings

- Transparent and sustainable business model

If you are ready to invest on a platform that pays out up to 13% rental yield from short-term rental units in Prague, Fintown is worth considering.

Ready to get a 2% investment bonus?

Or continue reading this Fintown review to learn how the platform works.

What is Fintown?

Launched in 2023, Fintown is a Czech-based investment platform that enables users to invest in rental real estate and selected development projects in Prague. Most investments generate between 8% and 14% annually.

The platform offers two types of structures:

- Monthly-paying rental loans

- Full bullet development loans repaid at maturity

All investments are managed by the Vihorev Group, a well-established local developer. This Fintown review, outlines how the platform works, expected returns, risks, and how it compares to alternatives.

Pros

- Vihorev is an experienced developer in Prague

- Flawless track record in repaying investors

- High yield

- Low minimum investment amount

- Monthly interest payments

- Option to invest as a company

Cons

- Limited diversification

- Fee for an early exit from investments

- Mostly unsecured loans

Are you wondering how Fintown works? Watch our Fintown review.

Fintown in 2025

Fintown announced several updates for 2025, including:

- Audited financial reports for 2024

- Early exit program

- Regulation

- IT improvements

- New products

Watch the summary of our interview here:

In the upcoming video, you can watch the full, raw interview with the founder and CEO, Maxim Vihorev.

Our Opinion Of Fintown

While investing in rental properties isn't new, Fintown offers a unique approach. You can invest in short-term rental properties with as little as €1.

The available investments are in fully operational rental units with high occupancy rates in one of Europe's most popular cities, backed by excellent guest reviews.

During our Fintown review, the owner, Maxim Vihorev, provided us with a detailed list of current bookings, showing the occupancy for the listed units.

The funding from current loans allows the company to invest its equity in new projects. Vihorev Investments is developing other promising real estate ventures, which you can explore in their project overview.

It's important to note that Fintown’s investments are not under specific regulation in the Czech Republic, which has been confirmed by the local regulator. You can find their statement on Fintown's website.

Investing in operational rental units lowers risk compared to development projects, which come with additional construction-related risks.

Based on the information we've reviewed, we believe the current opportunities on Fintown are attractive. However, since Fintown only launched in 2023, the platform will likely offer higher returns and more liquidity to attract investors.

As the platform grows and funds more projects, interest rates may decrease, similar to what we've seen on established platforms.

While many other platforms may offer investments in unsecured payday loans from regions like Africa, Asia, or South America, Fintown focuses on rental properties in Prague, offering comparable returns.

Although Fintown is a young platform, the company behind it has enough experience to justify investments in its rental properties.

We believe the current projects offer a solid risk-return balance, though only time will show if this remains true.

In the current market, where loan availability is limited on other platforms, Fintown provides interesting opportunities with favorable terms. That’s why we've decided to invest and share our experience with this new Czech crowdfunding platform.

Did we mention that all rental income is paid to your account monthly?

As long as you invest in rental units, there is no need to wait until the end of the loan term, like is the case with full bullet loans on EstateGuru, to receive interest from your investment.

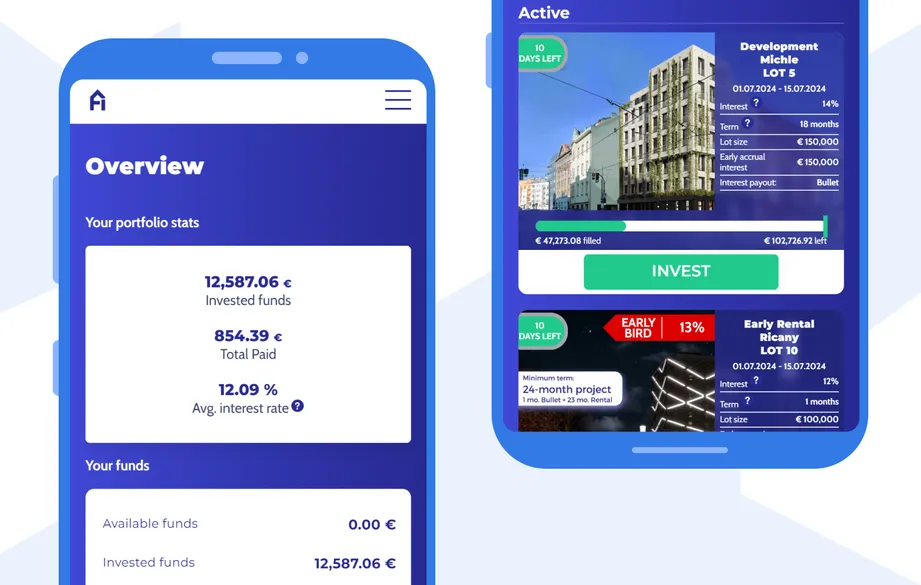

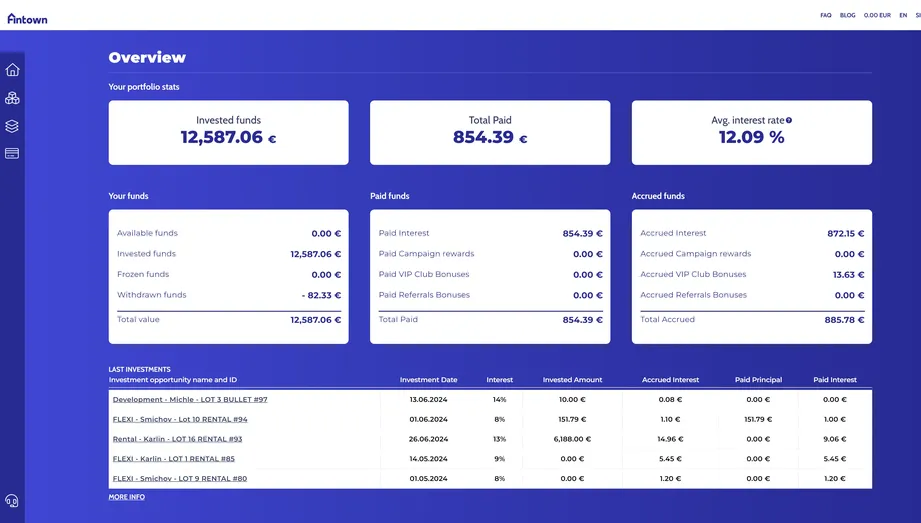

You can review our current exposure on our portfolio page.

Are you ready to test Fintown yourself?

Fintown Bonus

Sign up through our exclusive Fintown link, make your first investment, and receive a 2% bonus—with no maximum limit! Your bonus will be automatically credited to your account after your initial investment. Learn more about the Fintown bonus in our page about the Fintown referral code.

Fintown VIP Club

Investors with investments between €10,000 and €29,999 will receive an additional 0.5% bonus on top of their investments. Investments of more than €30,000 will grant investors a 1% bonus.

Any VIP bonuses can be reinvested or withdrawn after 12 months. Investors must maintain the investment amount throughout the year to redeem their rewards.

Requirements

To invest on Fintown, you have to meet the following requirements:

- Be at least 18 years old

- Send your funds from an EU bank account

- Verify your identity

- Deposit your funds in EUR with your unique reference code

It's essential to understand that users should only transfer EUR. The platform might charge you a €20 fee if you transfer a different currency. You might be charged a €10 fee for an incorrectly marked deposit.

The deposit of funds from our Revolut account to Fintown's business account took 24 hours during a workday. Fintown's business account is operated by Ceska Sporitelna, one of the largest and most regulated Czech banks.

Risk & Return

Evaluating the risk and return ratio on Fintown isn't as tricky as we have access to updated performance-orientated data. Additionally, the platform has been operating for over 2 years which gives us a good idea about the platform's track record.

Before evaluating the long-term performance of Fintown's investments, we will review the following information:

- Rental properties in Prague, occupancy and revenue

- Investment structure

- Past and future developments

Investment In Rental Properties

Fintown currently offers investments in rental properties and development projects in and around Prague, managed by the Vihorev Group.

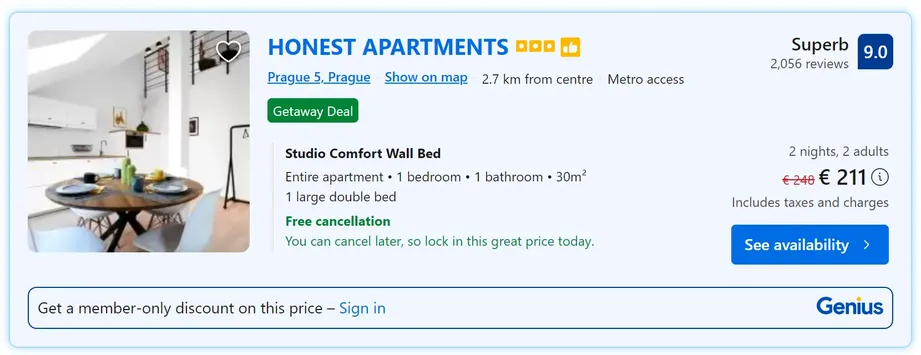

If you’ve visited Prague recently, you’ve likely noticed that short-term rentals can be expensive, with affordable options often lacking in quality.

For those wanting to stay near the city center to explore the main attractions, prices typically range from €150 to €250 per night during the high season. The apartments on the Fintown platform are listed on Booking.com and charge similar rates, reflecting their prime locations and quality.

Here is a snapshot of one of the apartments offered for short-term rental and owned by Fintown's founder.

The Booking.com rating of 9.0 certainly makes a good impression on potential guests, which increases the listing's occupancy.

During our research of the Fintown platform, we talked to the founder and requested additional information unavailable on the platform.

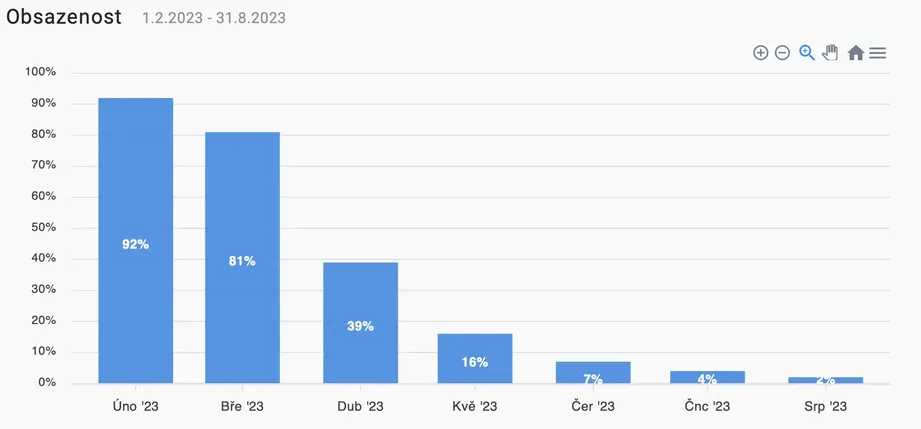

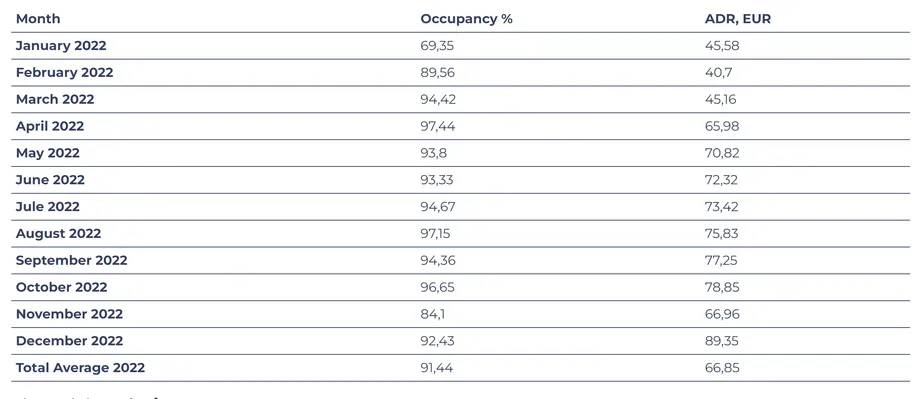

The chart below shows the occupancy of listed apartments in Honest Smichov, managed by the founder and his company. The company achieved high occupancy rates even in year.

In the project overview of available investments, you can also review the occupancy for previous periods.

The ADR metric represents the average daily rate charged to guests in 2022. According to our latest talk with the CEO of Fintown, the average daily rate increased to €100 in 2023. The ADR remains similar also in year.

If you are familiar with the rental industry, you might wonder about the costs of running this type of business.

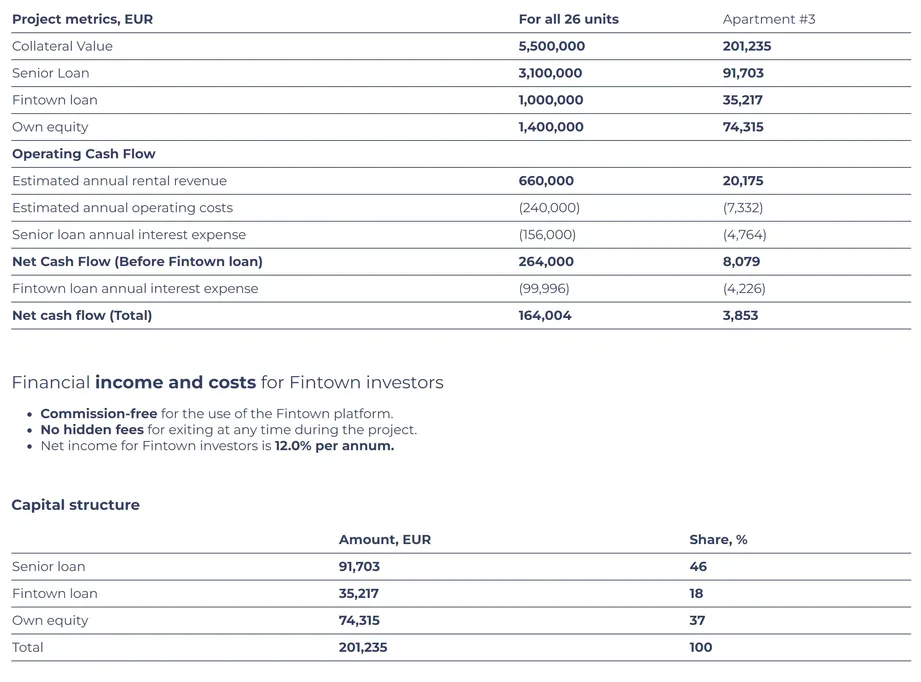

Fintown is breaking down the financials for every project so you can better understand the profitability generated by the rental income.

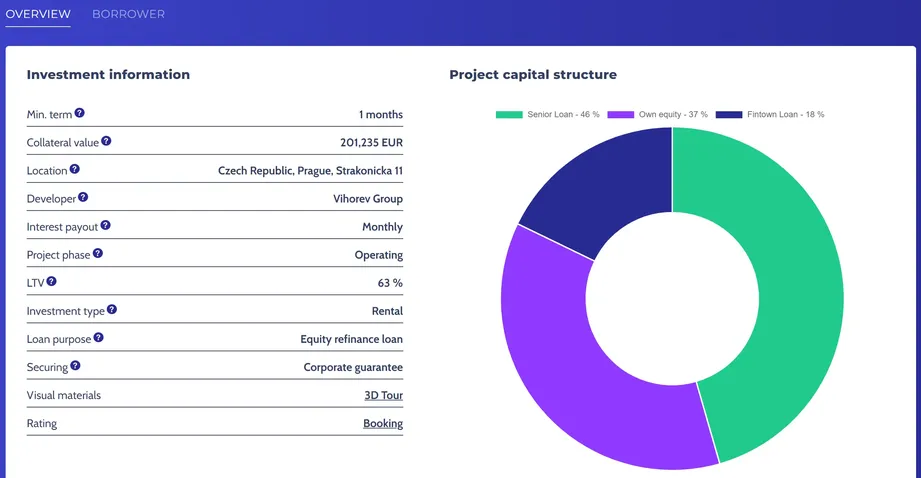

The chart above shows only the capital structure of one apartment available for investment on Fintown.

As you can see, a senior loan was used to purchase and renovate the building. The rest of the capital was paid with equity.

Fintown and, subsequently, the Vihorev Group aim to exit a portion of the equity to fund new projects. This will be done through refinancing with a mezzanine loan.

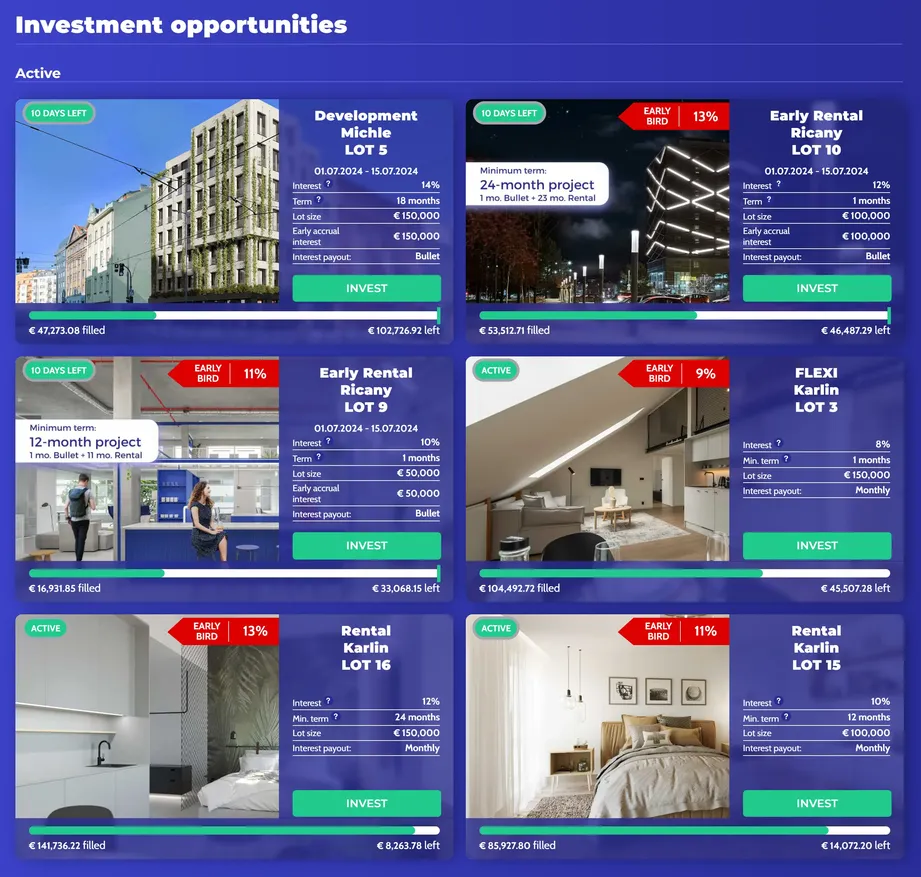

As of month year Fintown offers investments in various projects, including Kolovratz, Park Vista and Ricany.

Honest Ricany

With 140 units, Honest Ricany is Fintown's largest project yet. The property is situated 30 minutes by train from Prague's city center. Honest Ricany offers modern living in fully equipped studios with dedicated workspaces.

We were able to visit this property one month before its opening. At that time, 50% of the apartments were already pre-booked. Honest Ricany will target students and young professionals seeking affordable accommodation near Prague.

Fintown offers investments in Honest Ricany with an annual yield ranging from 9% to 14%.

Park Vista

Park Vista is Fintown's latest development project. As of month year, it is still in the demolition phase. Park Vista is a luxury residential property that will be developed by September 2026. The units will be sold to new owners rather than rented out as it is the case with other properties developed by the Vihorev Group.

In a recent interview with the CEO, we were informed that he is testing the opportunities in the luxury residential properties in Prague, for which there is a high demand. The CEO has, however, stated that the rental business is still the company's core focus.

Fintown offers investments in Park Vista as a development loan with a loan term of up to 24 months and an annual yield of 13%.

The interest and the principal will be repaid at the end of the loan term, whereas the yield from already operational rental units is paid out monthly.

The Seed - Costa Rica

In 2025, the Vihorev Group embarked on an ambitious real estate venture in Uvita, Costa Rica. Partnering with esteemed local experts, the group is poised to ensure the project's success from start to finish. Fintown is actively engaging investors to co-finance key phases of this development.

Offering an attractive 15% interest rate over a 24-month term, this investment opportunity in Costa Rica is not just lucrative but also groundbreaking. Discover all the details in our comprehensive guide on The Seed development.

Investment Structure

Fintown offers two different investment products:

- Investment in rental properties in the form of a mezzanine loan

- Investment in development projects in the form of participation

Development & Early Rental

Fintown is part of the Vihorev Group, which is developing several rental properties in and around Prague. Some of the investments on Fintown are structured as full bullet loans, with a relatively short term and the principal repaid at the end of the loan period.

The development projects listed on the platform already have valid construction permits, which helps reduce investor risk.

Fintown also offers "early rental" projects, where investors initially fund a development loan for several months. Once the project is completed, it transitions into a rental unit with monthly interest payouts. This allows investors to secure future rental income at attractive rates.

What is a mezzanine loan?

A mezzanine loan is essentially an unsecured form of subordinated debt. This means that if the borrower defaults, the borrower's assets will be sold to cover a senior loan (mortgage, for example) before covering other obligations such as subordinated debt.

As an investor who invests in rental units on Fintown, you are essentially investing in a mezzanine loan. The platform pays out interest from the yield generated by the rental properties.

The investment amount can be withdrawn after the minimum lock-up period. The platform follows strict liquidity management to ensure that the company always has enough funds on accounts to repay investors after the minimum lock-up period.

Liquidity Management

During our visit to the platform's headquarters in Prague, we discussed the amount of liquid funds and the platform's ability to fulfill withdrawals.

The CEO told us that as of June 2024, Fintown can meet 100% of the potential withdrawal requests from FLEXI projects.

Having a large portion of funds in a bank account is, however, not a sustainable business model, which is why the platform will be decreasing this amount to 50% in the future to be able to use those funds efficiently.

Therefore, during a bank run, the platform would be unable to meet all obligations should investors demand that all projects be exited simultaneously.

What is participation?

Participation is essentially debt to a borrower in which you share the entire income and losses resulting from the loan contract.

Both forms of investments are riskier than loans backed by a mortgage.

If you decide to earn yield from attractive rental properties on Fintown, you should know that your investment is backed by a corporate guarantee issued by the Vihorev Group. You can read the terms of the group guarantee in the guarantors declaration.

Refinancing Equity

When investing on Fintown, you are refinancing the developer's equity. This means that Vihorev Group can use this equity from individual properties to finance further developments. You can review the capital structure of every listed project directly on the platform.

Fintown will always keep at least 20% of its equity in the rental property, which can also be seen as "skin in the game".

As Fintown is a relatively new platform, we have reviewed the appraisal report and additional information about the occupancy, regulative environment, contract, and appraisals.

During our research, we retrieved the appraisal reports for the entire building. You can review it in Czech here:

The appraisals confirm the value of the building and its properties.

FLEXI Projects

Around 20% of Fintown's portfolio is allocated to FLEXI projects offering lower interest rates but higher liquidity. These projects are designed for new investors to test the platform, with the option to exit after 30 days. The interest rates for FLEXI projects range from 7% to 8%.

Once you've tested the platform, you can exit your FLEXI investments and reinvest in long-term rental deals. These deals offer higher interest rates but come with a lock-up period of 12 to 24 months.

The Most Significant Risk: Fluctuating Interest Rates

During our talk with Maxim Vihorev, the founder and CEO of Fintown, he shared that the biggest challenge his company ever faced was the increase in interest rates. Every project is co-financed with a senior loan with a variable interest rate connected to the PRIBOR.

If those interest rates change within a short period, Vihorev's costs increase, which impacts its profitability. Maxim shared with us that during that time, they had to increase the rental rates for guests in Prague to increase revenue and manage this risk.

Fintown vs Competition

The investments currently available on Fintown allow you to invest in rental properties that are already occupied and generate income.

The property owner has been running the rental business for several years, complying with all local laws and regulations.

These opportunities differ from some projects on platforms like InRento, where investors must fund the entire property or finance renovations before it can be rented out.

While rental yields on other platforms typically range between 5% and 7% per year, Fintown aims to attract investors with higher, inflation-adjusted initial interest rates.

By investing in Fintown, you start earning a yield from day one, as most investments are in operational rental units. This contrasts with other platforms where interest only begins once a tenant is found.

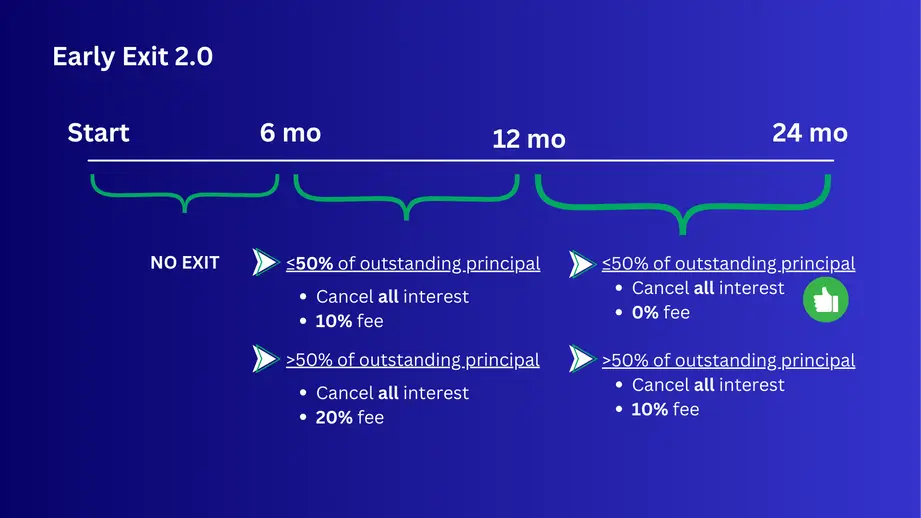

It's worth pointing out that you may exit the investment after the agreed term for free or for an exit fee before the proposed loan term ends.

Is Fintown Safe?

Investing on a recently launched platform is associated with various risks. However, it also creates an opportunity to diversify your portfolio, potentially decrease risk, and increase return in the long run.

Let's review the management behind Fintown and the platform's terms and conditions.

Who Leads The Team?

Maxim Vihorev and Vladislav Siganevich co-founded Fintown.

Mr. Vihorev has been active in the Czech real estate market since 2008 and has completed five real estate projects through his investment fund, Vihorev Invest SE.

Mr. Siganevich was the managing director for CreamFinance in the Czech Republic. Creamfinance (AvaFin) is a well-known player in the European consumer lending market. He was also involved in the early stages of Esketit. At the moment, he is engaged with Fintown and his lending startup called CentroFinance s.r.o., which operates the Czech payday lender Ofin.cz.

In July 2024, we visited Fintown's headquarters to discuss important risk-related questions with the founders. Watch our impressions from the visit in the video below.

As Vihorev Group owns the Fintown crowdfunding platform, it's worth pointing out the company's previous experience with crowdfunding.

Here are the funding volumes raised and repaid to investors on other European crowdfunding platforms.

| Platform | Project | Invested, EUR | Investors |

|---|---|---|---|

| Upvest | Prvniho Pluku | 1,6M+ | 212 |

| Fundlift | Business loan | 160K+ | 61 |

| Upvest | Strakonicka Apartments | 300K+ | 199 |

| Debitum | Business loan | 150K+ | 52 |

Having some actual track record in the industry is a good sign and something to consider if you are thinking about investing on Fintown.

Who Owns The Platform?

Fintown s.r.o is owned by the two entities which the founders own.

- Stonehill Capital s.r.o owned by Vladislav Siganevich

- Vihorev.Investments SE owned by Maxim Vihorev

According to the Czech business registry entry, those two entities own 100% of the Fintown crowdfunding platform.

Are There Any Suspicious Terms And Conditions?

We have reviewed all the legal documentation that you can find on the investment platform. Every user must agree to the participation agreement, which you must read before investing in listed projects.

You will find all the generic platform documents in your profile section.

Unfortunately, the participation agreement for a particular investment will not be sent to your inbox, nor will it be available under your investments after you have invested in a project.

Amendments

The terms and conditions may be amended in the future, but the platform will inform you two weeks before the change, and you can decide whether to accept the changes or exit your investment.

Potential Red Flags

Currently, we are not aware of any red flags. We evaluate the information we retrieved as credible.

Usability

Fintown’s user interface is simple and functional.

It provides a brief overview of your investment account, a section for currently available investments, and another section displaying key data related to your portfolio.

While the platform doesn’t offer visually appealing charts, it includes all the essential features, including deposit and withdrawal options.

Since Fintown is a smaller, newer platform, the functionality is not as advanced as what you might find on more established platforms. However, you won’t encounter issues like "funds in recovery" or "pending payments" that are common elsewhere.

In our recent discussions, we learned about several upcoming features, including a dedicated statistics page, audited financials, a referral program, a secondary market, and a mobile app.

Liquidity

Each project listed on Fintown comes with a minimum term, representing your funds' lock-up period.

These terms range from 9 to 36 months. After this period, you can withdraw your funds without any extra fees.

If you want to exit your investment before the loan term ends, you can request it by emailing Fintown at info@fintown.eu. However, an exit fee will apply, depending on the remaining investment duration and the requested principal amount.

Note that when requesting an Early Exit, the following conditions apply:

- Minimum payout amount: €100 per project.

- Initial lock-in period: Exiting is not allowed during the first 6 months of the project.

- Processing time: Fintown requires up to 30 days to process the payout.

- Partial or full exit: Investors can choose to withdraw part of their investment or the full amount from a project.

- All accrued interest earned up to the exit date will be deducted.

- Requests are allowed once every 90 days from the last Early Exit processing date.

Unlike other platforms in the industry, Fintown doesn't yet offer a secondary market where you could sell your investment to other investors.

The fees are pretty high if you wish to exit before the end of the investment period. We suggest not using this function unless necessary.

Fintown previously offered investments with a 6-month lock-up period. As of year, most newly listed projects have a 24-month loan term, meaning investors cannot exit their positions early without incurring exit fees. Based on this, we have lowered Fintown's liquidity rating.

Support

Fintown’s support is quite reliable for a small, newly launched platform. During our research, we communicated with the two co-founders, who responded to more complex questions within 24 hours.

As a user, you'll primarily interact with the support team, which is reasonably responsive during business hours. You can contact them via email, live chat (available after logging in), or through Fintown's Telegram group.

However, as with any smaller platform, immediate responses may not always be available. For basic inquiries, the platform offers a dedicated FAQ page with helpful answers.

Fintown Alternatives

Fintown is an excellent small platform suitable for investors looking to diversify their P2P-lending portfolio in a new product type: rental units.

Whether you are experienced or new to P2P lending, diversification across a few well-performing platforms is the key to maximizing your return while keeping the risk balanced. Let's look at some of the Fintown alternatives to consider.

Crowdpear

Crowdpear is a Lithuanian-based and regulated crowdlending platform offering investments in development projects in and around Vilnius. The platform was launched simultaneously with Fintown and offers mortgage-backed loans with an interest of 10% - 12%.

The interest is typically paid out every quarter, and so far, none of the funded projects on Crowdpear are delayed or defaulted. This means that you can expect to earn the promoted yield. The platform is operated by the team behind PeerBerry, one of Europe's best P2P lending sites. Learn more about Crowdpear in our Crowdpear review.

InRento

InRento is a regulated crowdfunding platform from Lithuania that offers investments in rental properties. The yield on InRento ranges from 8% to 12%, depending on the project type. Some of the loans on InRento come with a fixed annual capital growth, which can increase your return on investment.

The platform manages more than €10 M of investors' assets without delayed or defaulted loans, making it one of Europe's best-regulated P2P lending platforms. Learn more about InRento in our InRento review.

PeerBerry

If you want a P2P lending platform with a flawless track record, PeerBerry is the right place. This platform protected investors even during black swan events such as the global pandemic or the war in Ukraine.

Unlike other platforms, PeerBerry is honoring all buyback and group guarantee agreements, making it the most sustainable platform on the market.

While the loan availability is lower than the demand from investors, you can invest manually and earn between 9% and 11% interest per year, with a much lower risk than on some other platforms. Learn more about PeerBerry in our PeerBerry review.