Income Marketplace Review Summary

Income Marketplace stands out as one of the fastest-growing P2P lending marketplaces in 2025, having been operational since 2021 with an impressively low default rate of just 2%. The platform provides a diverse mix of short-term and long-term loans, ensuring ample availability and minimizing cash drag.

Although it may not be as user-friendly as some competitors and lacks a secondary market, investors have the opportunity to earn stable returns exceeding 10% annually, a rate superior to many other P2P lending sites.

Main takeaways from our Income review:

- Unique protection schemes

- Easy-to-use platform

- Limited diversification

- High interest rate

The Income Marketplace is a good fit for a stable and competitive yield with increased protection systems.

Ready to get some income?

What Is Income Marketplace?

The Income Marketplace is a P2P lending marketplace that allows you to invest in loans from seven lending companies that operate in different markets.

Investing on Income can earn you up to 15% annual interest. The platform is transparent when sharing relevant financial overviews, but can it compete with other P2P lending sites? That’s what you will discover in our in-depth Income Marketplace review.

Pros

- Up to 15% interest rate

- Better protection scheme as on most P2P marketplaces

- Experienced management

- Based in Estonia

- No Cash Drag

Cons

- No secondary market

- Support is not always up to users' expectations

- It is less user-friendly than other platforms

Income's underlying technological infrastructure and loan portfolio monitoring are superior to what we have seen on other platforms or P2P marketplaces. The cash buffer and junior share are also unique, making Income Marketplace an exciting investment site.

Are you wondering how the Income Marketplace works? Watch our Income Marketplace review to learn more about the platform.

Our Opinion of Income

Income is very transparent in terms of how investments in loans from various lenders are structured. The team has invested considerable time refining the buyback guarantee, ensuring lenders remain motivated to recover defaulted loans.

During our visit to Income's office in Tallinn, we had in-depth discussions with the founder, CEO, compliance officer, and risk manager. We also received insights into their workflow, platform technology, and how they monitor loan book performance. Income's technological infrastructure is notably advanced, improving monitoring accuracy and reducing the chance of human errors.

The platform shared its portfolio analysis with us and explained how it assesses portfolio quality and cash value. Additionally, Income maintains a conservative approach to country risk, which enhances the safety of investments on the platform.

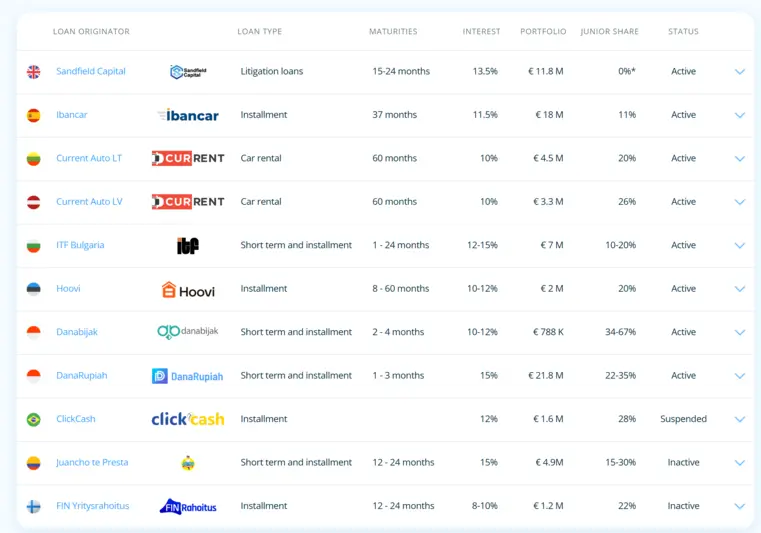

However, there are some significant drawbacks. The platform offers limited diversification, with high exposure to just a few lenders, which increases the risk for investors. The failure of ClickCash, a Brazilian lending partner, to continue repayments is a clear example of this vulnerability.

While Income advertises a high level of safety, it has struggled to deliver on that promise fully. The higher yields reflect the elevated risk profile, and investors should carefully study the performance of the available lenders and closely monitor repayment behavior.

Additionally, despite several years in operation, Income Marketplace has not yet reached profitability, presenting a further risk for investors to weigh before allocating their funds.

Nevertheless, with a default rate of only 2%, the platform still outperforms over 90% of other P2P lending platforms. While the management's intentions appear to be positive, historical examples demonstrate that even platforms with strong security measures can encounter difficulties. Should such challenges arise, Income Marketplace may experience delays in debt recovery.

You can learn more about our exposure to P2P loans in our P2P portfolio.

Income Invitation Code

The income marketplace offers a cashback bonus for our readers. If you sign up with our link, you get a 1% cashback bonus calculated from your invested amount during the first 30 days of your registration.

Sign up using our partner link to benefit from this Income Marketplace bonus.

Ready to earn passive income on GetIncome.com?

Requirements

To earn interest on your investment in Getincome, you must meet specific requirements.

- You must have a bank account registered in one of the EEA (European Economic Area) countries, Norway, Iceland, or Liechtenstein.

- Be at least 18 years of age

- Provide your identification documents

If you don’t have a bank account in EUR, you can open a free N26 account, use Revolut, or get the Wise card. Remember that you can only transfer EUR from an account in your name.

The verification of your identity takes less than 2 minutes. You will get a QR code to take a quick selfie and a photo of your ID card.

To top up your investment account on the Income Marketplace, you must deposit funds into Income's bank account via an SEPA transfer.

Remember to add your reference number so the marketplace can allocate your deposit to your investor account. You can find the reference number in your Getincome account. The transfer should take no more than two business days.

Remember that you must reside within the EU or EEA to invest in the Income P2P Marketplace. The platform doesn't offer investment opportunities for investors from outside of Europe.

Risk & Return

When it comes to P2P lending, you should always be able to evaluate the quality of the protection scheme and the quality of the loans you invest in.

In other words, look at the buyback guarantee and check the loan originators' financial information and the performance of their loan book.

Let’s first look at the buyback guarantee.

Buyback Guarantee Explained

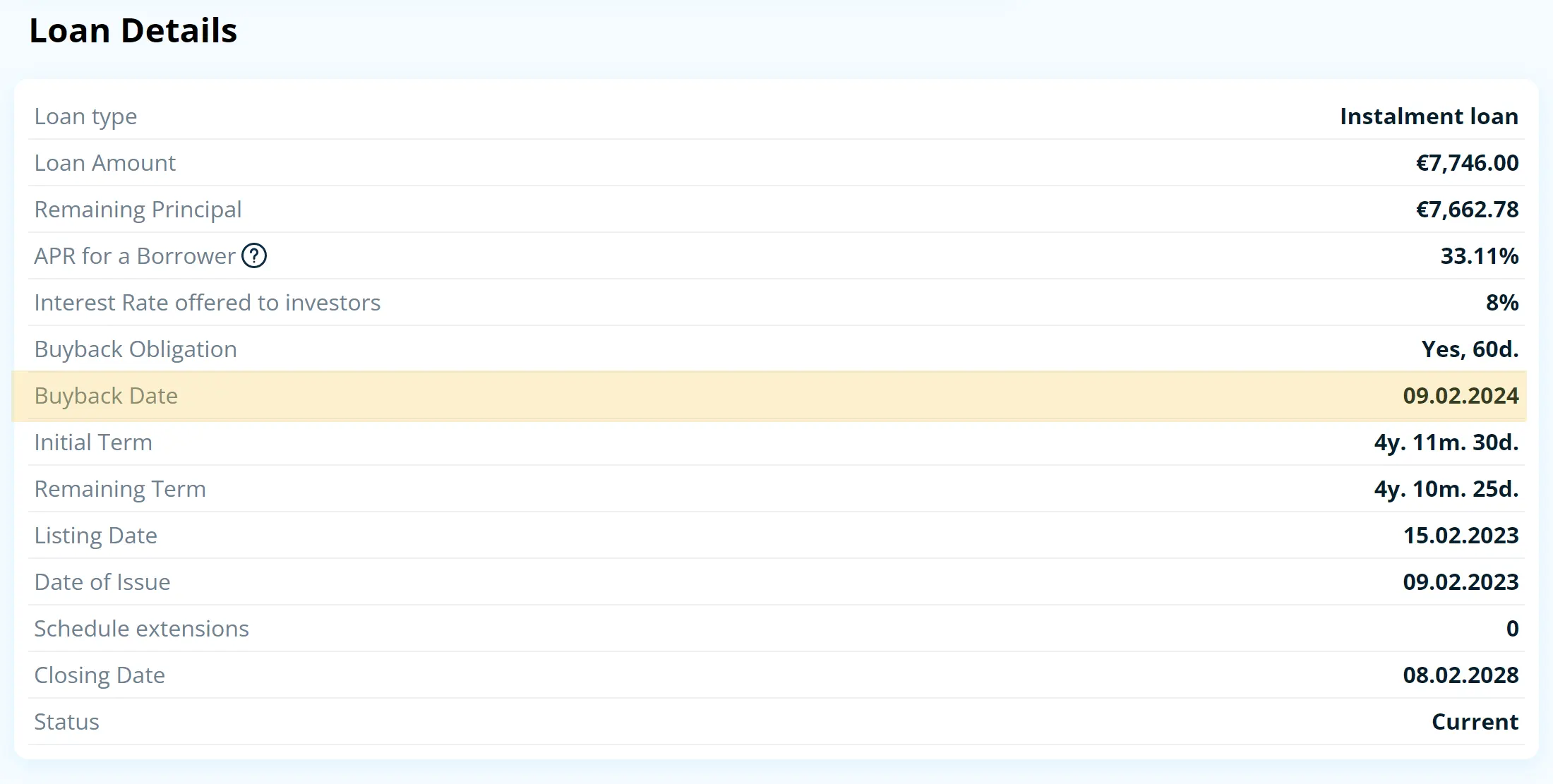

A 60-day buyback guarantee on Income backs your investment. This means that the loan originator promises to repurchase your investment and repay the accrued interest if the loan repayments are delayed by 60 days.

Experienced investors understand that the buyback guarantee is only as good as the lenders' financials and loan performance.

Remember that certain loan originators list their loans on Income via an SPV. Non-European lenders typically incorporate an SPV that lists loans on the marketplace.

Loan Originators

As of month year, the majority of available loans on the platform originate from the Indonesian lender Danarupiah, the Estonian lender Hoovi, and the Bulgarian lending company ITF Group JSC. Additionally, long-term loans are offered by Spanish lender Iban Car, Lithuanian-based Current Auto, and British lender Sandfield Capital.

This regional concentration means that Income Marketplace is best suited for investors looking to diversify their loan portfolio across these specific markets.

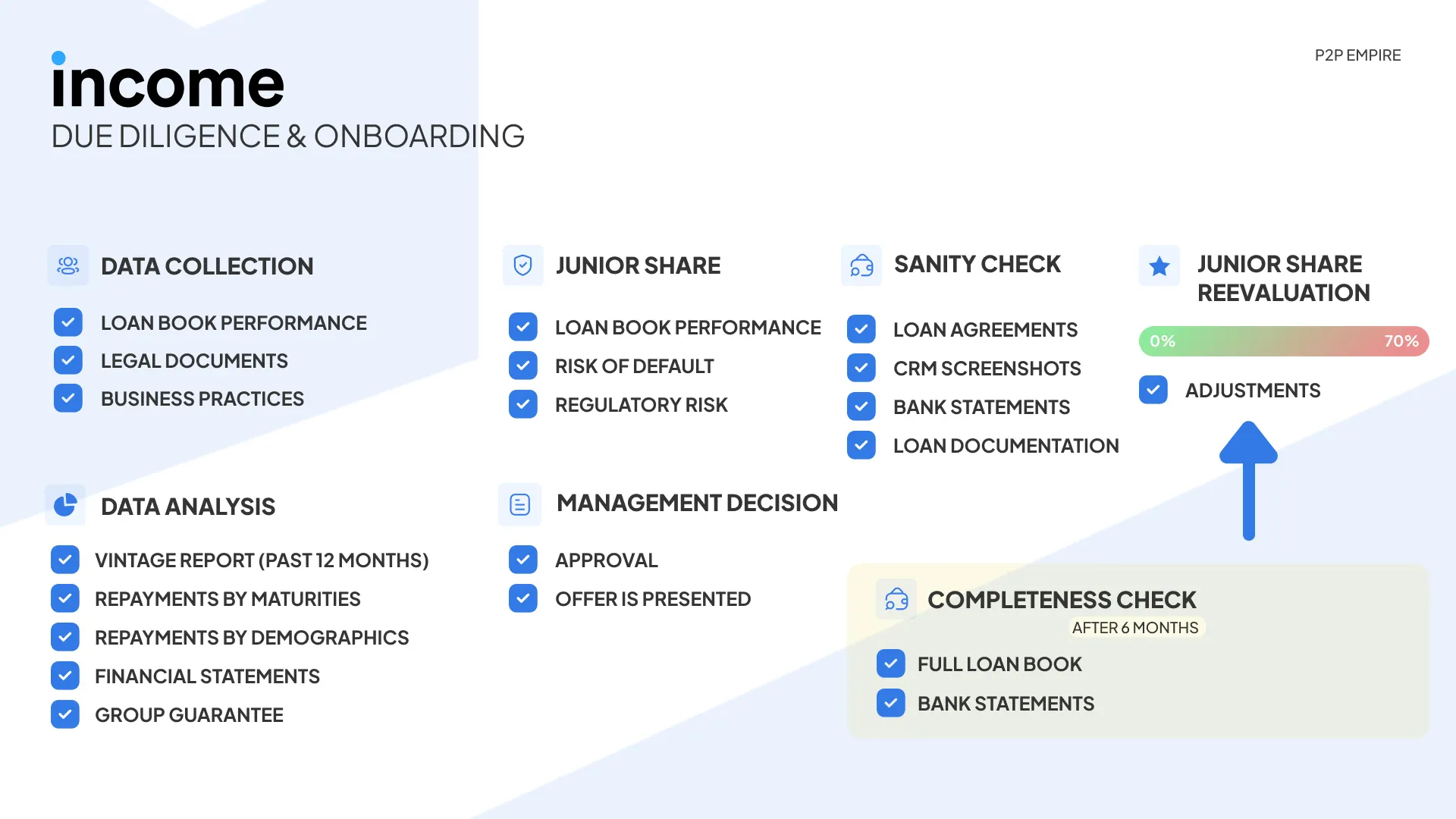

Income's Due Diligence And Onboarding

Let's get into more detail about the onboarding process of lenders on the Income Marketplace.

1. Initial Data Collection

The platform first gathers key information from the lending company, requiring legal documentation, financial statements, and an explanation of the company's loan origination process.

2. Risk Assessment

Income’s risk manager analyzes the submitted documents, focusing on loan book performance and portfolio profitability as primary evaluation factors.

3. Financial Review

The Head of Onboarding at Income conducts an in-depth review of the lender's financial statements, assessing them from multiple perspectives to ensure transparency and reliability.

4. Additional Guarantees (if necessary)

If the lender lacks an established track record, Income may require a group guarantee, particularly when the lending company is a startup operating under a larger financial institution.

5. Junior Share Calculation & Approval

The platform then calculates the junior share—the portion of loans the lender must retain—and submits the results for management approval. If approved, an offer is extended to the lender.

6. Final Compliance Checks

Upon offer acceptance, the platform performs a final verification, reviewing loan agreements, bank statements, and loan documentation to confirm that loans are properly backed by collateral.

7. Onboarding & API Integration

If all criteria are met, the lender is officially onboarded, and API integration is established, allowing Income to directly monitor the performance of listed loans from the lender’s loan management system.

8. Ongoing Monitoring

Every six months, Income conducts a completeness check and evaluates the performance of the entire loan portfolio. This periodic review helps determine adjustments to the junior share and ensures ongoing compliance.

Junior Share & Cashflow Buffer Explained

Income Marketplace positions itself as the “safest” P2P lending marketplace in Europe, implementing additional protection mechanisms such as the Junior Share and Cash Flow Buffer to enhance investor security.

The Junior Share is an improved version of the traditional Skin in the Game model. In most P2P platforms, Skin in the Game refers to the portion of a loan that is funded directly by the lender from its own balance sheet, ensuring that lenders have a vested interest in loan performance. However, the Junior Share goes a step further—it is subordinated to investor funds, meaning lenders absorb losses first in the event of default.

This structure provides an added layer of protection for investors, as the Junior Share acts as a financial cushion if a lending company fails.

To fully understand how Income’s protection measures stand out, let’s compare Skin in the Game with the Junior Share in more detail.

So, let’s say a lender with a €1 million loan portfolio and 10% skin in the game defaults.

In the next step, a collection company starts the recovery process.

Let’s assume that 40% of the portfolio could not be recovered, which means that 60% of the loan book is the final value that will now be distributed proportionally to the lender and the investors.

In this scenario, the lender and the investors are equally likely to recover the debt.

In this case, investors would lose 46% of their investments. Forty percent would be bad debt, and six percent would go to the lender.

That’s basically how skin in the game works.

Now, let’s look at the Junior Share.

The lender will list a €1 million portfolio on the platform, of which 35% is reserved as Junior Shares. That means that only 65% of the portfolio is investable by investors.

It’s important to highlight that Junior Share is subordinated to investors’ funds. Let’s examine what this means.

So, let’s say the lender goes bust, and the collection agency cannot recover 40% of the loans.

That’s not too bad,, as investors have invested in only 65% of the loan book. The junior share will be paid first to investors to cover the obligations before being paid to the lender.

In this case, investors receive all the recovered funds, resulting in only a 5% loss.

That solid protection mechanism significantly reduces your risk of losing money if a lending company defaults.

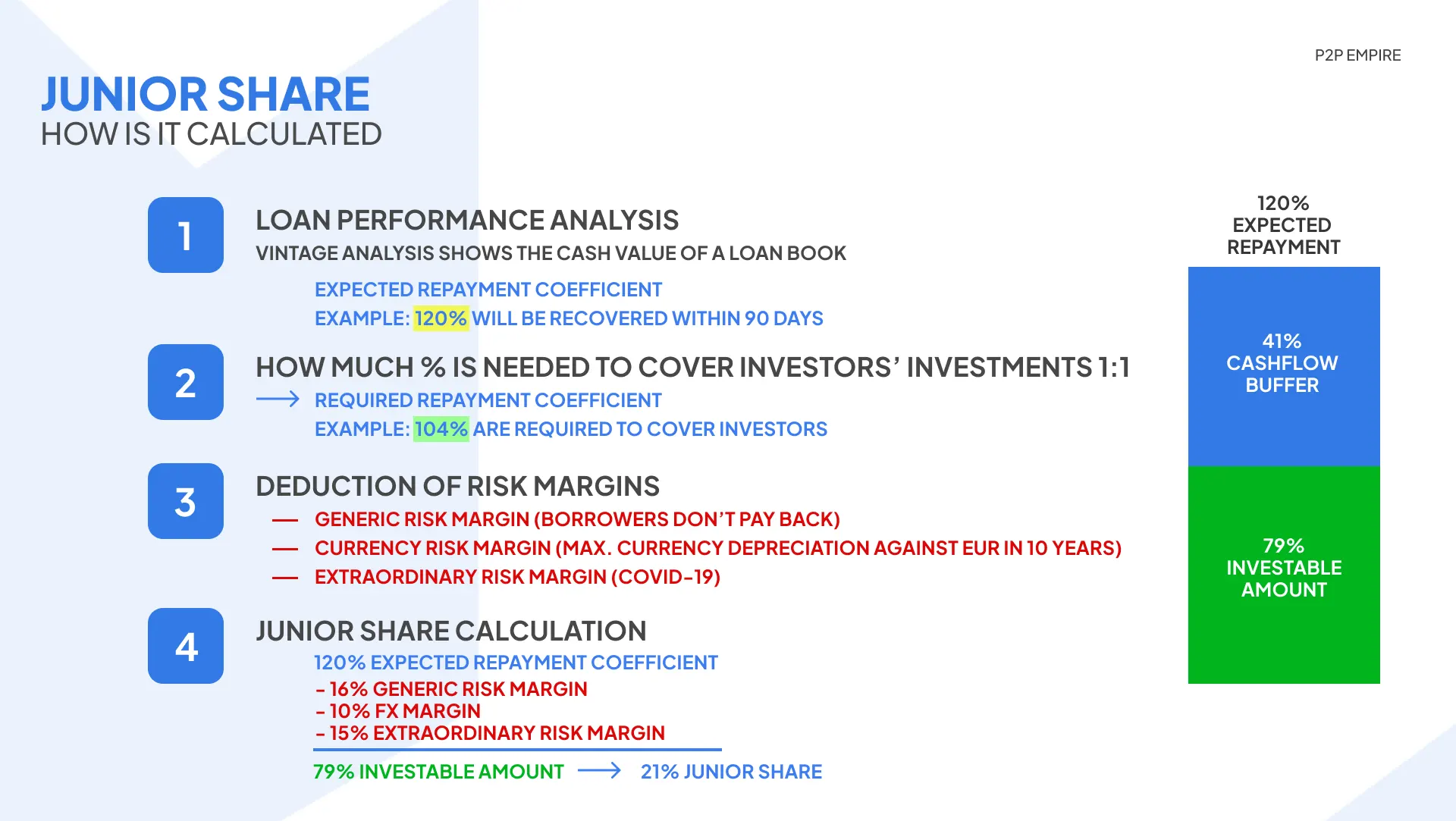

Junior Share Calculation

Based on the quality of the loan book, the Income Marketplace calculates the appropriate rate of “junior share” for every lender.

Every lender must invest the “junior share” amount from its balance sheet into every loan.

The calculation of the junior share is very straightforward.

First, the platform analyzes the performance of the lender’s portfolio.

Loan performance analysis is a crucial element in any due diligence process as it gives an idea of a portfolio's cash value over a specific time period.

So, let’s assume we expect to receive 120% of the portfolio within three months. This amount also includes the interest and fees that borrowers are paying.

In the lending business, this variable is called the expected repayment coefficient.

To figure this out, the platform must access the loan book performance.

In the next step, the Income Marketplace has to figure out how much is the required repayment coefficient to cover obligations to investors.

That includes loan principal, interest rate, and platform fees. Let’s assume it’s 104%.

So now, the platform knows, based on the loan book performance, how much is required to recover and how much is expected to be recovered.

In the third step, the platform deducts risk margins.

If the lender defaults, there are risks that you won’t be able to recover everything.

A risk factor could be that the borrower decides not to pay, the exchange rate changes or a global pandemic starts, and borrowers lose their jobs.

The Income Marketplace will calculate every risk margin separately, and it’s never the same for all lenders.

So now, the platform can calculate the investable amount by subtracting the risks from the expected repayment coefficient.

In this case, investors will be allowed to invest 79% into a loan, and they would be fully covered if all the potential risks materialize.

The cash flow buffer differs between the investable amount and the expected repayment.

A side note is that Income recalculates the junior share every six months or when the product and its pricing change.

So, the lender has a much larger "Skin in the Game (Junior Share)" if the Income Marketplace determines that the portfolio quality isn't as good or that the risks are too high.

It's a similar principle as when evaluating the LTV for real estate properties; just in this case, one considers the cash value of the loan book.

In the case of a defaulted lender, Income takes over the collection of loans of the entire portfolio and repays investors before the lender.

Investing on Income or other marketplaces depends on your risk appetite and investment preferences. Remember that any "protection scheme" isn't a 100% guarantee. By investing in P2P loans, you bear the default risk, valid on any platform.

If you are looking for higher protection, interest payments for delayed loans, better monitoring of lenders, and no pending payments, Income is undoubtedly the best option.

Is Income Safe?

This section of our Income review will dive deeper into the platform's management and terms and conditions.

Income's office in Tallinn (HQ) is Tornimäe 5 business center, 3rd floor, room D1 (next to Deloitte). It's pretty easy to find.

Here, you can watch the highlights of our visit to the Income Marketplace.

Who Leads The Team?

The CEO Lavreti Tsudakov leads the team behind getincome.com. The platform was founded by Kimmo Rytkönnen, who has previous experience in the Indonesian banking industry.

He also advises companies in Finland's insurance and lending industry. Previously, Kimmo funded Aasa, a lender that used to list loans from Sweden on Mintos.

According to our research, the company is employing another seven employees. You can learn more about the team on Getincome.com.

Who Owns the Platform?

According to the Estonian business registry, Income Company OU is owned by three shareholders: Mikk Läänemets, Kimmo Rytkönen, and Alexander Hauptmann.

Mikk is one of the members listed on the team page of getincome.com. He is a lawyer by profession. He has previously worked at Aasa Global, a Polish lending company. Mikk, as well as Kimmo, has previously worked at Supernova JV, a company related to Aasa.

Alexander Hauptmann is the 28-year-old son of Karl Hauptmann, the Supervisory Board Member. He oversees the family’s interests.

Watch our latest interview with the CEO here:

Are There Any Suspicious Terms And Conditions?

When reviewing P2P lending platforms, you should always review the terms and conditions to fully understand your rights and obligations.

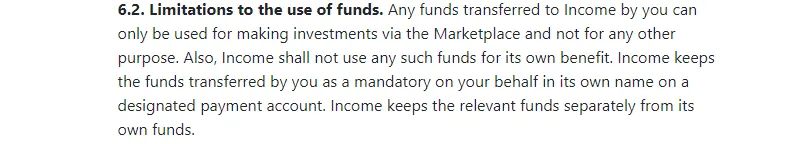

Storage of Funds

Income clarifies that the platform cannot use your funds other than investing in loans on your behalf.

Unfortunately, the platform doesn’t mention how Income safeguards your funds in its terms and conditions.

The platform’s FAQ section stores your funds in a separate bank account. This information should also be mentioned in the terms and conditions.

This info will likely become obsolete as we have learned that the Income Marketplace is moving towards implementing VIBAN accounts with Lemonway. In that case, you would not send your money to Income at all but to your bank account at Lemonway, which will be used to transfer funds to the loan originators.

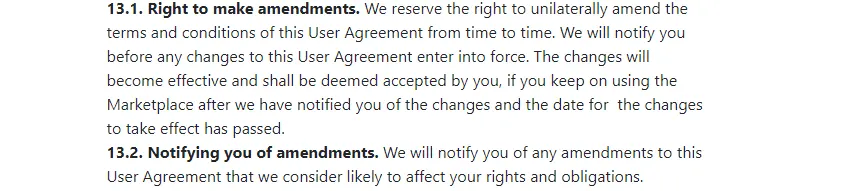

Amendments

Income reserves the right to amend terms and conditions at any time. The platform promises to inform you about any upcoming changes but doesn’t mention a specific time frame.

We understand that terms can change; however, it would be more transparent to clarify how much time the users have to review the new terms.

Access To Loan Agreements

Investors should have access to the loan agreements only after investing. Unfortunately, Income doesn’t publicly share the loan agreements before investing. This is something that you should pay good attention to.

This is likely due to the different structures in various business models. Every lender follows a slightly different scheme, and a template would not provide sufficient data.

You can review the assignment agreements when setting up your auto invest. Every lender has an assignment agreement that fits the business model.

Potential Red Flags

At the moment we aren't aware of any red flags or breaches of terms between the platform and users.

Learn more about possible red flags in our guide about how to avoid investing in P2P lending scams.

Usability

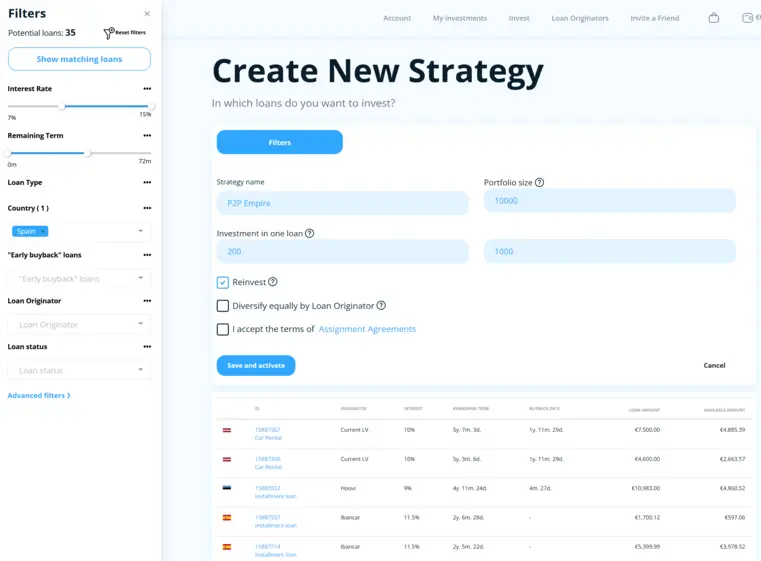

Income's usability is not the best, but it is sufficient for most P2P investors. The platform allows you to invest manually or set up an automated investment strategy.

Auto Invest

The auto invest comes with a lot of filter options. You can define the loan amounts, interest rates, loan term, loan type, country, lender, status, and loan extensions.

From our perspective, the Auto Invest feature offers more flexibility than the current loan availability can fully support.

While Income Marketplace may not be the best platform for broad portfolio diversification, it can serve as a valuable tool for minimizing cash drag on other platforms. By strategically investing in a specific loan portfolio, investors can optimize their capital allocation and enhance overall returns.

🧾Does The Income Marketplace Deduct Taxes?

The Income Marketplace does not collect taxes from your earnings. You may download a PDF file of your account statement for the selected date in your dashboard, showing all your income, including interest and bonuses. When you file your taxes in the country where you are a tax resident, you can save this report and submit it to the appropriate tax authorities.

Liquidity

The Income P2P marketplace has no secondary market or a “one-click” exit button. This means that your portfolio's liquidity relies on the loan term you are investing in.

Income offers investment opportunities in a variety of loans. Many are payday loans from Indonesia with a relatively short loan term of one month.

If you decide to invest in those, you can withdraw most of your investments within two months if you invest in short-term loans.

Early Buyback

The Income P2P Marketplace has introduced an "Early Buyback" option that allows you to exit your position in long-term loans before the end date of the loan term. This is useful for investors who are interested in investing in particular lenders that only offer long-term loans.

The first lender to offer this option is Hoovi from Estonia. The "Early Buyback" loans will be repurchased 12 months after the initial listing. They are listed on the primary market for 8% annual interest.

The lender offers up to 12% interest for its long-term loans.

Support

Income’s support is somewhat responsive. The founder is also very active on social media, which isn’t always the case with other founders in the industry.

During our initial research, the platform returned to us with answers to our questions within one business day.

We have also visited the Income Marketplace office in Tallinn, Estonia.

You can contact Income’s support team by sending them an email to hello@getincome.com.

Remember that the support quality may vary, depending on your expectations and particular case.

Income P2P Alternatives

While the loan performance on the Income Marketplace is often better than other P2P lending platforms, the loan availability is usually limited to a handful of lenders. This might result in cash drag, so you could consider investing on other platforms.

Esketit

Esketit is one of the best-performing platforms in year with €0 loans in recovery, making it a suitable alternative to the Income Marketplace.

While the loan availability is limited, the buyback obligation, as well as the platform's Auto Invest with instant cash out option, are exciting features that you will undoubtedly appreciate.

While the interest rates on Esketit are slightly lower, so is the platform's risk. Read our Esketit review to learn more about the platform.

PeerBerry

PeerBerry is one of Europe's best P2P lending platforms with an impressive track record. The Lithuanian-based P2P marketplace offers short-term and installment loans from Aventus Group and Gofingo, two well-established lenders.

PeerBerry offers a 60-day buyback guarantee and a group guarantee that protects your investments from unexpected market risks. PeerBerry has been offering attractive investment opportunities since 2017. Learn more about this top-rated platform in our PeerBerry review.

LANDE

If you want a better risk and return ratio, invest in agricultural secured loans on LANDE. This Latvia crowdfunding platform offers investments backed by machinery, land, or crops. LANDE is one of the best-performing platforms in year, with plenty of available loans.

Read our LANDE review to learn how to earn more than 10% annually by investing in secured loans.