Bondster Review Summary

In year, Bondster stands out as one of the worst P2P lending platforms in Europe. It consistently fails to safeguard investors' interests, prioritizing paid advertisements over building trust and attracting sustainable capital. The platform remains underdeveloped, and many lenders fail to honor their buyback guarantees, leaving investors exposed to higher risks than expected.

Main takeaways from our Bondster review:

- Unreliable buyback guarantee

- Poor communication

- Underdeveloped platform

Since better platforms are available, we suggest reviewing other P2P lending platforms instead.

Compare PlatformsWhat is Bondster?

Bondster is a Czech P2P investment platform that claims to serve over 20,000 investors by offering loans from various third-party loan originators, accompanied by a 60-day buyback guarantee.

However, despite this supposed security feature, many lenders are not honoring the buyback guarantee, leaving investors unprotected. Bondster has consistently failed to uphold investor interests, raising concerns about its reliability. Learn more about the platform's shortcomings in this detailed Bondster review.

Pros

- High interest rate

- Secondary Market

- No Cash Drag

Cons

- Not much information about suspended lenders

- Not profitable

- No option to download a portfolio overview

- No option to download an account statement

- The buyback guarantee isn't being honored

- No mobile-friendly website

- Poor communication and no proper updates

- Poor risk management

Our Opinion of Bondster

We have been closely monitoring Bondster for over three years, investing our own funds along the way. After thorough evaluation, here's our perspective on this Czech P2P marketplace.

While Bondster has its strengths, there are several critical issues that potential investors should be aware of. On the positive side, the due diligence process and risk monitoring seem to be unbiased. Bondster’s scoring model is a mix of objective data and subjective assessments, which the risk manager confirmed during our conversations. For example, lenders that have been operating for more than three years are given higher ratings than newer entrants. Bondster has access to more detailed data than what is available to investors, and from what we have seen, it is significantly more accurate.

However, Bondster suffers from a lack of transparency that is concerning. Their statistics page is not updated regularly, and investors are left without crucial, up-to-date insights. Despite a long discussion with the CEO in April 2022, where it was promised that live data on lenders and suspended loans would be prioritized, Bondster has yet to fulfill this promise. In fact, since that time, the platform's overall performance has deteriorated substantially, leaving investors in the dark regarding the state of many loans.

The most alarming issue is the opaque handling of defaulted loans. Based on our research, a significant portion of the funds under Bondster's management appear to be tied up in defaulted loans, with very little clarity offered to investors about their status. This lack of transparency raises serious questions about the platform’s risk management and commitment to investor interests.

Additionally, Bondster’s usability lags behind other P2P platforms. The interface is not user-friendly, and there is no mobile version of the site, which makes navigation cumbersome. The CEO has acknowledged these shortcomings, but despite outlining plans for improvement, Bondster has failed to deliver any meaningful updates.

Another major concern is Bondster's leniency towards non-paying lenders. Many lenders are allowed to delay buyback obligations due to insufficient cash balances, leading to a growing number of delayed loans on the platform. This leniency is detrimental to investors, as it prolongs uncertainties regarding repayments.

In summary, while Bondster offers some positives, such as a seemingly unbiased risk assessment process, the platform’s significant transparency issues and failure to fulfill promises make it a risky choice for investors. The defaulted loan portfolio, which may represent the majority of funds, combined with lax enforcement of buyback obligations, further compounds these risks.

There are, much better options to earn passive income on your investments. We recommend reading our reviews about the top-rated platforms.

Bondster is not a suitable platform for risk-averse investors. The platform underperforms in key areas, making it difficult to recommend. The advertised high yields are often unattainable for the majority of investors, and the frustration you will likely encounter with Bondster’s lack of transparency and unreliable performance simply isn’t worth the potential returns.

Requirements

Signing up on Bondster is straightforward. You should fulfill all the requirements if you consider registering on Bondster.

- Be over 18 years old.

- Have a European bank account

- Comply with the AML regulations (answer a few questions)

- Submit a copy of your ID document

- Provide a copy of your bank statement

You can either transfer funds in euros or Czech crowns. If you want to invest in euros, you should transfer your money in euros to avoid currency exchange fees.

You can use digital bank accounts from Revolut or N26 to top up your Bondster account should you decide to give Bondster a go.

Keep in mind that you have to verify your identity before making any withdrawal from Bondster.

Bondster will charge a €2 withdrawal fee if you withdraw your positive balance more than three times per month. The first three monthly withdrawals are free of charge.

Risk & Return

Bondster is a P2P marketplace that lists loans from other lending companies.

These lending companies are also called loan originators.

Bondster’s most significant strategic partner is ACEMA, a loan originator from the Czech Republic. ACEMA is an established lender. The owner of ACEMA also owns Bondster.

Furthermore, Bondster is funding loans from known loan originators such as:

- LIME Zaim (RU)

- Rapicredit (Colombia)

- Kviku (RU)

- Right Choice (PH)

- Lime (SA)

All the listed loan originators failed to fulfill the buyback guarantee in time. You can find a brief overview of all 24 lending companies on Bondster’s website.

Bondster is undoubtedly focusing on lenders offering higher interest rates. Risk management is rarely considered. The platform doesn't provide safe investments.

Remember that you will often find yourself investing in emerging markets. We recommend researching the lender before investing in its loan book.

Bondster’s Buyback Guarantee

Most unsecured personal loans on Bondster offer a buyback guarantee provided by the loan originator.

Depending on the loan company, the lender will purchase your investment and the accrued interest back from you within 30 or 60 days of delayed payments.

Buyback guarantee should cover: loan principal (your investment) + interest.

Buyback guarantees of this kind are standard within the P2P lending industry, and you’ll find similar features on platforms like PeerBerry, Robocash, and Esketit.

The difference with Bondster is that the lender can decide not to honor the buyback guarantee, and Bondster won't do anything about it.

It's important to point out that most investors on Bondster, have experienced delayed loans of more than 60 days. The money covers the buyback guarantee on the virtual account of the lender, which has to be topped up regularly to fulfill the buyback guarantee. Bondster is failing to protect investors' funds.

Loan Types

Bondster offers a variety of loan types.

If you decide to invest on Bondster, you will invest in consumer and short-term loans.

Bondster offers secured business loans (from ACEMA) and car loans or loans backed by crypto or mortgages.

Keep in mind that secured loans are subject to availability. Use the auto invest feature to determine whether currently available loans match your investment criteria.

Risk Ratings

Bondster's ratings are some of the most critical indicators to help determine the lender's portfolio profitability.

In theory, investing in the highest-rated lenders (A+ to A-) will significantly improve your risk and return ratio.

Look behind the scenes to understand better how Bondster is scoring its lending companies.

As you can see, the scoring process is pervasive. Keep in mind, however, that the situation is changing quickly, and unexpected risks might materialize at any time.This rating metrology does not yield the best results for investors.

Is Bondster Safe?

We suggest you do your due diligence about every P2P platform before investing money. Here is what we’ve found out about Bondster:

Who Leads the Team?

Bondster Marketplace s.r.o. is led by CEO Pavel Klema, who has previously worked in various Czech lending institutions.

Who is the Legal Owner of the Company?

Bondster s.r.o is owned by CEP Invest Private Equity SE. The owner of CEP Invest Private Equity SE is Václav Valeš. According to the Czech business register, one more company is based at the same address - CEP Investments s.r.o.

The CEP Investments s.r.o. is a company expressly set up for private investments by the CEP Invest Private Equity SE. Michal Ondrýsek is the executive officer of CEP Investments s.r.o.

We haven't found anything suspicious when researching information about the founder of Bondster. However, you should know that Bondster is funded by ACEMA (one of their primary lending partners).

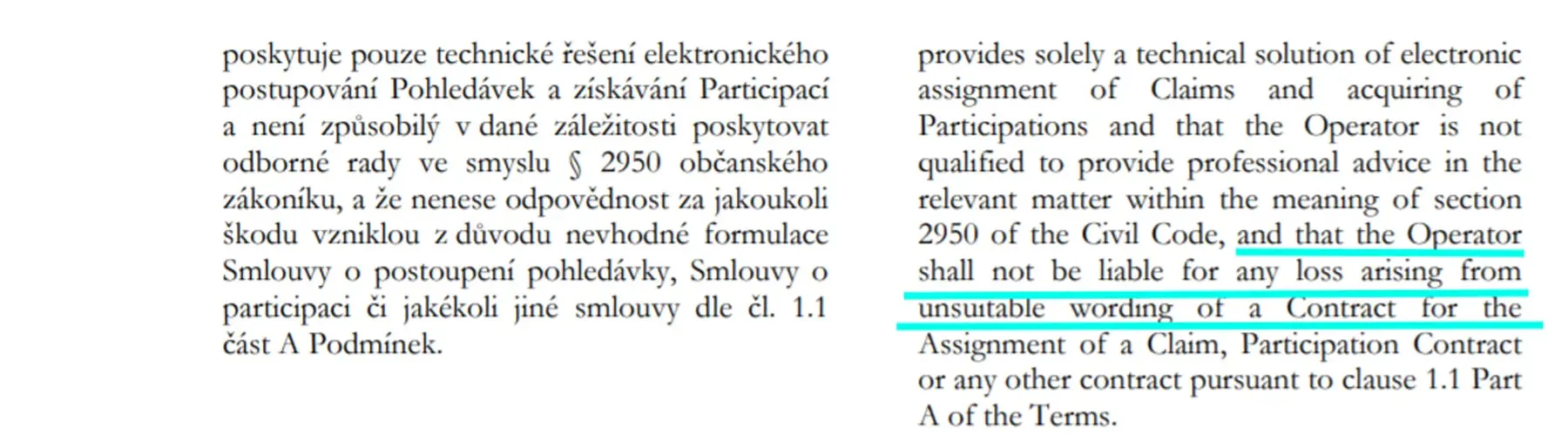

Are There Any Suspicious Terms and Conditions?

Bondster’s terms and conditions are 53 pages long, and we went through the contract with a fine-tooth comb to check for anything suspicious.

The result? Nothing major!

The company’s terms seem to be a standardized contract similar to those on other P2P lending platforms.

Clause 7.7 - Risk of Default

One thing to point out (although this is the case with all lending sites) is that Bondster’s terms state that investors risk losing all their investments when using the platform.

Clause 8.9. - Repurchasing Rights

Another exciting part of the contract is requesting the loan company to repurchase your assignment. Having this as part of the contract increases the trust in Bondster’s terms and conditions.

We also looked at Bondster’s assignment agreement and haven’t found any suspicious clauses.

Clause 1.3 - Amendments to T&C

We should also point out that Bondster will inform its users at least 30 days before the platform introduces changes to its terms and conditions.

That's excellent news, as many platforms change their terms and conditions as they wish.

However, Bondster won't notify you via email about those changes.

Usability

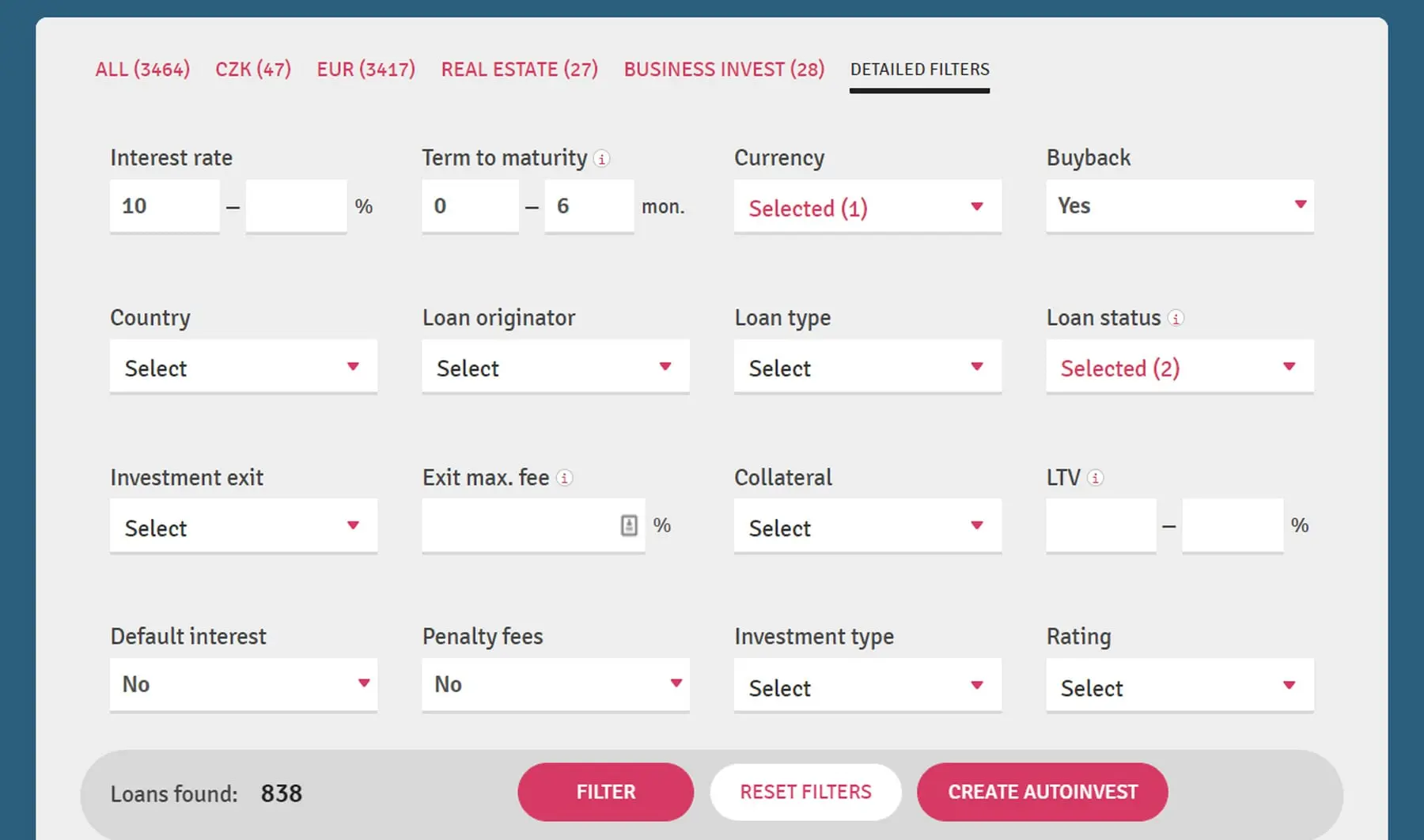

Before investing on any platform, you should define your investment period - how long do you want to invest?

It would be best to consider other factors, such as the securities and returns.

To see the currently available investments that match your criteria, click “Investment Offer” and click “Detailed Filters”.

You can now define your criteria and click on “Filter”.

Bondster offers a wide selection of loans, which is why you can define various variables.

We suggest sticking to the basics.

We defined:

- Min. interest rate

- Term to maturity

- Currency (EUR only)

- Buyback

- Loan Status (first two options - we don’t invest in late loans)

Always check how many loans match your investment criteria. Keep in mind that the availability of certain loans is limited.

You shouldn’t avoid activating your diversification settings, which you can do before saving your settings.

Some investors will suggest investing in everything to diversify your portfolio across all loan originators that currently list loans on Bondster.

Investing in everything shouldn’t be your preferred long-term strategy as you entirely rely on the competence of the platform that will be able to protect your investments.

Investing in more reputable loan originators with better reporting standards is better.

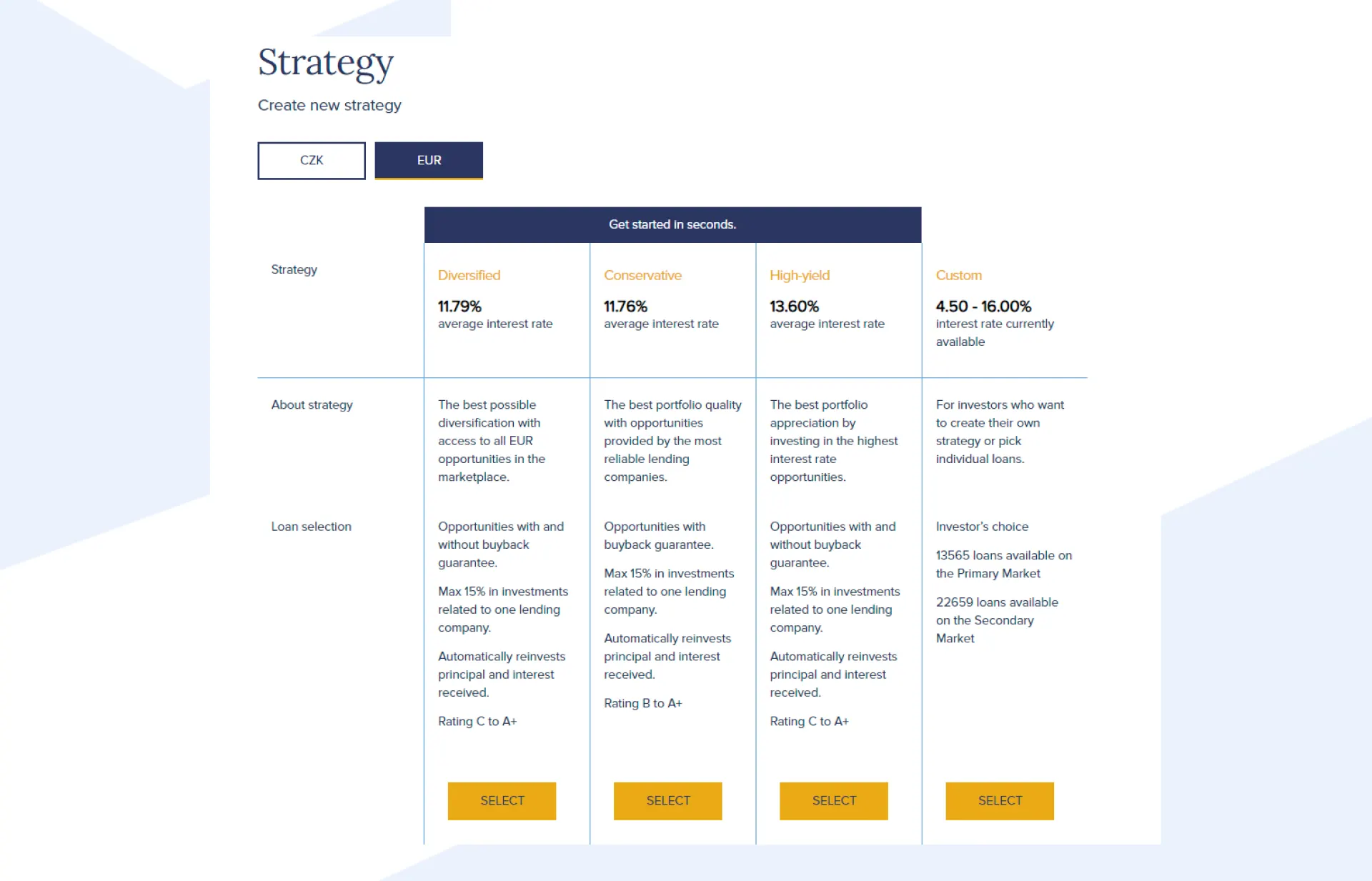

Bondster allows you to invest manually, customize and automate your strategy or use some of the predefined automated strategies.

Automated Strategies

At the beginning of 2022, Bondster introduced automated strategies to help you save time and maximize your returns.

Those automated strategies are good for you if you are only investing on Bondster. If you are active on multiple platforms, you might prefer to use the custom strategy and maximize your returns.

If you are happy with investing on Bondster, you can choose from two investment strategies:

- Diversified

- Conservative

- High-yield

Each strategy has predefined settings that help you fine-tune your portfolio according to particular risk preferences.

You want to minimize the risks and maximize your returns. Choose lenders that operate in regulated markets, provide updated financial information and show good portfolio performance. That's a more suitable strategy than blindly relying on the buyback guarantee.

🧾Does Bondster deduct taxes?

Bondster doesn't withhold taxes from your earnings. In your dashboard, you can download a tax report, which you can submit to your tax authorities when you file your taxes in the country where you are a tax resident. You can request a tax report directly in your dashboard. Bondster will send the link to the tax report to your inbox.

Liquidity

If your goal is to invest short-term, you won’t be pleased with Bondster.

The platform offers two different exit options for your investments:

- 1. Smart Reserve: The smart reserve is a function that allows you to withdraw your investments at no additional cost. Note that this is only available for certain loans with a low interest of 3.9%. These loans are specially marked with the option.

- 2. Guarantee of Liquidity: Some loans give you the option to exit your investment within a week, month, quarter or year. Sometimes, a fee (typically 1-2%) is connected to early withdrawals.

Bondster also has a secondary market, where you can sell your investments before the end of the loan term. Remember that Bondster will charge you a 0.5% fee if you sell your loans on the secondary market.

The liquidation of your assets on the secondary market can take several weeks, depending on the type of assets you are selling and your offered price. If your loans have matured or are delayed for more than 60 days, you can't sell them on the secondary market anymore.

Support

Bondster's support is terrible. Investors should consider themselves lucky if they receive any answer from Bondster within a week.

While during our visit to Bondster in spring 2022, the team was more transparent and answered all of our questions, we can't confirm the same in month year.

Bondster Alternatives

We don't recommend Bondster as a reliable P2P lending platform. The lack of transparency and broken promises from its management are strong reasons to avoid this platform. Fortunately, there are several better alternatives with stronger track records.

Esketit

Esketit, a Latvian-based P2P lending marketplace, offers investments through carefully vetted lenders with proven business models. The platform provides annual returns between 9% and 12%. It also features automated investment strategies, improving liquidity and reducing the risk of cash drag. Esketit is currently one of the top-performing platforms in the industry. Read our Esketit review to learn more.

PeerBerry

PeerBerry is widely considered one of the best P2P lending platforms in the industry. It offers a diverse range of investment opportunities, with returns from 9% to 12%, especially if you take advantage of their loyalty program. The platform also provides enhanced security features to protect both invested and uninvested funds. If you're looking for a reliable, passive investment option, PeerBerry is definitely worth considering. Read our PeerBerry review for more details.

Fintown

Fintown focuses on investments in operational rental units in Prague, Czech Republic. Based on our research and a visit to their headquarters, we consider the platform’s business model to be sustainable. If you're looking to avoid payday loans and prefer earning interest through rental yields, Fintown is an excellent option. Read our Fintown review to learn more.