Indemo Review Summary

Indemo is one of the most unique platforms in the P2P lending industry. The company offers investments in secured, discounted, defaulted loans from Spain with an attractive minimum return of 15.1% per year.

While liquidity is limited, Indemo’s products could offer a substantial risk-to-return ratio for investors willing to lock up their investments for 2 years.

Main Takeaways From Our Indemo Review:

- Unique product in the industry

- Regulated platform and business partners

- User-friendly platform

- Better legal framework than competitors

If you want to earn the best risk-adjusted returns, Indemo should be on your list of active investment platforms.

Are you ready to earn the right yields?

Are you wondering how Indemo works? Watch our Indemo review.

What is Indemo?

Indemo is a regulated investment firm based in Latvia, specializing in discounted debt investments, specifically defaulted loans secured by mortgages in Spain.

These loans are purchased from Spanish banks at a discount and resold at market value, offering investors a unique opportunity to earn yields from the profit share.

Indemo advertises an expected return of 15.1%, with a minimum loan term of 24 months, providing a potentially high-yield investment option backed by real estate.

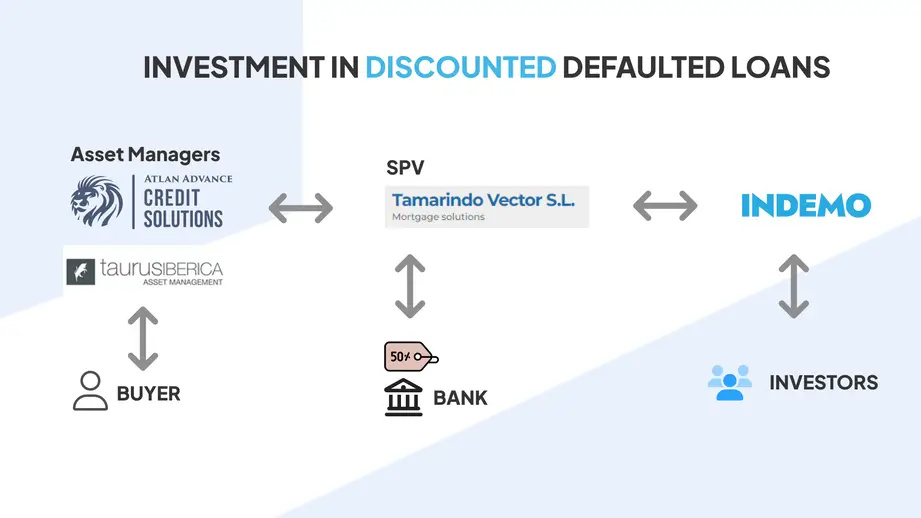

Indemo works with SPVs in Spain, such as Tamarindo Vector S.L., to list debts on the platform. These SPVs purchase discounted debts from Spanish banks. Tamarindo collaborates with asset managers like Tauris Iberica, which carefully selects discounted debts for Tamarindo Vector.

Once Tamarindo Vector acquires the debts, the debt collection process is outsourced to asset servicing companies, which then handle the recovery efforts.

To expand its portfolio, Tamarindo Vector refinances certain debts through Notes on Indemo.

Investors on Indemo can participate in these debt recoveries. Once a debt is successfully recovered, legal costs are first covered, followed by a share for the asset manager and Indemo. The remaining profit is then split 50:50 between the SPV (for example, Tamarindo Vector) and the investors.

The faster a debt is recovered, the lower the legal and administrative expenses, resulting in higher potential returns.

However, if the recovery process takes several years, the profit margin may shrink due to accumulating fees and costs deducted before investors receive their final payout.

Pros

- Regulated in Latvia

- Very user-friendly platform

- The only platform that offers secured, discounted debt investments

- High potential interest

- Unique concept

Cons

- No monthly cash flow

- No liquidity

- No backup servicer - higher reliance on Taurus Iberica

Do you want a quick update on the latest developments at Indemo and what to expect in 2026? Watch this video to find out.

Our Opinion on Indemo

Indemo introduces a unique and innovative concept to the P2P lending market by specializing in discounted, mortgage-backed loans from Spain, a niche that remains largely untapped by other platforms.

While platforms like Esketit invest in unsecured, discounted loans through Spanda Capital, Indemo focuses exclusively on real estate-backed debts, providing investors with a stronger collateral base and potentially higher recovery value.

The platform targets an annual return of 15.1%. So far, results have surpassed expectations: 13 completed investments have generated an average return of 23% with an average recovery period of 13.6 months, ranging from as little as 6 months to as long as 21 months.

Investor returns have varied widely, from a minimum of 15.1% to an exceptional 118% annualized. Although these figures are impressive, such outperformance may be difficult to maintain as the platform expands and handles a larger portfolio.

For a more accurate estimate of Indemo’s long-term performance, it will be necessary to review at least 100 completed recoveries. Generally, shorter recovery periods translate into higher effective yields, while longer recoveries tend to erode profitability due to rising legal and administrative costs.

The platform’s interface is clean and intuitive, and its transparent investment structure, including real-time monitoring of the recovery process, sets a high standard for clarity in this niche. However, investors should be aware of the 24-month lock-up period and the absence of monthly cash flow. If you are seeking a flexible savings account alternative to rebalance your portfolio quickly, Indemo may not be the most suitable choice.

In summary, Indemo is best suited for experienced investors looking for high-yield, real estate-backed opportunities with long-term horizons. Success requires patience, a tolerance for risk, and confidence in the platform’s management and recovery capabilities.

Discover how Indemo performs in our personal P2P portfolio, featuring annual returns so far.

Are you an existing investor, or are you planning to invest in Indemo? This podcast will reveal what investors can expect from the platform in 2026.

Indemo Promo Code

Earn up to 5.5% cashback on your investments until February 28, 2026 when registering with our partner link.

- Invest between €250 and €1,499 and receive a 2.5% cashback bonus + 0.5% bonus for new users

- Invest between €1,500 and €4,999 to get a 4% cashback bonus + 0.5% bonus for new users

- Invest €5,000 or more to get a 5% instant cashback bonus + 0.5% bonus for new users

Whether you're growing your portfolio or making your first investment, this is an excellent opportunity to maximize your returns.

You can review the terms and conditions on our Indemo promo code page.

Requirements

The registration process on Indemo takes at least 15 minutes. You can register as an individual or as a company. The following steps demonstrate the registration process for private investors.

Please note that Indemo does not accept investors from the UK, as the EU financial services license is no longer valid there. Additionally, users from Bulgaria and Croatia are temporarily restricted from investing on Indemo because both countries are currently on the FATF grey list due to significant AML/KYC deficiencies identified by international organizations.

During the sign-up process, you are required to type in your name, email, country of residence, and the promo code P2PEMPIRE.

After verifying your email address via the link in your inbox, you must add information about your country of birth, current address, tax details, and whether you are politically exposed.

In the next step, you will have to pass the sustainability and appropriateness test and answer questions related to your experience in investing and your finances.

In the final step, verify your identity via Veriff, your verification partner. During this process, you will be asked to scan a QR code on your screen and upload a photo document along with your selfie.

The Indemo team will then review your registration and activate your account. This usually takes only a few hours.

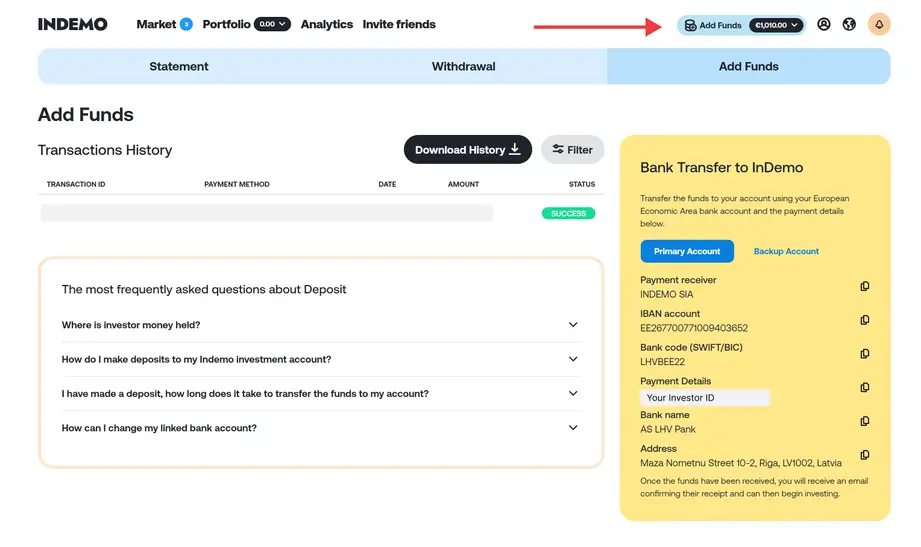

Upon activation, you can transfer funds to your investment account. Ensure you top up your account from a bank account in the European Economic Area held in your name.

You will find the deposit information by clicking on “Add Funds” in the top right-hand corner of your screen.

When transferring funds to your Indemo account, it's important to enter the correct payment details so Indemo can allocate the transfer properly. Typically, both deposits and withdrawals are processed within one business day. After your first deposit, future deposits are credited to your account instantly.

When transferring funds to your Indemo account, it's important to enter the correct payment details so Indemo can allocate the transfer properly. Typically, both deposits and withdrawals are processed within one business day. After your first deposit, future deposits are credited to your account instantly.

Note that Indemo only accepts investors who are at least 18 years old and reside in EU/EEA.

We recommend activating your 2FA in the Settings menu in your account to increase the safety of your investment account.

Risk & Return

Investing on any P2P or crowdfunding platform comes with certain risks and you must understand how those risks impact your investment portfolio.

Indemo currently offers investments in defaulted mortgage-backed loans from Spain with limited measurable returns. During our research, we identified the following risks:

- Platform Risk

- Lender Risk

- Market Risk

Platform Risk

Indemo is a newcomer to the P2P lending space, having launched in late 2023. Despite its short track record, it has already attracted nearly €18 million in assets under management.

The platform aims to grow this figure to €25 million by the end of 2025. While ambitious, this target may be difficult to reach given the current lack of a secondary market and the relatively illiquid nature of its offerings.

In our view, Indemo would likely need to scale its portfolio to at least €50 million to achieve long-term profitability. Similar projections by other fintech startups have often proven optimistic, especially when early growth relies heavily on external capital and investor sentiment.

So far, Indemo has raised €1.53 million in equity, demonstrating strong investor interest. However, sustained growth will depend on consistent performance, successful debt recovery, and the gradual building of investor trust.

The core platform risk lies in Indemo’s ability to maintain operations while managing a growing portfolio of complex, long-duration investments. Should recovery rates drop or investor inflows slow, the platform may face operational challenges.

Lender Risk

It's important for investors to understand that Indemo serves as an intermediary between investors and lending companies by listing investment opportunities in the form of Notes on its platform.

The quality of Indemo’s portfolio is largely dependent on the operations of its lending partners, who acquire discounted debts in Spain with the intent to sell them profitably.

To better grasp the risks involved, let’s first explain how Notes are listed on Indemo.

The platform works with debt suppliers such as Tamarindo Vector S.L., a Spanish special purpose vehicle (SPV) that holds mortgage titles on its balance sheet.

Tamarindo Vector is licensed by the Bank of Spain as a real estate lender (Prestamista inmobiliario) and by the Directorate General for Consumer Affairs for loan contracting and intermediation services.

There are several risks tied to the lending companies, including:

- Loss-making operations: Losses may arise due to various factors such as intense competition, higher debt collection costs, or shrinking portfolio sizes.

- Macroeconomic factors: Recession, war, natural disasters, and pandemics can significantly affect operations.

- Loss of lending authorization: Revocation of the lender’s required licenses would halt operations.

- Freezing of bank accounts: Issues such as AML/KYC breaches, sanctions, or insolvency could result in account freezes.

- Loss of bank account access: The lender could lose access to corresponding bank accounts.

- No contingency plans: A lack of backup servicers may jeopardize debt servicing if the lender can no longer operate.

- Breach of contractual obligations: Mortgages could be transferred to third parties, or loan receivables may be pledged to other creditors.

- Insolvency: Financial failure of the lender could lead to disruptions.

We’ve reviewed Tamarindo’s financial report for 2023, which you can access here. Tamarindo Vector achieved profitability in 2023.

Tamarindo works closely with Tauris Iberica, a company that handles due diligence, debt management, and debt recovery.

This firm advises Tamarindo Vector on purchasing discounted debts that meet the company’s criteria.

Indemo also shared that Tauris Iberica manages over 5,000 assets valued at €500 million.

Unfortunately, there is no public database to independently verify these figures or assess the performance of their assets under management.

Asset Management Services

The risk associated with the lender is directly linked to the quality of asset management services provided by these supporting companies.

Asset management and servicing firms conduct scoring, due diligence, and select the most suitable debts available in the market.

This process involves internal and external valuations, with only about 10% of available debts making it into the portfolio.

These debts are then packaged into Notes and listed on Indemo, along with key metrics such as Price-to-Value and Price-to-Debt.

Indemo's base prospectus outlines specific scenarios that could negatively impact your returns, including:

- Due diligence limitations: Information may be missing, incorrect, or outdated.

- Valuation limitations: Valuations may be incomplete, outdated, or based on insufficient methods.

- Macroeconomic factors: Changes in the market could lower property values or reduce liquidity.

- Exit strategy limitations: Changes in cooperation with borrowers or out-of-court settlement chances could affect returns.

- Enforcement and collection limitations: The claim amount may decrease, recovery costs could increase, or funds may be allocated to other creditors.

- Challenges with enforcing mortgages: Mortgage values may decline, limiting recovery efforts.

As you can see, there are numerous risks to consider. While Indemo operates within a robust legal framework, investors should fully understand and accept these risks before committing funds. Additionally, investors are heavily relying on Taurus Iberica to recover the debt as there is currently no backup-servicer available, should the company, fail in it's debt recovery.

Risk Mitigation

To reduce risk for investors, Indemo applies strict criteria when selecting which debts are listed on its platform. Only high-quality, secured loans make it through this process.

Here’s how Indemo filters investments:

- Collateral Type: Only fully built residential properties—such as apartments, townhouses, or villas—are eligible. Construction or development projects are excluded.

- Location: The focus is on liquid and stable areas in Spain, including major cities and popular coastal regions, particularly in the mid-price segment.

- Key Metrics: Each debt must meet strict thresholds for Price-to-Value (PTV) and Price-to-Debt (PTD) ratios. An official, up-to-date valuation report is also required.

Another critical safeguard is that Tamarindo Vector, the Spanish SPV, purchases the debts from its own funds before listing them on Indemo. This pre-financing reduces execution risk and allows investors to access Notes composed of debts already in various recovery stages.

In short, Indemo’s filtering process aims to list only recoverable, well-documented debts in attractive locations—reducing the likelihood of poorly performing assets entering the platform’s portfolio.

Performance Scenarios

According to the key information document provided by Indemo, the return on the investment in discounted secured debts depends on various factors. Here are some relevant data that may help you to better understand the risk and return on Indemo.

The following scenario calculations are based on an average Price-to-Value (PTV) and Price-to-Debt (PTD) ratio of 62% for the Note.

Stress Scenario:

Debt recovery fails, and the real estate properties are taken over and sold at a 44.3% price drop after 3.5 years, reflecting Spain’s largest property price decline during the 2008-2014 mortgage crisis. Auction taxes, fees, and brokerage commissions are included.

Unfavorable Scenario:

After two years, properties are sold at auction for 15% below the appraised value, with taxes and fees included.

Moderate Scenario:

A pre-trial arrangement allows the debtor to repay 90% of their obligations within 18 months.

Favorable Scenario:

A pre-trial arrangement allows the debtor to repay 90% of their obligations within 9 months.

Indemo advertises returns based on the moderate scenario, signaling the company's confidence in operating within the moderate to favorable range.

However, for Indemo to achieve its financial objectives, it will need to consistently deliver on these expected returns.

If investors experience stress or unfavorable scenarios, it could significantly undermine confidence in the platform, leading them to seek alternatives elsewhere. Maintaining performance within the advertised scenarios is crucial for sustaining investor interest.

High Yields

Investing in discounted debt investments (DDIs) on Indemo offers two main strategies, each with different return and liquidity profiles:

- Early-Stage Investments: These Notes are based on debts at the beginning of the recovery process. They typically have a lower Price-to-Value (PTV) ratio, meaning you're buying the debt at a deeper discount. If a settlement is reached early, returns can be significant. However, the holding period tends to be longer, and liquidity is limited until Indemo’s secondary market becomes available.

- Advanced-Stage Investments: These involve debts already in the later stages of recovery. The PTV is higher, but the time to recovery is shorter. While the upside is somewhat lower, this strategy suits investors seeking quicker exits and more predictable cash flow.

In both cases, investors benefit from significant discounts on real estate-backed claims. According to Indemo, returns on these investments have ranged between 15% and 35%, depending on how quickly the debt is recovered.

The primary risk is time—debt recovery may take months or even years. But for investors willing to wait, the yield potential remains among the highest in the P2P lending space.

€20,000 Protection Scheme

Indemo SIA is part of the national investor compensation scheme, established under EU Directive 97/9/EC. This scheme provides protection by compensating investors if Indemo SIA is unable to return financial instruments or cash. The maximum compensation an investor can claim is 90% of their net loss, capped at €20,000.

It's important to note that this compensation does not act as a buyback or group guarantee. If market or lender-related risks materialize, investors may not receive any compensation under this scheme.

Taxes

Since investors on Indemo are investing in transferable securities (Notes), Indemo, as the withholding agent, must deduct withholding tax from individual investors.

For EU/EEA tax residents, the standard tax rate is 5%, unless reduced by an applicable double tax treaty, such as in Lithuania, where the rate is 0%. If you're investing through a corporate entity, the withholding tax rate is 0%.

No additional tax documentation is needed, as Indemo relies on the information provided during the onboarding process.

As a MiFID-regulated investment firm offering EU securities, Indemo provides a tax report that enables investors to easily offset the tax paid on the platform against the tax due on passive income (interest) in their home country, thereby avoiding additional tax liabilities.

Is Indemo Safe?

The safety of your investment depends on various factors, including the management's ability to act in good faith. Let’s examine the team and the legal framework under which the platform operates.

Who Leads the Team?

Indemo is headed by CEO Sergejs Viskovskis, a lawyer with experience at both Rietumu Bank and Mintos.

The founding team also includes Daniels Zirjakovs, Aleksandr Volosins, and Pavels Pochtarenko. Aleksandr and Pavels have a shared history, having previously worked together at Rietumu Bank. Additionally, Aleksandr, Pavels, and Daniels co-own a consulting firm, KBL Solutions.

Daniels is also a council member of Aquarium Investments, one of Indemo's shareholders, further strengthening his ties to the company.

To learn more about Indemo, click on the image below to watch our onboarding call with the CEO, where we dive deeper into several key aspects of the platform.

Who Owns the Platform?

The platform is co-founded by the aforementioned individuals. During our research, we identified 24 shareholders, including Ilya Hagins, who also serves as the director of Atlan and Tamarindo—two companies closely associated with Indemo.

Other notable shareholders include Andrzej Pawlow, AS "Aquarium Investments," Vairis Dmitrievs, and several others. You can view the complete list of shareholders here.

Are There Any Suspicious Terms and Conditions?

Our research has not uncovered any suspicious terms or conditions. All risks are clearly and transparently disclosed in Indemo’s key information sheet and investor prospectus.

Storage of Funds

According to the information in Indemo’s terms and conditions, the platform stores investors’ funds separately from its operational accounts on bank accounts from LHV bank and Rietumu bank.

Amendments

Note that Indemo may introduce management fees. Should the company decide to amend the current terms, investors will be notified ten calendar days in advance.

Access to Loan Agreements

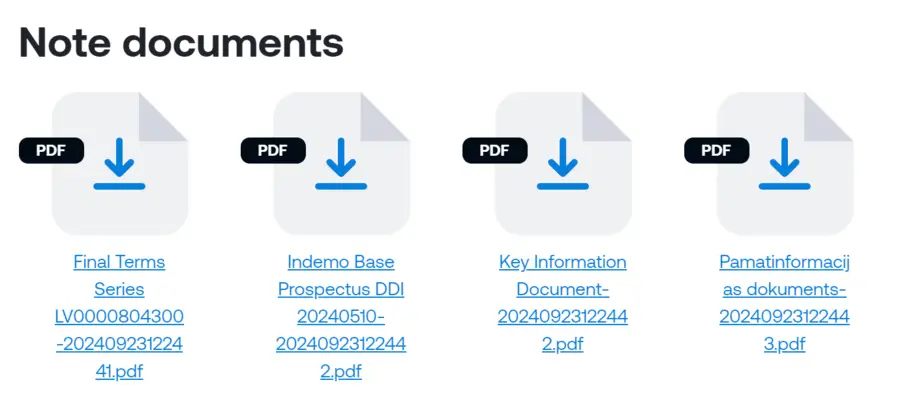

When investing in Notes manually, you have access to all the legal documentation, including the terms for the specific Notes.

Potential Red Flags

At this time, we have not identified any potential red flags. Our research into the team behind the platform revealed no concerns, suggesting that the management is operating in good faith.

Usability

The team behind Indemo has put significant effort into enhancing the platform's usability, tailored explicitly for investing in discounted mortgage-backed securities in Spain.

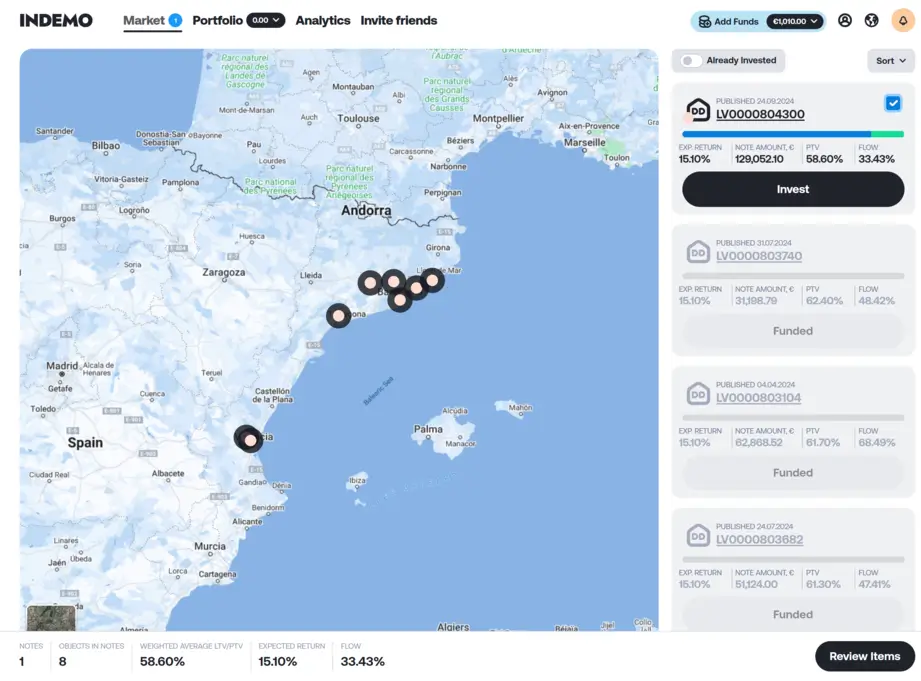

Upon logging in, you’ll immediately see the available Notes, complete with the expected return, Note amount, Price-to-Value ratio, and Flow progress. The updated version of this view also enables you to filter the available Notes based on your preferences.

By using the filter, you can select investments at earlier or later legal stages, giving you greater control over the potential expected return and the liquidity of an asset.

Investing in early-stage discounted debts usually means longer capital commitment and lower liquidity. If you decide to invest in later-stage notes, you can expect a lower potential yield and higher liquidity.

By clicking the checkmark button in the top-right corner of a note, you can review the discounted mortgages displayed on a map, giving you a clear view of the asset locations.

Indemo primarily focuses on financing mortgage-backed securities in coastal areas and larger cities, as these properties tend to be more liquid than those in rural areas.

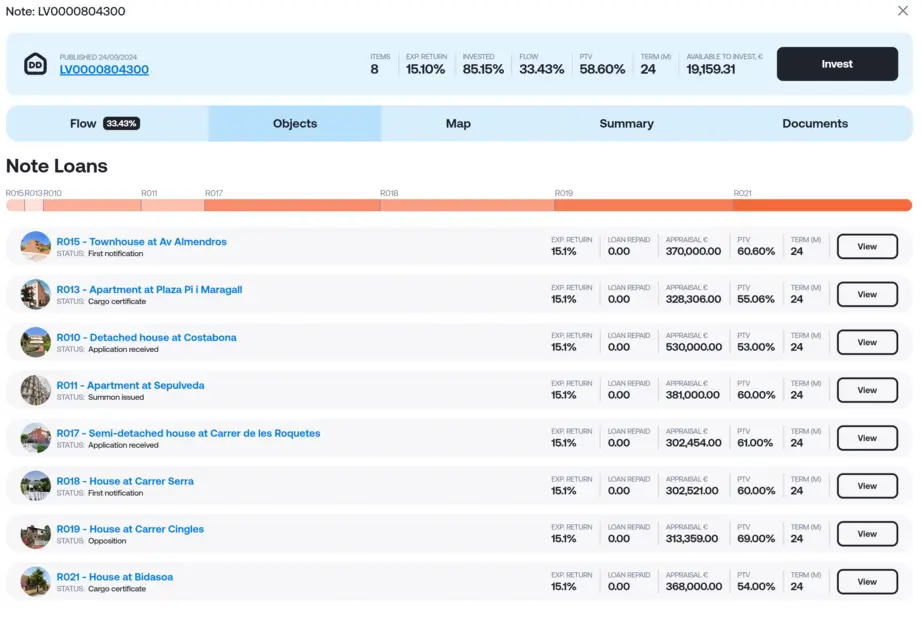

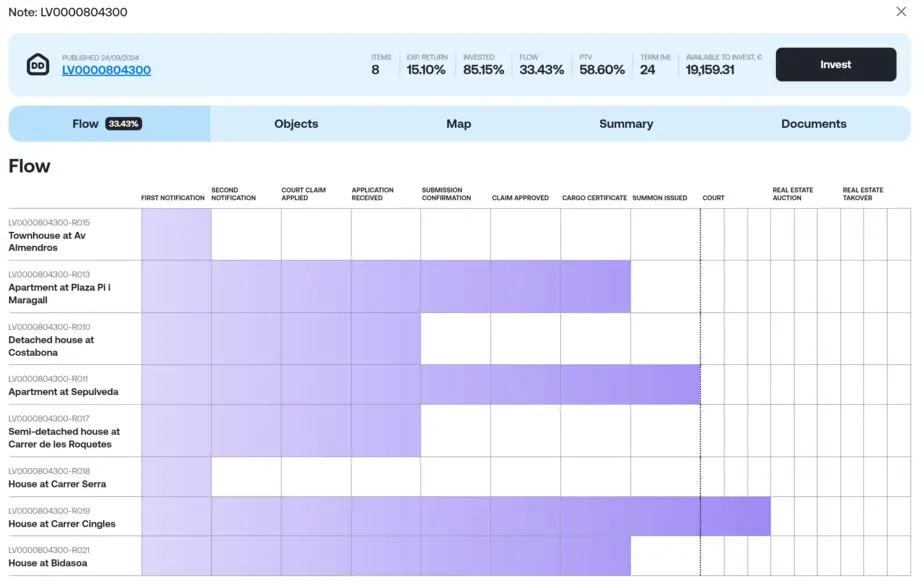

By selecting the note number, you’ll open the Flow view, where you can see the legal progress of loan recovery. While previous one Note included multiple discounted debts, from November 2025, Indemo offers only investments under the 1-Note-1-Debt structure.

The further along in the recovery process, the more liquid your investment becomes. While the platform suggests a 24-month term, you may receive your funds and profits earlier if the asset managers can sell the debt sooner.

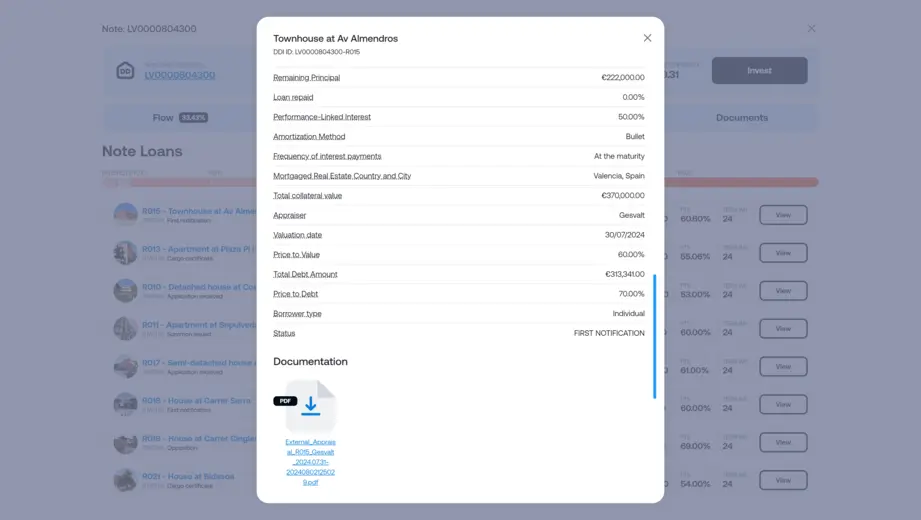

In the “Objects” tab, you can explore more detailed information about the properties within the Note, including the price-to-value ratio and current status. The orange bar chart shows the portion of the debt allocated to that specific Note.

You can also click on individual properties to learn more about them and view the attached appraisal reports, which are available for all listed properties.

The “Note Summary” tab provides additional details about the Note. After investing, you can monitor your portfolio under the “Asset” section in the navigation bar.

Indemo Auto Invest

Indemo offers an Auto Invest feature that lets you set your own criteria and have the platform automatically allocate funds to matching loans.

If you’re new to Indemo, it’s best to start with manual investments first to get familiar with the available options and loan types.

Please note that access to Auto Invest is granted only after successfully completing Indemo’s sustainability test, which requires answering a few short questions to assess your investment knowledge and preferences.

Liquidity

As of our testing, Indemo does not yet offer a secondary market. However, during our conversation with the CEO, it was confirmed that a secondary market is planned for the first half of 2026.

Given that debt recovery on Indemo can take an average of two years, investors should be prepared to commit their capital for the medium term. In return, they may benefit from premium returns on their investments.

It’s important to note that once you invest on Indemo, you won't be able to withdraw your funds until the debt is recovered, which can range from a few months to up to 5 years.

Support

During our testing, we contacted the CEO directly and received in-depth answers to all of our questions within one to three business days.

We also engaged with the platform’s support team, which handles client onboarding, and their response time was typically within one business day.

We rate the support quality as high. If you use the live chat function on Indemo’s website, you can expect a response within a few minutes or hours, depending on the complexity of your query.

Indemo Alternatives

Indemo is a high-risk, high-return platform with irregular payments and longer investment terms compared to most other platforms. While it has delivered returns above the advertised rate, its track record is still limited. As a result, you might want to explore other investment options to diversify your portfolio.

Fintown

Fintown is a Czech-based platform offering investments in operational rental units in Prague. Investors can earn monthly rental income from these properties. Fintown also provides higher-yield investment opportunities through development loans managed by Vihorev Group. The platform only lists in-house loans, which helps reduce external risks that investors might face on platforms like EstateGuru. Learn more in our Fintown review.

InRento

For a regulated platform with a flawless portfolio and monthly rental income, InRento is worth considering. It offers above-market returns on mortgage-backed loans used to refurbish and manage rental properties in Lithuania and Poland. Discover more in our InRento review.

LANDE

If you're looking for a more traditional crowdfunding platform with secured, higher-yielding investments, LANDE is a solid option. This regulated Latvian platform specializes in agricultural loans, secured by land, crops, or machinery. Learn more in our LANDE review.