TWINO Review Summary

TWINO is a suitable P2P lending site for risk-friendly investors seeking yield from short-term loans. The platform offers 12% interest per yield by investing in loan securities from its Polish lender, Netcredit.

Key Takeaways From Our TWINO Review:

- Easy-to-Use P2P lending platform

- Frequent changes in management

- Over €4 M of funds are stuck in Russia

- Exposure to high-risk markets

What Is TWINO?

TWINO is a Latvian P2P lending platform founded in 2009. Since then, the P2P platform has paid more than €25 M in interest to more than 60,000 investors. By investing in unsecured loans with a duration of up to 12 months, you can earn up to 12% interest per year. Read our TWINO review to learn more.

Our Opinion Of TWINO

We have actively invested in and monitored TWINO over the past five years. While TWINO was once a solid platform with a balanced risk profile, this is no longer the case in year.

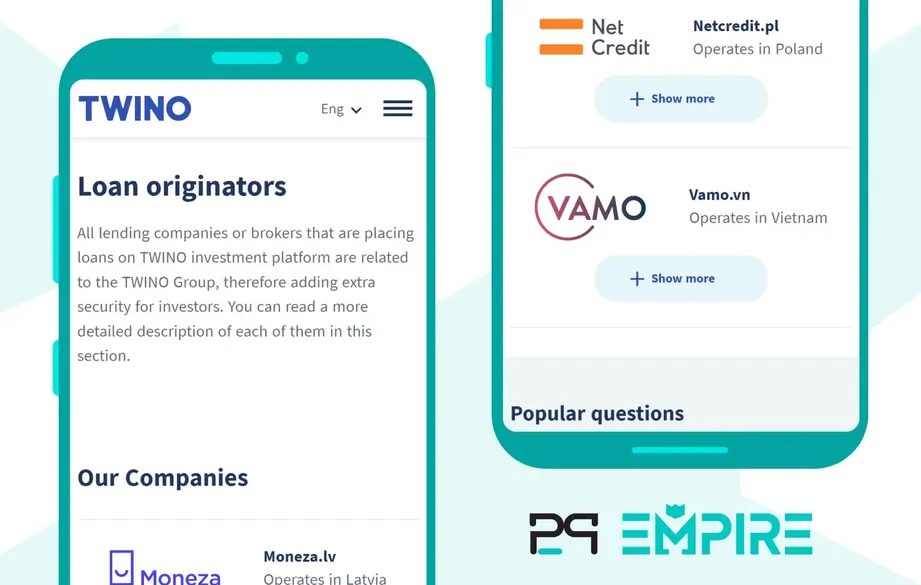

Currently, TWINO is only suitable for risk-tolerant investors willing to take on high-risk lending portfolios. In 2023, the platform offered loan securities from Poland, Vietnam, and the Philippines. However, in early 2024, TWINO announced its exit from the lending business in Asia, leaving investors with the sole option to invest in Polish loans.

Following regulatory changes in Poland in 2024, where funding consumer loans through retail investors was prohibited, several platforms stopped offering Polish loans. TWINO, however, found a workaround by reclassifying its Polish lending portfolio as a credit card product, which doesn't fall under the new regulation. While this allows them to continue offering Polish loans, it increases investor risk, as the Polish regulator may close this loophole in the near future.

Beyond limited investment options, TWINO has significant exposure to Russia. Although the platform does not offer a group guarantee, it has made little effort to recover funds from its Russian portfolio for investors. As of month year, over €4 million of the total portfolio remains illiquid due to Russian regulations.

These recent events raise concerns about the quality of TWINO's risk management. The platform has remained in high-risk markets like Vietnam far longer than competitors, many of whom exited earlier to safeguard their investors. In July 2024, TWINO revealed that its Vietnamese lender had defaulted, resulting in a minimum loss of €1.3 million. Whether investors will be reimbursed remains uncertain.

Adding to these concerns, TWINO's financial report for 2023 indicates that the platform was not profitable, further undermining confidence in its long-term stability and ability to deliver returns. Given the mounting risks, we recommend investors approach TWINO with caution.

We warned our community about the risk in Vietnam in January 2024 on our YouTube channel.

Requirements

There are only a few requirements that you should keep in mind when investing on TWINO:

- Be over 18 years old

- Reside within the EEA (European Economic Area)

- Have a European citizenship (Non-EU citizens are not accepted)

You can also sign up and invest with your business if you wish to do so.

The process is straightforward. You only need to answer a few finance-related questions and upload a valid identification document.

It shouldn't take you more than five minutes.

No EUR bank account? No problem

- 💳

- 💳

Risk & Return

Earning 12% interest annually by investing in unsecured consumer loans isn't risk-free. This is why you should always get familiar with the protection scheme that the P2P lending platform offers.

First, let’s examine the loan types that TWINO funds. As of year, the majority of TWINO loans are unsecured short-term consumer loans. Occasionally, TWINO also funds real estate loans.

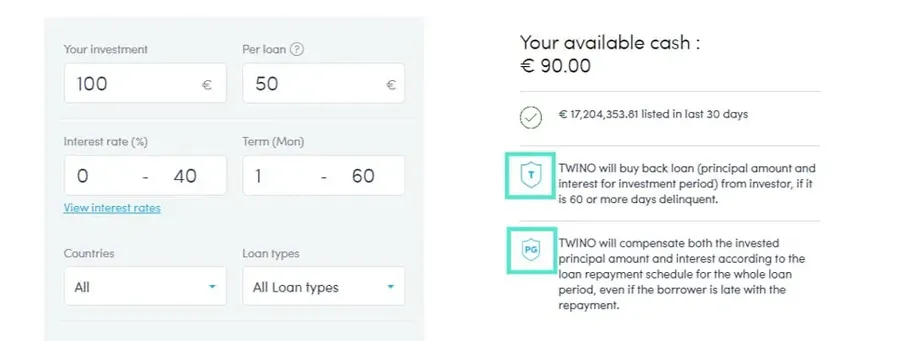

To protect your investment, TWINO introduced two protection schemes:

TWINO's Buyback Guarantee

If you have invested in loans on different platforms before, you might be familiar with the buyback guarantee.

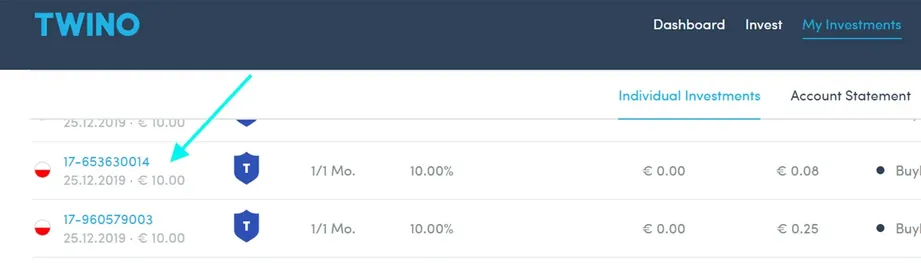

Investments that are marked with the buyback guarantee badge (which looks like a shield with a ‘T’ on it) are secured by TWINO.

This means that if your loan is delayed for more than 60 days, the platform will repurchase your investment and pay you the outstanding loan amount and the accrued interest and late payment fees.

It’s important to highlight that TWINO will also refund the accrued interest. The loan originators cover the buyback guarantee on those P2P marketplaces. TWINO isn't a marketplace but a finance group with several loan originators.

You can learn more about TWINO's loan originators directly on TWINO's website.

TWINO Payment Guarantee

TWINO fully secures investments marked with the payment guarantee badge (PG). If the borrower fails to repay the loan, TWINO will pay back the interest and the monthly principal amount as per the original loan repayment schedule. You also don’t have to wait 60 days.

Remember, however, that during black swan events, TWINO won't uphold the buyback guarantee. The financial group doesn't offer a group guarantee, meaning if a lending portfolio suddenly becomes inaccessible, you will need to wait until it is recovered, which may take several years.

Is TWINO Safe?

If you have been following our work on P2P Empire, you know by now, that we read the terms and conditions of every platform and do our own little background check about the key management of the company. Here are our findings of TWINO.

Who Runs the Company?

TWINO used to be operated by its CEO, Anastasija Oleinika, who also joined one of our podcast episodes. The role of the CEO is currently occupied by Helvijs Henšelis. The management of TWINO keeps changing regularly.

Who is the Company’s Legal Owner?

TWINO is founded and owned by Armands Broks. Armands got his MBA from the Stockholm School of Economics in Riga.

According to the financial report 2019, Armands Broks owns 100% of the company. He regularly appears at fintech conferences and networking events.

Are There Any Suspicious Terms and Conditions?

TWINO's user agreement is only 11 pages long, so let’s dive right into it.

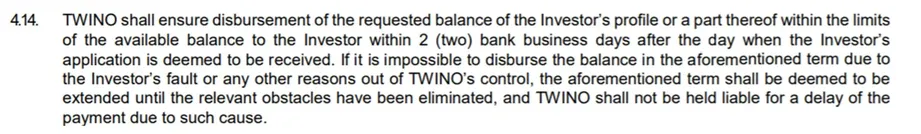

Clause 4.14 - Withdrawals

Section 4.14 shows that TWINO needs to process your withdrawal request within two business days.

Unfortunately, no segregated bank accounts are mentioned in TWINO’s T&C. The only mention of how TWINO is storing your funds is found on TWINO’s FAQ page.

This means, that TWINO stores your funds on the separated bank account which belongs to SIA TWINO. Those funds may be distributed to other TWINO Group accounts for the purposes of funding loans.

From our dialogue with TWINO we learned that TWINO's account balance is always at least twice the amount of investor's uninvested funds. Any withdrawals should be therefore covered within two business days.

TWINO is currently in the process of obtaining the IBS license in Latvia, which will make the storage of investor’s funds on TWINO even more transparent and secure.

Clause 11.7 - Liability

Every investor is liable for their own actions and there is no guarantee that the borrower will be able to repay your investments. This is specifically mentioned in section 11.7. As with every P2P investment, you as the investor bear the full risk.

Clause 14.2 - Amendments

Unfortunately, TWINO reserves the right to amend the T&C at any time without prior notice, unless the changes refer to changes around the claim servicing charge. Those will be announced 10 days in advance.

We are not big fans of this clause. You should be always notified about any changes in advance.

Do Investors Have Access to Individual Loan Agreements?

If you have registered or invested you do have access to TWINO’s assignment agreement. If you're using TWINO’s Auto Invest you have the chance to view the assignment agreement before activating the Auto Invest. You can also view the template here.

You can view the assignment agreements for all active and repaid investments under My Investments → Agreement Number.

Usability

TWINO is fairly easy to use in terms of usability. It offers features such as the portfolio builder, secondary market, cash flow forecast, and income statement reports.

Compared with other European P2P platforms, TWINO has one of the most aesthetic dashboards.

It also shows your interest income, information about your investments, and the portfolio state that displays data about your assets protected by the earlier-mentioned protection schemes.

TWINO Auto Invest

One of the most valuable tools any P2P lending platform can have is an Auto Invest feature.

P2P lending doesn’t need to be time-consuming. With TWINO's Auto Invest feature, you can automate most of your investments. Define your investment strategy, and the system will invest your funds in loans that match your preferences.

Most of the P2P lending platforms that offer investment opportunities in personal loans have a similar feature.

We suggest setting your Auto Invest settings broadly; otherwise, you might encounter cash drag. This means that your criteria wouldn't match the currently available loans, resulting in uninvested funds on your TWINO investor account.

TWINO's App

TWINO is also one of the few platforms that offer a fully functional native mobile app for Android and iOS.

The app offers exactly the same functionalities as the browser web app. Additionally, you can set up notifications and track your portfolio from anywhere.

Liquidity

When investing in P2P loans, you should remember that some P2P platforms, particularly those in the real estate or business loan niche, might lock your capital for an extended period.

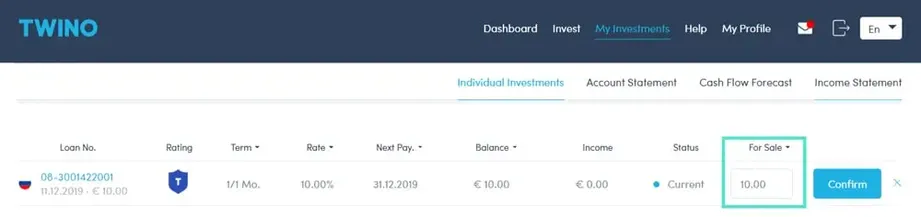

With TWINO, you can also sell your investments on the secondary market without any additional fees or discounts.

Selling back your investment is possible for the asset's face, discount, or premium value. Remember that the liquidity of your investment on TWINO might be limited if certain regulatory risks in dedicated markets materialize.

Withdrawing your money from TWINO shouldn’t take longer than a few days. However, the exact time depends on the size of your portfolio.

If you want instant withdrawal options, look at features such as Esketit's Strategies or Bondora’s Go and Grow.

Note that neither feature will allow you to control your investment preferences, and the withdrawal function only works during "normal market" conditions when the demand for investments is higher than the supply.

Support

TWINO's support is semi-responsive; you can expect to receive an answer within three business days of contacting them.

We have been in touch with TWINO several times, and the support has always been on point.

TWINO's interface is currently available in three different languages—English, German, and Latvian. If you struggle with English, don’t worry—TWINO has international customer support.

The easiest way to get in touch with the team is to send an email to info@twino.eu

TWINO Alternatives

While TWINO used to be a popular choice for investors, the risk has increased in the past few years. If you don't want to give control over your funds to a company willing to expose your investments to high-risk lending markets, you better look elsewhere.

Esketit

Esketit is one of the best alternatives to TWINO. The platform has an excellent track record, no funds in recovery, and an instant exit option, which increases your liquidity. You can expect to earn between 10% and 12% interest on Esketit, with seemingly better risk management than on TWINO.

The platform is straightforward, making it suitable for beginners and more experienced investors. Learn more about how Esketit works in our Esketit review.

Income Marketplace

Income Marketplace offers investments of up to 15% annual interest. The platform isn't as well developed, but the loan availability is higher, meaning you won't suffer much cash drag.

A buyback guarantee covers your investments on the Income Marketplace, and specific lenders even pledge their loan book as collateral. Learn more about how you can earn income in our Income Marketplace review.

Fintown

If you are looking for a suitable alternative platform that generates interest similar to TWINO, Fintown might be a good fit. The yield you earn is generated from rental properties from short-term rental units in the city center of Prague.

So, instead of funding credit lines in Poland, your money is used to finance European rental properties. Learn more about this platform in our Fintown review.