Lendermarket Review Summary

Lendermarket is an Estonian-based and Ireland-registered P2P marketplace controlled by Creditstar. While Lendermarket offers some of the highest interest rates in the industry, the investments on this platform come with much greater risks.

Main takeaways from our Lendermarket review:

- Semi-reliable buyback guarantee

- Limited performance-oriented data

- Frequent changes in management

- Misleading historical marketing statements

What Is Lendermarket?

Lendermarket is a peer-to-peer (P2P) lending marketplace that lists short-term loans ranging from 30 days to 53 months, with interest rates between 9% and 16% per annum.

All loans are secured by a 60-day buyback guarantee. However, this protection scheme is bypassed by systematically extending the loans.

The minimum deposit is only 10€, and you can diversify your investments across seven countries. Learn more about this P2P lending platform in our latest Lendermarket review.

Pros

- High cashback bonuses

- High-interest rates of up to 16% p.a.

Cons

- No secondary market

- Limited diversification

- Many delayed loans are being extended up to 6 times

- €50 minimum withdrawal amount

- Unavailable funds can be reinvested

Our Opinion of Lendermarket

Lendermarket has historically been a high-yield platform attracting investors with a higher risk appetite. Previously, the lack of visibility into its loan book and limited disclosure about due diligence made it difficult for investors to properly assess risks.

While originally launched by Creditstar, Lendermarket has since moved toward becoming a multi-lender platform. For a long time, this raised concerns about conflicts of interest, as Creditstar remained by far the largest loan originator. The situation has changed in several key areas.

The long-standing issue of pending payments has now been fully resolved, marking a significant milestone for the platform. In addition, Lendermarket now features regulated loans under ECSPR licensing, which should provide investors with an extra layer of oversight and compliance.

The platform has also worked on strengthening its image and investor trust. Its Trustpilot score has improved to 4.1. More loan originators have joined the marketplace, with additional lenders expected to be added in the near future.

Platform visuals and the user interface have been updated to make navigation smoother, while performance data is presented in a clearer, more transparent manner.

Another area of improvement is customer support, which now responds faster and is more proactive in assisting investors compared to earlier years. Despite these developments, it is important to note that Creditstar still plays a dominant role on the platform, and investors should remain aware of the associated risks.

While the platform has taken meaningful steps forward, it continues to be driven mainly by attractive interest rates and cashback campaigns rather than structural investor protection.

As of month year, the pending payment backlog affecting users of Lendermarket 1.0 has been resolved, and no issues have been reported on Lendermarket 2.0. Nevertheless, investors should continue to approach this platform with caution, keeping in mind its history and Creditstar’s central role.

Lendermarket Bonus

Increase your investment during the campaign period and earn a cashback bonus based on your portfolio growth. Boost your funds by 5–9% to receive a 0.5% bonus, 10–19% to receive 1%, 20–34% to receive 1.5%, and grow your portfolio by more than 35% to earn the maximum 2% bonus. Valid until 19. May 2026. Learn more about this campaign on our Lendermarket promo code page.

Risk & Return

Lendermarket follows a similar business model to P2P lending sites such as Bondster, IUVO, or Mintos.

The goal is to raise funds to fund the loan portfolio of Lendermarket's parent company, Creditstar.

Like other P2P lending platforms, Lendermarket offers a buyback guarantee and a group guarantee for loans issued by its lenders.

Please be aware that based on investor feedback and changes in the platform's terms, we evaluate Lendermarket's buyback guarantee as unreliable.

Buyback Guarantee

If the borrower delays payment for more than 60 days, the loan originator will buy back your investment for the principal loan amount.

The truth is, however, that lenders on Lendermarket may extend the loans up to six times.

Lendermarket's buyback guarantee does not come with significant benefits compared to other P2P lending platforms.

Note that most loans on Lendermarket are automatically extended up to six times.

If you have invested in a 30-day consumer loan, chances are that your investment will be locked up to 240 days, which consists of 180 days of loan term + 60 days until the buyback is executed.

There is no secondary market on Lendermarket, meaning your liquidity is limited.

Diversification

The diversification of your portfolio provides better protection than any buyback guarantee. This isn't, however, the case for investors with exposure to Lendermarket.

On Lendermarket, you can invest in the Estonian loan provider Creditstar Group, Rapicredit, which faced payment difficulties on Bondster, and QuickCheck, a Nigerian lending company.

If you wish to learn more about the listed lending partners, we suggest reviewing the documentation on Lendermarket's website under "Loan Originators."

Is Lendermarket Safe?

We looked at the team and read the terms and conditions of Lendermarket, and here is what we found.

Who leads the team?

Lendermarket announced in September 2023 that Carles Frederico Arnabat is now running the team behind Lendermarket.

The management team of Lendermarket is changing frequently, which is not a good sign for investors. Any important decision is made by Credistar, the main entity that controls Lendermarket.

Who owns the platform?

It's incredibly tough to find any information about the owners or shareholders of Lendermarket.

We had to read the entire document about platform rules to find out that Tauri Jaanson signed in as the director and Veiko Väli as a secretary.

Neither person shares information about their roles at Lendermarket on their LinkedIn profiles.

We requested further information from Lendermarket, and here is what we found out:

Who is the legal owner of Lendermarket?

SA Financial Investments OÜ owns Lendermarket Limited OÜ – an Estonian holding company that is, in turn, wholly owned by Mr. Aaro Sosaar - the CEO of Creditstar Group. He is the ultimate beneficial owner of Lendermarket Limited."

In short, Creditstar is making the decisions for Lendermarket. If you are unhappy with Creditstar's performance, then Lendermarket is not your platform.

A recorded interview with Mr Sosaar to address the platforms issues has not been accepted by Credistar.

Where can investors visces of Lende officesrmarket?

"Lendermarket's office is in Estonia, where the core team is located."

Again, we had to follow up to find the exact location.

"Lendermarket is sharing the office space with Creditstar on Lõõtsa 5, 11415 Tallinn."

Are there any suspicious terms and conditions?

We have read the platform rules, the privacy policy, as the loan agreement, and this is what we found:

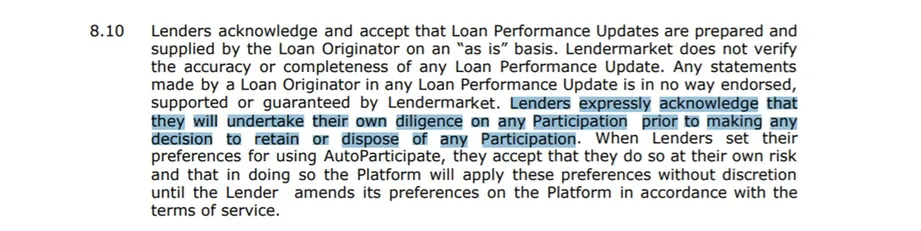

Clause 8.10

According to clause 8.10, investors should do their due diligence about loan originators on Lendermarket. Also, investors accept that the Lendermarket does not question any information received from the loan originator.

This means the platform does not do much due diligence on the loan originators but accepts all data on an "as is" basis.

We reached out to Lendermarket and asked for a comment:

"As in every agreement, all parties have rights and obligations. The Rules of the Platform are no exception. All parties must conduct due diligence before entering the contract and throughout its duration. Lendermarket is committed to protecting investors' interests and carrying out due diligence in its operation; however, this is not incompatible with investors conducting the corresponding assessment of our financial service."

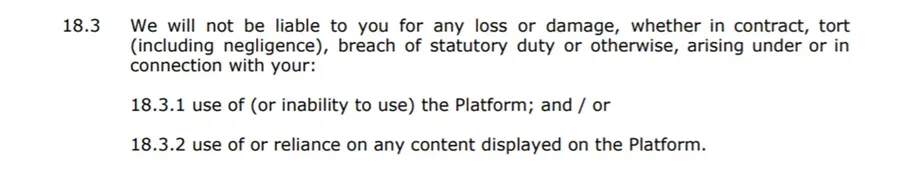

Clause 18.3

Like any other P2P lending site, the platform distances itself from any liability for loss in connection to investors' activities on the platform.

In case the platform presents inaccurate data, they aren't liable for it. As an investor, you invest based on information no one is responsible for.

Clause 18.3.2 is quite confusing. Here is Lendermarket's explanation:

"Clause 18.3.2 states that Lendermarket is not liable for the use the investors make with the content displayed on the website. Lendermarket is liable for the content on their website; however, it's not liable for the use users will do of it."

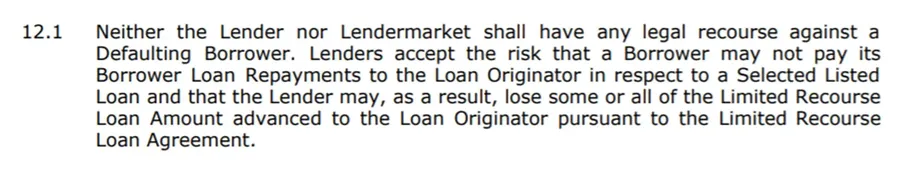

Clause 12.1

In 12.1, the platform explains that lenders might lose their money if the borrower does not repay the loan. This looks like it contradicts the buyback guarantee.

Do investors have access to individual loan agreements?

Verified investors do have access to loan agreements. You can view the PDF file when setting up your Auto Invest. We have reviewed the document, and here is what we found out.

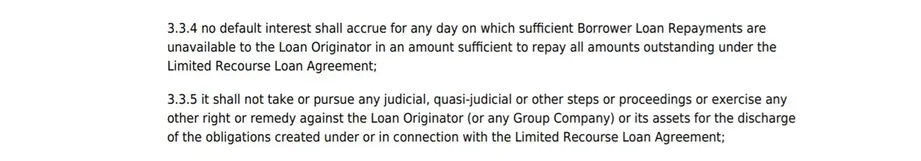

Clause 3.3.4 - 3.3.5 Loan Agreement

Are you getting a headache when reading this? You are not alone. We asked Lendermarket to explain this to us.

Different clause, same response. The legal team could not find an answer to this.

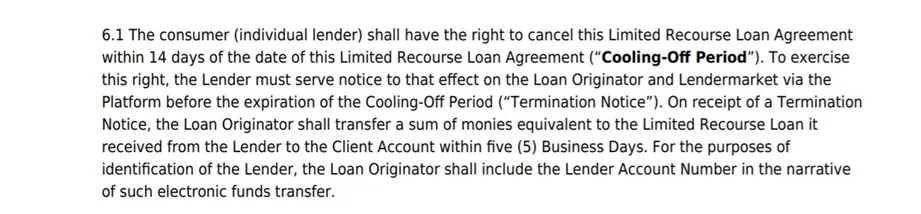

Clause 6 - Loan Agreement

There is one positive aspect worth mentioning. Every investor can cancel their auto investments within 14 days of setting up their Auto Invest.

Note that you need to follow a specific process. This is one of the few aspects many P2P lending sites do not add to their loan agreements.

Other than this clause, the contract is very standardized. If you decide to invest on the platform despite our warnings, we suggest you review the latest terms and conditions which may change from time to time.

Usability

You can set up an Auto Invest or invest manually.

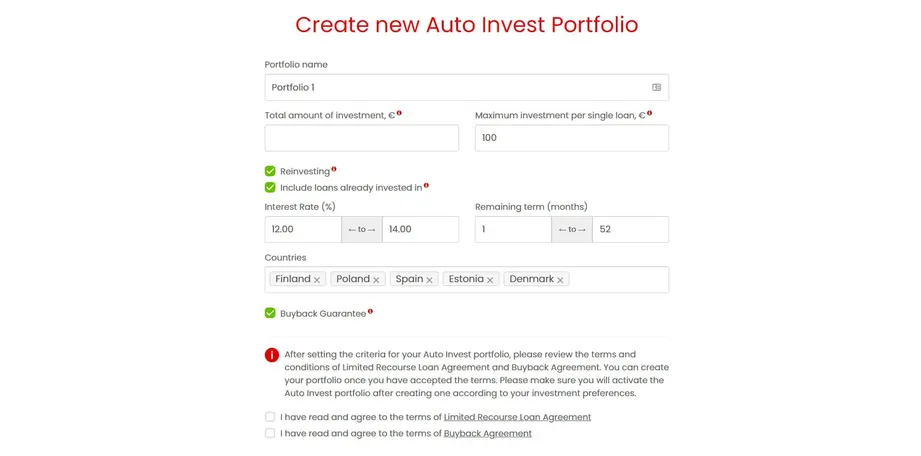

Auto Invest

The Auto Invest allows you to set up the total amount of your automated portfolio and the maximum amount you are willing to invest into one loan. The minimum investment is €10.

You can also activate the option to reinvest your earned interest and invest multiple times in already invested loans.

Investing in already invested loans is not recommended, as this harms your diversification.

Furthermore, you can set up the loan interest and the loan term. Don't forget to include the countries and activate the buyback guarantee.

Read the loan and buyback agreements before submitting your settings to know what you are signing up for.

Investors can download income statements and tax reports directly from their profile pages.

At this point, you probably noticed that Creditstar is listing loans on Mintos and Lendermarket, so we asked Lendermarket:

How is it different from investing on your platform in loans from Creditstar as compared to investing in Creditstar loans on Mintos?

"One of the advantages of investing in Creditstar's loans in Lendermarket is having less risk and exposure than Mintos. Currently, Lendermarket focuses only on loans from Creditstar's operating entities, while Mintos has many originators. We want to think we can provide better Investor Support and communications via Lendermarket by focusing more on a single partner. The loans have a shorter term, are highly appreciated by investors, and have higher interest."

Investors should know that there are always two sides to a coin. While Lendermarket's reasoning makes sense to a certain extent, the added diversification investors have on Mintos easily outweighs the logic.

Liquidity

Lendermarket doesn't offer a secondary market, and some investors on Lendermarket reported that a significant part of their portfolios is often delayed.

While it is common to have delayed payments when investing in payday loans, it's not common to have 50% of the portfolio (or more) delayed consistently.

While Lendermarket isn't publicly sharing information about the performance of its portfolio, the platform informed us that the amount of delayed loans usually stands at around 20%.

The liquidity on Lendermarket is unpredictable, and it's likely you won't be able to plan your exit.

Loan Extensions

It's worth noting that borrowers may occasionally extend their repayment schedule. The loans can be extended up to six times, with each extension lasting up to 30 days.

These numbers represent the maximum and do not imply that all loans are continually extended by that time.

This way, the lender doesn't need to initiate the buyback guarantee but extend the loan, significantly affecting the liquidity of the investor's portfolio on Lendermarket as the platform doesn't offer a secondary market. A 60-day loan can, therefore, be extended up to 240 days.

Support

Lendermarket's support team is limited to answering questions about the platform's functionality. If you are looking for more transparency, you won't find it on Lendermarket.

The response time is usually around 48 hours.

Lendermarket Alternatives

Lendermarket offers some of the highest yields in the P2P lending industry. This high return comes with higher risk, as the lender can decide not to honor the terms and extend the loans to increase liquidity.

If you want a platform that meets investors' expectations and respects the advertised terms, consider the following alternatives.

Esketit

Esketit is a more transparent platform that can deliver on its promises to investors. You have access to live statistics, so you are always aware of the performance of Esketit's loan portfolio.

The platform also offers a secondary market to buy or sell your investments.

Additionally, you can automate your investments with Esketit's automated strategies, which provide an instant exit option.

While you will "only" earn 11% on Esketit, the platform offers a far better risk and return ratio than what you will find on Lendermarket. Learn more about Esketit in our Esketit review.

PeerBerry

If you are looking for a stable platform with a decent yield, we suggest looking into PeerBerry.

This P2P lending marketplace offers loans from the Aventus Group trademark, the only financial group able to cover all war-affected loans with its group guarantee.

While the loan availability is low on PeerBerry, it's far less risky than aiming to earn high yields on Lendermarket, where you can't even withdraw your funds due to Creditstar's poor liquidity management.

Read our PeerBerry review to learn more about this platform.

Fintown

If you want higher yields but aren't ready to take extreme risks, like on Lendermarket, look at our Fintown review.

Fintown is a platform raising funds to invest in further real estate development projects from the Vichorev Group in Prague.

As an investor, you can invest in development projects or rental properties with high occupancy and daily rental rates. The platform is more transparent than Lendermarket, despite having only been operational since January 2023.

Are you wondering how much money you lose by letting your money sit in a bank account? Find out with our inflation calculator. Beat inflation with our P2P lending calculator.