PeerBerry Review Summary

PeerBerry is one of Europe’s leading P2P lending platforms, trusted by over 110,000 investors since 2017. Offering buyback and group guarantees, zero capital loss, and annual returns of up to 9%, it’s an excellent choice for stable investments. Its transparency and strong loan recovery process make it a standout platform. The only downside of PeerBerry is the limited loan availability, which should gradually improve in 2026.

Ready to invest? Discover why PeerBerry is a favorite among European investors.

Here are the main takeaways from our PeerBerry review:

- Average return in year: Up to 10% p.a. for loyal investors

- Responsive support that answers all of your questions

- Lower availability of loans due to high demand from investors

- Publicly available statistics, including financial reports

- Reliable buyback and group guarantees

Are you still not convinced? Well, how about we tell you that you can get a 0.5% PeerBerry bonus?

Our readers will receive a bonus calculated based on the average investment amount during the first 90 days of registration. The PeerBerry referral code will be automatically added if you sign up using our exclusive partner link.

Ready to let your money work for you?

What is PeerBerry?

PeerBerry is one of Europe's most popular P2P lending sites. Since 2017, over 110,000 users have earned over €50M in interest with no capital loss. Investors can invest in long-term loans, protected by a buyback guarantee, with interest of up to 9% per year.

Is PeerBerry a good fit for you? Read our PeerBerry review to find out!

Pros

- Reliable buyback and group guarantee

- Attractive interest rates

- Well-developed P2P lending platform

- One of the safest P2P lending sites in Europe

- Good security features

- Financial reports of its loan originators are disclosed

Cons

- Cash drag

Are you wondering how PeerBerry is doing in 2026? Watch this video right here:

PeerBerry remains an excellent choice even in month year. Note, however, that due to the platform's popularity, the loan availability is limited, which can often lead to cash drag. That's why some investors prefer to use suitable PeerBerry alternatives to invest their money.

While investing in PeerBerry remains lucrative, it's no longer as passive as it was a few years ago. Later in this PeerBerry review, we cover some strategies that let you invest even in year.

Our Opinion Of PeerBerry

We’ve been investing with PeerBerry since 2018, giving us seven years of hands-on experience. In our opinion, PeerBerry is the best P2P lending platform for European investors. It has weathered numerous challenges without any capital loss for its investors.

Even during the conflict in Ukraine, which delayed some loan repayments, we stayed invested. PeerBerry has repaid all war-affected loans on the 16. December 2024, with no capital loss to investors. Competing platforms like Twino, Debitum, and Mintos have struggled to recover debts from Russia and Ukraine, despite their claims of “high-level risk management.”

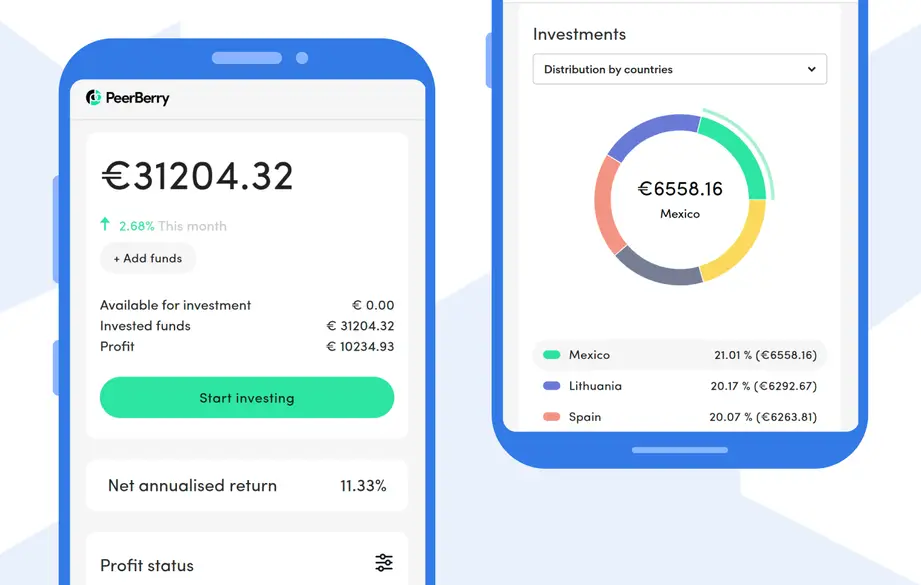

Investing and withdrawing funds on PeerBerry has always been a smooth process, making it one of our favorite P2P platforms. With rates up to 9% annually, PeerBerry remains highly competitive. Our current portfolio includes exposure to countries like Romania, the Czech Republic, Spain, Mexico, and Lithuania.

During our visit to PeerBerry’s office in Vilnius, we met the team and looked at their tools for monitoring loan performance. PeerBerry has real-time access to the loan portfolios of Aventus Group companies and to all key performance indicators (KPIs).

No other P2P marketplace offers this level of transparency. PeerBerry’s data access provides a clearer picture of how your investments are performing.

We also maintain regular communication with the CEO, which enables us to adjust our portfolio allocation in response to the latest industry developments.

PeerBerry has consistently shown that protecting investors' funds is its top priority.

The only drawback? Loan availability is sometimes limited, so you may need to invest manually as soon as new loans hit the primary market. The high demand means auto-investing tools may not always perform as expected.

At the time of writing, we have over €40,000 invested in the platform. If you’re curious how our PeerBerry stake compares to other platforms, check out our complete P2P portfolio.

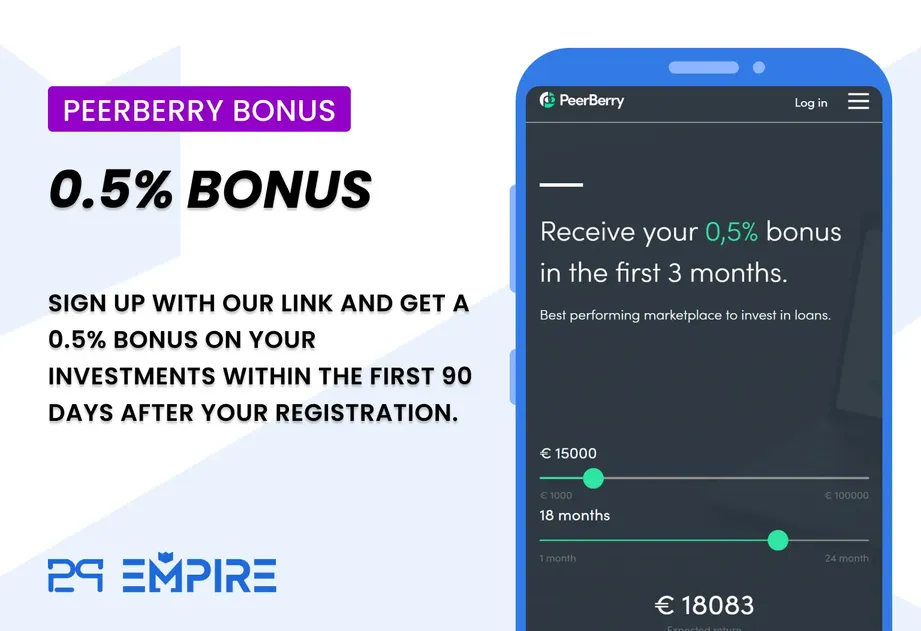

PeerBerry Bonus

Before we get into the in-depth PeerBerry review, let's examine some of the bonuses investors can receive.

Many P2P lending platforms offer you sign-up bonuses and referral codes. PeerBerry is also offering an exclusive reward for new and loyal investors.

PeerBerry Bonus for New Investors

Use our referral code for PeerBerry and get a 0.5% PeerBerry bonus for all your investments during the first three months after registration.

Note that you need to invest money to receive your PeerBerry bonus. This offer is only valid if you sign up on PeerBerry using our referral link.

⭐ PeerBerry Loyalty Bonus

There are three different levels of loyalty bonuses:

- Silver: This is for portfolios over €10,000, and you'll receive a 0.5% bonus

- Gold: This is for portfolios over €25,000, and you'll get a 0.75% bonus

- Platinum: This is for portfolios over €40,000, and you'll get a 1% bonus

To obtain the above rewards, sign up for PeerBerry and start investing!

The platform will only add this PeerBerry bonus to your active investments if your portfolio size meets the bonus criteria.

Ready to get your PeerBerry bonus?

Requirements

PeerBerry is one of our favorite P2P lending platforms since it's so easy to get started.

However, there are some requirements you must meet to invest in this platform.

- Be over 18 years old

- Have a European bank account in your name

- Your country of residence cannot be listed on the FATF list

Although you can deposit your money in any currency, we suggest transferring your funds in Euros to avoid potential currency exchange fees.

If you don't have a bank account, we suggest opening a free Wise account, as explained in our Wise card review. Alternatively, you can also read the N26 review to learn how to use the N26 bank to transfer funds to PeerBerry.

Transferring money to your PeerBerry takes less than three business days.

🧾Does PeerBerry deduct taxes?

PeerBerry doesn't withhold taxes from your earnings. In your dashboard, you can download tax statements, which you can submit to your tax authorities when you file your taxes in the country where you are a tax resident.

Risk & Return

As mentioned, PeerBerry is an excellent P2P lending platform for investors who prefer investing in stable, long-term loans.

When investing in PeerBerry, you're investing in unsecured consumer or business loans.

Most P2P lending platforms don't advertise this aspect of P2P lending since those loans offer a buyback guarantee, meaning you don't need to deal with defaulted loans as they get repurchased by the loan originator.

Buyback Guarantee

PeerBerry is also one of the P2P lending platforms offering a buyback guarantee for loans delayed by more than 60 days.

In this scenario, the loan originator you've invested in would buy back the claim against the borrower. This dramatically reduces the risk associated with this P2P platform, eliminating the need for debt collection.

Watch our visit to PeerBerry's HQ in Vilnius to get exclusive insights into the platform's operations:

Late Payments

If the borrower is late with their payments, the lender will return your investment, so you will not lose anything.

The best part about PeerBerry's buyback guarantee is that the loan originator also pays back the interest on the delayed loan.

The buyback guarantee protects you from the borrower's default.

Remember that the buyback guarantee is not the ultimate protection. Note, however, that during "black swan" events such as the war in Ukraine, loan originators cannot honor the buyback guarantee. In this scenario, PeerBerry deployed the group guarantee to cover the loan repayments. Keep reading our PeerBerry review to learn more.

Are you wondering how PeerBerry compares to Mintos? Check out our latest comparison PeerBerry vs Mintos.

In PeerBerry's history, no investors have lost money. This is mainly because PeerBerry's loan originators have never funded more than 45% of their loan books via P2P lending. Therefore, the loan originators can cover any potential buyback guarantees. PeerBerry's business partners always maintain 10% of the listed portfolio in cash to facilitate buyback guarantees and settle with investors.

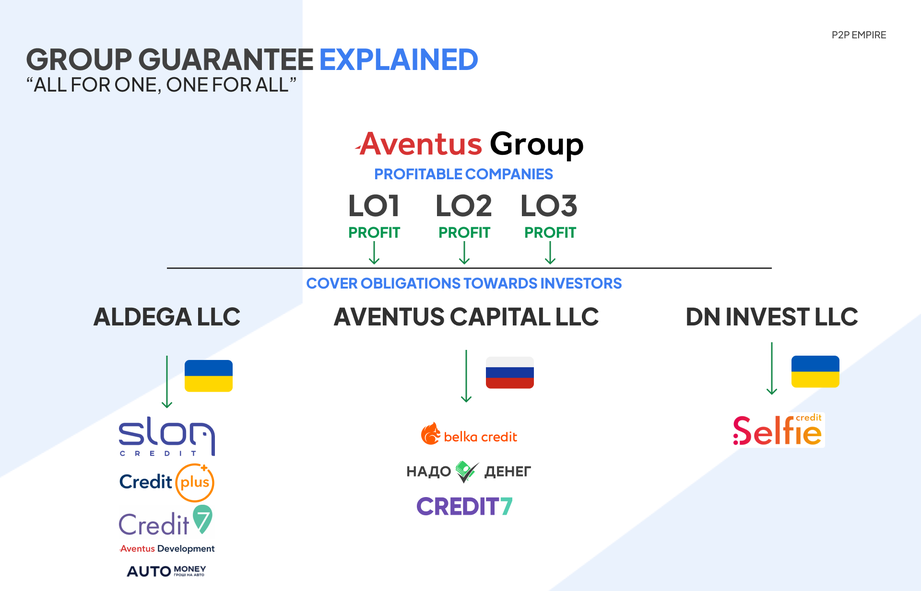

Additional Guarantee (Group Guarantee)

PeerBerry offers an additional guarantee by the parent companies of the loan originators. Most originators offer loans in different countries, although it's worth noting that two large investment groups own them.

Most loan originators on PeerBerry are operated by - Aventus Group and Gofingo.

While the loan originators work as independent entities, the additional guarantee claims that the parent company will step in and repurchase your claims if the loan originator cannot cover the buyback guarantee.

In our latest P2P talk with the CEO of Aventus Group, Andrejus Trofimovas, we learned that Aventus Group is operating very sustainably, allowing it to grow its market share and fulfill its obligations to investors.

This interview was recorded in December 2025.

Loan Originators

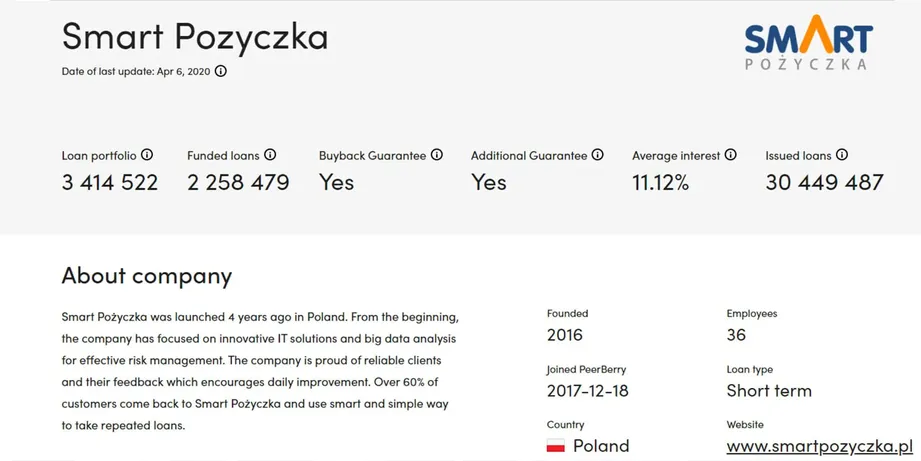

As mentioned above, PeerBerry collaborates with two large finance groups, Gofingo and Aventus Group, and two smaller lenders, Lithome and SIB Group. In total, you can invest in loans from 24 loan originators.

On PeerBerry's website, you will find more information about every loan originator. You can access the size of their loan portfolio, the total amount of funded loans, and information about the buyback guarantee and interest.

If you wish to review the financial position of individual loan originators, navigate to our "Loan Originator" sections a the top of our PeerBerry review, where you can review key financial metrics and access the financial report.

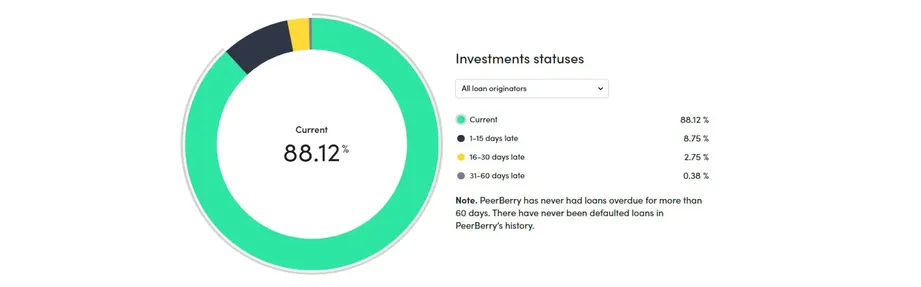

PeerBerry has also recently added information about delayed loans from individual lenders. You can now see which loan originator has the most delayed loans on PeerBerry. It's worth mentioning that the average percentage of delayed loans is between 15% and 20%, which is considerably lower compared to other market players.

This is how the loan status typically looks during normal market conditions. However, any force majeure event might delay your loans.

Investing in Long-Term Real Estate Loans

PeerBerry offers not only high-yielding short-term loans but also medium-term real estate loans with up to 9% interest over 12 months, backed by a buyback guarantee.

Trusted partners Lithome and SIB Group fund a portion of their projects on PeerBerry, supplementing with bank financing at later stages. Both have strong track records, with Lithome funding over €14 million and SIB Group €16 million on the platform, with no capital losses.

Long-term loans alleviate the cash drag, a common issue with short-term loans, and offer stable returns with less active portfolio management. These loans are an excellent choice for diversifying your investments while earning competitive returns from reliable lenders.

This table shows the performance of lenders offering investments in real estate and business loans. The data was retrieved in December 2024.

| Lender | Funded | Repaid | Total Interest |

|---|---|---|---|

| Lithome | €33,028,308 | €18,567,048 | €2,209,177 |

| SIB Group | €22,603,486 | €6,667,749 | €2,347,681 |

| LLC Teratus | €1,017,350 | €1,017,350 | €68,803 |

| LLC Pakrantės būstas | €21,549,043 | €6,216,729 | €1,909,417 |

Country Risk

When investing in lenders from various countries, you could prioritize those from regulated markets. PeerBerry is very transparent when sharing additional data about the regulatory environment in individual markets.

Please note that all PeerBerry lenders are required to comply with local laws and regulations. The country's exposure to PeerBerry's loans can vary depending on market conditions.

We propose setting up multiple auto-invest portfolios or investing manually to control your diversification settings. If you want an equally diversified portfolio, that's the only way to achieve it.

The availability of loans from specific lenders varies, as PeerBerry reduces the exposure of loans issued by start-ups in developing countries.

If you're experiencing cash drag, consider reviewing our Crowdpear review to learn more about another crowdfunding platform operated by PeerBerry's team.

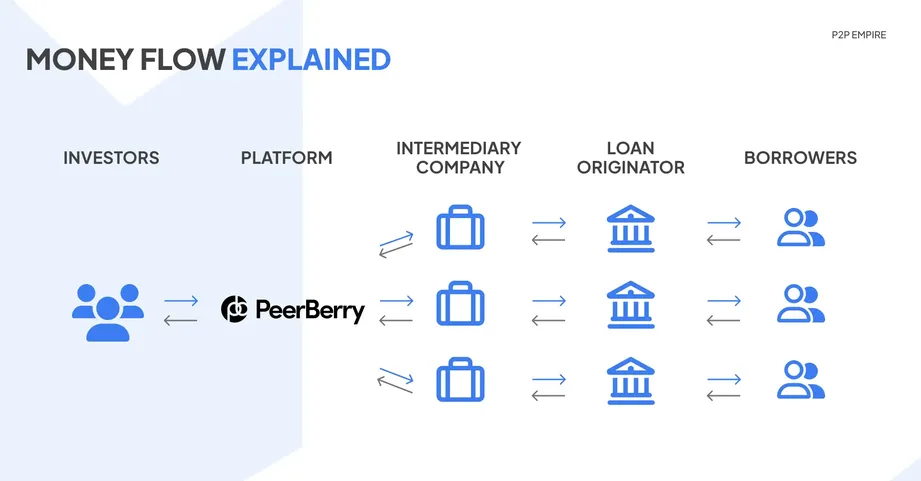

When investing in loans in emerging markets, it's essential to remember that PeerBerry uses an indirect investment structure to protect investors from force majeure events. This means that before the money is sent to the loan originator, it must pass through an intermediary company.

This graph illustrates the process of money being transferred to the borrowers. Remember that the safety of your investment relies on the performance of the loan book.

To gain a deeper understanding of macroeconomic risks in various markets, review our country risk data hub for P2P investors.

Is PeerBerry Safe?

Based on PeerBerry's seven-year track record in the industry and zero capital loss, many investors would agree that the platform is one of the safest options in the P2P lending industry.

The safety of your investments is further ensured by the sustainable lending practices of the companies you invest in.

We have also investigated the platform's management, reviewed their financial reports, and read all the terms and conditions.

Who Leads The Platform?

Arunas Lekavicius is the CEO of PeerBerry and is also responsible for its business decisions. Before Arunas joined PeerBerry, he was the Head of Leasing at the Lithuanian lender 4finance.

PeerBerry's team consists of 10 employees, while many tasks connected to IT and accounting are being outsourced.

Who Is The Owner Of The Platform?

PeerBerry is owned by three investors: Andrejus Trofimovas (50%), Ivan Butov (25%), and Vytautas Olšauskas (25%)

Are There Any Suspicious Terms and Conditions?

Let's see whether we can spot some unusual clauses.

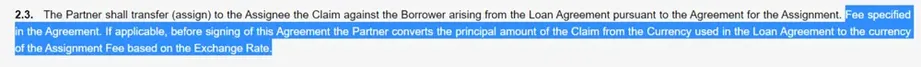

Clause 2.3 - Currency Risk

PeerBerry doesn't offer a multi-currency solution. All of the investments are made in euros.

Even though the loan originator's loans often originate in other currencies, you, as an investor, are not exposed to any currency risk.

The loan originator earns enough interest to cover potential currency fluctuation. From our talks with the CEO of PeerBerry, we learned that their business partners don't hedge against currency risk (volatility). They do consider it and adjust their cash buffer accordingly.

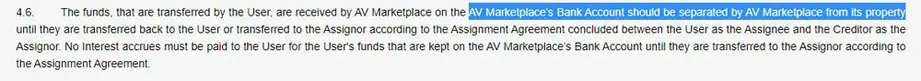

Clause 4.6 - Security of Your Funds

All your funds are stored in a separate bank account of Peerberry d.o.o - the operator of PeerBerry.com.

The separation of funds is a standard procedure in the P2P lending industry. To increase the safety of investors' funds, we would certainly appreciate it if PeerBerry introduced individual IBAN accounts.

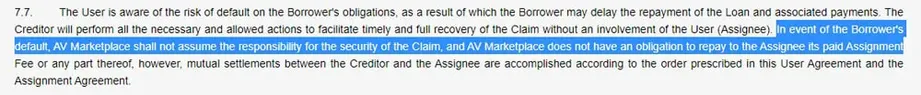

Clause 7.7 - Liability

As with every P2P investment, the P2P lending platform isn't reliable for any losses if the borrower doesn't fulfill its obligations. PeerBerry's business partners are earnest about protecting your money.

Suppose the borrower is late with its payment for more than 60 days. In that case, the loan originator is responsible for repurchasing the claim from you and returning the outstanding interest and loan principal to your account.

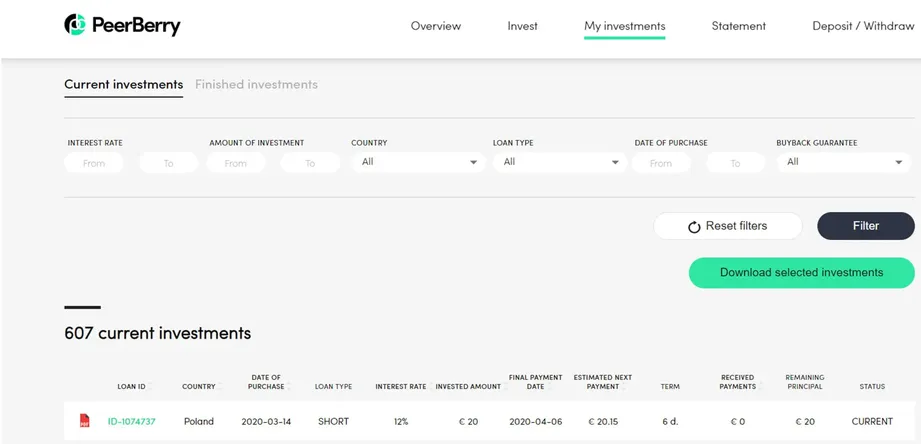

Do Investors Have Access To Individual Assignment Agreements?

Investors can view individual assignment agreements with more details about their claims under "My Investments." Before investing in loans, you can manually review the assignment agreement.

Click the PDF icon next to the LOAN ID to download the file.

Usability

PeerBerry is made for all types of P2P investors, so whether you're just starting with P2P lending or looking for new platforms to help you lower the risk, we'd recommend you seriously consider PeerBerry.

PeerBerry's dashboard is very intuitive, and you can reach all the essential sections of the website within just a few clicks.

With their Auto Invest feature, you can view your investments, export transactions for your tax statements, and automate your investment strategy.

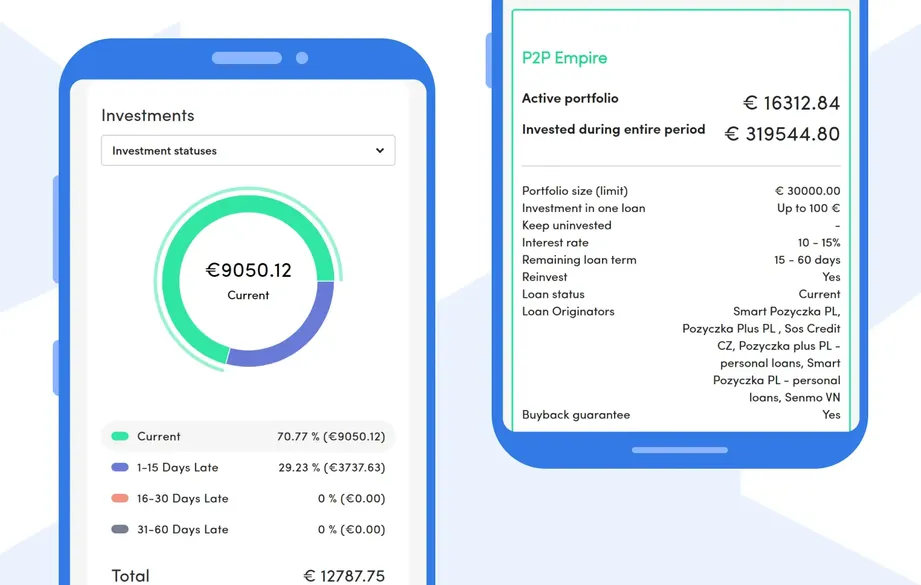

PeerBerry Auto Invest

The auto invest feature on PeerBerry allows you to set up essential variables such as portfolio size, maximum investment per loan, interest rate, loan period, status, countries, and loan originators. You can also reinvest all your returns.

We suggest avoiding exclusions of loan originators, as loan availability changes constantly. Restricting your Auto Invest settings may result in uninvested money in your account.

PeerBerry Auto Invest Not Working? Here’s What to Do

If your PeerBerry Auto Invest isn’t working, start by reviewing your Auto Invest settings and the number of loans that fit your criteria.

If your funds aren’t being invested automatically, we recommend enabling notifications on the PeerBerry app and manually investing as soon as new loans are listed. Due to the high demand for short-term loans, the Auto Invest feature may struggle to allocate all available loans evenly among investors.

Investors with a higher loyalty tier generally get priority over those with smaller portfolios.

To increase your chances of getting funds invested, consider manually investing in newly listed loans on business days between 7:30 and 9:00 AM CET. Keep in mind that 65% of the loan supply is reserved for Auto Invest, while the remaining 35% is available on the Primary Market for manual investing.

While loyal investors with larger portfolios have priority, it doesn’t guarantee that loan supply will meet demand, regardless of your loyalty tier.

After testing multiple Auto Invest strategies over the years, we haven’t found any significant impact on our investment performance. You can tweak your Auto Invest by interest rate or loan period, but don’t expect other settings to improve your returns drastically.

As of month year, we recommend investing manually due to lower loan availability resulting from high investor demand. Watch the following short video to learn about our current investment strategy for PeerBerry.

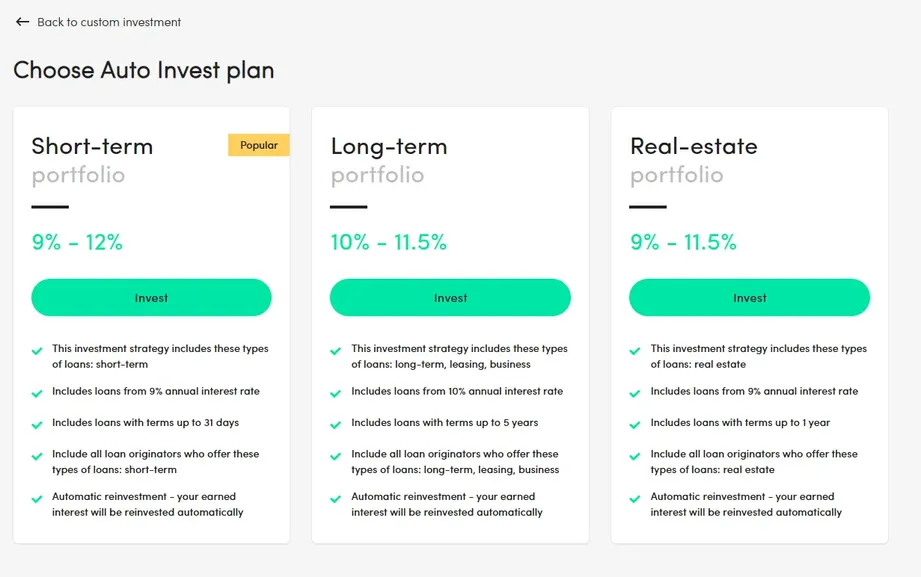

PeerBerry Auto Invest Plan

PeerBerry also offers a feature that will help you diversify your portfolio with just one click.

The main differences between individual strategies are the investment term and the loan type.

Remember that those strategies won't diversify your portfolio equally. We recommend setting up individual auto-invest portfolios or investing manually if you want to control your exposure to specific lenders or countries.

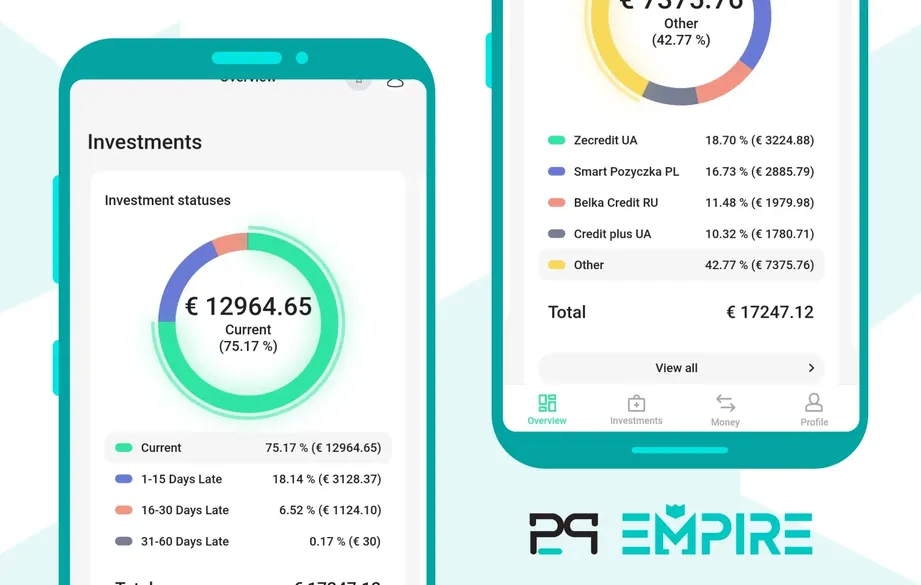

PeerBerry App

PeerBerry is also available as a mobile App.

The PeerBerry app allows you to review your portfolio quickly. You can view your available funds, invested funds, paid interest, and annualized net return.

An excellent app feature is a daily interest repayment chart.

Under the "Investments" section, you can also get an overview of your portfolio, now segmented into loan originators and types. The PeerBerry app also comes in dark mode. To stay updated on your portfolio performance, we recommend enabling all notifications.

Do you enjoy this review? Invite us for a coffee ☕

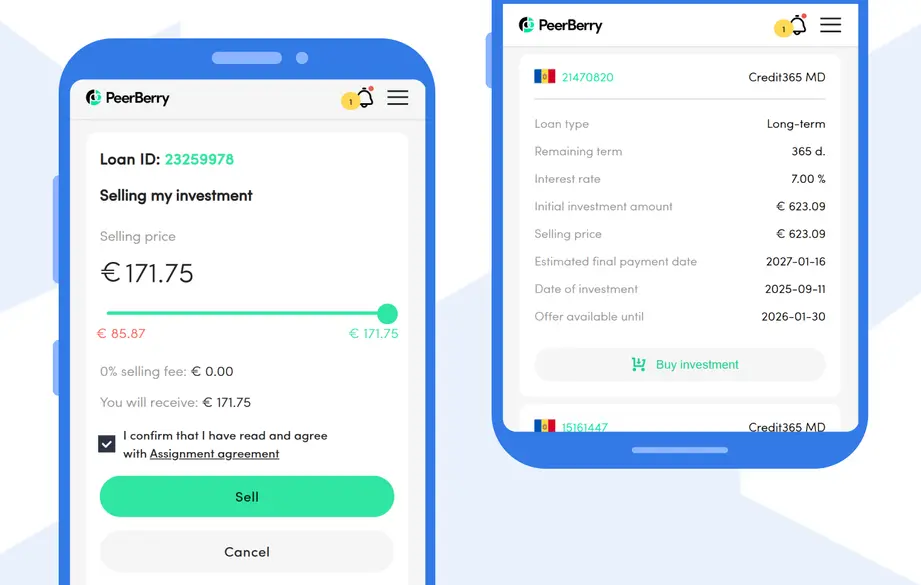

Liquidity

PeerBerry has launched a Secondary Market, allowing investors to sell their existing investments to other users once they have been held for at least six months.

This feature improves liquidity and gives investors more flexibility when managing their portfolios.

The Secondary Market is available in your PeerBerry account under the Invest section. Currently, it can be used only on a desktop. Mobile app access is planned for later this year.

All investors can sell their investments on the Secondary Market. To buy investments, users must complete identity verification and have enough available funds.

The same rules and investment conditions apply to both the Secondary and Primary Markets.

How the PeerBerry Secondary Market works:

- No fees are charged for selling or buying investments.

- Investments can be sold at their remaining value or with a discount of up to 50%.

- Only full investments can be sold; partial sales are not possible.

- Each sale offer remains active for 14 calendar days and is automatically cancelled if not sold.

- Sale offers can be changed or cancelled at any time before purchase.

- Investments bought on the Secondary Market can be resold after 1 day.

- If you sell mid-month, you will lose all rights to the interest for that period.

Support

We believe having a dedicated support team is crucial when trusting a P2P lending platform with your money. It’s important to know that your funds are protected and that you can rely on the platform when needed.

In our experience, PeerBerry’s support has been consistently responsive. You can also check out reviews on Trustpilot or Reddit, where hundreds of other investors share positive feedback about the platform.

The best way to reach their support team is by emailing info@peerberry.com. Most of our inquiries have been answered within a day; something that can't be said for some other platforms.

It's a smart idea to test customer support on any P2P platform before committing to it as an investor. Make sure they can handle your requests before you entrust them with your money.

Compared with even the biggest European P2P platforms like Bondora, PeerBerry's support is exceptional.

PeerBerry Alternatives

While PeerBerry is one of Europe's most reliable P2P lending platforms, the loan availability in month year is low. This means that it can be challenging to keep your money invested. Uninvested funds don't generate any interest, so you might want to consider some alternatives instead.

Esketit

Esketit is one of the best alternatives to PeerBerry. The platform boasts an excellent track record, no funds in recovery, and an instant exit option, thereby increasing your liquidity. You can expect to earn between 10% and 12% interest on Esketit, slightly higher than on PeerBerry.

The platform is straightforward, making it suitable for beginners and more experienced investors. Learn more about how Esketit works in our Esketit review.

Nectaro

Nectaro offers investments of up to 14.5% annual interest. The platform is well developed, offering a higher loan supply, so you won't be stuck with uninvested funds. Currently, you can diversify your portfolio in well-capitalized lenders from Romania and Moldova. If you are less risk-sensitive, you can also invest in consumer loans from the Philippines.

Your investment on Nectaro is backed by a 60-day buyback guarantee. Learn more about how you can earn income in our Nectaro review.

Triple Dragon Funding

Triple Dragon Funding offers up to 14% interest on business loans to game development studios, backed by tax credits and receivables. The loans are issued by Triple Dragon, a UK-based lender which have been funding its loan book for several years via P2P investors with no loss of capital. Learn more about this platform in our Triple Dragon Funding review.