Bondora Go & Grow Review Summary

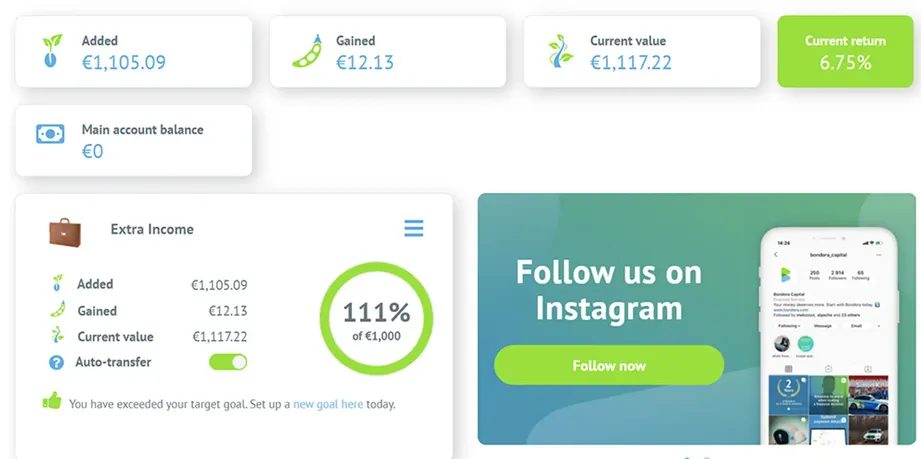

While our experience with our Bondora Go & Grow has been positive, the platform decreased the offered interest rate to just 6.75%, which for many investors, is not worth the risk compared to other P2P lending platforms.

Main takeaways from our Bondora review:

- Transparent and open communication

- Confusing statistics

- Automated investment strategies

- Easy-to-use product

If you’re looking for an alternative investment opportunity with high liquidity and returns of as high as 6.75% per year, Bondora’s Go & Grow might be a good option. Be aware, however, that investing in P2P loans always comes with a risk.

Ready to grow your money?

Are you not convinced yet? Explore other P2P lending sites.

What is Bondora?

Bondora is one of Europe's oldest Peer to Peer lending platforms. This platform lists self-originated unsecured personal loans from Estonia and has advanced tools to help investors automate their strategy. Find out more in our Bondora review.

Pros

- Instant liquidity

- Bondora's Go & Grow is easy to use

- Regulated lender in Estonia

Cons

- Low interest rate

- Frequent investment limits

- The distribution of the Go & Grow portfolio isn't publically disclosed

Watch our latest video, where we test and review Bondora's Go & Grow product.

Bondora Bonus

Bondora always offers sign-up bonuses and promo codes to incentivize you to invest. Every new investor who signs up with our link will receive a €5 bonus.

The best part about this is that you can get the Bondora referral bonus right after registration.

Is this Bondora bonus tickling your fancy?

Requirements

If you’re over 18 years old and live in the EU, Switzerland or Norway, you’re eligible to invest on Bondora.

Unlike competitor platforms, Bondora’s sign-up process is very intuitive. Bondora also supports registration with Google and Facebook accounts to increase the ease of signing up.

You can use SEPA transfer (bank transfer) to add funds to your Bondora account.

No EUR bank account? No problem. You can transfer money from any European bank account, such as N26 or Revolut.

Risk and Return

When investing, it’s essential to understand certain investments' risk and safety and conclude whether the risk and return ratio is aligned with your financial goals.

When investing on Bondora you’re investing in unsecured personal loans from Estonia, Spain and Finland.

Bondora has a very different business model compared to most other P2P lending platforms such as Mintos, PeerBerry or Swaper.

Bondora isn’t only a platform that connects loan originators with investors, it also takes over the loan originator role itself.

This means that Bondora lends money directly to the borrower, thus eradicating the middleman that exists on platforms like Mintos.

Bondora’s direct line of communication with the borrower is beneficial if payment delays occur or in the case of a defaulted loan.

As a result, you are essentially lowering your investment risks by investing in this platform. This isn’t the case with Mintos, as the platform primarily tracks the performance of loan originators rather than the performance of individual loans.

If you have invested on other platforms like Twino, PeerBerry or Mintos, you might be familiar with the buyback guarantee.

Bondora does not offer this feature. The only way to minimize the risk is to diversify your portfolio as much as possible.

Unlike Twino, Bondora doesn’t repurchase your claims against the borrower after 60 days. If you invest directly in loans on Bondora you will experience defaulted loans and they will lower your expected returns.

Learn more about TWINO in our TWINO review.

Bondora offers three different products with potentially other returns. We will review them individually in more detail later. Most investors use the Bondora Go and Grow product, which can be used as an alternative to a savings account with no protection scheme.

Monefit Smartsaver offers essentially the same product.

The annual return for Bondora Go and Grow Unlimited is only 4% which is half of the net return you can achieve with platforms such as PeerBerry or EstateGuru.

Is Bondora Safe?

Our reviews about P2P lending platforms include information about the features and benefits and the background of the company’s leaders.

We also read through the Terms and Conditions to ensure there aren’t any obvious red flags. The quality of information that we want to provide to our readers is our top priority, and due diligence is undoubtedly a part of it as well.

Who Runs the Company?

Bondora AS is run by the management board, consisting of two gentlemen, Pärtel Tomberg and Rein Ojavere .

Pärtel Tomberg is the current CEO and co-founder of Bondora. He founded the company during his bachelor studies back in 2008. Before he dedicated his full attention to Bondora, Pärtel worked at Quelle AG, later acquired by Halens, where Pärtel was active as a business development manager.

Other co-founders are Mihkel Tasa and Martin Rask.

Rein Ojavere is the CFO of Bondora. He is in charge of all financial matters within the company. Before Rein joined Bondora, he was the head of corporate banking of the DNB bank in Estonia. He was also engaged with the asset management company Northern Star and Hansa Investment Funds. Rein holds an MBA from the University of Tartu.

Who’s the Company’s Legal Owner?

According to our understanding of the company’s structure, the company’s shareholders are the members of the supervisory board: Joao Monteiro, Mati Otsmaa, Phil Austern, as well as the following two investment firms.

- Valinor Management LLC - a private investment firm from the USA

- Global Founders Capital GmbH Co. - investment firm from Germany

Bondora isn’t sharing the exact amount of shares every shareholder is holding.

Are There Any Suspicious Terms and Conditions?

Bondora’s terms and conditions are pretty straightforward. Let’s have a look at some of the clauses worth mentioning.

Clause 5.7 - No liability for the credit scoring

As you already know, Bondora isn’t just a platform that connects investors with loan originators, it’s the loan originator itself. This means that it also does credit-scoring. In section 5.7, it states that the company or the person in charge is not liable for the validity of the credit scoring.

The credit score is just a metric, and it does not guarantee any returns of your investments. If you decide to invest in loans on Bondora, you do it at your own risk.

Clause 9.3 - What if Bondora defaults?

In section 9.3, Bondora ensures investors that in case of bankruptcy, it won’t have any effect on the validity of the loan and resale agreements.

This means that if you use Bondora’s Go and Grow, you will still be able to request a withdrawal. How this will work in reality is another story.

Clause 11.2 - Amendments to T&Cs

If you are a loyal reader of P2P Empire, you know that some of the companies tend to reserve the right to change their terms and conditions as they wish.

Trustworthy P2P lending platforms always give you time to evaluate the changes before any amendments and that’s the case with Bondora.

Most platforms, Mintos and Debitum Network included, will give you only ten days to accept the changes. Bondora gives you four weeks, which we highly appreciate.

Segregated bank accounts

Bondora’s terms and conditions do not mention how Bondora safeguards your funds. In one of Bondora’s blog posts, we discovered that your funds are stored in segregated client accounts with the SEB bank.

All of your funds should be accessible by you at any time. Bondora uses your funds only when you, as an investor, give an order to purchase claim rights against the borrower.

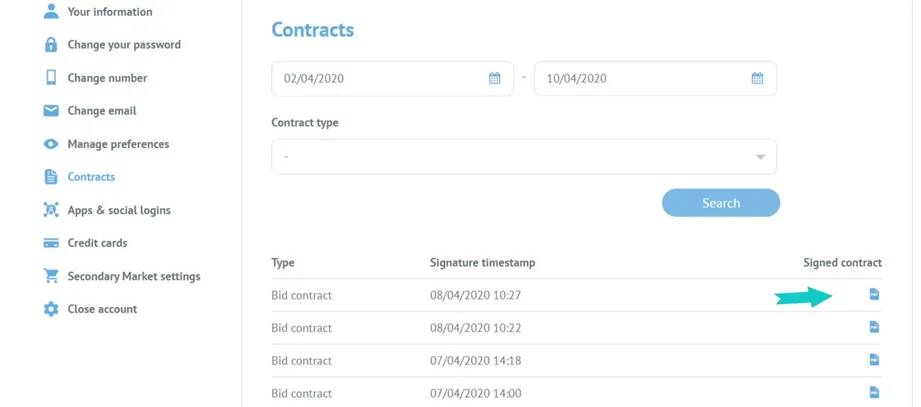

Do Investors Have Access to Individual Loan Agreements?

There are no assignment agreements for loans you have invested in with the Bondora Go & Grow tool. This is because you often invest in only a fraction of a claim. Given the claims are so small, it's not useful for investors to display detailed information of the specific claims in your Go & Grow portfolio on your dashboard.

We have not spotted any suspicious clauses during our due diligence check.

There are, however, investors who like to believe that Bondora is using a different write-down policy for their own defaulted assets vs those of investors.

This would suggest that all non-Estonian markets would make a loss for Bondora and its investors. This could be why Bondora has stopped loan originations outside of Estonia.

Potential Red Flags

- Bondora uses different write-down policies for statistics presented in the annual reports vs. those presented to investors.

Learn more about possible red flags in our guide about how to avoid investing in P2P lending scams.

Curious about other platforms? Head over to our ⚖️ P2P lending platform comparison for a quick overview of the currently available platforms.

Our opinion of Bondora

While Bondora is a popular investment platform amongst European investors, the risk and return ratio is not the best.

Bondora's Go & Grow product offers excellent liquidity at a much lower interest rate than similar features on platforms like Esketit or Robocash.

While Bondora was mainly able to fulfill the obligation towards investors, the platform has declined any interviews with us on multiple occasions.

If liquidity isn't your priority, there are better Bondora alternatives to consider.

Bondora’s Usability

Regarding usability, Bondora does a few things differently from other P2P lending sites. First of all, you can customize the entire dashboard to your preference.

You can customize how much information you see by clicking on your name in the top right corner and choosing the change view.

Insights into Bondora’s Past Performance

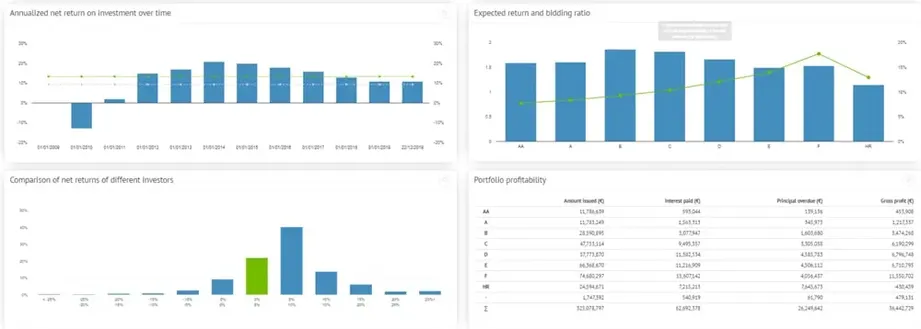

Bondora also gives you access to various statistics that you can use to gain more insights into Bondora’s past performance.

The statistics won’t give much value to Go and Grow users.

It would be nice if Bondora could improve the structure of their statistics with some additional description, as right now, it’s not immediately clear what each chart represents and how they affect your portfolio.

Bondora offers three different investment products. Let’s look at their differences to give you an idea of which product is the best fit for you.

Bondora Go & Grow Review

Bondora Go and Grow is the most popular investment product. You can expect a stable return of 4% per year, high diversification, and immediate liquidity. Find out how much profit you will earn on Bondora with our Bondora calculator.

Bondora’s Go & Grow is the ideal choice for beginners who don’t want to spend time educating themselves about P2P lending and comparing various P2P platforms.

Using this feature is easy and can be done within just one minute.

You create a Go and Grow account, choose your investment purpose, and define the starting amount, monthly contribution, and loan period.

Before you save the settings, the tool will estimate the potential returns. If you wish to calculate the exact returns, use our compound interest calculator.

Your money within your Grow and Go account will be diversified across 90,000 loans. There is no better way to diversify your portfolio on Bondora with any other tool than Go & Grow.

If you want to withdraw your capital, you can do so anytime for a withdrawal fee of €1.

"Anytime" isn't always valid. During the "bank run" in the spring of 2020, investors had to wait two months to receive their money from Bondora's Go and Grow. So take Bondora's claims with a grain of salt.

The Go & Grow account is ideal for investors using P2P lending as an "alternative" to savings accounts.

You can set up monthly payments to your Bondora account, and then you don’t have to worry about anything else. The Go & Grow tool will invest your added funds without further actions from your site.

Please note that Bondora's Go & Grow product is not an alternative regarding the safety and liquidity of your funds in a savings account. The risk with Go & Grow is naturally higher.

Are you wondering in which platforms we invest? Check out our .

Are you curious how Bondora compares to Mintos? Check out our latest comparison Bondora vs Mintos.

Go & Grow Unlimited

The Go & Grow Unlimited is the new level of the traditional Go & Grow product. This new feature offers 4% interest per year, instant liquidity and no monthly investment limits.

Bondora no longer needs to attract new investors as they cannot issue more loans. The demand for investments is higher than the supply of loans, which is why Bondora has decreased the interest rates to 4% per year.

Anyone opening a new Bondora Go & Grow account will automatically earn 4% on his/her deposits. If you are an existing Go & Grow user, you continue earning the previously valid interest rate of 6.75%. Remember that the risk of your investment doesn't decrease with Go & Grow Unlimited.

Liquidity

When investing, you’re constantly moving money into different assets. Some of the assets might lock your capital for a certain time. The same applies to P2P lending.

Your capital is locked at the very least for the duration of the investment period.

Is there a way to access your capital and withdraw your money earlier? Yes.

Investors using Bondora Go and Grow can withdraw money instantly (during normal market conditions).

During our Bondora Go & Grow liquidity test at the beginning of September 2020, we withdrew our €1,000 portfolio within one minute.

Secondary Market

A secondary market is where investors sell their claims against the borrowers. Most investors trading on the secondary market do so because they want to withdraw their capital and invest elsewhere or because they think the borrower will not be able to repay the loan.

As of month year, there is no need for a secondary market as you can liquidate your Go & Grow position at any time without waiting for buyers on the secondary market, which was the case when Portfolio Pro and Manager were offered on Bondora.

Support

Every investor should ensure that the platforms they invest on have a solid support center. Bondora has over 130,000 investors. With many people relying on the platform, their customer service must be up to scratch.

Bondora’s FAQs Section

So, what’s Bondora’s support system like? The platform has automated the support wherever possible. Frequently asked questions are grouped into categories and answered within a dedicated support section on Bondora’s website.

Communicating with the Bondora Team

If you can’t find the answers to your questions on the support section, you can get in touch with Bondora by emailing them at investor@bondora.com or by calling them on +44 1568 6300 06.

While Bondora didn't respond to our support requests a few months ago, our latest test of their support team turned out to be a much better experience.

Bondora's support got back to us within a few minutes. All of our questions regarding assignment agreements have been resolved. We will monitor the quality of Bondora's support and update our Bondora review accordingly.

Suppose you are starting with P2P lending and you’re having difficulty answering all of your questions. In that case, Bondora's blog and their FAQ section is a good resource that will expand your knowledge about Bondora's products.

If you want to learn more about P2P lending, head to our P2P lending academy to expand your know-how within the P2P lending space.

Are you new to P2P lending? Learn how to choose your first P2P platform.