InSoil Finance Review Summary

InSoil Finance is undoubtedly an exciting platform for more sophisticated investors who like to add agricultural loans backed by heavy machinery to their P2P portfolio. However, as of month year, InSoil Finance is dealing with many defaulted loans, which limit the liquidity of investors' funds.

Continue reading our InSoil Finance review to learn more about the platform.

Key Takeaways From Our InSoil Finance Review

- Backed by heavy machinery & mortgage

- Suitable for experienced investors

- Secondary Market and Auto Invest

- Regulated by the Bank of Lithuania

InSoil Finance is one of the options if you are looking for a way to invest in agricultural loans on a regulated crowdfunding platform.

Ready to become to make money from agricultural loans?

Or explore other real estate platforms.

What Is InSoil Finance?

InSoil Finance (formerly Heavy Finance) is a peer-to-business lending platform regulated by the Bank of Lithuania. What’s unique about InSoil Finance is the fact that all the listed loans are secured by heavy machinery or land.

As an investor in InSoil Finance, you can expect to earn an average annual interest of 12% by investing in agricultural loans. Read our in-depth review to learn more about InSoil Finance.

Pros

- Unique agricultural loans

- Regulated in Lithuania

- Individual IBAN accounts

- Backed by heavy machinery

Cons

- Withholding 15% tax on investments from Lithuania

- Limited diversification

- Poor portfolio quality

Do you prefer to watch a video? Here is our video review of InSoil Finance, formerly known as Heavy Finance.

Please note that this video was recorded in 2022; a significant amount has changed in InSoil Finance since then. We suggest you review the current portfolio performance on our P2P lending comparison page.

Our Opinion of InSoil Finance

InSoil Finance is undoubtedly one of the more transparent platforms in the industry. During our research, which included a visit to InSoil Finance's offices in Lithuania, we found no indications of fraudulent behavior.

The platform is regulated and operates in full compliance with the law. The management team is openly presented on the website, and the platform is consistently eager to provide additional data to our readers.

While InSoil Finance is a legitimate business, its portfolio performance has been below most investors' expectations. Currently, over a third of their portfolio is delinquent or delayed, meaning borrowers are not paying on time, which significantly limits investors' liquidity and increases risk. The high default rate further complicates the ability of investors to exit their investments as expected.

Although the portfolio is secured by tangible collateral, the quality of that collateral directly affects investor risk and liquidity. As the default rate remains high, investors need to exercise caution.

If you decide to invest in InSoil Finance, we strongly recommend reviewing the portfolio's quality on the company’s statistics page and focusing on investments with an A+ risk rating, as these tend to have the lowest default rate.

Do you appreciate this review? Invite us for a coffee ☕

InSoil Finance Bonus

Sign up with our link and invest on InSoil Finance for a 2% cashback bonus calculated from your investment amount during the first 30 days after registration. There is no need to type in any specific InSoil Finance referral code during your registration.

Cashback Bonuses for Active Investors

InSoil Finance regularly introduces cashback bonuses for individual projects to increase funding speed.

When there aren't enough investors who invested in a single project, the platform might email you a unique promo code that gives you +1% if you use it. If you invest in a project early, you might miss that bonus code.

This is not a fair practice towards investors who had initially funded the project, as the bonus code can only be used for "new investments".

Requirements

To sign up and use InSoil Finance, you need to fulfill the following requirements:

- Be over 18 years old

- Fill in the KYC questionnaire

- Be a resident in the EU

The InSoilFinance platform enables you to invest as an individual or a company. You must submit your personal information, such as your tax residency, address, birth date, and gender, during your registration process.

Upon registering with InSoil Finance, you will open a virtual bank account with Lemonway, which will serve as your investment account.

That way, you are not depositing money into InSoil Finance but into your funding account, which increases the safety of your uninvested funds.

New investors signing up on InSoil Finance must open a Lemonway VIBAN account to send funds to your investment account. This safety feature decreases the risk of losing your uninvested funds.

Ready to become a InSoil Finance investor?

Risk & Return

Investing in loans is risky on any crowdlending platform. InSoil Finance mitigates some risks by taking heavy machinery or land as collateral.

Every investor in InSoil Finance should read the risk disclosure and be aware that they may lose money.

The value of the collateral can change over time, and there’s no guarantee that, in the case of the borrower’s default, the collateral can be liquidated and your investments will be repaid.

You should know that InSoilFinance is always the beneficiary of the collateral. If the borrower cannot repay the debt, the collateral will be sold to cover the debt.

If the debt cannot be covered with the sale of the collateral, the borrower will need to repay the outstanding amount.

Note that some Lithuanian projects are backed by the Agricultural Credit Guarantee Fund of Lithuania, which would cover up to 80% of the loan principal if the loan defaults. This "state guarantee" is valid only for Lithuanian projects.

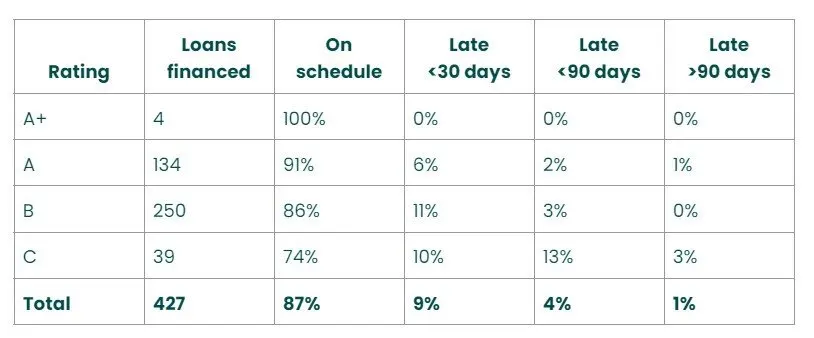

InSoil Finance offers a very user-friendly statistics page where you can review the performance of the lender's loan book at any time. Additionally, you can analyze the portfolio quality in more depth in the platform's monthly updates published on their blog.

We strongly recommend our readers who plan to invest on the platform to review the portfolio quality before investing.

It's worth mentioning that despite the platform's growth into new markets, the default rate is relatively high, which is not the case with the Crowdpear loan book, which performs much better.

New Loan Type

InSoil Finance also offers unsecured agricultural loans. These loans allow you to invest in farmers' working capital. Note that any specific assets do not secure those loans; they solely rely on the borrower's accountability to repay the debt. Unsecured loans on InSoil Finance come with a 2% higher interest rate than loans secured by collateral.

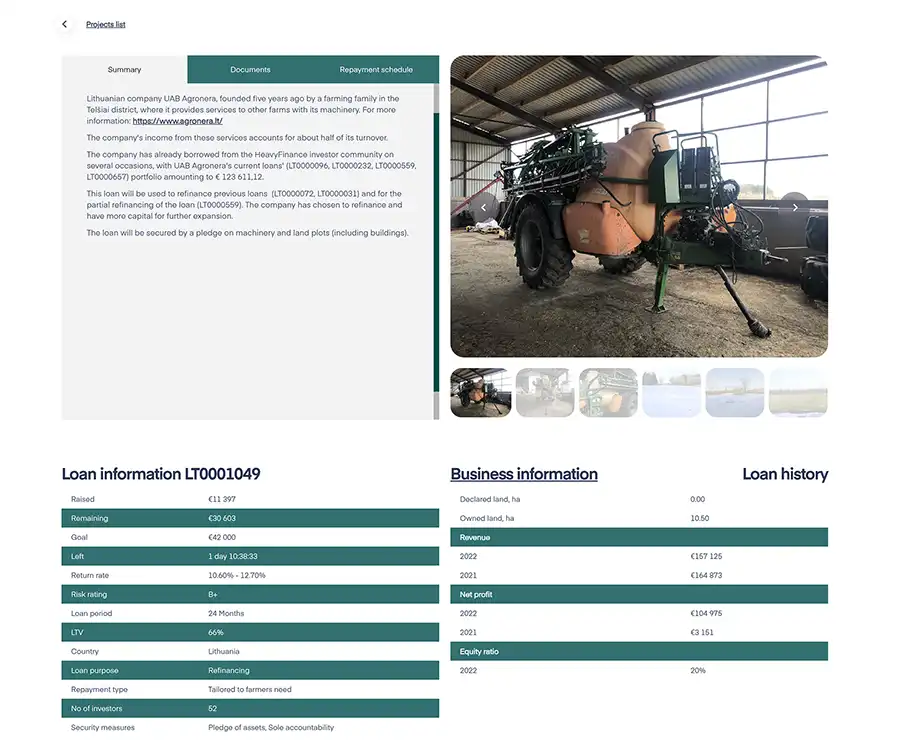

Project Overview

Every loan comes with a solid project description, which includes further information about the collateral and the mortgage.

The projects on InSoilFinance are typically used to expand land or purchase new equipment, which helps farmers expand their business operations.

The pledge typically includes farmland and heavy machinery.

Every property used as collateral comes with a valuation report that you can find in the project overview. In addition to this report, you can view the borrower's financial statements or crop declaration.

What’s worth mentioning is that the interest rate depends on your investment amount. The more you invest, the higher the return.

Every project includes photos of the collateral and a risk rating by InSoilFinance.

The loan period on InSoilFinance is typically between 24 and 36 months, and the borrower also provides financial numbers for the last two years.

It is essential to point out that InSoil Finance doesn't finance loans against collateral. The LTV of max. 70% is calculated based on the profitability of a dedicated farm. The collateral backing your investment helps the investor increase the loan recovery.

InSoil Finance Risk Levels

Different risk levels should always be considered regardless of whether you invest in unsecured or secured loans.

Particularly with agricultural loans, it has not been easy for retail investors to estimate the real risk of those loans.

For this reason, InSoil Finance has introduced a risk level scheme that helps you determine a particular loan's risk based on seven categories ranging from A+ (lowest risk) to D (high risk).

Here, you can review the default rate of loans based on risk categories.

Is InSoil Finance Safe?

InSoil Finance is a regulated platform backed by Startup Wise Guys, an investment fund that helped finance EstateGuru, EvoEstate and InRento.

Who runs the company?

InSoil Finance is run by the founder and owner, Laimonas Noreika, who co-founded a successful P2P lending platform FinBee.

Laimonas exited FinBee in 2020 to launch a unique P2B platform that offers investments backed by heavy machinery.

Laimonas brings extensive experience from the fintech scene to the table. He has also partnered with Rytis Darganivicius, who has knowledge of agricultural machinery.

Rytis is also responsible for verifying the valuation reports of the heavy machinery, which licensed specialized local rating companies are conducting.

Want to learn more about InSoil Finance? Watch our interview with the founder and CEO, Laimonas Noreika, at the company's headquarters in September 2022.

Are there any suspicious terms and conditions?

When reading the terms and conditions and loan agreements, you will notice that InSoil Finance is very precise and transparent.

You should read the user terms to familiarize yourself with the terms and the fees you must pay for administering delayed payments and any secondary market transaction.

Fees and Interest for delayed payments

InSoil Finance will charge borrowers 0.2% of the overdue amount every day the borrower is delayed with the payment.

InSoil Finance charges the investor a 0.1% administration fee when receiving the payment.

Consequently, investors get 0.1% of the overdue amount for every delayed day.

In addition, you, as a seller, will be charged a 1% secondary market fee.

Clause 3.2 - Storage of Funds

As mentioned, you can use a Lemonway account to participate in crowdfunding on InSoil Finance. InSoil Finance doesn’t store your funds in separate business accounts.

Clause 14 - Amendments

Unless there’s a change in fees, you will get notified about the amendments to terms and conditions on the day specified by InSoil Finance, which can be when new terms and conditions get into effect.

You will be notified 14 days in advance if InSoil Finance changes its pricing policy.

🧾Does InSoil Finance Deduct Taxes?

All interest paid to non-Lithuanian residents will be taxed with a 15% personal income tax, deducted by InSoil Finance. The platform won't deduct any income from cashback bonuses that must be declared in the country where you have your tax residency.

The tax deduction applies only to interest from Lithuanian projects. If you invest in loans from other countries, InSoil Finance won't deduct any taxes, and you must report your earnings in the country where you are a tax resident.

The platform also offers the option to decrease the tax rate upon submission of a DAS-1 form and proof of tax residency.

If you live in one country with a double-tax treaty exemption with Lithuania, you do not have to pay the income tax twice. The tax that you have already paid will be taken away from the income tax that you owe in your country.

For further information, please consult your local tax expert.

Usability

InSoil Finance is a very easy-to-use platform.

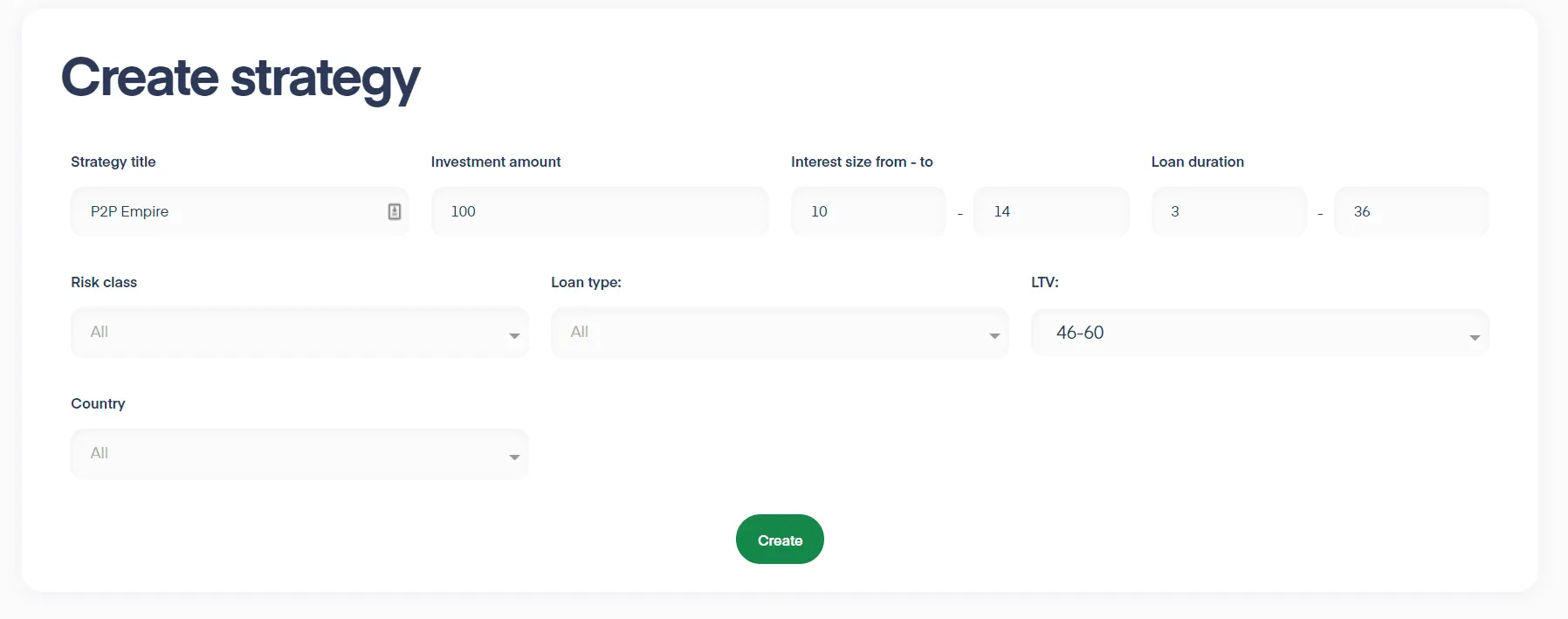

InSoil Finance allows you to invest manually into individual projects or set up the Auto Invest and automate this process.

Auto Invest

The Auto Invest on InSoil Finance is a relatively new feature. This tool defines the investment amount, interest rate, loan duration, risk class, loan type, LTV, and country.

The Auto Invest on InSoil Finance will help you automate your investments if you don’t want to analyze individual projects yourself (which we recommend for anyone new to InSoil Finance).

Liquidity

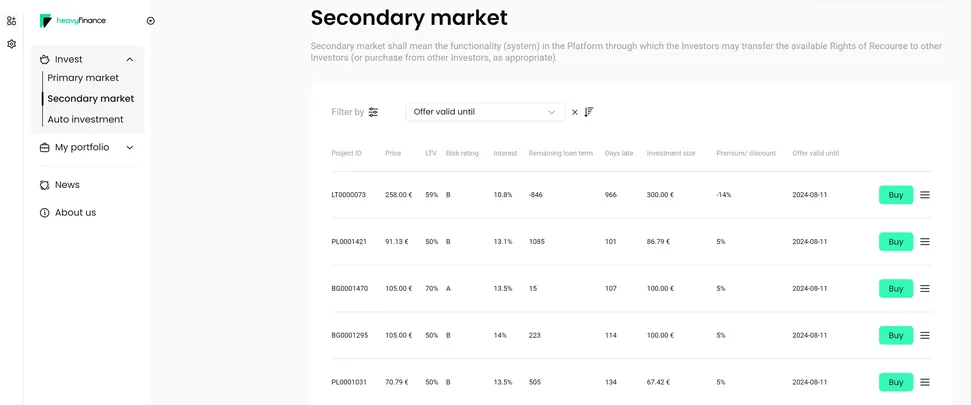

InSoil Finance offers a secondary market, which is not always the case on other platforms in the peer-to-business sector.

We haven’t tested this feature on InSoil Finance, so we can’t comment on the period it takes to sell your investments.

InSoil Finance allows you to offer a discount or premium for your loan, which may influence the period until your investment is sold and you can withdraw your money.

However, InSoil Finance charges a 1% secondary market fee for your sales on the secondary market.

Support

InSoil Finance doesn’t have live chat support yet, but you can contact them via their contact form or simply email info@InSoilfinance.eu.

The website also offers a dedicated FAQ page, where you will likely find your answers instantly.

Reading the terms and conditions might also resolve some of your questions.

InSoil Finance's support is typically very responsive; we have already exchanged several emails and even talked with the crowdfunding platform's founder.

InSoil Finance Alternatives

InSoil Finance is a legitimate platform; however, its portfolio performance might discourage investors who wish to earn passive income without the hassle of delayed or defaulted loans. In that case, you might want to explore some suitable alternatives.

LANDE

LANDE is the direct competitor to InSoil Finance, as the platform is also raising funds to finance agricultural loans. The Latvian-based company offers a slightly lower interest rate, but its portfolio performs significantly better.

LANDE also provides an auto invest as well as a secondary market, which gives you additional liquidity. Learn more about LANDE in our LANDE review.

Fintown

Fintown is a Czech-based crowdlending platform that offers investment in already operational rental units in Prague. The company uses your funds to finance its ongoing development projects, which are then offered to tenants.

Fintown's business model is very transparent and investors can earn attractive returns for a longer period.

On Fintown, you don't need to deal with payment delays or defaults as the company is responsible for the payouts and not third-party borrowers, which is the case with InSoil Finance. Learn more about Fintown in our Fintown review.

Crowdpear

Crowdpear is a regulated Lithuanian crowdlending platform offering mortgage-backed investments with interest ranging from 10% to 12% annually. The platform has an excellent portfolio quality.

Crowdpear is operated by the team behind PeerBerry, one of Europe's most trustworthy P2P lending platforms.

Learn more about Crowdpear in our Crowdpear review.