Monefit SmartSaver Review Summary

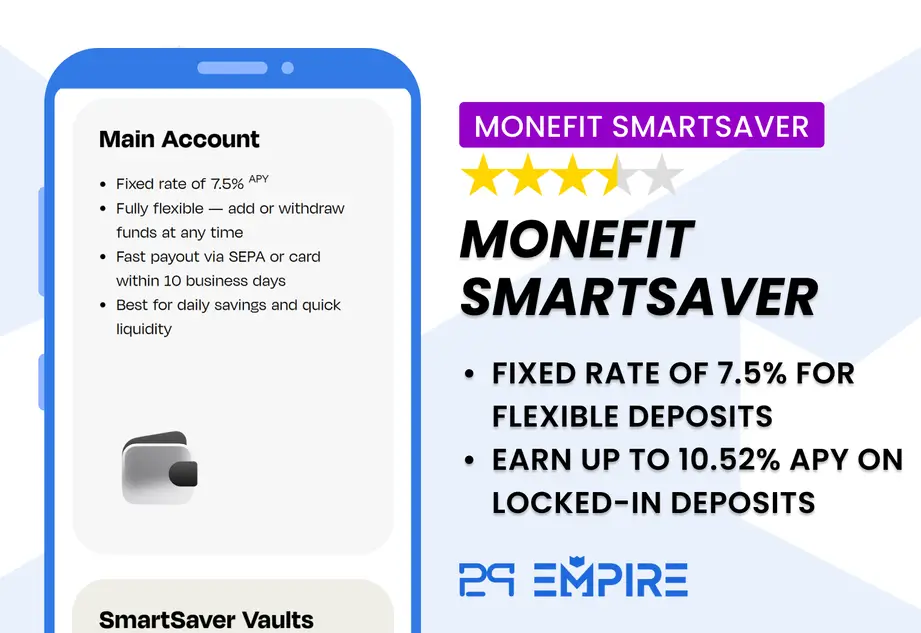

Monefit SmartSaver is a funding channel for the Creditstar lending group, offering retail investors a savings-style product with flexible access and a 7.5% annual return. Investors can withdraw up to €1,000 per month instantly, while larger amounts are subject to a 10-business-day processing period.

Here are the main takeaways from our Monefit Smartsaver review:

- High yield of 7.5% with flexible withdrawals

- Increased yield of up to 10.52% with a 24-month lock-up period

- €1,000 instant withdrawal per month

- Not regulated

Those seeking higher yields can opt for Monefit Vaults, which offer returns of up to 10.52% in exchange for lock-up periods of up to 24 months. It’s also worth noting that SmartSaver retains full discretion over how investor deposits are allocated within the group. You can explore all details in our full Monefit SmartSaver review.

What Is Monefit SmartSaver?

Monefit SmartSaver is an investment product developed by Creditstar and backed by Lendermarket, offering the potential for annual returns of up to 10.52%, depending on the lock-up period you choose. In this review, we’ll take a closer look at how Monefit operates, its features, and the potential risks, helping you determine if it’s the right investment option for your portfolio.

Pros

- Easy to use

- Fixed return

- Loans from an audited finance group

- Somewhat higher liquidity

Cons

- No securities

- €50 minimum withdrawal amount

- No performance-oriented data

What's Our Opinion Of Monefit?

The platform’s terms and conditions offer little to no protection for investors. Some clauses are quite unreasonable, especially when compared to other platforms, similar to the issues Lendermarket faced when it launched in 2019.

While the product itself may appear attractive, especially given its advertised high returns, investors must consult Creditstar’s financial reports to understand how their funds are used. In 2024, Creditstar reported a €7.24 million profit and a 10.77% ROE, with an improved equity-to-assets ratio of 21.68%.

These metrics are stronger than those of many other lenders in the sector, suggesting a comparatively stable financial base, despite a rising debt-to-equity ratio of 4.2x.

Monefit SmartSaver positions itself as an alternative to a “savings account,” offering daily liquidity alongside a fixed 7.5% interest rate. However, the lack of transparency on portfolio allocation and the absence of investor protection clauses raise questions about whether the risk-return balance is favorable.

For those willing to commit funds for longer periods, Monefit Vaults offer higher yields of up to 10.52% with lock-up periods of up to 24 months. The platform’s simplicity and advertised liquidity remain key selling points. Monefit claims withdrawal times of up to ten days, which may appeal to investors prioritizing fund access.

Still, competitors like Bondora’s Go & Grow offer near-instant withdrawals (for smaller sums), while Esketit and Robocash typically allow partial portfolio exits within a few days via the secondary market. Only time will tell whether Monefit’s yield and liquidity promises will prove reliable.

The product may appeal to less experienced investors seeking easy returns, but given the platform's vague terms and limited protections, we see it as unsuitable for those prioritizing transparency and robust risk management. That said, Creditstar’s solid audited results may justify minor, cautiously sized exposure for more informed investors.

Monefit Bonus

Monefit offers a bonus of 0.25% on invested funds is paid out 90 days after registration.

Risk & Return

Depositing money on Monefit carries a high level of risk. This platform is neither a traditional peer-to-peer lending platform nor a marketplace.

It's a tool designed to provide additional funding to Creditstar, a lender that was not always able to honor its obligations to investors on platforms like Lendermarket.

Credistar Group may use those funds to support its loan portfolios in various markets or to fund other ventures.

Monefit's website shows that the funds will be used to fund consumer loans issued in Europe. However, it is unclear how exactly your deposits will be used.

Creditstar's Loans

Credistar Group is a well-established, audited lending group in Europe that lends to European borrowers. The lender is active in Spain, the UK, Sweden, Denmark, Poland, the Czech Republic, Estonia, and Finland.

While Credistar reported a profit in its audited annual report for 2024, the lender's approach to fulfilling its obligation towards investors is more than "flexible."

Credistar also funds its loans through Mintos and Lendermarket. Investors who used those platforms experienced significant payment delays, as Credistar refused to pay back investors due to a lack of liquidity to fund its loans.

Matured investments on Mintos were moved into "pending payments," and investments on Lendermarket were extended for two years before being returned to investors.

This increased the risk for investors and significantly impacted their liquidity. The reason for Creditstar's "liquidity issues" might have been the lender's aggressive lending practices and the unexpected volatility in funding.

Poor liquidity management and aggressive premium pricing for investors are reasons to be cautious when investing in Credistar's loans.

To increase profits, the lender must issue more loans and secure additional funding. This might be why the financial group launched yet another "funding source" - Monefit SmartSaver.

Monefit SmartSaver is a simple product that will provide additional funding to Credistar. It offers at least a 7% APY and high liquidity.

Investors should be informed that there is no transparency about how the deposits will be used, and any buyback or group guarantee does not back them. The goal is to market this product as an alternative to Bondora's Go & Grow account.

Yield on Monefit SmartSaver

The investment site offers an interest rate of up to 7.5% per year. The interest will be added to your account daily. The platform also offers up to 10.5% interest for users who are willing to lock up their funds for 24 months.

This yield is "fixed" for the time being. It's unclear whether the platform will amend the interest rate in the future.

Investors should be aware, however, that the 7.5% APY isn't guaranteed and that the platform does not guarantee any specific returns, as outlined in its terms and conditions.

Is Monefit SmartSaver Safe?

Investing money in a black box is never a safe practice. Even though Creditstar is a regulated and audited company, this doesn't mean investments in unsecured loans are safe.

Who leads the team?

Credistar operates the website. To our knowledge, Kashyap Shah is the Chief Product Officer responsible for Monefit's development.

Who owns Monefit?

Monefit is owned by the Credistar Group, whose beneficial owner is Aaro Sosaar. Creditstar Group is regulated in local jurisdictions and audited by KPMG.

Are there any suspicious Terms and Conditions?

Before creating an account, we strongly recommend reviewing the terms of use to ensure you are fully aware of your rights before depositing money.

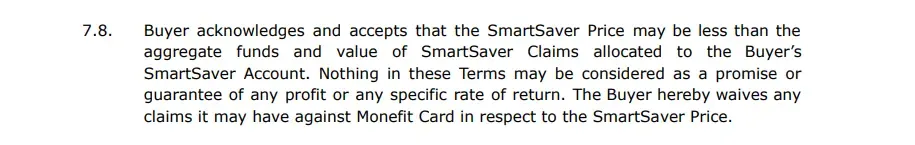

7.8 No Specific Return

Monefit SmartSaver clearly states that the website does not promise or guarantee a return. When depositing money on Monefit, you waive any claims against Monefit Card, the company operating the website.

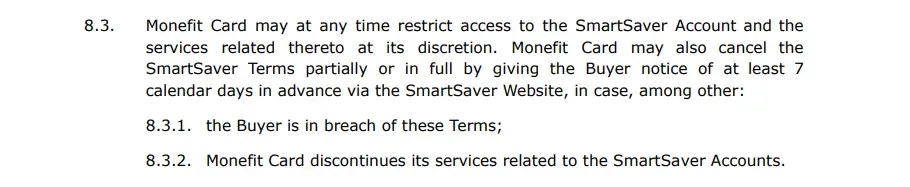

8.3 Restricting access to your account

It's important to highlight that Monefit can restrict access to your account at its discretion.

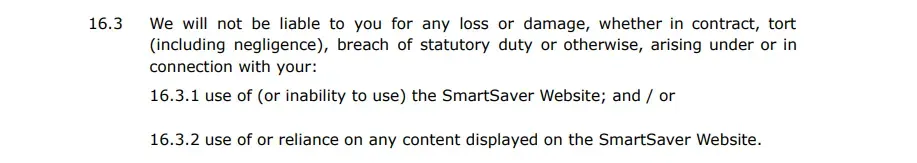

16.3 Liability waiver

If you decide to deposit your money through Monefit Smartsaver, based on the promoted terms and conditions, you should know that Monefit Smartsaver isn't liable for any damage or losses.

12.5.3 Distribution of information about SmartSaver is forbidden

Suppose you share any information about Monefit SmartSaver you gathered on their website. In that case, you can't do so without written consent from Monefit Card (the legal entity behind Monefit SmartSaver).

Amendments

The platform may change its terms and conditions by notifying you four weeks in advance.

You can review the full document here.

Usability

Monefit SmartSaver is extremely easy to use. After you create your account and verify your identity, you can deposit funds on the platform.

You can choose to use their Flexible Account or opt in for SmartSaver Vaults, which offers a higher interest rate with lock-up periods ranging from six to 24 months.

The website offers a basic dashboard for a quick overview of the deposited amount and the interest rate.

You can also access account statements, an excellent tool for insights into your interest payments.

Liquidity

Monefit states that withdrawals from the Flexible Account should be processed within ten business days, although this timeline is not contractually guaranteed. The company recently introduced a new feature allowing investors to withdraw up to €1,000 per month instantly, while larger amounts remain subject to the standard processing period.

Transfers may still take an additional 1–3 business days to reach your bank account, depending on the timing of your request, weekends, bank holidays, and the speed of the receiving bank.

We have not tested the withdrawal functionality ourselves, as the risk-return profile of Monefit does not justify allocating funds to the platform.

However, we have not tested this feature as the risk and return ratio on Monefit is incorrect.

Support

As Monefit SmartSaver is operated by the same team behind Lendermarket, you can expect a similar level of support. The platform provides only a basic FAQ, and while live chat and email are available, several key questions remain unanswered.

Monefit has not clarified whether investor funds are fully at their discretion due to the product’s unregulated status, whether deposits are ring-fenced or used to cover other obligations, or whether the stated €85 million reflects the current outstanding portfolio. They also provided no breakdown of Creditstar’s €155.5 million P2P liabilities, details about collateral backing, performance data of loans funded through SmartSaver, or reasons for the lack of published statistics.

Additionally, the actual cost of capital after cashback campaigns and the total interest paid to investors since launch remain undisclosed.

These gaps significantly limit transparency for anyone evaluating the platform’s risk.

Monefit SmartSaver Alternatives

Monefit SmartSaver is a simple investment product for uneducated investors. Unfortunately, there is not much information about how your funds are used. If transparency is an essential criterion for you, you should consider alternatives.

Nectaro

Nectaro is a regulated P2P lending marketplace from Latvia, offering high-yield loans originated by the DYNINO Group (Ecofinance) across Romania, Moldova, and the Philippines. With returns ranging from 11% to 13.5%, it stands out as an attractive option for yield-focused P2P investors.

While Nectaro does not provide instant cash-out features, it compensates with significantly higher transparency: investors can review individual financial reports from each listed lender and better assess the underlying risk.

This is in contrast to Monefit SmartSaver, where only the consolidated Creditstar Group report is available. Learn more in our full Nectaro review.

Fintown

One of the most exciting features of Monefit SmartSaver is the compounding interest, which is added to your account daily. Fintown also adds compounding interest to your account, but you can access it only at the end of the month.

The Czech-based platform offers between 8% and 12% interest on investments used to fund rental units in Prague's city center. As an investor, you know exactly how your funds are being used.

Additionally, you can generate more interest on Fintown than with Monefit SmartSaver. Learn more about this unique platform in our Fintown review.

Income Marketplace

The Income Marketplace could be an excellent alternative if liquidity isn't your primary concern.

The Estonian-based platform offers up to 15% interest on loans in Asia or America. Investing in Income Marketplace requires you to commit your funds for at least 1 month, as there is no secondary market.

Income Marketplace pays higher interest rates than Monefit. Your funds are backed by a buyback guarantee, unlike Monefit SmartSaver, which offers no securities. Learn more about Income in our Income Marketplace review.