Mintos Review Summary

Mintos is still the market leader in P2P investing in Europe. Nevertheless, the P2P lending site isn’t always able to protect investors’ interests. If you decide to invest in Mintos, you should have prior experience with P2P lending and pick the best loan originators.

As Mintos moves towards a multi-asset platform, you should carefully study the terms and conditions before investing in bonds, ETFs, or rental properties.

Key takeaways from our Mintos review:

- Lower historical return as on other platforms

- Broad diversification options

- Many new lenders from emerging markets

- Only suitable for experienced P2P investors

If you are considering joining Mintos, you should do in-depth due diligence about their lending companies before investing your money.

Our Opinion of Mintos

Our assessment of Mintos is based primarily on its P2P lending business, rather than the newly introduced investment options such as bonds, ETFs, or real estate.

Mintos: A Platform Built to Fund Its Own Lending Companies

Mintos was originally designed to finance the lending portfolios of companies owned by its shareholders. While it has since repositioned itself as a P2P lending marketplace, this shift has come at a significant cost to investors.

Over the years, Mintos has locked up millions of euros in defaulted lenders who failed to honor their buyback guarantees, leaving investors with funds stuck in recovery for years.

Loan Performance: Some Improvement, But Issues Remain

Through 2024 and 2025, the performance of Mintos’ loan portfolio has improved, but this progress has been marginal compared to the sheer size of the defaulted portfolio. Many investors are still waiting for their funds to be recovered, and liquidity challenges remain a major concern.

Ongoing Liquidity Issues & "Pending Payments"

Investors on Mintos continue to experience liquidity restrictions due to "pending payments", which arise when lenders fail to process payouts on time. This puts investors in an unfavorable position, as they have little control over when they can access their money.

Regulation: A Marketing Point, Not a Safety Feature

Mintos became a regulated platform in Latvia in 2021, spending €433,000 on legal fees to obtain its license. However, this regulation has not significantly increased investor protection. Instead, it allows Mintos to expand its business model by offering a broader range of financial products.

Despite promoting regulation as a key advantage, Mintos’ current portfolio performance suggests that this benefit offers little real value.

Mintos Is Only Suitable for Experienced Investors

Mintos may still appeal to experienced investors looking for high returns, but only those who can critically assess the financials and risks associated with individual lenders.

If you are unable to thoroughly evaluate loan originators' financial stability, you risk significant losses, especially considering Mintos’ track record of problematic lenders and liquidity issues.

Better Alternatives for Passive Investors

While Mintos was a top performer in its early years, the P2P landscape has evolved. Investors today have access to better platforms that offer higher returns, lower risks, and more reliable liquidity.

Platforms like Esketit, Robocash, and PeerBerry often provide a more consistent investor experience, with fewer concerns about pending payments, fund recovery, or complex tax reporting.

Our Experience with Mintos

We previously maintained an active portfolio on Mintos, but we liquidated our investments in 2020, well before the platform began locking up investor funds.

Given the historical loan book performance, we believe Mintos is only suitable for experienced investors who are willing to conduct in-depth research, select only the best loan originators, or explore one of Mintos’ newly introduced investment products.

Final Verdict: Not for Passive Investors

If you’re looking for an easy way to earn passive income without constant research and monitoring, Mintos is not the right platform for you. The risks, liquidity concerns, and ongoing recovery issues make it a challenging choice for casual investors.

What Is Mintos?

If you're looking for a comprehensive review of the regulated P2P lending marketplace Mintos, you've come to the right place.

In this article, we'll look at what Mintos is, how it works, and whether or not it's worth your time and money.

We'll also explore some pros and cons of using Mintos as an investor. So, let's get started with our Mintos review!

Pros

- Biggest P2P lending marketplace in Europe

- A wide variety of loans

- Regulated in Latvia

- Higher yield for newly joined investors

- No cash drag

Cons

- Unreliable buyback guarantee

- Many suspended lenders

Mintos Bonus

With our Mintos promo code, you can receive a €25 bonus after registering with our link and investing at least €1,500 within 30 days.

User Requirements

To invest on Mintos, you’ll need to fit with a couple of their requirements, such as:

- Be over 18 years old

- Have a European bank account in your name

- Don't reside in the UK

- Pass the KYC requirements

- Pass the suitability and appropriateness test

Remember that if you don't pass the suitability test, which tests your knowledge in the P2P lending space, you won't be able to use some of the critical functions of Mintos, like the Mintos strategies.

No EUR bank account? No problem

You can transfer your money in nine different currencies, but we recommend transferring your funds in EUR to avoid any conversion fees.

Mintos allows you to invest in different currencies. Note, however, that this increases foreign exchange exposure.

On top of that, Mintos can disable the exchange feature on the platform anytime, meaning you won't be able to exchange your investments back to EUR and withdraw them.

The most cost-effective way to transfer funds to your Mintos account is via SEPA transfer.

If you’re from the UK and want to invest in European P2P lending platforms, have a look at our Fintown review and PeerBerry review, as Mintos doesn't accept investors from the UK currently.

Risk & Return

History shows that Mintos is a higher-risk investment than other P2P lending platforms.

While Mintos offers many cashback bonuses, which increase the potential return, remember that over 20% of the current portfolio isn't performing as expected.

This significantly decreases the possible return for broadly diversified portfolios.

Let's dive deeper into the risk variables and various products offered to investors on Mintos.

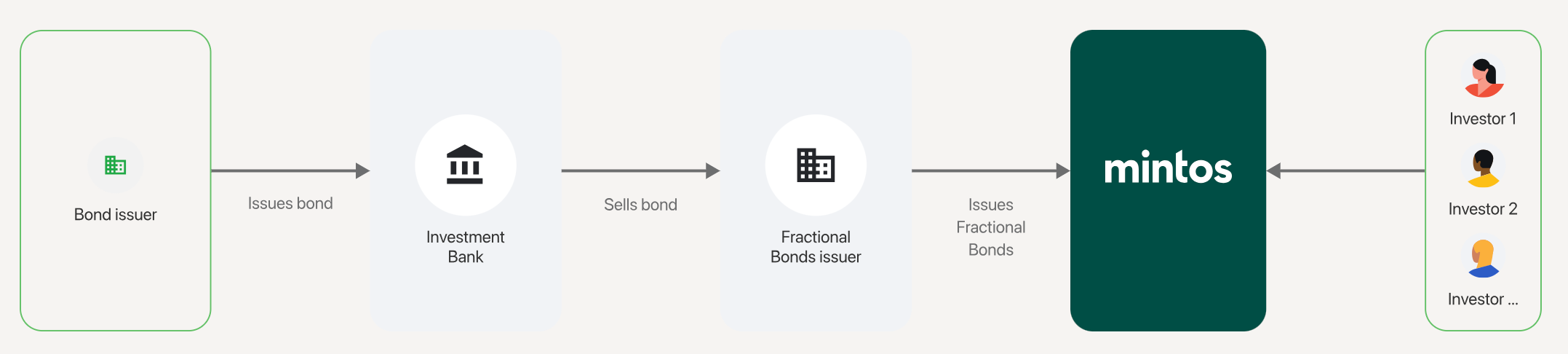

Fractional Bonds Explained

Mintos is the only P2P lending marketplace offering the possibility to invest in fractional bonds for as little as €50. The platform has just started offering these investments, so the currently available bonds are somewhat limited.

Bonds on Mintos typically have longer loan terms, fixed yields, and quarterly interest payouts. All bonds can be sold on the secondary market, which may increase their liquidity. Every bond comes with a base prospectus, where you can learn more about the terms and conditions.

As Mintos informs its users when investing in fractional bonds, you don't invest in the bond directly but via a bond-backed security issued by a special-purpose vehicle within the Mintos group.

It's worth noting that investing in fractional bonds comes with similar risks as when investing in loans.

Additionally, if you decide to sell your fractional bond on the secondary market, you might not be able to find a buyer who is willing to pay the initial price.

Mintos Real Estate Explained

Mintos now offers investments in residential real estate properties in cooperation with the Austrian fintech company Bambus.

Bambus Immobilien Gmbh purchases the property from homeowners who retain the right to live in the home while paying monthly rent. This system enables owners to utilize their equity for additional investments.

The rental properties on Mintos are offered via Notes, meaning you can start investing from only €50. The average interest (net rental income) is around 5%, with an expected annual capital appreciation of 3%.

This type of investment is backed by an underlying bond. The maturity of the real estate security is 10 to 25 years. Investors on Mintos have the option to sell their investments on the secondary market.

Investments in real estate rental properties carry significant risks, as outlined in the key information sheet.

Mintos Notes Explained

Mintos has transitioned from claim rights to Notes (asset-backed securities) as a regulated company.

Before Mintos received the investment firm brokerage license, the platform offered investments starting from €10 in single loans, with a dedicated claim right in the form of a loan assignment.

Now, Mintos is packaging multiple similar loans into Notes.

This pool of loans is defined as a financial instrument with an ISIN (International Securities Identification Number).

The minimum investment amount into one Note has increased to €50, and one Note can include between 6 and 20 loans.

Here is a simplified process for issuing Notes on Mintos.

Nothing has changed in terms of return from the previous structure. With Notes, you receive the interest paid by borrowers on the underlying loans.

When discussing protection, it is evident that Mintos allows the lending company (loan issuer) to provide a buyback guarantee, meaning the lender will repurchase your investment should the loan be delayed by more than 60 days.

Remember that this is not a reliable protection scheme on Mintos, as many lending companies have not honored this buyback obligation in the past.

€20,000 Protection Scheme

As a regulated firm in Latvia, the government is providing €20,000 investor protection on investors' uninvested funds on Mintos, meaning if Mintos goes bust and you have uninvested funds, Latvia will reimburse you up to €20,000.

This "scheme" doesn't cover your active investments on the platform, and Mintos pointed out that it should not be interpreted as a "deposit insurance."

Mintos & Taxes

Another change investors are experiencing with Notes is the requirement to withhold taxes on their earnings.

Previously, Mintos didn't withhold taxes on claim rights; this has changed for Notes.

As you receive interest from investments in Notes, Mintos will automatically withhold tax based on the applicable tax rate.

Tax rates on Mintos

- 20% for private investors and tax residents of Latvia

- 5% for private investors that are EU/EEA residents outside of Latvia (no documentation is required)

- 0% for Lithuanian tax residents (tax certificate is required); otherwise, 5%

- 20% for investors from outside of the EU/EEA (can be reduced if a tax certificate is provided)

- 0% for legal entities

When you report taxes in your country of tax residence, you may usually lower the taxes paid by the withheld amount, so your effective rate will be the same as if you invested in claims. Mintos provides tax reports and income statements in users' dashboards.

This is only valid if your country has a double tax treaty with Latvia.

If you don't want to deal with this hassle, you can also invest on Mintos as a company for which no taxes are deducted.

If you reside outside the EU or don't provide a tax residence certificate, Mintos will deduct 20% tax from your earnings.

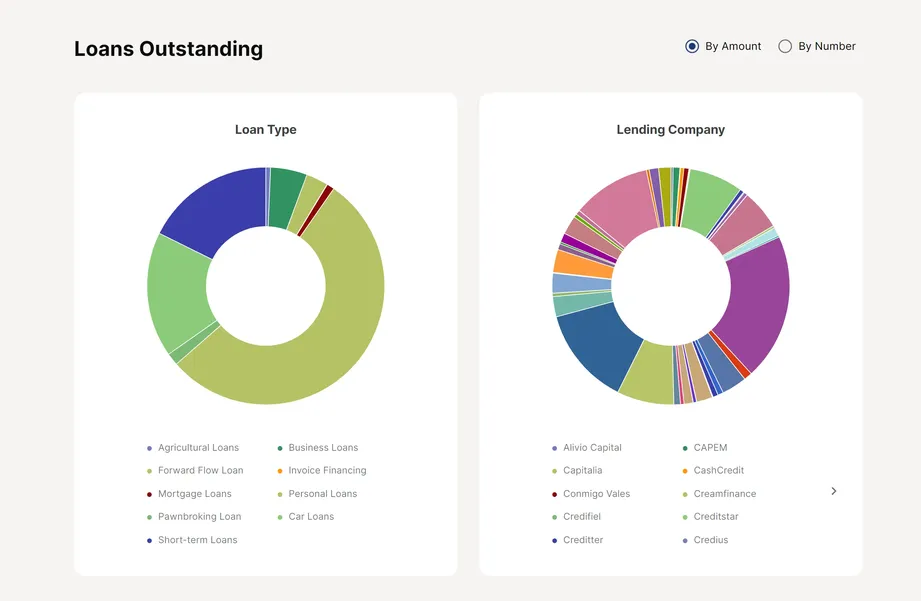

Loan Types

While Mintos promotes various loan types, most loans bundled into Notes on Mintos are short-term, personal, or car loans.

Almost two-thirds of loans on Mintos are short-term loans, otherwise known as micro or payday loans.

Those loans usually have a short-term max. 90 days.

Note that short-term loans are riskier than mortgage-backed loans, as the default rates can be up to 40%, depending on the country and the lending company.

Mintos also lists mortgage, business, and agricultural loans and invoice financing. Those loan types are, however, barely available. If you are looking for investments in secured loans, you might want to read our review of LANDE.

Diversification Options

Mintos’ popularity stems from the variety of loan originators it offers.

Theoretically, you can invest in over 70 loan originators from 33 countries.

In reality, the supply of loans from different loan originators varies. There are currently just a few established loan originators that you should consider investing in.

Note that on Mintos, the number of loans, rather than their quality, helps you minimize your risks.

Many larger financial groups operate multiple lending companies in various developing countries.

Remember that there is a direct correlation between the lending companies and that if one lender within a group defaults, it significantly increases the risks for other lending companies within the same group.

Many financial groups on Mintos offer a "group guarantee," which should cover the obligation in the event of a defaulting lender.

However, this is not the case, as we saw previously with Varks' suspension in Armenia and the fall of the Finko Group.

As an educated investor, you should be aware that several lending partners share the same shareholders as Mintos.

The P2P marketplace funds many payday loan providers owned by the same shareholders. This conflict of interest may harm your investments on Mintos.

More than 50% of "funds in recovery" are from lenders connected to Mintos' shareholders.

Buyback Obligation

Another feature worth mentioning is their buyback obligation. If you invest in loans with a buyback guarantee, your investments will be repurchased by the lending company after it's delayed for more than 60 days.

This appears to be just a promise, as lending companies don't honor this buyback obligation (previously referred to as a buyback guarantee).

Note, however, that lending companies might exploit this in their favor. Instead of activating the buyback obligation, the lending company can extend the loan term up to 6 months.

Suppose the lending company decides to extend the loan. In that case, they don't need to activate the buyback obligation, meaning your investment term can be extended by several months, which harms your liquidity.

This sneaky strategy is also being followed on Lendermarket and partially on VIAINVEST.

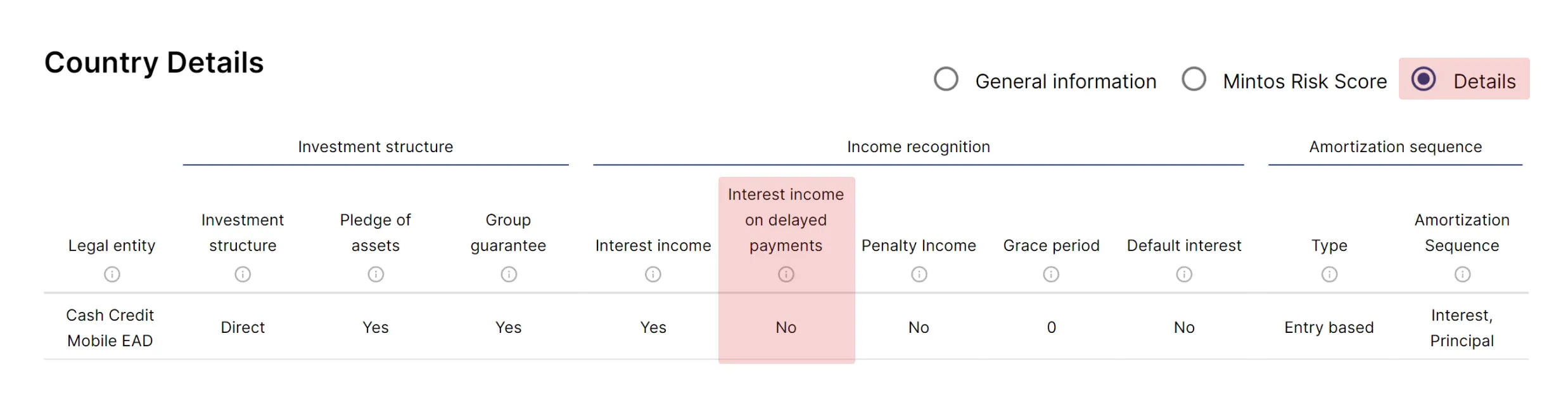

No Interest on Delayed Payments

Not all Mintos lending companies pay interest for delayed loans.

If your investment in Notes is delayed, you may not receive any interest for this period, significantly lowering your return and increasing the risk.

If you decide to invest in Notes on Mintos, we recommend reviewing whether the loan company pays interest on delayed payments.

You can do so by navigating to the "Loan Originator Page", scrolling down to "Country Details," and activating the radio button "Details".

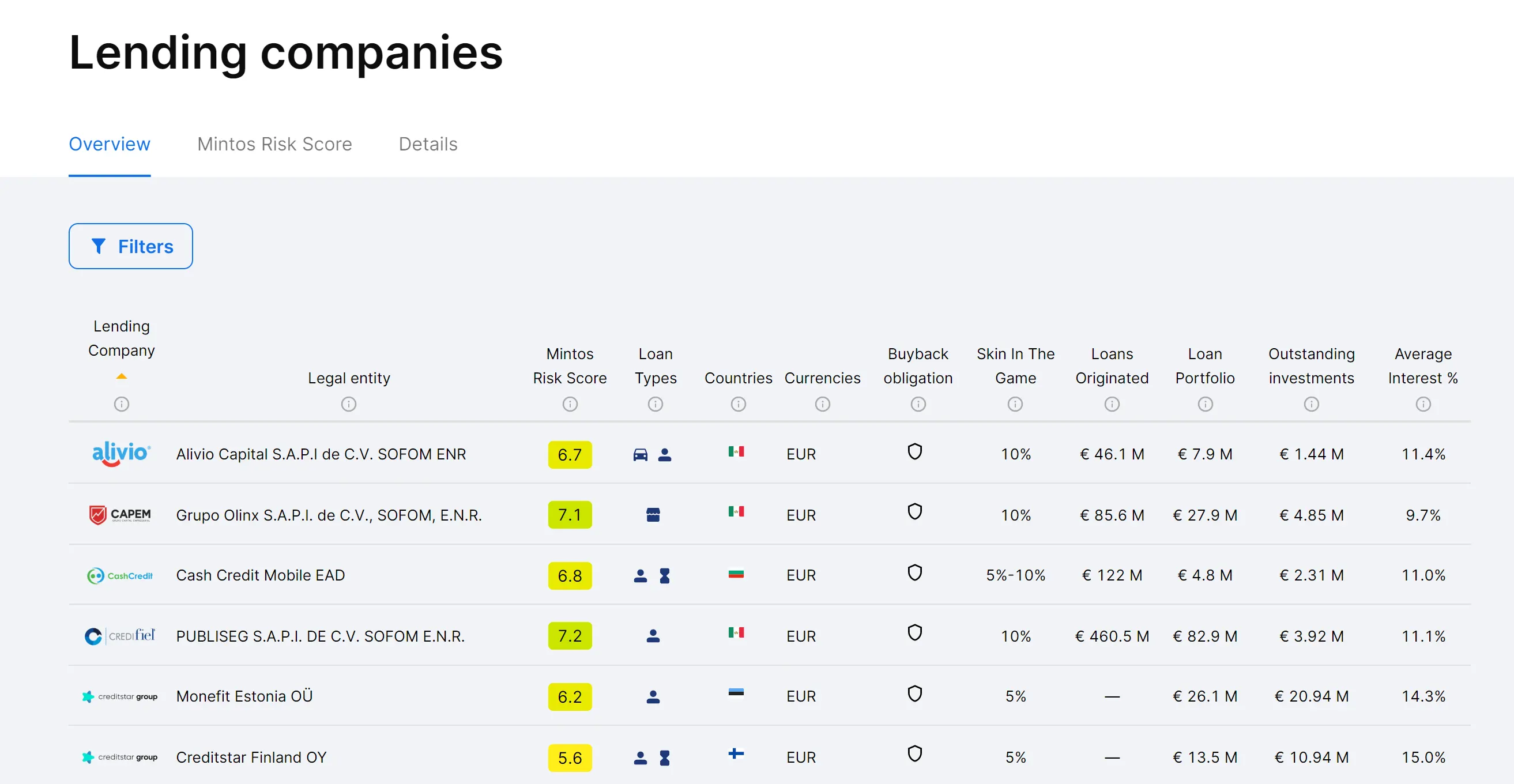

Mintos Loan Originators

One of Mintos' users' favorite features is the loan originator section.

Few P2P lending platforms give you as many details about their loan originators as Mintos. You can learn about the following:

- Skin in the Game (how much of its own money the lending company is investing in its loans)

- Mintos' Risk Score (how well-rated is the lending company)

- Countries

- Loan types

- Currencies

- Portfolio performance (limited)

- Company’s financial reports

You can analyze every loan originator or exclude countries, automatically eliminating loan originators operating in high-risk locations.

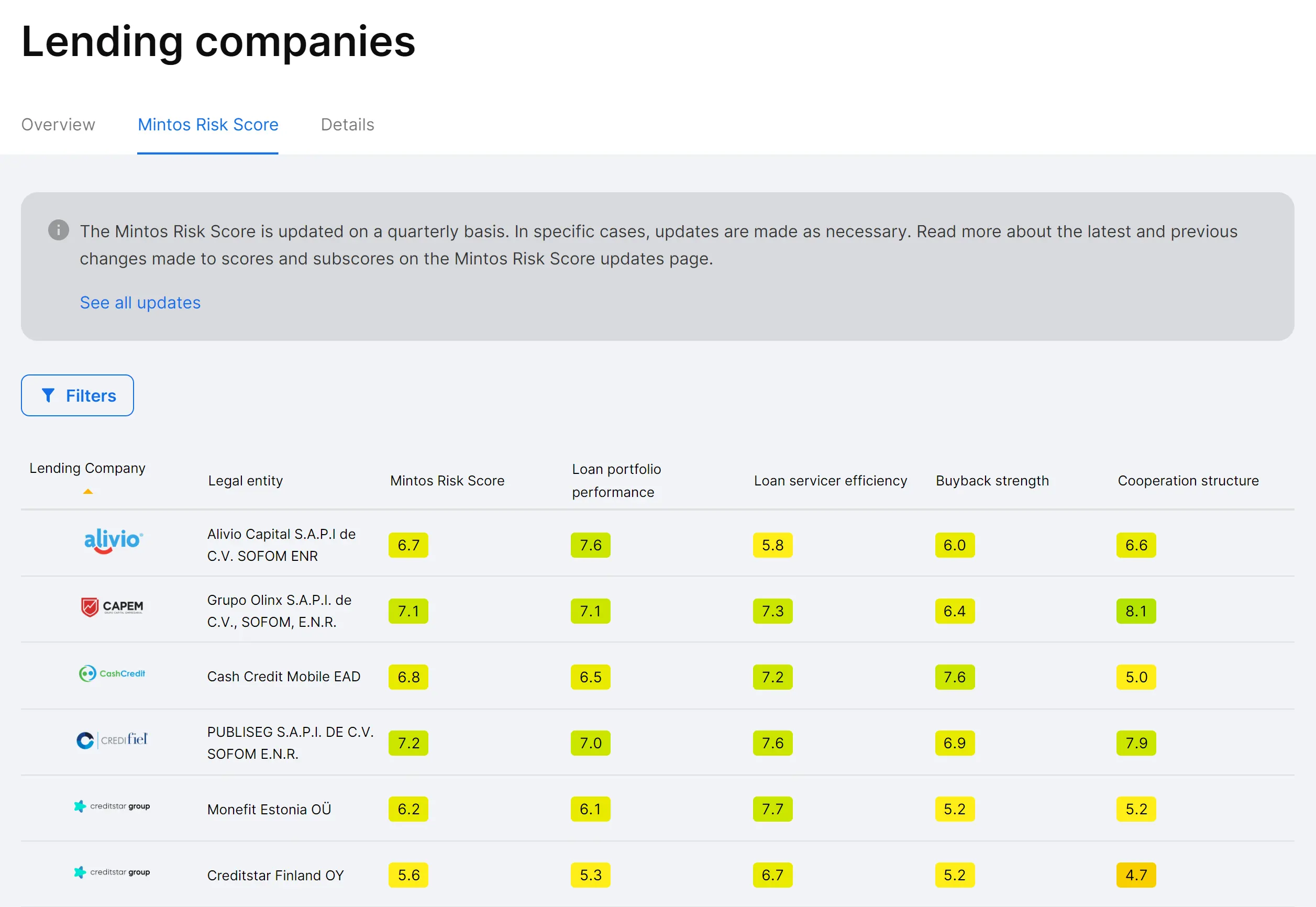

Mintos Risk Score

Mintos Risk Score is the platform's rating for individual loan originators. The rating is scoring criteria related to:

- Loan portfolio performance

- Loan servicer efficiency

- Buyback strength

- Cooperation structure

While the risk scores may guide you when defining your portfolio on Mintos, we would not suggest relying on them, as they can change quickly without many investors realizing it.

🤔 Should You Trust Mintos Lender Ratings?

In terms of returns, you can anticipate earning around 9% interest per year during normal market conditions.

The net return for 2020 was at 2% for "well-diversified" portfolios as many risks materialized, so keep in mind that the return rate might vary.

The return of your portfolio is highly dependent on the current interest for the available loans and the performance of the loan book.

Correlation between Performance and Return

Suppose you invest €10,000 in a broadly diversified portfolio that offers 10% APY while performing at 75% (based on current performance). In that case, you will receive €750 interest per year, and €2,500 of your funds won't be available.

The risk of locked funds increases significantly as the liquidity decreases. Your liquid investments after one year are €7,500 and €750 in interest.

The "funds in recovery" don't typically earn any accrued interest, which lowers your overall return on Mintos.

Additionally, you don't know when, or if, you will get the money back.

Investors can earn significantly more stable returns on other platforms. Are you wondering how Mintos compares to Esketit? Check out our comparison Esketit vs Mintos.

Mintos Recoveries

Mintos regularly shares updates on the current developments of their recoveries. We report about the changes in our monthly performance updates on our YouTube channel.

When investing on Mintos, you should familiarize yourself with the typical recovery process.

4 Stages of the Debt Recovery Process

- Monitoring - Mintos evaluates triggers such as breach of the law, equity to asset ratio, financial performance, unfavorable development in the market or negative changes in the management

- Limitation - Mintos limits the exposure of loans from the loan originator (placement of new loans is paused or suspended)

- Restructuring - Mintos negotiates a restructuring plan where the loan originator agrees to cover obligations toward investors

- Liquidation - Mintos takes legal action against the lender

If you decide to invest on Mintos, you should expect that some of your funds will eventually get stuck in "pending payments" or "in recovery", which limits your liquidity, increases the risk, and lowers your return.

Is Mintos Safe?

That's what we're going to address in this section.

Let's have a look at the safety of your investments on Mintos.

Who Runs the Company?

Mintos is run by its Co-founder and CEO Martins Sulte. Martins has been leading the company since its inception back in 2015. He also worked as a six-year financial analyst at the SEB investment bank.

Martins Valters co-founded the platform. He is currently Mintos's COO.

Both gentlemen gathered valuable experiences at Ernst & Young before launching their platform.

Watch our P2P talk with the CEO and co-founder of Mintos to get insights about the current developments of the platform and lessons learned from 2020.

Who is the Company’s Legal Owner?

Four angel investors and company shareholders fund Mintos.

Here is the list of the principal shareholders of Mintos:

- Maris Keiss (co-founder of 4finance and Mogo)

- Aigars Kesenfelds (co-founder of 4finance and Eleving Group former Mogo and owner of several loan originators)

- Kristaps Ozos (co-founder of 4finance and Eleving Group former Mogo

- Alberts Pole (co-founder of 4finance and Eleving Group former Mogo

- Martins Sulte - CEO Mintos (decision maker)

- Martins Valters - CFO / COO

- Employees through stock options

Note that Mogo was renamed to "Eleving Group" in mid-2021.

Are There Any Suspicious Terms and Conditions?

Mintos is changing its T&C according to what fits the company. Breaches of old T&C are ignored, and the new terms are being updated.

The terms and conditions will mostly favor the company and protect its interest. As an investor, you accept that Mintos is not responsible for any losses you might suffer.

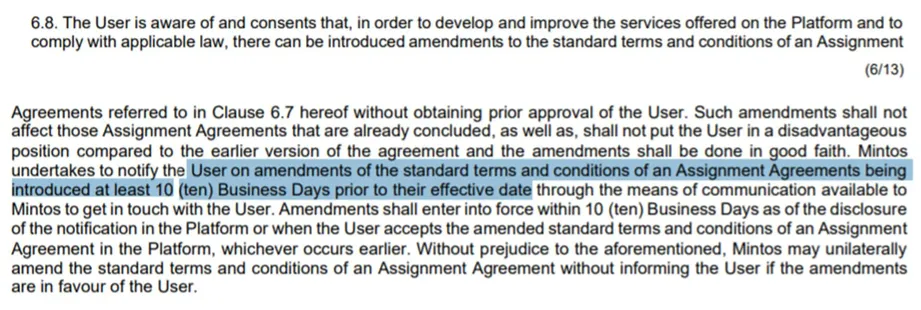

Old T&C Clause 6.8 - Amendments

Previously, Mintos could amend the terms and conditions of an assignment agreement without your approval.

Those amendments should not have affected already concluded agreements and should not put the user in a disadvantageous position compared to the earlier agreement version.

According to our understanding of the terms, Mintos didn't honor this clause as the P2P marketplace introduced loan extensions for already concluded agreements that put the users in a disadvantageous position.

It’s hard to imagine that any regulator would allow those practices in a regulated market.

We stopped monitoring Mintos' clauses as it no longer provides any substance for investors.

Past "updates" of terms and conditions show that clauses can be amended to fit the company's needs at any time, even if it puts the investors in a disadvantaged position.

If you are thinking about investing on Mintos, we suggest reading the current version of the terms and conditions before you invest.

Potential Red Flags

- Mintos expanded the number of possible loan extensions to six. The changes also applied to already concluded agreements. This update has been rolled out without prior notice to the investors. This put the investors in a disadvantageous position. According to our understanding, Mintos has breached clause 6.8. (old T&Cs) of Mintos' Terms and Conditions. The terms and conditions have been updated for the launch of Notes which don't include this clause.

Learn more about possible red flags in our guide about P2P lending scams.

Curious about other platforms? Head over to our ⚖️ P2P lending platform comparison for a quick overview of the currently available platforms.

Usability

P2P lending sites tend to get very complex as new features are being developed, and you want to invest in an easy-to-use platform, right?

Mintos has plenty of features that will help you to automate your investments, such as the Mintos Auto Invest or Mintos Core Portfolio.

Let's have a look at some of Mintos' features.

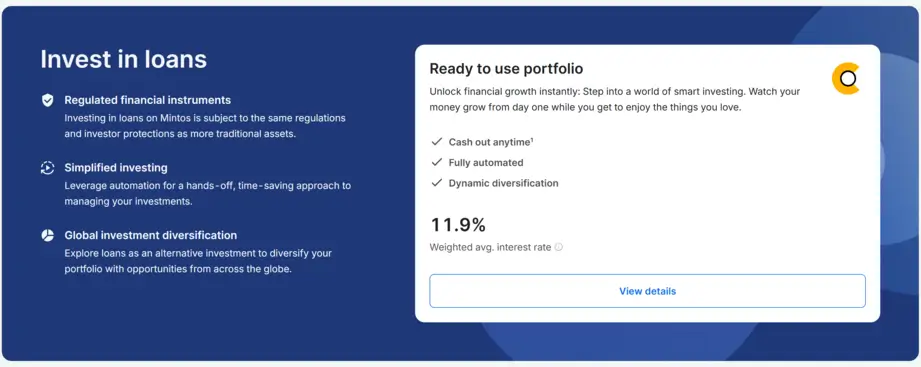

Mintos Core Portfolio

The Mintos Core Portfolio is the revamped version of Mintos’ previous products, including Mintos Strategies and Mintos Invest & Access.

It’s designed for investors who want a fully automated, diversified, and hands-off investment experience – while still targeting high returns.

Key Features:

- Weighted average interest rate: 11.9%

- Fully automated: No manual loan selection required

- Dynamic diversification: Your investment is spread across many loans

- Cash out anytime¹: Flexible liquidity

- Management fee: 0.39% annually (charged monthly)

Example: With a €1,000 portfolio, the monthly fee is approx. €0.32 or €3.90 per year

How It Works

Your Core Loans portfolio (formerly known as Mintos Core or Diversified Strategy) diversifies across all current loans with a Mintos Risk Score between 10.0 and 4.0, and includes only loans with a buyback obligation.

- The algorithm prioritizes both diversification and returns

- Exposure per lending company is capped at 15%, to reduce concentration risk

The portfolio invests only in Sets of Notes that have:

- Less than 20% exposure to late loans

- No loans that are more than 10 days overdue

- The investment criteria automatically adjust to market conditions for optimal protection and stability

Who It’s For

Mintos Core Portfolio is ideal for investors looking for a simple, automated solution with high return potential, while maintaining a reasonable level of risk through algorithmic diversification. However, as with all P2P investments, underlying risks remain.

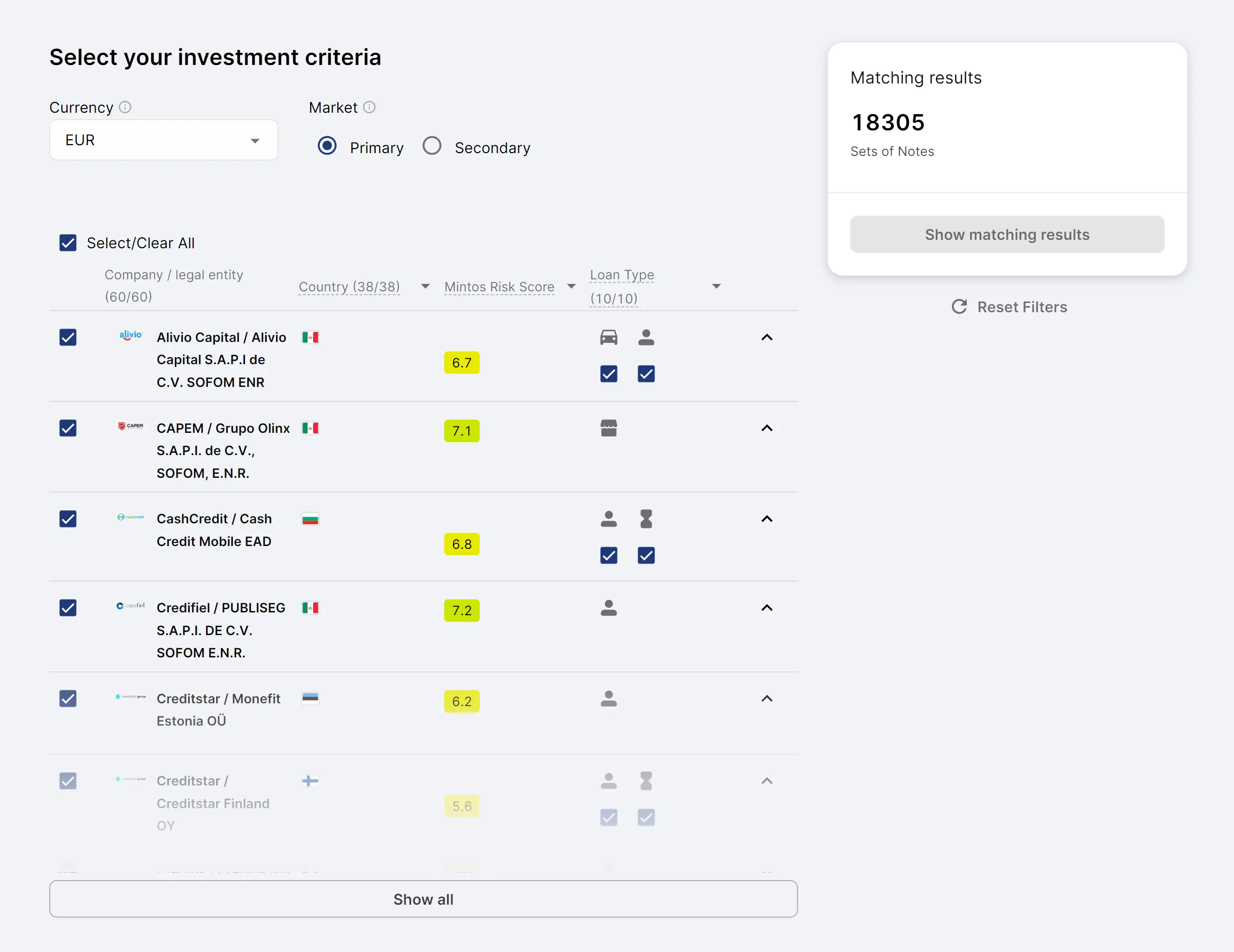

Mintos Custom Strategy

You can use the custom strategy to either:

- Automate your investments based on your own criteria

- Invest manually based on your own criteria

- 0.29% annual fee

Automated or manual custom strategies should only be used by experienced investors. If you're starting out with P2P lending, these options likely won't add much value.

Mintos Auto Invest - Automated Custom Strategy

The Mintos Auto Invest's functionality relies on the current market conditions. You shouldn’t just set it up once, but monitor the supply and demand for investment opportunities and adjust your settings regularly.

Setting up your Mintos Auto Invest is a more advanced topic, so we have created a dedicated guide where you will learn all there is to create your own Mintos Auto Invest strategy.

The automated custom strategy on Mintos allows you to take complete control over the diversification of your portfolio, which is beneficial if you invest large sums of money.

Mintos allows you to define the following criteria:

- Currency

- Market

- Lending Company

- Country

- Risk Score

- Loan Type

- Buyback Obligation

- Loan Status

- Pending Payments

- Investment Structure

- Amortization Method

- Borrower APR

- Interest Rate

- Remaining Loan Term

- Maximum Portfolio Size

- Investment amount in one loan

- Diversification settings

As you can tell, the Custom Automated Strategy comes with many options.

After "fine-tuning" your settings, don't forget to click on "show matching results" to see how many loans match your criteria.

Accept the terms and save your settings if you are happy with the selection.

Remember that loan availability on Mintos fluctuates, and if your settings are too strict, you may experience cash drag (uninvested funds) because your settings won't match any available loans.

Liquidity

How fast you can withdraw your money depends on the market conditions and the tools you use.

Selling on the Secondary Market

If you invest on Mintos manually or have invested in long-term loans via Mintos Custom Automated Strategy, you can sell your investments on the secondary market.

This is recommended if you want to withdraw your funds before the end of the loan period.

Mintos has reintroduced a 0.85% fee for investors who want to sell their investments on the secondary market.

Although we don’t typically trade on the secondary market, it’s beneficial to help your liquidity on Mintos if you find buyers.

The liquidity of your portfolio on Mintos is relatively high if the lender you have invested in is not suspended.

Mintos also processes all withdrawal requests within two business days.

Mintos Loan Extensions

Mintos increased the number of possible loan extensions to six in 2020. This means that the loan originator can continue to increase the loan term up to six months.

That's NO good!

You might need to sell your investments on the secondary market if they get extended and you want to withdraw your cash earlier than six months.

Cash out with the Mintos Core Loans

If you use one of the "Ready to use strategy" also called "Core Loans", you can withdraw your money anytime if enough investors use the same strategy.

Note that this is highly dependent on the market situation.

If none of the investors have this strategy enabled, you won't be able to cash out, as no one will buy your investments.

Remember that you can still sell them on the secondary market.

Keep in mind that if a lending company is suspended, you won't be able to sell your stake if you have invested in its loan book.

Are you wondering how Mintos compares to PeerBerry? Check out our latest comparison Mintos vs PeerBerry.

Support

If you’re new to P2P lending, you should start with a P2P platform that will answer your questions and educate you about P2P investments.

Some Mintos functionalities may require further explanation, and this platform features a customer support center to assist you with every step.

If you email Mintos’ customer support center, you can expect an answer within 48 hours.

Based on our personal experience, we recommend using the Live Chat function, which is significantly faster.

Notice

As Mintos frequently updates its terms and conditions, some of the information in this guide may be outdated. We suggest conducting your research before using any of the mentioned platforms to verify the accuracy of the information.

Mintos Alternatives

While Mintos is one of Europe's largest players in the P2P lending industry, it doesn't mean it's the best fit for you. The pending payment and millions of users' funds in recovery are why more and more investors tend to look for suitable Mintos alternatives that perform better.

Esketit

Esketit is one of the best alternatives for Mintos if you want an efficient platform that delivers on its promises. You don't need to deal with pending payments, lost funds, or money in "recovery".

On Esketit you invest and earn yield every month. Esketit's Strategies enable you to diversify your portfolio and save time while earning passive income. Learn how to earn between 12% and 13% interest on Esketit in our Esketit review.

Income Marketplace

The Income Marketplace may be a good option if you enjoy using one platform to diversify your investments.

This platform enables you to invest in various lenders from various countries. That way you don't need to expose yourself to just one lender in one region, which may increase your risk.

Income Marketplace offers investments that pay up to 15% interest. Additionally, your money is protected by a buyback guarantee. Specific lenders even pledge their portfolio as collateral, increasing your investments' safety. Learn more about this platform in our Income Marketplace review.

Fintown

If you are looking for something different than Mintos, where you don't invest in payday loans in emerging markets, Fintown might be the right fit. This newly launched platform pays out 10% and 12% interest generated from rental properties in the city center of Prague.

So, instead of funding payday loans, you are funding rental units that generate rental income. Learn more about how it works in our Fintown review.