InRento Review Summary

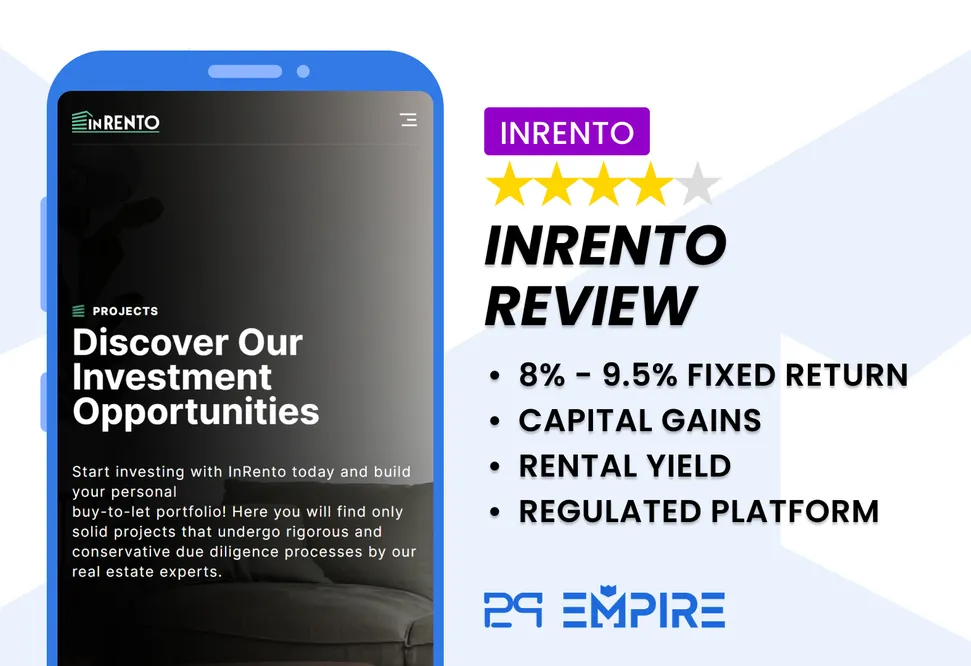

InRento is a regulated crowdfunding platform offering investments in rental deals with a fixed annual return of 8%. It is ideal for professional investors seeking long-term capital commitments and assets secured by a first-rank mortgage.

Key Takeaways from our InRento Review

- Regulated in Lithuania

- One of the best-performing platforms in month year

- Low risk

- Backed by a first-rank mortgage

If you are convinced of InRento’s offer, click the link below to register on the platform and start making money by investing in rental properties.

Ready to make money from rental deals?

Or explore other real estate platforms.

What Is InRento

InRento is one of the best real estate crowdlending platforms on the market. The platform allows you to invest in buy-to-let properties with an annual rental yield ranging from 8% to 9.5%. Additionally, you can expect to earn capital gains after the projects are sold.

The platform is also regulated by the Bank of Lithuania, making it the only regulated P2P lending site that allows you to invest in rental deals.

Read our comprehensive InRento review to learn more about the company.

Pros

- Regulated since its inception

- Good track record

- Flawless portfolio performance

- Excellent risk and return ratio

- Audited financials

Cons

- Some investors reported minor IT issues

- Limited diversification options

Our Opinion of InRento

InRento is a strong platform for investors seeking exposure to rental properties without the complexities of direct ownership. It provides an excellent opportunity to benefit from current real estate trends while earning passive income.

If you're interested in property investment but don't have the necessary capital, InRento offers an accessible alternative. With a minimum investment of €500, you can become a co-investor in a property that generates both rental income and potential capital gains.

However, it's important to note that real estate investments typically lack the liquidity found in personal loans on P2P lending platforms. While InRento offers a secondary market for selling your shares, you'll need to find a buyer and pay a 2% fee based on the initial investment amount. This means investors should be prepared to commit their capital for several years.

Investments on InRento are backed by mortgages, adding an extra layer of security, and the platform is overseen by the Lithuanian Central Bank, bolstering its credibility and regulatory compliance.

The platform’s property portfolio has shown strong performance to date. For those looking for a stable, long-term investment in Lithuania's rental market, InRento is a solid option.

InRento Promo Code

InRento currently offers a €20 bonus to every new investor who joins using our partner link. You must invest to get your €20 bonus.

Ready to invest on InRento?

Requirements

To sign up on InRento, verify your identity with Ondato (Inrento's verification partner). If you decide to invest money on InRento, you must open a Paysera or Mangopay account, which will be linked to your InRento account.

InRento is one of the few platforms offering additional protection for uninvested funds.

Instead of depositing funds on InRento, you deposit in your account. This guarantees that uninvested funds are segregated from InRento's business accounts.

As with any European P2P lending platform, you need to fulfill the following requirements:

- Be over 18 years old

- Successfully verify your identity and pass the KYC requirements

- Open a Paysera or Mangopay account

- Fill out and submit the DAS-1 form

You should also be aware of the €500 minimum investment amount. InRento indeed targets investors who are ready to commit more capital.

Risk & Return

The beauty of InRento is that you are essentially funding rental projects, which generate monthly rental income and capital growth. All your investments are backed by a first-rank mortgage signed by the founder of InRento and the project owner at the notary in Vilnius.

We witnessed this process during our visit to InRento's headquarters in 2022.

When investing your money on InRento, you should be ready to commit your capital for at least two to three years.

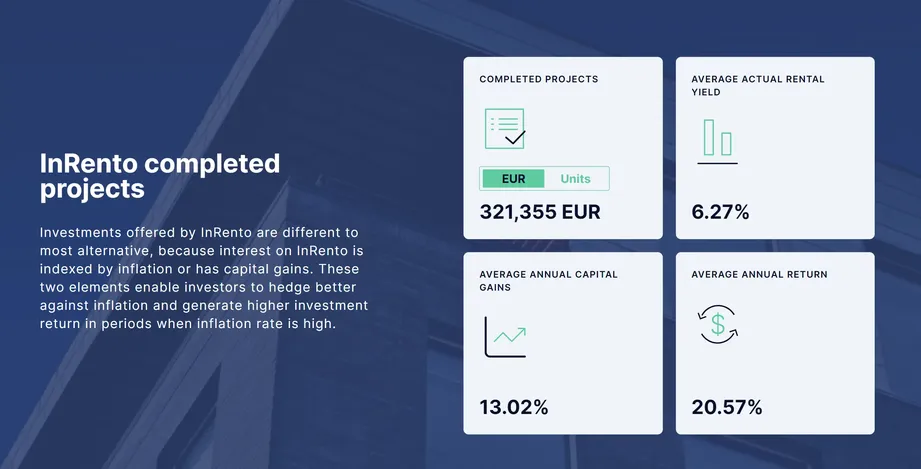

The platform has already "completed" a few projects, meaning the property has been sold, and investors received their capital gains.

As you can see in the statistics above, the rental yield and the capital gain from the exited projects are far higher than what investors get when investing in P2P lending platforms like PeerBerry, Robocash or Esketit.

However, while InRento's performance has been excellent so far, risk is still involved. Every investor should read InRento’s risk disclaimer to be fully aware of the risks that can lead to the total loss of their investments.

If you are new to P2P lending, you might have difficulty grasping the investment opportunities InRento offers.

Here’s how it works:

- Investors invest in the acquisition of real estate properties that will be rented out

- InRento is the platform that facilitates the transaction between the investor and the borrower, who will own and manage the property

- The borrower pays the rental yield to the investor

- If the property is vacant (without a tenant), the borrower pays 1% annual interest rate for the first three months and 5% interest rate after three months from which the property is vacant. (these numbers change with every project)

- If the property is sold out in the future at a higher price, the capital growth will be distributed in the following structure: 60% investors, 30% borrowers, 10% InRento

What you are investing in is a loan secured by a first-rank mortgage.

The borrower will purchase the property and take care of the property management. In exchange for this service, the borrower will take 18% of the rental yield and 30% of the capital growth.

Keep in mind that the distribution of capital growth varies from project to project. For selected projects, you can get up to 70% of the capital growth if you invest €30.000 or more.

InRento has a solid business model, considering that the investors bear the default risk. At the same time, all your investments are backed by a first-rank mortgage.

Yield on InRento

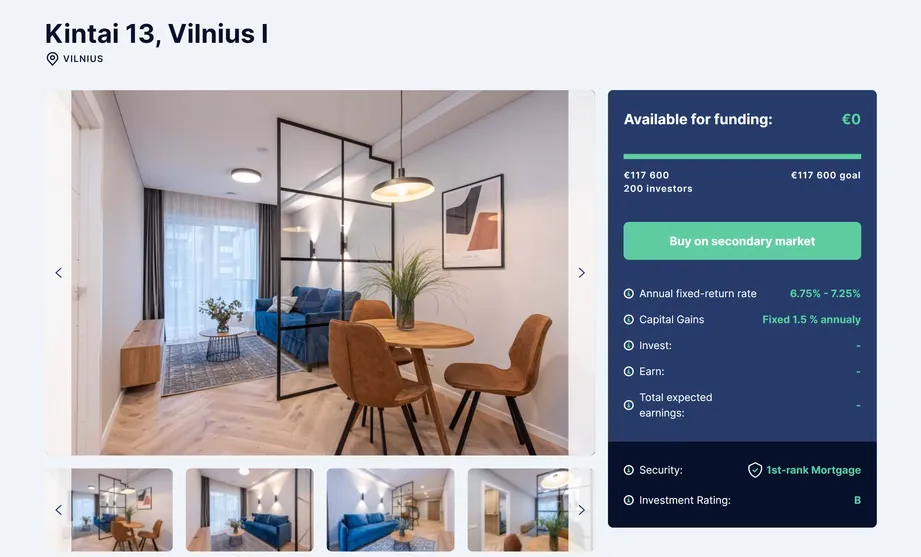

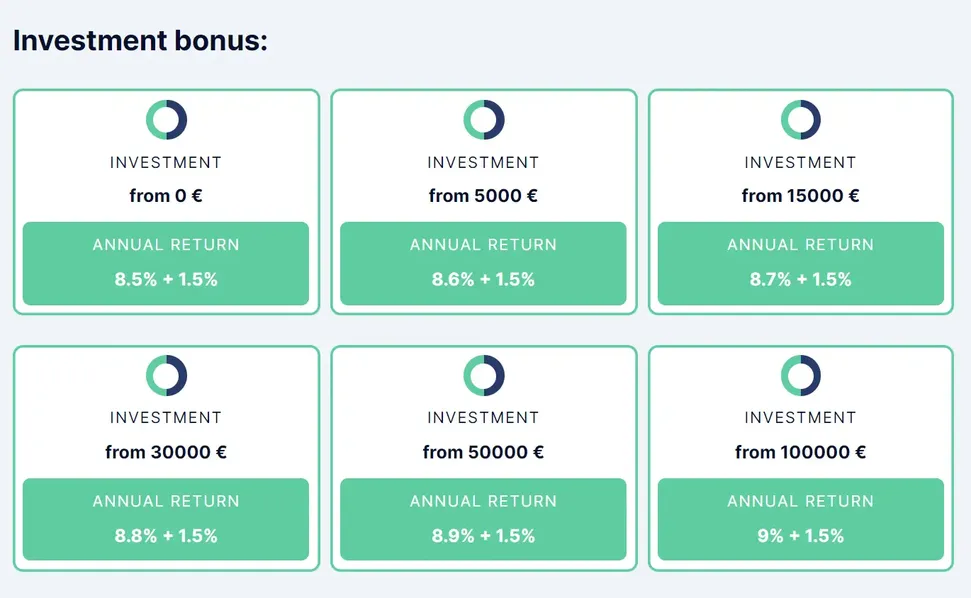

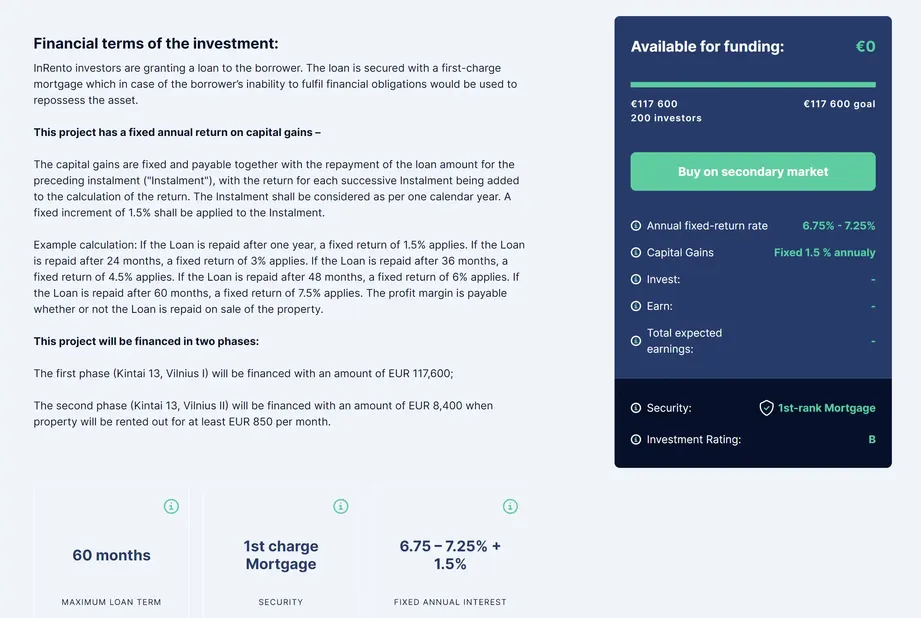

Before deciding to invest, you should know that the interest rate you earn varies with every project. InRento often lists rental deals with an annual fixed-return rate and fixed capital gains.

This yield structure gives you a clear idea about the expected return, but you might miss out on higher capital gains (if the market develops in your favor).

You can always review the rate for every project, allowing you to choose from investment opportunities with fixed or variable capital gains.

If you invest a higher amount, InRento will increase your return for certain projects. You can learn more about this option on the project page.

Project Overview

InRento’s project overview is well-structured and easy to digest. The information on the project overview page makes much more sense than on other crowdfunding platforms.

Every listed project comes with additional information about the financial terms, loan terms, and security. You can also gather further information about the borrower, which is useful when conducting your due diligence.

What’s undoubtedly unique to InRento is the “occupancy calculator,” which shows you how much yield you will earn by investing a certain amount and considering the property's occupancy.

This tool is only available before the project is fully funded.

Risk Ratings

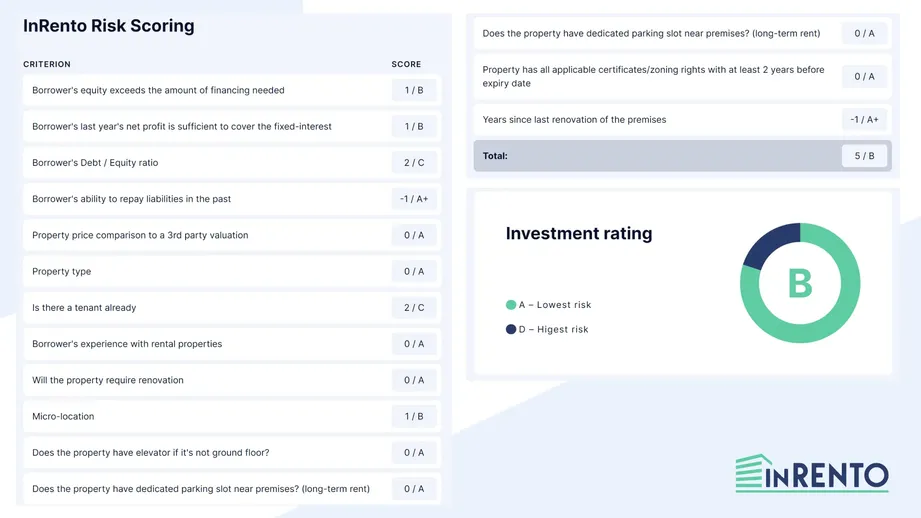

Every project comes with an InRento Risk Score, which should provide additional information that more sophisticated real estate investors usually use.

While the performance of the outstanding portfolio is impressive and the yield on the exited projects impressive, you should still keep the risk in mind.

The above graphic shows the variables that InRento evaluates when listing projects on the platform. In addition to the individual ratings, you will get a total investment rating represented by a letter (A - lowest risk, D - highest risk).

Is InRento Safe?

InRento is a relatively small platform with a little track record. It was founded by Gustas Germanavicius, an experienced entrepreneur and the co-founder of EvoEstate.

InRento later acquired EvoEstate.

Despite InRento being a newly launched platform, the P2P lending site follows the latest standards and regulations.

- Ondento, a known user-identification service provider in Lithuania, conducts the identity verification.

- Your funds are not sinred on InRento's bank accouninbut on your Paysera or Mangopay account.

- In addition to those protective measures, InRento is regulated by the Bank of Lithuania.

Who Runs the Company?

InRento is run by Gustas Germanavicius. Gustas' team consists of a relatively small number of experienced professionals.

We visited the company in 2022. You can watch our interview on-site to get an idea of who runs it.

Are there any suspicious Terms and Conditions?

Storage of Funds

As mentioned, you can only invest if you have a Paysera account. If you choose to invest in particular projects, your funds will be deducted directly from your Paysera account. You are not transferring funds directly to InRento.

Clause 14 - Amendments

InRento reserves the right to unilaterally amend the contract without prior notice. If the company changes its fees, InRento must inform you 14 days before the effective date of the changes.

Clause 78 - Liability

As with any P2P platform, InRento is also not liable for any losses you might suffer. The platform is also not liable for the accuracy or correctness of the information in the project overview.

Potential Red Flags

As of month year we are not aware of any red flags.

Learn more about possible red flags in our guide about how to avoid investing in P2P lending scams.

Usability

InRento is very easy to use, as you can only invest in projects manually. The number of newly listed projects is relatively low, meaning an Auto Invest isn't necessary.

Every project has a well-structured overview, which you should read before investing. After you have made your investment, you will receive a monthly return, which is added to your account (bank account).

You can review all the essential information in the portfolio section of your InRento account.

Apart from the project page, you can also access the Transaction or Investments pages with additional details.

🧾Does InRento deduct taxes?

As a regulated Lithuanian crowdfunding platform, InRento is legally obliged to deduct a 15% tax rate from your interest if you are a non-Lithuanian resident. Income earned from late payments and penalties is not taxed. You can deduct this tax rate to 0% if you reside in the United Arab Emirates, Cyprus, or Latvia.

The platform allows a 10% deduction for many other countries if you fill out and sign the DAS-1 form and send it with proof of tax residency to info@inrento.com with the subject "Withholding taxes."

After verifying your documents, InRento will reduce the tax rate that is being withheld. This is only valid for residents from countries with a double-tax treaty exemption agreement with Lithuania.

Living in one of those countries means you do not have to pay income tax twice. The tax that you have already paid will be taken away from the income tax that you owe in your country.

Certain tax benefits might apply depending on your country. We recommend that you contact your local tax professional for further information.

Liquidity

If you are looking for a short-term capital commitment, you won’t be happy with InRento. Most of the deals have an investment term of at least 18 months.

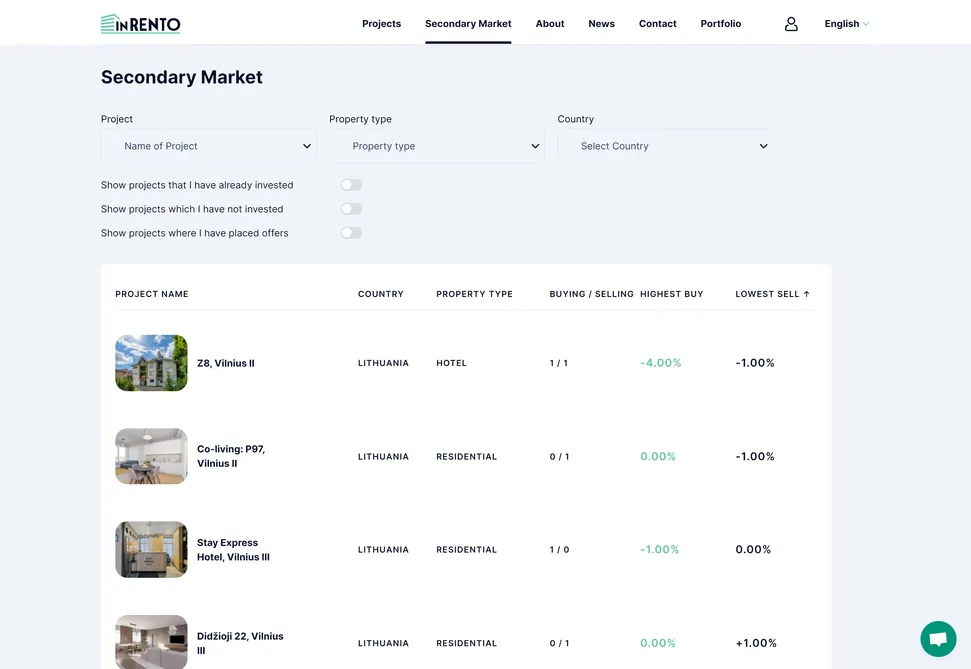

There is a secondary market on InRento; however, the trading volumes are low, so you should not rely on the option to sell your investment before the end of the project.

Additionally, InRento charges a 2% secondary market fee for sellers.

Support

InRento offers a Live Chat and the option to reach support via email at info@inrento.com. You should expect an answer within 48 hours.

During our research, we had a few discussions with the CEO, Gustas Germanavicius, who was willing to address all questions. Overall, we believe that InRento offers good customer support.

InRento Alternatives

InRento is an excellent platform for investing in the Lithuanian rental market. If you prefer to diversify across other regions or platforms with a slightly different business model, you can explore the following alternatives.

Fintown

Fintown is a Czech-based crowdlending platform that pays out up to 13% of the rental yield from already operational rental units in Prague. The platform manages the rental properties independently, so no third-party borrowers are involved.

Learn more about the available investment opportunities in our Fintown review.

LANDE

LANDE might be a good alternative if you like investing in secured loans on a regulated platform. This Latvian crowdlending site offers investments in agricultural loans with an annual interest of up to 12%.

Learn more about LANDE in our LANDE review.

Crowdpear

Crowdpear is another Lithuanian crowdlending platform based near InRento. It is run by the team behind PeerBerry, one of the most trusted platforms in the industry. Crowdpear offers investments in mortgage-backed real estate loans in and around Vilnius with an attractive interest rate of up to 11%.

Learn more about Crowdpear in our Crowdpear review.