GoParity Review

GoParity is an impact investing crowdfunding platform that offers loans to businesses dedicated to funding sustainable projects.

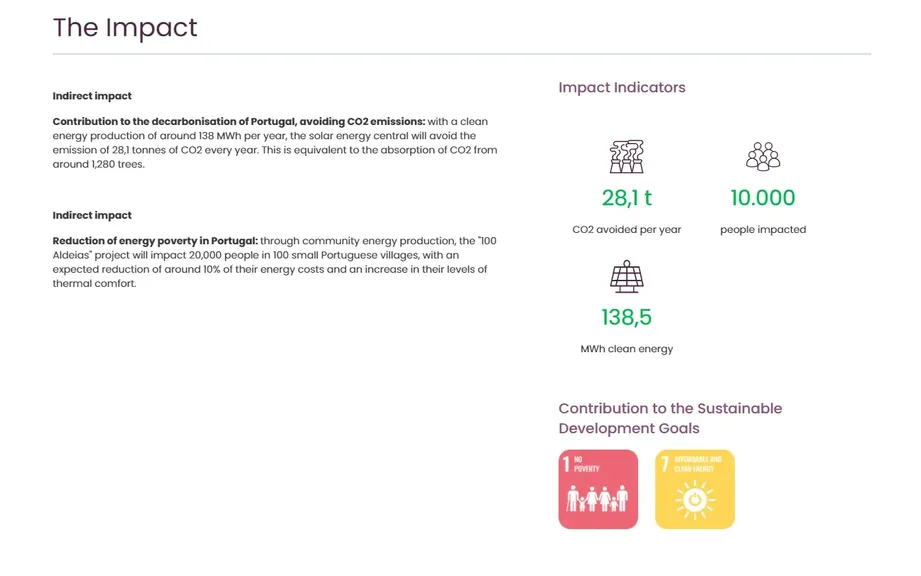

All projects listed on the platform are required to align with the United Nations Sustainable Development Goals (SDGs), which include a wide range of objectives such as gender equality, clean water and sanitation, and creating sustainable cities and communities.

While we provide an extensive review of GoParity, it’s important to note that we do not actively monitor developments surrounding the platform. Therefore, we recommend that investors independently verify the information on this page to ensure it remains up to date.

GoParity in Numbers

Let’s first review some of GoParity’s track record, which helps us to determine the real return for investors as well as the platform’s achievements. ;

Here are some of the main statistics:

- GoParity has enabled 22,757 tonnes of CO2 to be avoided per year, and 67,064 people have been impacted by the projects.

- The platform has funded 153 projects since 2017, and the average interest rate is 5.26% per year.

- In terms of the outstanding portfolio size, it’s currently at €8 million, and the average interest rate of the outstanding loan portfolio is 5%.

- The average maturity of a project is 3.6 years and so far GoParity has drawn in over €11 million in funding for its projects.

- The GoParity platform has over 19,000 registered users from almost 50 countries.

- The average LTV is 50%, however, GoParity does go up to 80% LTV on some projects, and even over in special cases.

When it comes to the number of loan applications that get approved, GoParity provided us with the statistic that until September 2021, 68% of loan applications were accepted.

The platform analyses each promoter (borrower) independently, and obtains risk reports from credit risk providers, but does not make this information publicly available.

You can educate yourself about more statistical data directly on the platform.

Requirements

In order to invest on GoParity, you must fulfil the following requirements.

- Be over 18 years old

- Have a valid email address

- Pass the KYC verification process

- Have a bank account within the EU/EEA

No EUR bank account? No problem

- 💳

- 💳

In order to complete the KYC verification, users will need to supply personal information including your name, date of birth, taxpayer number, and estimated net annual income, as well as a copy of an identity document such as a passport, driver's licence or national ID card.

The verification of your documents takes typically just a few moments.

Risk and Return

When evaluating any impact investing platform, it's important to do your due diligence by weighing up the risks and returns.

When it comes to how GoParity makes money, the platform is transparent about this.

It generates a profit by charging an initial set up fee to the funds raised by project promoters, as well as charging an ongoing fee on the standing debt for the duration of the loan term.

GoParity uses a risk assessment scale on the platform which ranges between A+ and D.

An A+ is a low-risk investment opportunity and the risks get higher all the way down to D which is the highest risk.

This risk assessment scale is defined by looking at the eligibility of the project, as well as the statistics of the business model to evaluate whether the loan is likely to default, and a technical evaluation which includes an evaluation of the project's financial viability.

How Are The Loans Secured?

It's important to find out how loans are secured in order to evaluate risk on a platform.

GoParity reduces the risk to the investor of the borrower being unable to repay the loan in several ways, including:

- securing compensation via an equipment pledge

- a financial guarantee from the legal representatives or parent company

- co-financing by another company which ensures that should a default happen

Keep in mind that this varies depending on the projects. The financial guarantees from the legal representatives are not as valuable as pledges on assets.

Mortgage-backed loans on platforms like EstateGuru or Reinvest24 might therefore offer better security.

Is GoParity Regulated?

GoParity is regulated by the Portuguese Securities Market Commission (CMVM), which regulates crowdlending platforms in Portugal.

This is great news as this means that the business model and the processes have been approved by a regulator, which decreases the platform risk.

Due Diligence Process

GoParity is very selective about the types of projects it funds.

All projects have to fall under one or more of the 17 SDGs, however, the platform is most interested in funding projects that:

- aim to end poverty

- supply clean drinking water and sanitation

- ensure access to sustainable and modern energy

- create safe and resilient cities and communities

- combat climate change

- work towards sustainable ocean practises and

- protect and conserve our terrestrial ecosystems

Once a project has been proven to fit within one of the sustainability categories, the fundraisers (borrowers) need to provide evidence that:

- they are entitled to decision power within the company

- they are not in debt with the bank

- they have at least two years of registered activity

- they are not defendants of a lawsuit containing material evidence

As well as this, GoParity also evaluates the companies financial stability to ensure they will be able to repay the loan and interest.

This is what makes GoParity a unique platform in Europe. There’s no other platform that takes the sustainability of a project into account. If you want to support impactful projects, GoParity is the best place to do so.

How Is GoParity Secured?

In order to ensure the safety of your funds, you should always check the security features of a platform.;

GoParity uses MangoPay as the payment service provider, to manage all transactions, and perform KYC validation. There is also 2FA for withdrawals in order to ensure the safety of your money.

GoParity uses MangoPay as the payment service provider, to manage all transactions, and perform KYC validation. There is also 2FA for withdrawals in order to ensure the safety of your money.

When it comes to credit risk, GoParity also performs a rigorous risk assessment of internal procedures, as well as outsourcing risk reports from credit risk providers, in order to mitigate the risk of default.

How Much Do Investors Earn?

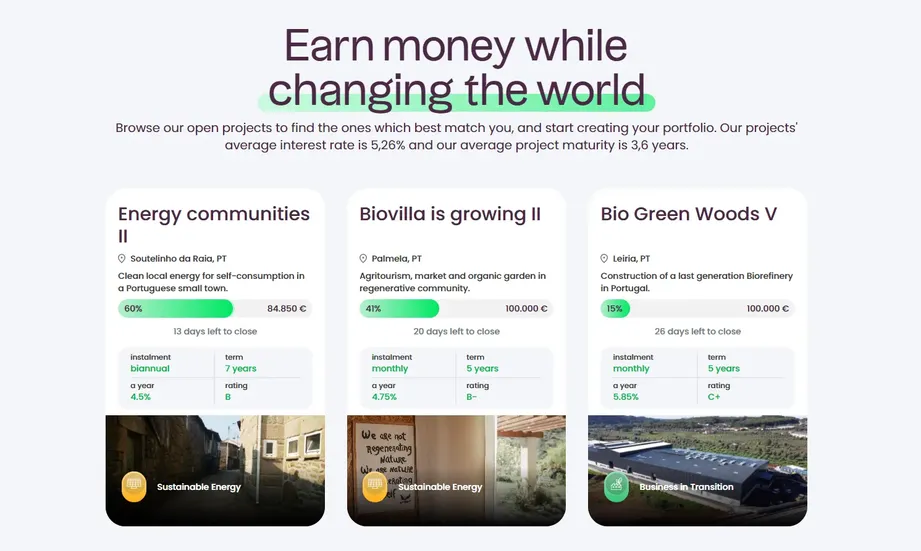

Investors on average earn 5.26% per year by investing in sustainable projects on GoParity.

The projects that are currently available to invest in on the platform range between 4.5% and 6%.

These figures are lower than investing on other crowdlending platforms, however, users are motivated to invest on GoParity because of the environmental impact of the projects, as well as the returns.

All of the loans on GoParity are amortized, meaning that as well as receiving monthly interest payments, your investment is paid back monthly as well, rather than at the end of the loan term. This isn't always the case on real-estate platforms.

This means that throughout the loan term, the default risk is diminishing as you are receiving the interest as well as the loan repayments.

In terms of minimum and maximum investments, the minimum investment for all projects is €5.

When it comes to the maximum users can invest, it depends on their annual revenue and on whether they are an individual investor or a corporate investor.

Individual investors with gross annual revenue below €70,000 are limited to a maximum investment of €3,000 per project, whereas individual investors whose gross annual revenue is above €70,000 can invest up to €24,999 per project. Corporate investors have no limitations on the size of their investment.

Is GoParity Safe?

As with any crowdlending platform, taking a look behind the scenes at the team that is building the platform, as well as where the company is based and the terms and conditions, is a good way to evaluate the safety of a platform.

Who leads the team?

The team is co-founded by 3 individuals, Nuno Brito Jorge, Luís Couto, and Manuel Nery Nina.

Nuno is the CEO of GoParity and has a background in business development and energy.Luís is the COO and has a financial background with Santander. Lastly, Manuel is the CCO and has a background in project management.

The team is made up of 17 individuals with backgrounds ranging from finance to social science, marketing, biology, renewable energy, marketing, and engineering.

Are there any suspicious terms and conditions?

Currently, there are no suspicious terms and conditions.

Potential Red Flags

We know of no red flags.

Our Opinion of GoParity

GoParity is a platform well-suited to a specific type of investor—those who are more interested in making a positive social and environmental impact than maximizing financial returns.

Investors who want to support projects that benefit disadvantaged communities and address sustainability challenges, as outlined by the United Nations Sustainable Development Goals, will find GoParity’s approach highly rewarding.

One of GoParity’s strengths is its user-friendly functionality. The platform offers a mobile app for both iPhone and Android users, along with features like auto-invest and a secondary market, allowing for easier portfolio management and enhanced liquidity.

The low entry barrier, with a minimum deposit of just €5, makes it accessible for beginners or those with limited funds.

However, for investors focused primarily on high returns, GoParity may not be the best fit.

The platform's returns average between 4% and 8%, which is lower than what can be found on other crowdlending platforms. Loan terms are also longer, typically ranging from 5 to 7 years, which could require more patience from investors looking to build larger portfolios.

It's also important to note that GoParity tends to have a limited number of projects available at any given time. While the platform has funded 156 loans since its inception in 2017 and typically lists at least three active projects, those looking to scale their investments quickly may face some limitations.

Additionally, we no longer regularly monitor developments on the GoParity platform, so we recommend that you verify any current information independently before making investment decisions. For those seeking higher returns, consider checking out our article on the best P2B platforms to maximize your investments.

Usability

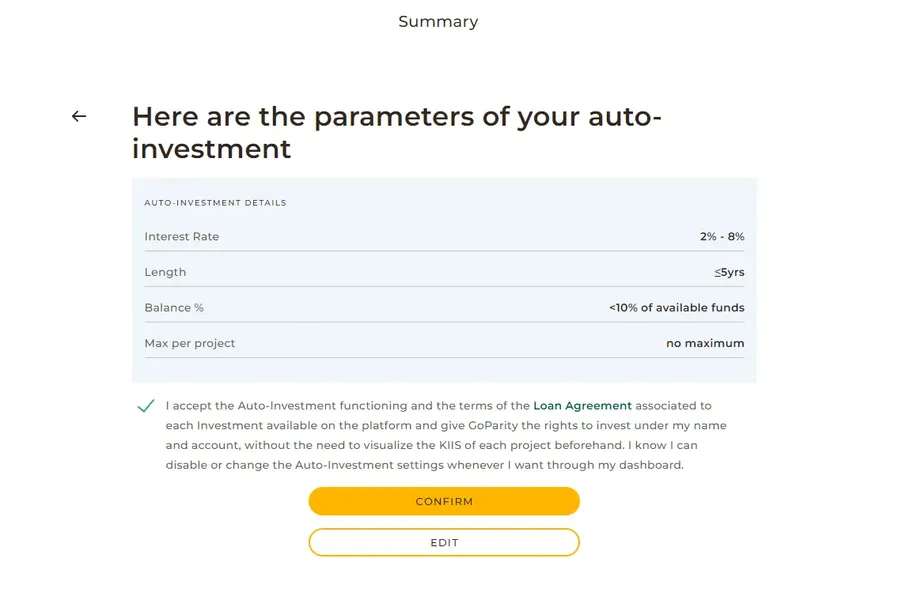

GoParity does have an auto invest feature, allowing users to automatically invest in new projects that fit predetermined criteria that they have previously set.

This is a great way for you to passively diversify your portfolio.

Alongside traditional loans, the platform offers convertible loans which allow the user to convert their investment into equity or shares of the promoter's organization.

That’s quite unique within the crowdlending sector in Europe.

There is also a helpful simulation feature for those looking to invest.

You simply need to enter the amount you're looking to invest, select the project you're interested in, and the simulation tool will calculate how much interest you will earn over the loan period, as well as how much the monthly repayments which consist of your capital and interest will be.

It also provides a timeline of the loan and tells you which payment you will receive and when.

GoParity lists roughly 7 - 8 loans on the platform per month, and there are always 3 projects open.

In terms of the length of time it takes to fund a project, on average, projects are fully funded within 3 weeks

Liquidity

Withdrawing funds on GoParity is straightforward and efficient. Withdrawal requests submitted before 3:30 PM CET are processed on the same day, while those submitted after this time are processed the following day. It typically takes up to 48 hours for the funds to appear in your account.

Users can withdraw as little as €0.10, and withdrawals are free of charge, except in cases where the funds were never invested, which incur a 1% withdrawal fee.

This ensures that active investors can access their funds without unnecessary costs.

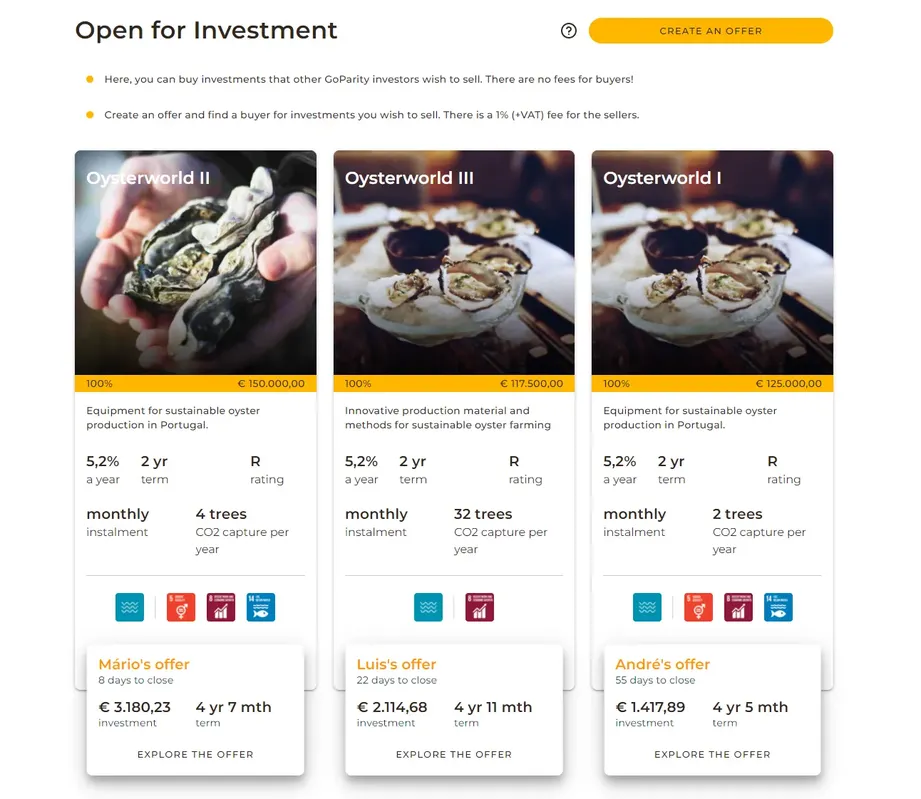

Secondary Market

The platform also has a secondary market where users who have changed their minds on a project can sell their investment.

This is also a good opportunity for new users to invest in projects that have already closed.

Bear in mind, you must sell your entire investment, not just a portion of it.

You can also only sell your investments after 30 days. This feature comes with a fee of 1% taken by GoParity.

Support

If you need support when using GoParity, there are several options.

There is a live chat option available on the website, although it is not monitored 24/7. You can also email hello@goparity.com or contact the team by phone. There is also a FAQ section available on the website.

When we reached out to the platform, we found their support to be quite good, although a little slow at times. However, they provided us with detailed answers to our questions.

GoParity Review Summary

GoParity is a regulated and legitimate crowdfunding platform from Portugal. If you are willing to accept lower returns and fund sustainable projects, GoParity is the best option for you.

Key takeaways from our GoParity review:

- Sustainable and impactful projects

- Invest from only €5

- Average returns of just 5.26%

GoParity Alternatives

While GoParity appears to be a legitimate platform, its risk-to-return ratio isn't ideal. Here are some better alternatives worth considering.

Esketit

Esketit, a Latvian-based P2P lending marketplace, offers investments through carefully vetted lenders with proven business models. The platform provides annual returns of 9% to 12% and features automated investment strategies, which enhance liquidity and minimize the risk of cash drag. Esketit is currently one of the top-performing platforms in the industry. Read our Esketit review for more details.

LANDE

LANDE is a regulated crowdlending platform from Latvia that specializes in agricultural loans. It offers both an auto-invest feature and a secondary market, making it easier to automate your investments and improve liquidity. Returns range from 10% to 12% annually. Learn more in our LANDE review.

Fintown

Fintown focuses on investments in operational rental units in Prague, Czech Republic. After conducting research and visiting their headquarters, we found their business model to be sustainable. If you prefer earning returns through rental yields rather than payday loans, Fintown is a great option. Read our Fintown review to learn more.