Crowdpear Review Summary

Crowdpear is a regulated Lithuanian crowdfunding platform specializing in mortgage-backed real estate loans, offering competitive annual yields of 10.5% to 11.5% through a loyalty program. With a minimum investment of €100 and quarterly interest payouts, Crowdpear provides an attractive option for risk-conscious investors.

The platform's conservative risk assessment and support from the team behind PeerBerry ensure reliability, while its recently launched secondary market enhances liquidity.

Despite a slightly bureaucratic onboarding process and limited diversification, Crowdpear stands out as a solid alternative for those seeking stable returns without cash drag.

Main takeaways from our Crowdpear review:

- Operated by an experienced team

- Investments in secured real estate loans from Lithuania

- Limited diversification and liquidity

- Excellent loan performance

- Powered by PeerBerry

If you are looking for a reliable platform to diversify your investments further and are willing to commit funds for at least 12 months, Crowdpear can be a good option.

Are you ready to earn passive income?

What Is Crowdpear

Crowdpear is a regulated Lithuanian crowdfunding platform that enables you to earn 10.5% interest on your investments in secured business loans. The minimum investment per loan is just €100, and the interest will be added to your account once per quarter. Is Crowdpear a good fit for you? Let's find out in our Crowdpear review.

Pros

- Regulated crowdfunding platform

- No cash drag

- Mortgage-backed investments

- Min. investment from €100

- Conservative approach to risk assessment

- Option to invest as a company

Cons

- A slightly more bureaucratic onboarding process

- Limited diversification

- No secondary market yet

Our Opinion Of Crowdpear

Crowdpear is a regulated crowdfunding platform offering competitive yields, backed by an experienced and trustworthy team that ensures a professional approach to investments.

The platform’s portfolio performance has been strong, positioning Crowdpear as a promising competitor to players like EstateGuru. Lithuanian real estate loans on Crowdpear are secured by first-rank mortgages, providing investors with an added layer of protection and confidence.

While there is room for growth, such as expanding loan diversification and features, Crowdpear is an excellent choice for those facing cash drag on other platforms. Recent increases in loan availability make it easier for investors to deploy funds efficiently.

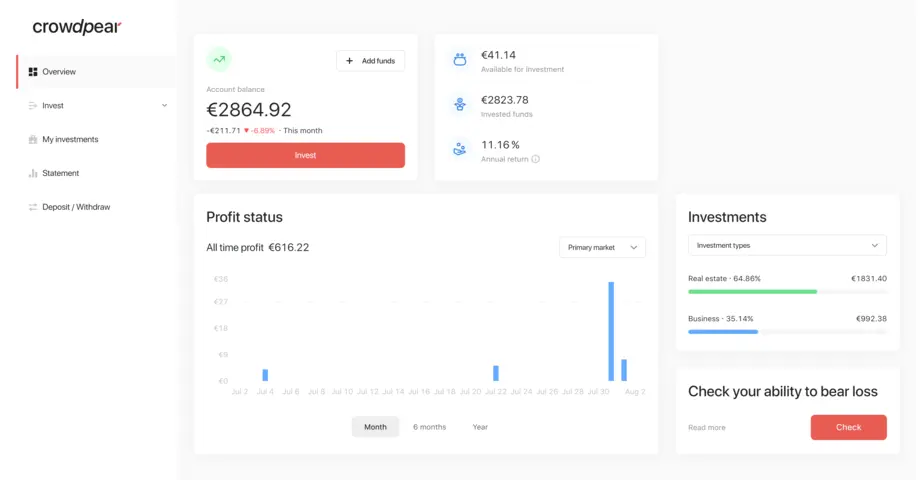

Having invested on Crowdpear since early 2023, our experience has been consistently positive. T

he platform's steady development and attractive returns make it a viable option for investors seeking stability and growth in the crowdfunding space. You can explore our exposure to Crowdpear in our P2P lending portfolio.

If you don't want to miss out on attractive and reliable returns, Crowdpear should undoubtedly be on your radar! You can use our P2P lending calculator to calculate the expected return from your investments on Crowdpear. To fine-tune your calculation, use our compound interest calculator.

Crowdpear Bonus

Sign up with our link on Crowdpear and invest to receive a 1% bonus of your invested capital within 90 days after your registration.

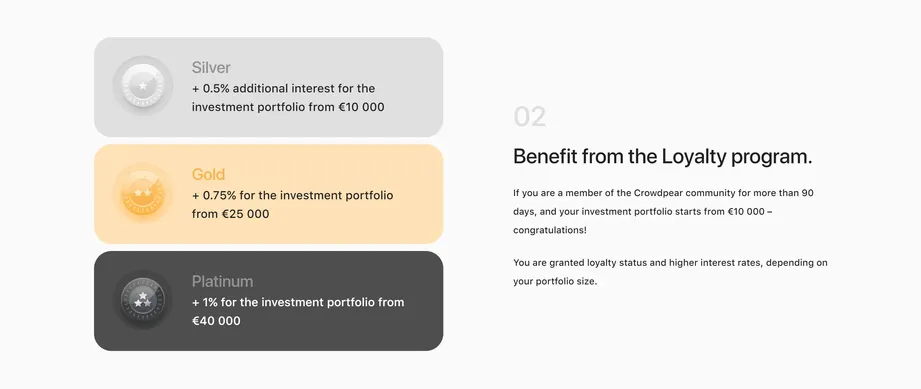

Crowdpear Loyalty Bonus

In addition to your investment bonus, you will receive additional rewards if your portfolio reaches €10,000 (+0.5%); €25,000 (+0.75%); and €40,000 (+1%).

Logically, you have to invest money to get a higher interest rate.

The loyalty bonus won't be added to your account if your funds aren't invested.

Please be informed that you can join the loyalty program only after being registered on Crowdpear for at least 90 days.

Requirements

To earn passive income by investing on Crowdpear, you must fulfill the following requirements.

- be at least 18 years old

- reside in the EU or EEA

- pass the AML and KYC questionnaire (multiple choice)

- verify your identity

- declare your tax residency

- your country of residence cannot be listed on the FATF list

The entire sign-up process can be done within five minutes. The verification happens through your smartphone, so ensure your phone is closed when verifying your identity.

Crowdpear supports registrations of natural persons as well as companies.

If you are risk-conscious, we highly recommend activating the 2FA to protect your account.

Crowdpear and Taxes

As a regulated crowdfunding platform, Crowdpear must deduct a 15% tax from your earnings if you are a non-Lithuanian tax resident. Those taxes will be automatically transferred to the State Tax Inspectorate of Lithuania.

If your country has a double tax treaty with Lithuania, you can reduce the withholding tax by submitting a DAS-1 form, which has to be signed by you and verified by the tax authority in your country.

It's recommended to submit this document before your first investment. This certificate shall be provided in the calendar year.

Crowdpear doesn't deduct taxes from non-Lithuanian companies registered in the European Economic Area. The company is responsible for paying applicable taxes according to the country's legislation where the company is registered.

Risk & Return

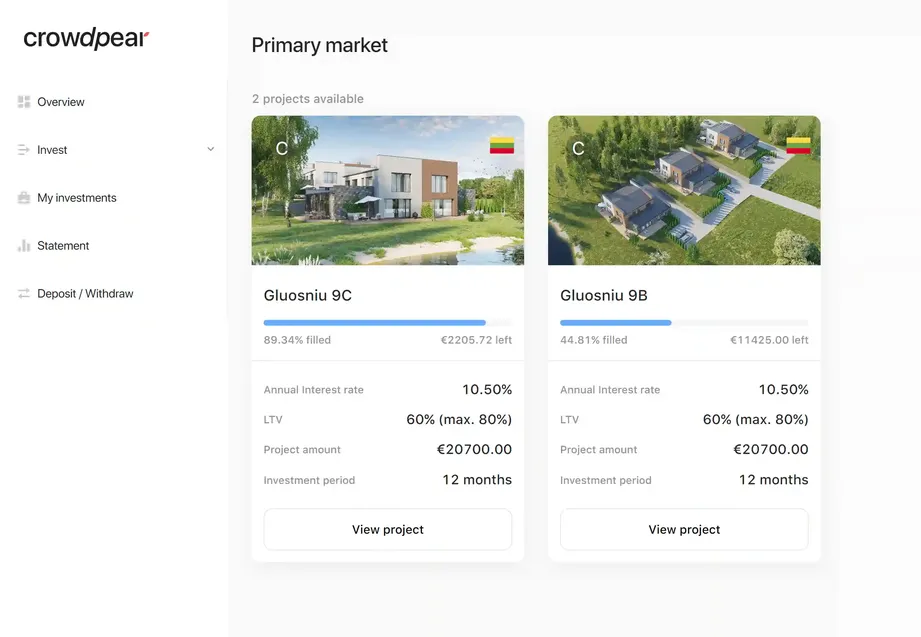

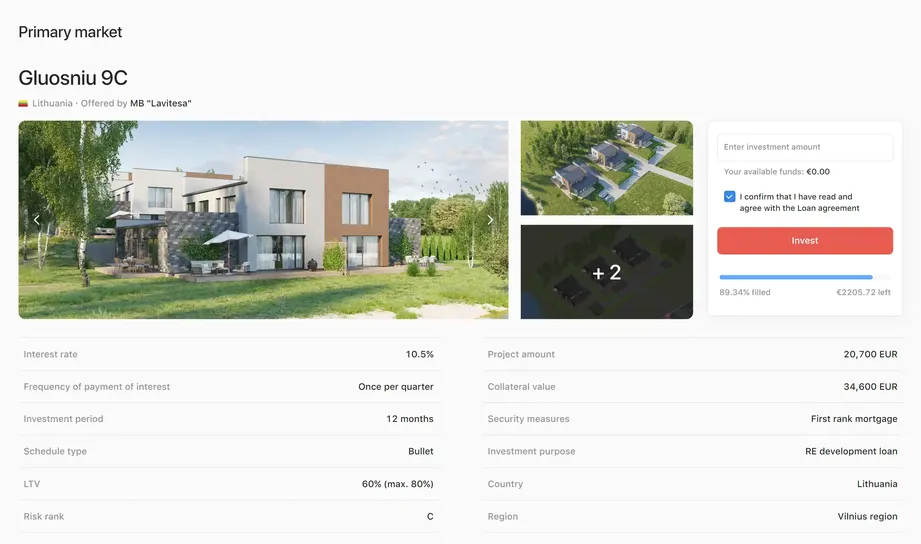

Investing in any loan is not risk-free. On Crowdpear, you can invest in Lithuanian real estate loans backed by a first-rank mortgage.

On Crowdpear, you earn interest when you invest in a loan, not when the loan is fully funded.

This is a unique benefit that most other crowdfunding platforms don't offer, as it increases your return on the platform.

The LTV of the currently listed loans is around 60% and can be increased to 80% in future stages.

Stage Loans

Many development projects are often funded in stages, which allow the borrower to obtain funding when needed.

Investing in multiple-stage loans from one borrower increases your investment risk, as "diversification" is not considered in this scenario.

Should the borrower have trouble repaying one stage, it will likely have issues with other stages. Therefore, experienced investors avoid investments in multiple-stage loans to decrease the borrower risk.

Secured Investments

Crowdpear is currently offering only mortgage-backed loans. Every project has a dedicated description and an appraisal report for the provided collateral.

It's always recommended to verify the information in the project overview with the appraisal report's data before you invest your money into a specific project.

In addition to the appraisal report, you are informed about specific risks associated with investing in a real estate project.

The platform currently offers a 10.5% yield on your investments. If you decide to commit more funds, you will be able to benefit from the loyalty program and boost your return to up to 11.5% per year.

This is an excellent yield in the current market environment.

Note that Crowdpear is offering bullet loans, which means that the principal will be returned at the end of the loan term, whereas the interest will be added quarterly to your Crowdpear account.

Is Crowdpear Safe?

Crowdpear is a newly launched crowdfunding platform regulated by the Central Bank of Lithuania.

Who Owns The Platform?

Here you can find more information about Crowdpear's shareholding structure:

Vytautas Stražnickas (50%)

Vytautas Olšauskas (25%)

Ivan Butov (25%)

The Central Bank of Lithuania has approved all shareholders.

Who Leads The Platform?

The CEO of Crowdpear is Vytautas Olsauskas, who is also a shareholder of PeerBerry. Arunas Lekavicius is listed as the Chief Business Development Officer to help lead the platform in the right direction.

The team behind PeerBerry, one of the most popular and reliable P2P lending platforms in Europe, provides support for Crowdpear.

Are There Any Suspicious Terms And Conditions?

During our research, we haven't spotted any suspicious terms and conditions. The platform follows strict disclosure guidance from the local regulator.

Potential Red Flags

Currently, we aren't aware of any potential red flags

Usability

Crowdpear offers a fundamental user interface with essential details. If you have some experience with crowdfunding platforms, you will have no issues with the navigation on Crowdpear, as all the essential information can be accessed almost instantly.

The platform offers a very user-friendly primary market where you can review the currently available loans and make your investment.

An auto invest isn't available yet as the volume of loans is still relatively low. If the number of projects increases, investors will likely expect to have the option to automate their investments.

Crowdpear offers transaction and tax statements, which are handy if you want a quick insight into your investments' performance over a specific period.

The platform currently doesn't support individual IBAN accounts, making it easier for investors to deposit and withdraw funds as no additional verification is needed with another payment provider.

You can deposit your funds to Crowdpear's bank account with your payment details so the platform can allocate your deposit.

Liquidity

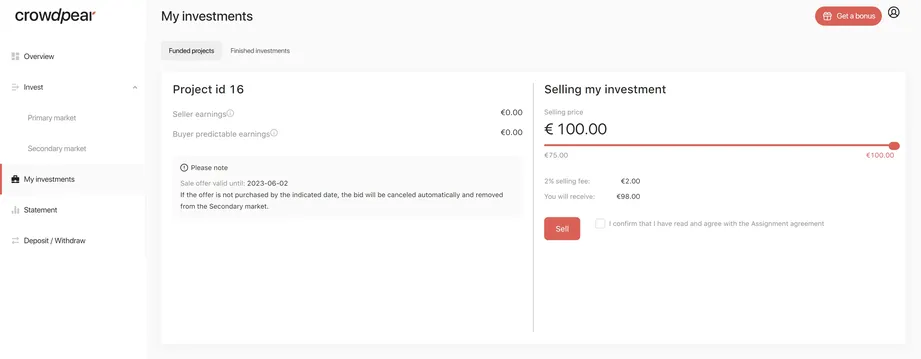

The liquidity on Crowdpear is limited as all the listed loans come with a 12-month loan term. The platform has, however, recently activated its secondary market, where you can buy or sell your investments before the loan is repaid.

The sale of your investment is very intuitive. Navigate to "My Investments" in the left menu, click on the cart icon next to the investment you wish to sell, and confirm your listing on the secondary market.

Crowdpear applies a 2% seller fee. There are no fees for buyers.

Your listing on the secondary market is valid for 14 days. Crowdpear allows you to sell your investments with up to a 25% discount.

Remember that you can only sell the entire investment into one loan. If you invest higher amounts into a single loan, other investors might not want to purchase your investment.

Crowdpear's secondary market increases your liquidity.

Support

The support team behind PeerBerry handles Crowdpear's support, offering some of the industry's best customer support. If you haven't found the answer to your questions in Crowdpear's FAQ section, contact Crowdpear at info@crowdpear.com. The response time is typically within a few minutes during business hours.

Crowdpear Alternatives

The number of newly listed projects on Crowdpear is limited as the platform's management takes a more conservative approach to growth. Building a fully diversified portfolio on Crowdpear might take several months, so you might want to consider some suitable alternatives.

LANDE

LANDE is one of Latvia's most popular crowdfunding platforms. It enables investors to earn around 11% interest annually by investing in secured agricultural loans. Your investments in LANDE are backed by crop, insurance, and often other types of collateral.

LANDE is one of the most transparent platforms in the industry, with a good track record and a dedicated statistics page where you can learn more about the performance of LANDE's portfolio. Learn more about LANDE in our LANDE review.

Fintown

If you want attractive interest rates by investing in already operational rental units in Prague, Fintown might be a good Crowdpear alternative. The platform pays out interest from rental projects every month, which isn't typically the case on Crowdpear, as most of the loans on this platform pay out interest every quarter. Learn more about earning up to 14% interest in our Fintown review.

InRento

InRento is a unique platform that enables investors to invest in buy-to-let projects. You can earn yield directly from a particular apartment's rent, and for specific projects, you can also have a capital gain when the unit is sold.

A first-rank mortgage backs all the loans on InRento. Based on past performance, InRento's projects in Lithuania are some of the lowest-risk investments in the P2P lending industry. Learn more about InRento in our InRento review.