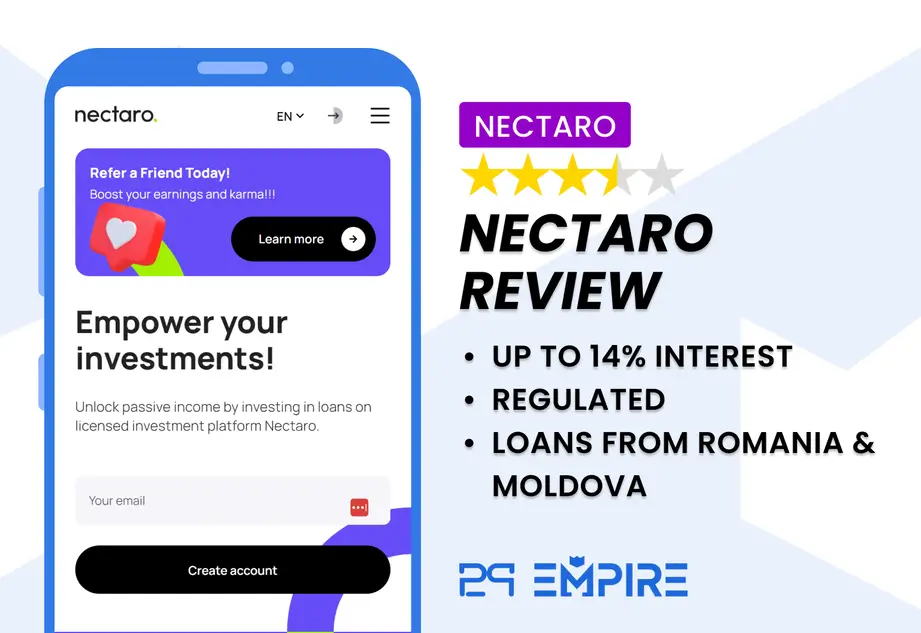

Nectaro Review Summary

Nectaro is an interesting platform, offering investments in lending portfolios from Romania, Moldova, and the Philippines with attractive yields ranging from 11% to 14.5% annually. All loans come with a buyback obligation, providing an additional layer of security for investors.

Key Takeaways from Our Nectaro Review:

- Competitive interest rates

- Easy-to-use platform

- Quick and smooth onboarding process

- Longer loan terms

If you're looking to boost your returns from P2P lending, Nectaro could be a promising option for you.

What is Nectaro?

Nectaro is a regulated investment firm based in Latvia, offering opportunities to invest in loans from Moldova, Romania and the Philippines. Investors can expect annual returns ranging between 11% and 14.5%, with loan terms of up to 4 years.

Nectaro provides access to loans from EcoFinance, a part of the DYNINNO Group, a large corporation involved in multiple sectors, including financial services, entertainment, and travel. This connection to a well-established group adds a level of credibility to the platform's offerings.

Pros

- Regulated platform

- User-friendly investment dashboard

- High yields of up to 13.5%

- High cashback bonuses

- No cash drag

Cons

- Limited diversification

- No secondary market

- Ecofinance’s lender in Russia owns money to investors on Mintos

- No group guarantee

- Pending payments can delay your withdrawal requests

Our Opinion On Nectaro

Nectaro is a regulated platform with a relatively short track record compared to some of the larger players in the P2P lending industry.

The underlying lenders from Moldova and Romania have demonstrated solid financial results, making exposure to their loan books potentially appealing.

According to information from Nectaro, these two lenders rank among the top five non-banking lenders in their respective regions and regularly publish financial reports, which you can review in our "Loan Originator" section above.

Their financials appear capable of supporting the buyback obligations offered, which provides some security for investors. Additionally, the longer loan terms suggest that the Ecofinance lending companies are less likely to be affected by regulatory restrictions that typically target short-term lenders.

Experienced investors may find profitable opportunities in the loan books of Nectaro's business partners. However, there are areas for improvement.

Ecofinance does not provide a group guarantee, unlike platforms like PeerBerry, Lonvest, or Fintown. This means that in cases of force majeure, other companies within the Ecofinance group will not assume responsibility for debts owed to investors.

However, in our interview with the CEO, it was mentioned that Nectaro's business partners might introduce a group guarantee in the future.

While Nectaro offers a user-friendly interface and valuable features, investors should carefully assess the current structure and potential future developments.

Do you prefer to watch a video? Here are the main highlights from our Nectaro review:

Nectaro Bonus

New investors on Nectaro can earn a 1% cashback bonus on their investments made within the first 21 days of registration.

The bonus will be credited to your account within five business days after the campaign period ends, with a maximum bonus cap of €1,000. Note that there is no requirement to type in the Nectaro referral code during your registration.

Requirements

The registration process on Nectaro is efficient and straightforward.

First, you'll need to verify your email and provide personal details such as your residential address, tax information, and financial situation.

You'll also be required to upload a picture of yourself along with a valid identification document. Additionally, you'll need to complete an investor questionnaire, which assesses your knowledge of investing in regulated Notes.

The entire sign-up process takes less than 10 minutes. Once you've submitted your information, the Nectaro team will verify your data and unlock the platform's features. In our experience, this verification took around 3 hours, after which we were able to deposit funds.

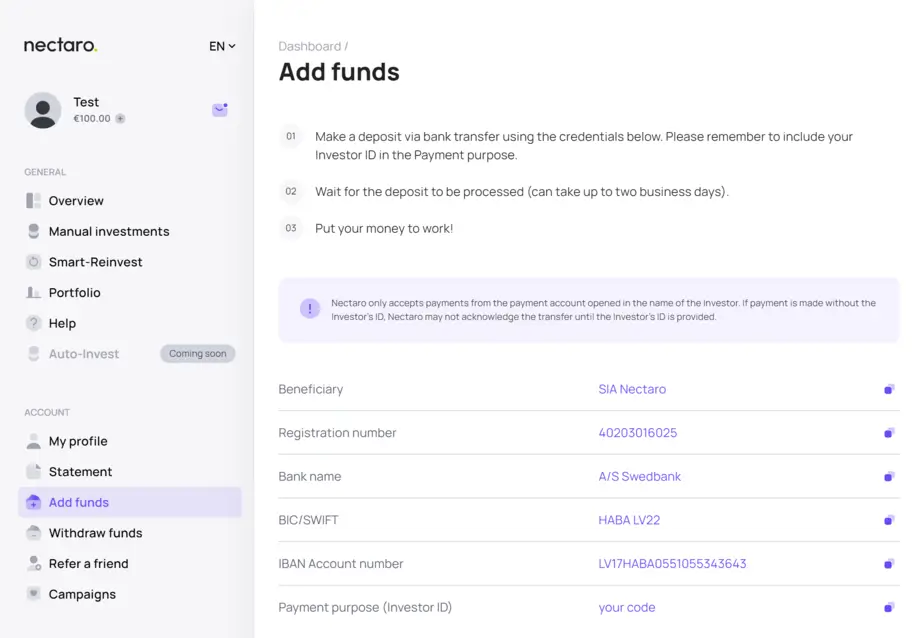

To top up your account, simply click on "Add funds" in the left menu and follow the on-screen instructions. Be sure to include your investor ID when transferring funds, so Nectaro can correctly allocate the payment to your account.

Please note that you can only transfer funds from a bank account within the EU/EEA that is registered in your name. In our experience, the bank transfer from a European account was completed within a few hours.

Withdrawals

During our tests, we evaluated both deposits and withdrawals on Nectaro. Deposits were credited to our account within 5 hours, while the withdrawal of uninvested funds was processed within 1 business day. It's important to note that withdrawals are only possible for uninvested funds; invested funds cannot be withdrawn.

For investors, it’s crucial to understand that Nectaro clears debts with the Romanian lender twice a week and with other lenders once a week. This schedule may result in "pending payments" when a loan is officially due, but funds have not yet been transferred by the loan originators. Such delays can extend withdrawal requests for seemingly available funds by 7 to 10 days, depending on the timing of the request. Additionally, Nectaro processes withdrawals only on business days.

Nectaro also adheres to strict anti-money laundering (AML) regulations. Investors with larger portfolios may be subject to random AML checks, requiring them to provide detailed proof of their funds' origin. This process could temporarily impact the liquidity of your investments. If you are uncomfortable sharing detailed financial information, Nectaro may not be the right platform for you.

Risk & Return

Investing in Nectaro comes with certain risks. As the platform only launched in October 2023, its track record is still relatively limited.

Although you are investing in loans that are packaged into Notes on Nectaro, you remain exposed to the risks associated with the underlying lenders and their markets. To review the market risk, please navigate to our Country Risk Data Hub.

Loan Originators

Nectaro's main objective is to finance the lending portfolios of EcoFinance entities within the DYNINNO Group, which is also Nectaro’s parent company. This setup positions Nectaro as a direct P2P lending platform, much like TWINO or Robocash, where investors fund in-house lenders.

This structure benefits investors, as Nectaro’s management can closely monitor loan performance on the platform. Currently, there are no plans to onboard third-party lenders until the second half of 2025.

Beyond personal loans, Nectaro also offers business loans from SIA Abele Finance, a company established in June 2024 to fund businesses within the DYNINNO Group. This loan, with a lower interest rate of 11% and a term of up to 8 months, supports the development of a new loan originator in the Philippines, which is expected to join Nectaro in the future.

Nectaro rewards investors who commit to longer loan terms. Without a secondary market, the platform offers an illiquidity premium through higher interest rates to compensate for the lack of liquidity.

Buyback Obligation

If you choose to invest on Nectaro, your investments are protected by a 60-day early repayment obligation. This means that if any loans are delayed for more than 60 days, the lender is obligated to repurchase your investments.

However, it’s important to note that EcoFinance, Nectaro’s main lender, does not provide a group guarantee for its loans. In the event of a force majeure, other companies within the EcoFinance group will not step in to repay the investments for those who invested in Nectaro’s lenders.

EcoFinance Russia

The financial group behind Nectaro’s lenders in Moldova and Romania, EcoFinance, was also active in Russia. Although this information isn’t available on their official website, EcoFinance used the Mintos platform to finance its Russian loan book.

EcoFinance RU was suspended on Mintos on June 13, 2022, with a principal exposure of €4 million and interest in recovery of approximately €84,000. According to Mintos' statistical data on overdue loans, the marketplace expects a 50% to 75% recovery rate from EcoFinance.

Since the suspension, EcoFinance RU has repaid €536,732 in principal, but only €2,244 in recovered interest over the past two and a half years. As of September 2024, €3,607,703 of investors' funds remain at risk. To date, EcoFinance RU has repaid only about 11% of the outstanding loans to investors (source).

EcoFinance, the financial group behind the two lenders listed on Nectaro, has provided an update on their current situation regarding non-performing loans in Russia and their debt to investors on Mintos. Due to the sensitive nature of certain details, including the names of banks involved, we have been requested not to disclose all the information publicly to avoid jeopardizing repayments to investors on Mintos.

In summary, EcoFinance has faced challenges in repaying its debt due to sanctions imposed on Russian banks, which have disrupted external transactions. Despite these obstacles, EcoFinance has been actively seeking solutions to fulfill its obligations to investors. I

In December 2022, they negotiated a debt restructuring agreement with SIA Mintos Finance, aligning repayments with the Russian Central Bank's monthly limits for external transactions.

Starting in January 2023, EcoFinance began repaying the debt according to the new schedule. However, further sanctions in February 2023 affected their ability to continue repayments. Throughout 2023, EcoFinance attempted to open accounts in non-sanctioned Russian banks but faced difficulties due to internal bank policies.

In June 2024, they successfully opened accounts in a non-sanctioned bank and resumed monthly repayments, adhering to the contractual payment schedule. As of November 12, 2024, the outstanding principal debt is 18,866,260.65 RUB and 2,649,998.49 EUR.

EcoFinance and Mintos have maintained open communication, working together to find payment solutions that comply with EU and other regulatory sanctions. This ongoing collaboration underscores their commitment to meeting investor obligations despite challenging circumstances.

€20,000 Protection Scheme

Nectaro is an authorized investment firm and a member of the national investor compensation scheme in accordance with Directive 97/9/EC. This scheme protects investors by offering compensation if Nectaro is unable to return financial instruments or investor funds.

It’s important to note that the maximum compensation under this scheme is 90% of the investor's net loss, with a cap of €20,000. However, this compensation does not cover typical investment risks, such as poor performance of underlying loans, borrower defaults, or defaults by lending companies.

Taxes

When individuals invest in Notes with Nectaro, a withholding tax is deducted from their interest income as required by law. Here’s a summary of the process:

- You invest in Notes.

- The borrower or lending company makes an interest payment.

- Nectaro credits the full interest amount to your account.

- A portion of the interest is automatically withheld as tax, based on the applicable rate.

You can usually offset this withheld amount against your tax liability in your country, avoiding double taxation. The withheld tax will appear separately in your account statement and tax report. Note: Legal entities are not subject to this withholding tax.

For EU/EEA tax residents, Nectaro deducts a standard withholding tax rate of 5% from interest income, unless a double tax treaty applies—such as in Lithuania, where the rate is 0%.

Is Nectaro Safe?

When investing on any P2P lending marketplace or platform, it's important to consider the management team and their prior experience, as this can significantly influence both your potential returns and the level of risk involved.

A well-experienced management team may be better equipped to navigate challenges, optimize platform performance, and ensure more stable outcomes for investors.

Who Leads The Team?

The platform is led by Sigita Kotlere, who serves as both CEO and Board Member. She has been the "face" of the company since 2022. Prior to joining Nectaro, Sigita worked at Mintos as a Partnership Executive and has additional experience in the banking sector.

However, Nectaro was founded by Dmitry Tsymber, who is also the founder of the EcoFinance group, the lending institution listing loans on Nectaro. Dmitry’s extensive background in lending adds depth to the platform's leadership.

Do you want to get to know the person behind Nectaro? Watch our onboarding call with the CEO to learn more about the platform.

Who Owns Nectaro?

Nectaro is owned by DYNNINO Fintech Holding in Cyprus, which is part of the DYNINNO Group, a U.S.-based corporation operating across various industries.

Are There Any Suspicious Terms and Conditions?

Before investing on any platform, it's important to review the terms and conditions to understand the legal framework in which the platform operates.

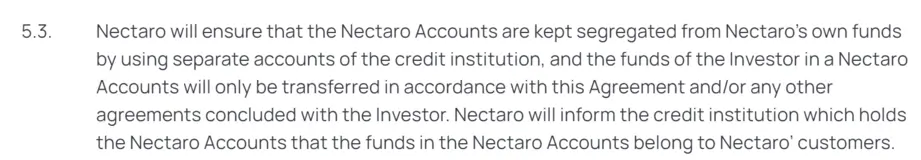

Storage of Funds

Investors on Nectaro do not have individual IBAN accounts, but funds are kept separate from Nectaro's own funds through segregated accounts, providing an extra layer of security.

Amendments

Nectaro informs investors 30 days in advance of any changes to its terms and conditions. However, the platform reserves the right to make immediate changes if they are in the investor’s favor.

Loan Agreements

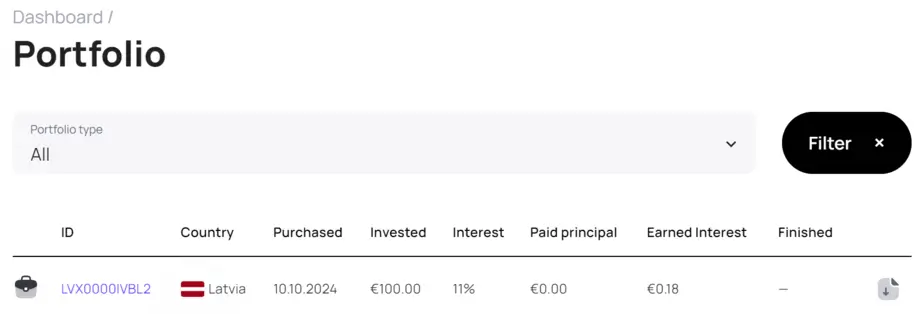

You can easily download the legal document for your specific Note investment directly from your portfolio overview by clicking the file icon on the right.

Potential Red Flags

As of the time of writing, we have not spotted any red flags that would indicate a contractual breach from Nectaro’s end.

Usability

Nectaro is a highly user-friendly platform, making it easy to navigate regardless of your prior experience in the P2P lending industry.

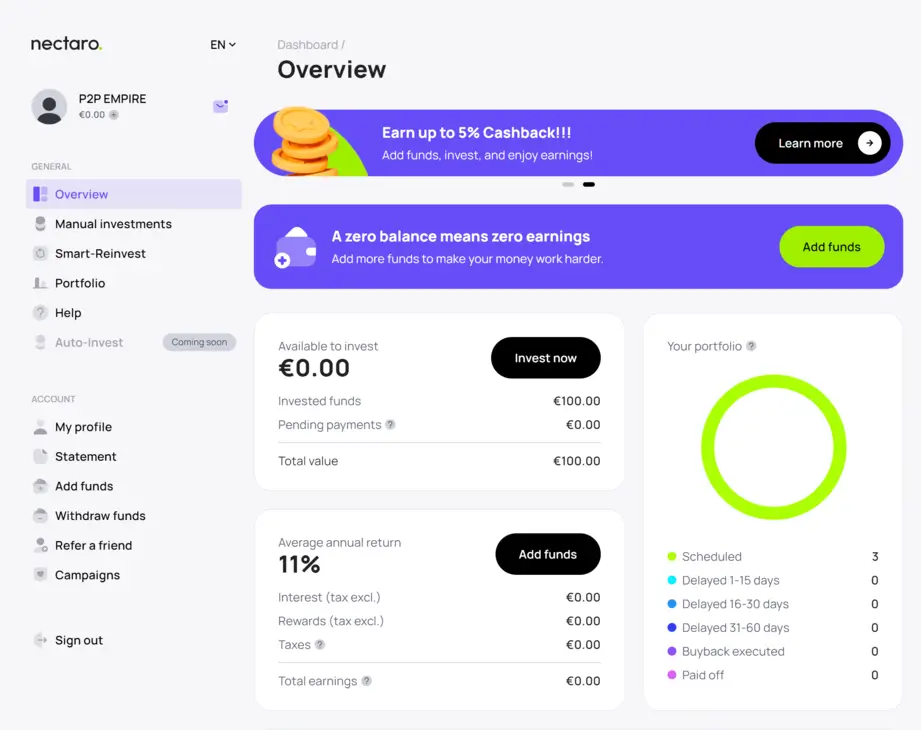

Upon logging in, you'll find a clear overview of your investments, complete with a chart displaying the status of your loans. Additionally, you'll be able to view your available funds and your average annual return, ensuring a smooth and intuitive experience for investors.

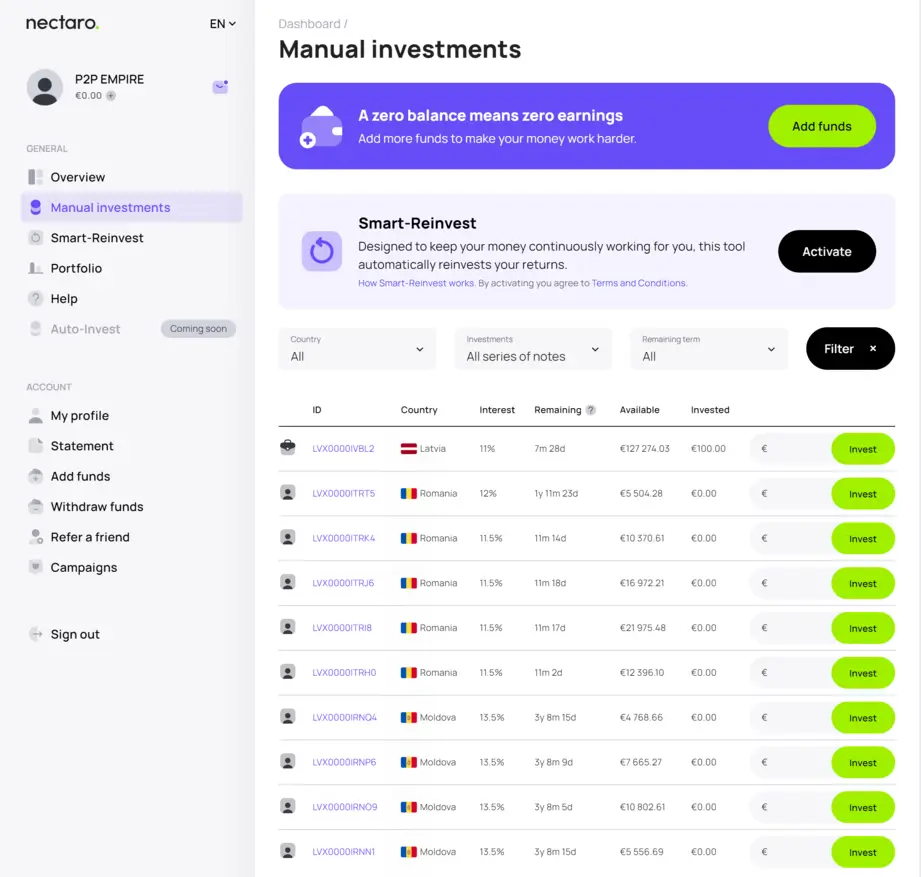

Nectaro’s dashboard is intuitive and easy to navigate. The platform also features a primary market, allowing you to manually invest in loans according to your specific preferences and requirements, making it accessible for both new and experienced investors.

In the "Manual Investments" view, you can filter available loans by country and loan term to find options that match your investment criteria. Once you've selected suitable loans, simply enter your desired investment amount and click "invest." Upon confirmation, your funds will be allocated to the chosen Notes.

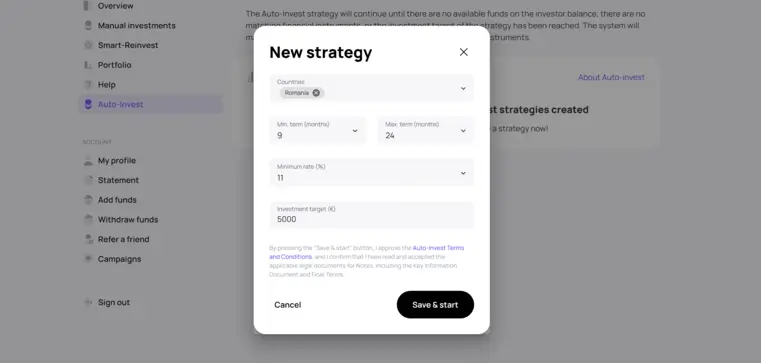

Auto-Invest

Nectaro recently introduced an Auto-Invest tool, allowing you to automate the allocation of idle funds into predefined strategies. You can set parameters like countries (Romania, Moldova, Latvia), minimum and maximum loan terms, interest rates, and the total investment target for your Auto-Invest strategy.

Nectaro supports up to three separate Auto-Invest strategies, each executed at least once daily. Your Auto-Invest strategy can invest in loans ranging from €10 to €250. If you prefer more control over the maximum investment per Note, manual investing may be a better option.

Keep in mind that Auto-Invest might not evenly diversify your portfolio. It’s designed to automate your investments, saving you time on manual selections.

Remember that Auto-Invest investments are illiquid, meaning that the instruments are held until maturity. Nectaro does not guarantee liquidity and does not provide a secondary market for financial instruments selected through Auto-Invest.

Smart-Reinvest

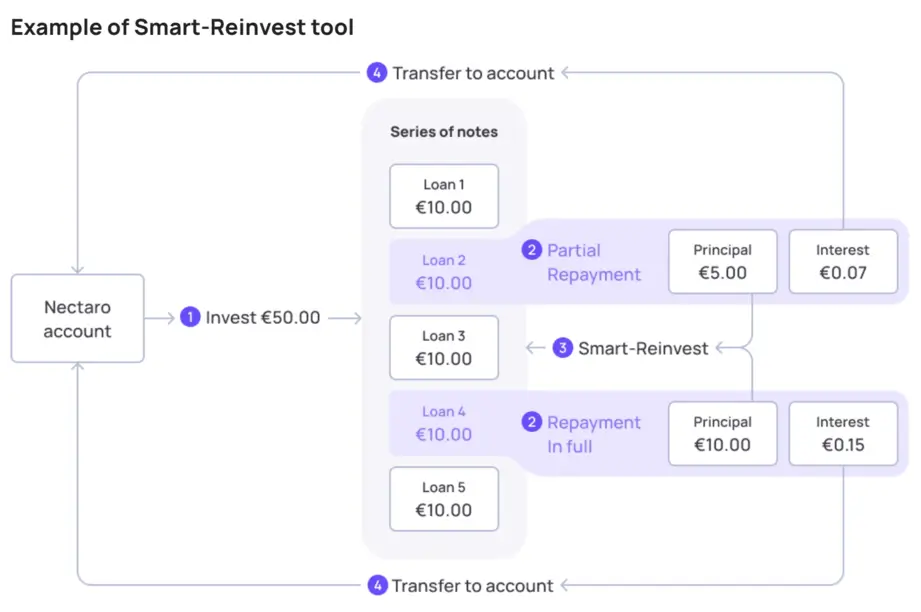

The Smart-Reinvest tool is designed to automatically reinvest your received principal if a borrower repays their loan before the end of the term. When activated, the system reinvests your funds into the same batch of Notes.

If no investment opportunities are available in that specific series of Notes, the repaid principal will simply be credited back to your Nectaro account, ready for your next investment decision.

You invest €50 in a series of Notes, which consists of five loans, with your investment evenly distributed across them. Over time, you receive repayments on two of these loans—one in full and the other partially. These repayments include both the principal (the original amount you invested) and the interest (your earnings).

The Smart-Reinvest tool then evaluates the repaid principal and automatically reinvests it into other available loans within the same series of Notes. In this example, your €15 is redistributed among the open loans. Any interest you earn from these loans is directly credited to your Nectaro account.

The key advantage of the Smart-Reinvest tool is that you don't need to actively monitor your account balance, which does not generate interest. Smart-Reinvest ensures that your available capital is continuously deployed to maximize your returns.

By default, Smart-Reinvest is turned off, but you can easily activate it within your investment account settings.

Liquidity

Nectaro does not provide a secondary market or an early exit option, so once you commit funds, you should plan to keep them invested until the loan term ends. However, due to the structure of credit lines, you can generally expect to receive 50% to 70% of your investments back within the first 12 months.

If liquidity is a priority for you, it may be worth considering platforms with a secondary market. However, if you're comfortable committing your funds for a longer period, Nectaro could offer a high-yielding opportunity without the common issue of cash drag that many investors experience on more established platforms like PeerBerry, Esketit, or Robocash.

Moreover, due to the nature of the credit line lending product, investors typically receive up to 40% of their initial investment back within the first six months, providing a partial return of capital even during longer-term investments.

Support

Nectaro is a smaller platform with limited resources, which means the support may not be as responsive as on larger platforms. You shouldn’t expect immediate answers. If you need to get in touch with Nectaro, it's best to reach out via email at support@nectaro.eu.

Alternatively, you can also join Nectaro’s official Telegram channel for updates and to engage with the community.

Nectaro Alternatives

While Nectaro can appeal to investors with a higher risk appetite, savvy investors understand the importance of diversification to protect their portfolios. If you're looking to spread your investments, consider exploring these Nectaro alternatives:

Indemo

Indemo is a regulated investment platform that offers some of the highest yields in the industry. On Indemo, you can invest in discounted, defaulted mortgage-backed loans from Spain, with an average expected return of 15.1% per year. Although the platform doesn’t offer a secondary market, it has generated impressive returns for investors so far. Learn more in our Indemo review.

Fintown

Fintown is a Czech platform offering investments in rental units. Operated and owned by the Vihorev Group, a renowned real estate developer in Prague, Fintown provides attractive returns backed by operational rental units. This structure lowers the risk compared to investing in personal or payday loans from other countries. For more details, read our Fintown review.

Income Marketplace

To diversify your P2P lending portfolio further, consider investing through Income Marketplace. This Estonian-based platform offers high-yielding loans from countries such as Estonia, Bulgaria, Indonesia, and Spain. Find out how it works in our Income Marketplace review.