Triple Dragon Funding Review Summary

Triple Dragon Funding is a new P2P platform backed by a profitable lender with a 9-year track record. Investors face no cash drag, gain rare exposure to the UK, Canada, and the US, and invest in loans secured by receivables or tax credits.

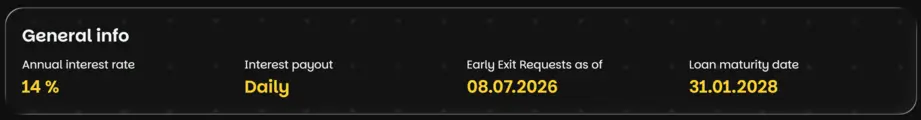

With no investor losses so far, the platform offers up to 14% interest, loan terms of up to two years, and an early exit option.

Main Takeaways From Our Triple Dragon Funding Review

- Unique product in the industry

- High-quality collateral (securization of loans)

- Daily compounding interest feature

- Operating in a semi-regulated environment (exceptions)

Triple Dragon Funding enables you to secure a higher interest rate, with an Early Exit option, which offers an attractive alternative to other, more established platforms on the market.

Are you wondering how Triple Dragon Funding works? Watch this video right here:

Are you ready to increase your yields?

What is TD Funding?

Triple Dragon Funding (tdfunding.eu) is a newly launched P2P lending platform registered in Luxembourg that facilitates funding for the UK-based Triple Dragon loan originator. The company specializes in funding game development, backed by receivables, contracts, and government tax credits.

TD Funding offers up to 14% interest on 2-year loans, with a minimum investment of €1,000.

Pros

- Smart legal setup

- High initial interest rate

- Daily compounding interest payouts

- Early Exit

- Experienced management

- Profitable business with a long track record and less than 1% bad debt

Cons

- High minimum investment amount

- Not yet a fully regulated crowdfunding platform

Our Opinion Of Triple Dragon Funding

Triple Dragon Funding feels less like a typical fintech launch and more like a platform that finally opened its doors to external investors.

While the platform itself is still in MVP stage, with a few bugs and unfinished elements, the lending business behind it is clearly not new.

The team has been originating and managing loans for almost nine years, and that experience shows in how the loans are structured, priced, and underwritten.

In our view, this is not a case of a startup experimenting with investor money, but an established lending operation now making its strategy accessible through a crowdlending platform.

What clearly stands out is the securitisation and funding structure, which is more robust than what we see on many other crowdlending platforms.

Combined with a 14% interest rate, no withholding tax, and the option for legal entities to invest, the offer is very attractive on a risk-return basis.

The loan book looks strong, with around 70% recurring borrowers and no losses for P2P investors so far. Importantly, these loans are repaid from tax credits or receivables, not from asset refinancing. This significantly reduces refinancing risk compared to real estate or forestry-backed platforms.

We also like the geographic exposure. Around 95% of loans are linked to the UK, Canada, and the US, which is very unusual in the crowdlending space and helps diversify away from higher-risk regions.

On the operational side, there is no instant exit, so liquidity still needs to prove itself over time. The platform also relies on a third-party software provider, which adds some dependency risk.

Financials are transparent, but not yet audited, and the platform currently operates under a regulatory exclusion. A formal regulatory application is planned for Q2 2026, with completion expected within 6–12 months.

Positively, there is no cash drag, a large loan pipeline, and a compounding feature that keeps funds invested.

Management is confident they can double the loan book by the end of 2026 without lowering quality, which we will monitor closely as the platform scales.

Overall, Triple Dragon Funding offers a unique product, strong yields, and a lending model that looks more institutional than typical P2P platforms.

While regulation and liquidity still need to be proven, the risk-reward profile currently looks very competitive for experienced investors who understand the structure.

Triple Dragon Funding Bonus

Our readers on P2P Empire can benefit from a two-part bonus structure. All investments made within the first 60 days after registration qualify for a 1% cashback bonus. In addition, investments made during the special campaign period, valid until March 2, 2026, receive an extra 2% instant bonus.

The total bonus is calculated based on the invested amount and is uncapped, meaning the more you invest during the eligible periods, the higher the cashback you receive.

Should you decide to sign up with our link and invest €1,000, you will receive a €30. For a €10,000 investment, you will receive a €300 bonus. The bonus amount is uncapped; the more you invest in the first two months, the more cashback you will receive.

Learn more about it on our Triple Dragon Bonus page.

Requirements

TD Funding is available to private investors who own a European (EEA) bank account as well as to legal entities. Signing up on the platform is easy and straightforward.

You need to confirm your email and verify your identity to register on the platform.

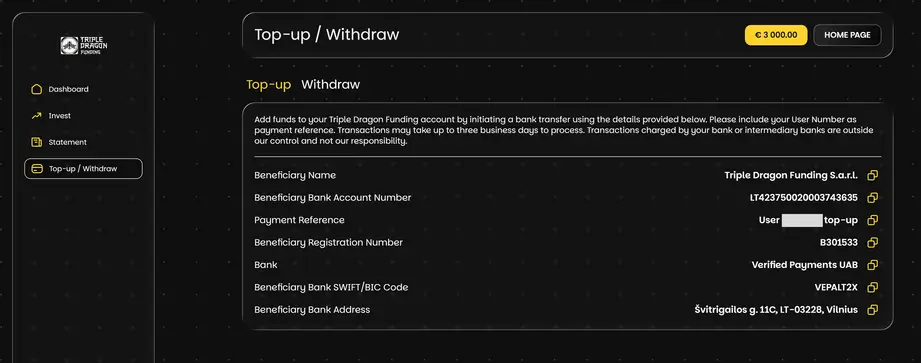

TD Funding is currently not requesting additional details or suitability tests, as is the case on other regulated platforms in the Baltics, which makes the onboarding process much faster. After you have passed the verification, you can top up your account.

You can retrieve the top-up information in the left navigation by clicking on the “Top up / Withdraw” menu item.

Triple Dragon Funding is working with a Lithuanian payment institution, and our deposit was credited to our account within a few hours.

Risk & Return

As a critical-thinking investor, you should always evaluate the risk of any investment relative to the return. For Triple Dragon, the main risk is the lender’s track record and the due diligence on its founders.

Let’s review both aspects to determine whether the offered interest rates are sustainable and attractive in today’s market environment.

Do you prefer to watch a video instead? As part of our due diligence, we conducted an interview with the platform’s founder and CEO, during which we discussed the business model and the risks you should consider.

You can read a short summary of the Triple Dragon interview or watch the full interview with timestamps below.

What Is Triple Dragon?

Triple Dragon works with game developers who publish games on platforms such as Steam, Google Play, the App Store, Xbox, PS5, and Nintendo Switch.

The lender provides flexible financing with an average annual interest fee of 24% (paid monthly). The terms of the issued loans range from 6 to 24 months, and the loan sizes range from €100K to €5M.

Many developers prefer to borrow money to fund their projects rather than give away equity to outside investors.

User Acquisition Finance

Triple Dragon's unique proposition is that it can finance marketing and user acquisition for game developers. As long as the lifetime value of a customer exceeds the cost per instal (hence ensuring profitability), the borrower can use additional funding to increase revenue and profits without having to sell equity.

Cashflow Funding

If an established gaming studio requires funding to develop a new title, while already having multiple games in the portfolio that generate recurring revenue, Triple Dragon can provide working capital. Receivables and government tax credits are used to repay the debt.

Triple Dragon ensures that revenues from sold titles via app stores, platforms, and game distributors are first used to repay loans before reaching the borrower’s bank account.

Triple Dragon - Track Record

Triple Dragon launched its lending activity in December 2016. Since then, the company has funded more than €50M in loans, paid out more than €7M in interest to investors. Since its inception, the company has written off less than 500K EUR as bad debt.

That’s an outstanding performance compared to other competitors in the crowdfunding industry.

As of January 2026, the outstanding portfolio of Triple Dragon is 28M USD (€24M). 70% of its clients are recurring customers.

Funding Sources

- Equity (retained earnings)

- Debitum Investments (regulated P2P platform)

- Wholesale facility in the UK (non-bank lender)

- Luxembourg securitisation with a single institutional investor (credit fund)

- TD Funding (TD platform) - new funding source

You can review the latest consolidated financials for the Triple Dragon company can be reviewed in our statistics section above. Financials of the Triple Dragon Holding Company can be accessed directly via the Companies House.

Here are some key performance indicators based on Q3 /2025 results.

- Equity / Assets Ratio: 11.88%

- Debt / Equity Ratio: 7.36 x

If we were to apply our P2P lender risk scale, Triple Dragon’s financial KPI would be classified as “moderate risk”. What’s worth pointing out is that in Q3 / 2025, Triple Dragon reports a net profit of 1.03 M USD.

- The annual overviews present pro forma consolidated figures in USD, derived from management accounts of the relevant group companies and prepared for internal reporting purposes only.

- The group is not required to produce audited consolidated accounts. Individual group company financial statements are prepared by external accountants or auditors and may be revised, which could affect these overviews.

- The figures are also subject to reconciliation differences and FX translation adjustments, to be resolved in the statutory accounts of each company.

- The consolidated overviews include income and assets/liabilities from ring-fenced SPVs, which may be subject to restrictions on distributions to the parent company.

Note that Triple Dragon fully hedges its foreign exchange exposure. As a result, the reported negative FX results do not reflect unhedged currency risk, but rather accounting adjustments that mirror current market conditions, as required by accounting standards.

Geographic Exposure of the Loan Portfolio

Triple Dragon operates mainly in countries with well-known and reliable legal systems. The current loan portfolio is focused on:

- United Kingdom

- Canada

- United States

There are a small number of borrowers located in EU countries such as Germany or Sweden. If a borrower is based outside the UK, Triple Dragon may create a UK-based SPV. The loan is then issued to this UK entity instead of directly to the foreign company.

This allows Triple Dragon to keep the legal framework and enforcement rules consistent.

At the moment, there are no active loans in the Middle East. The entity established in Abu Dhabi is not used for lending and exists only to support future regional expansion.

Lending to Game Developers Outside the UK

Triple Dragon only lends in markets it understands well. Differences between countries are usually limited, but local rules still matter. For example, in Canada, lending conditions vary by province. Some provinces are suitable for lending, while others are not.

To reduce risk:

- The team meets borrowers in person at international gaming conferences

- Relationships are built face-to-face

- Underwriting rules are adjusted based on borrower location and business model

The gaming industry operates globally, so borrowers often work across borders. This means geography alone does not define risk.

Collateral Requirements

All loans must be secured by collateral. The minimum collateral requirement is:

- At least 120% of the outstanding loan amount

In some cases, higher collateral levels are required, depending on:

- Borrower risk

- Type of collateral

- Revenue stability

Type of Collateral in the Current Loan Book

The loan portfolio is secured by different types of receivables. Current breakdown (January 2026):

- Tax credits and grants: 39%

- Publisher and platform receivables: 48%

- Other receivables: 13%

- User acquisition (UA) receivables: 0%

The collateral can be reviewed on the loan level. In this illustration, the loan is backed by tax credits. There are no major differences in collateral types by geography.

Loan Applications and Approval Rate

Triple Dragon does not publish detailed statistics on loan applications; however, during our research, we were able to review some of the borrowers ourselves. Triple Dragon informed us that most borrowers who approach Triple Dragon are rejected.

The main reasons for rejection are:

- Insufficient experience

- Weak or inadequate collateral

Rejection rates are similar across regions. The gaming industry is global, and developers often operate internationally rather than locally.

Loan Recovery Process – Real Example

Despite Triple Dragon having a low write-off rate, we were curious about its recovery process, so we requested a description of how it typically recovers defaulted loans.

Reasons for a default

In 2023, a borrower was affected by widespread project cancellations in the gaming industry. This led to staff layoffs and the inability to continue loan repayments.

Triple Dragon initiated a recovery process that included:

- IP ring-fencing: The game was moved into a separate legal entity to protect the asset

- Asset preparation: Critical bug fixes were completed so the game could be reviewed by publishers

- Grant applications: The borrower applied for external funding, games investment fund of a L2 protocol

- Phased repayment: Grant funds would first be used to repay the loan, with remaining funds supporting the game launch

During our research, we were curious whether the lender could share a best-case and worst-case recovery scenario, which would give the investor a better understanding of the recovery process and recovery time.

Best-Case Recovery Scenario

- Recovery strategy: Successful grant funding

- Expected recovery: Up to 100% of the outstanding amount

- Expected timeframe: 2–3 months

Worst-Case Recovery Scenario

- Recovery strategy: Revenue from a mobile game version published by a third-party publisher

- Expected recovery: 25%–50% of principal

- Expected timeframe: Up to 18 months

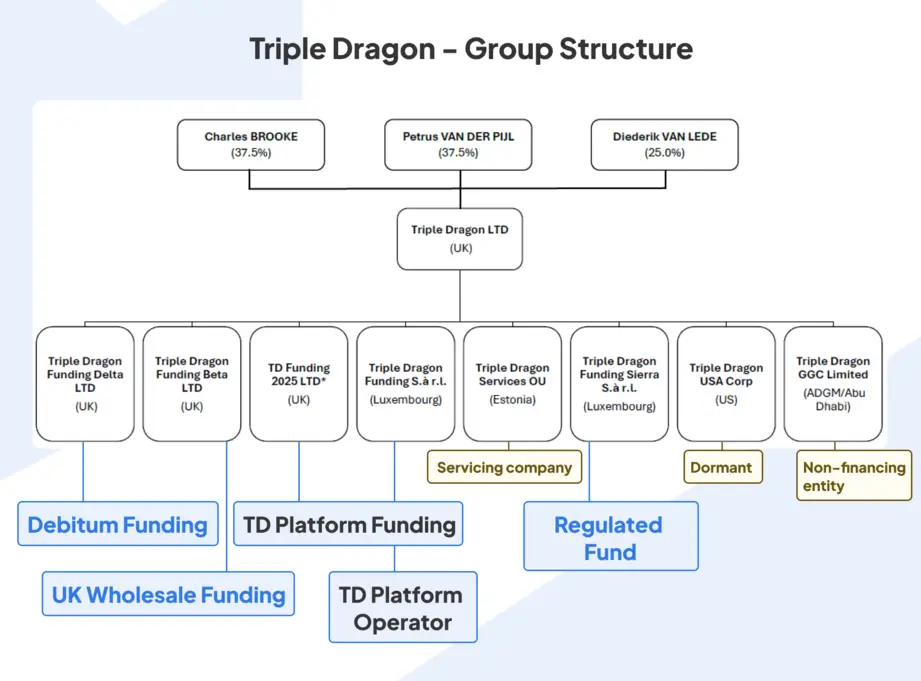

Triple Dragon - Structure

This chart shows the group structure of Triple Dragon. It helps investors understand how the company is organised and how different funding activities are separated.

Each funding source operates through its own special purpose vehicle (SPV). This means the money, loans, and risks of one funding source are legally separated from the others.

Every SPV has its own security structure, so assets are not mixed across platforms or lenders. These SPVs hold loans that are used as collateral for these facilities.

For the TDF platform, the security is registered at the UK Companies House. This makes it publicly visible and easy for third parties to verify. The assets of the TDF platform are pledged to TD Funding 2025 Ltd. under a first-ranking debenture. This is the strongest form of security priority.

The debenture also includes a negative pledge. This means the SPV is not allowed to use the same assets as security for any other lender.

Because this security is publicly visible, other funders can see that these assets are already pledged. As a result, they are unlikely to lend against them, since they would only receive second-ranking (weaker) security.

Overall, this structure is designed to clearly separate funding sources, protect investors’ claims, and avoid overlapping or conflicting security interests.

Crowdfunding Regulation

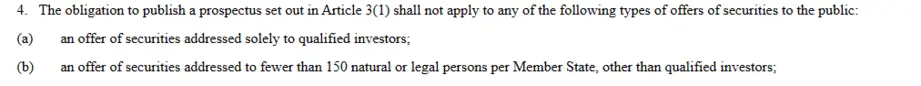

As of today, Triple Dragon is not regulated by any regulatory framework (MiFID II, ECSP). Triple Dragon plans to apply for the license at the end of Q2 2026.

The licensing process may take up to 12 months, as this would be the first CSP license issued in Luxembourg. Once the application is submitted, the timeline will largely depend on the regulator.

In the meantime, the platform operates under an exemption in the EU Prospectus Regulation (Article 4(b)). Under this exemption, each investment offer is limited to a maximum of 149 investors per EU member state.

This setup was confirmed with a legal opinion, which we have reviewed during our due diligence process. Unfortunately, the platform informed us that it should not be publicly available because it could serve as a roadmap for competitors.

Buyback Obligation

The Triple Dragon Funding platform includes a 90-day buyback obligation provided by the underlying SPV, TD Funding 2025 Limited.

This means that, under defined conditions, the SPV is responsible for buying back loans from investors that are more than 90 days past due.

To support this obligation, Triple Dragon is contributing a significant amount of its own assets to TD Funding 2025 Limited.

These assets are used to strengthen the SPV’s balance sheet and improve its ability to meet the buyback commitment. The initial capital contribution is at least EUR 3 million and may increase to up to EUR 5 million over time.

This capitalisation is intended to provide an additional financial buffer for investors and reduce the risk that the SPV will be unable to fulfil its obligations.

Platform Infrastructure Risk

The TD Funding platform’s technical infrastructure is outsourced to a third-party provider, White Label Solutions. This company is owned by SIA WIN WIN INVESTMENTS.

The same white-label system is used by other platforms, including Ventus Energy, Devon, and Asterra Estate. This setup creates certain risks for investors.

These include potential data access by third-party employees and reputational risk. If another platform using the same system were to fail, it could negatively affect confidence in other platforms supported by White Label Solutions.

According to Triple Dragon, there is no overlap in ownership or conflicts of interest between the software provider and the lender’s core business. Additionally, the platform is the owner of all data which is stored on the cloud, together with a copy of the platform's code.

Further Risks

As with any investment, there are risks that are simply outside of the platform’s control. This could be delays in paying out tax credits or payments under co-development contracts.

Additional default risk by underlying debtors, such as platforms, app stores, and game publishers, is present.

Reliance on New Investor Funding

TD’s business model is not dependent on continuous new investor inflows. If new funding were to slow or stop completely, the company would continue collecting repayments from existing loans.

These cash flows would be used to repay investors in full, with any remaining margin retained as profit.

The interest charged to borrowers is higher than the interest paid to investors and other funding sources, providing sufficient margin to service all obligations without relying on new inflows.

New loans are funded primarily from retained profits, supporting organic portfolio growth rather than refinancing old obligations with new investor money.

Returns

Given that Triple Dragon Funding will be offering loans secured by tax credits, receivables, and contractual payment rights - all mechanisms that have been polished and refined over the past 10 years - the prospect of earning 14% per year is highly attractive.

Is TD Funding Safe?

In this section of our Triple Dragon Funding review, we will analyse the platform’s team, including the shareholders and the CEO.

Who owns the platform?

TD Funding is owned by Triple Dragon Limited, established in December 2016 which in turn is owned by three shareholders.

- Pieter van der Pijl - Pieter has many years of experience in cross-border mergers and acquisitions (M&A) and finance transactions. He combines this financial background with a strong focus on the video games industry. Pieter is a co-founder of Triple Dragon and is responsible for sourcing, analysing, and structuring gaming-related financing deals.

- Diederik van Lede - Diederik is a corporate lawyer based between London and Brussels. He has advised on numerous large-scale M&A transactions, including deals worth several billion euros. His experience covers Europe, the Americas, Asia, and Africa. He also serves as a non-executive director on the boards of several international companies.

- Charles Brooke - Charles has 18 years of experience in finance and long-standing involvement in the video games industry. He began his career in private equity, with a focus on real estate, and later became an active startup investor. His investments span fintech, video games, and educational software. In 2015, he founded his private investment company, Warwick Capital, and in January 2017, he co-founded Triple Dragon.

Our research about the owners did not yield any findings related to controversies or misconduct.

Who operates the platform?

Triple Dragon Funding is operated by a team of experienced professionals in the P2P lending sector. Most of the staff have been working with Triple Dragon for multiple years, which is a testament to the company’s ability to retain and reward their employees.

- Vitalijs Zalovs - CEO - Joined Triple Dragon in 2025 (former CEO at Esketit)

- Jozua Laudams - Head of Portfolio Management - joined Triple Dragon in October 2023

- Ritesh Thadani - Head of Business Development - joined Triple Dragon in February 2022

- Kaloyan Dimitrov - CFO - joined Triple Dragon in 2019

Are there any suspicious terms and conditions?

During our onboarding process, we have reviewed the terms and conditions and requested clarifications on a few terms.

TOU 15.2: Why are user accounts terminated after three months of inactivity even if a positive balance exists?

As we plan to apply for a CSP license, we avoid holding client deposits. Investor deposits are therefore treated as advance payments for claim rights. If funds are deposited but not invested, they are returned after three months.

This prevents the platform from being used to park funds and avoids additional regulatory scrutiny. It also limits onboarding and KYC/AML costs for investors who do not invest.

TOU 21.1.2: Please explain the purpose and necessity of this clause.

This applies only in exceptional cases where there is a suspected fraud risk, for example when the verified investor appears to be acting on behalf of someone else.

In past cases, it was clear that accounts were managed by individuals other than the person who completed the remote verification. In such situations, we will cover travel costs for in-person verification, ensuring the process is transparent and cannot be manipulated.

TOU 30: Notification of changes to the T&C

Changes to the Terms of Use will not apply retroactively and will not affect existing user rights, such as current assignment agreements or purchased claims. Normally, users will be notified at least 30 days in advance. However, immediate changes may be made if required by law or regulation, for example, to comply with updated KYC or AML requirements.

We have reviewed all legal documents and have not spotted any anomalies or clauses that would require further clarification. As terms and agreements tend to change over time, we suggest reviewing the latest versions before using the platform, to ensure that you understand the risks and rights associated with the investment on TD Funding.

Conflict of Interest

Some SPVs (for example, A One Games) are used only for technical and operational purposes. Their role is to manage bank accounts and handle invoice collection and payments under contracts.

These SPVs do not generate profits for Triple Dragon or TDF and do not give the platform any financial upside. For this reason, they are not considered ownership conflicts.

In some cases, Triple Dragon may receive additional benefits such as equity options, equity kickers, or revenue-sharing rights linked to a game. Whenever this happens, it is clearly disclosed on the platform.

If equity kickers or similar rights are agreed, they usually sit with the originating entity, typically TD Funding 2025 Ltd. This means these assets form part of the overall security available to investors.

Usability

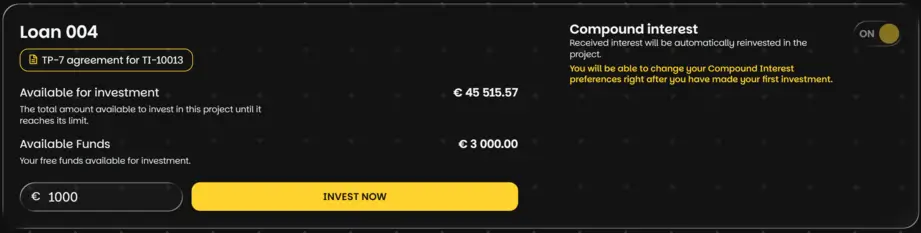

Triple Dragon Funding doesn’t offer an auto-invest feature, so you will need to invest manually in individual loans, which you can review under the “Invest” menu item in the left navigation.

To proceed with an investment, you will need to click on the “Request investment offer” button. This process is required to ensure the platform complies with the regulatory exemption requirements mentioned earlier in our review.

In the next step, you will need to tick the radio button that you acknowledge your investment and click on “Continue”.

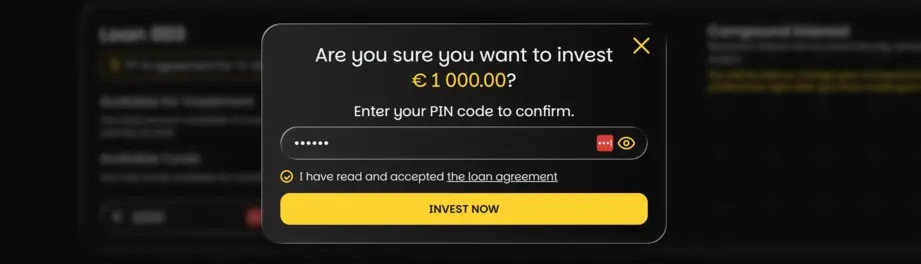

In the following step, you will be required to enter your investment amount (minimum €1,000), review the loan agreement, and activate or deactivate the compound interest feature.

In the final step, you will be requested to type in your PIN code, which you defined when you registered on the platform.

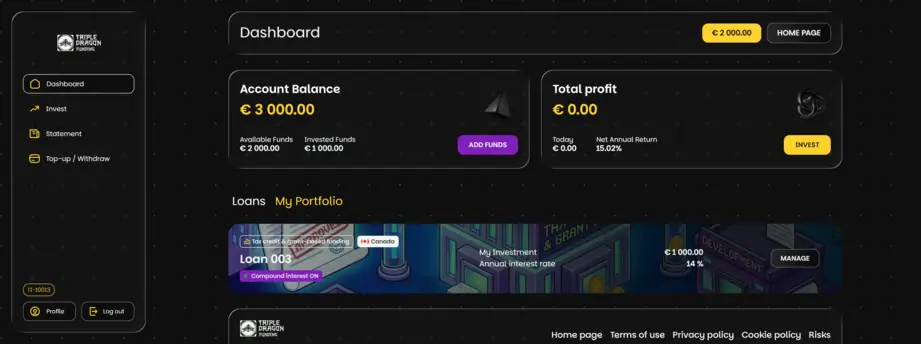

After you have invested in a specific loan, you can review your investments in the investor dashboard by clicking on the “My portfolio” tab.

Compound Interest

The compound interest feature allows you to automatically reinvest your daily interest into the same loan, enabling compounding over time.

Additionally, this feature enables you to avoid having uninvested funds sitting in your investor account.

If you prefer to withdraw your interest or allocate it to a different loan, this feature can be disabled at any time after investing. Simply navigate to your portfolio, select the loan, and deactivate the compound interest feature.

Liquidity

Triple Dragon Funding offers an early-exit feature that allows investors to list their loans on the secondary market after a defined holding period. For newly listed loans, this minimum period is six months.

Once a loan is listed for sale, other investors can purchase it either in full or in parts, depending on available demand.

As the platform is still being tested, this feature is not yet fully operational, which means we cannot currently assess its real-world liquidity or exit reliability. Investors should therefore assume a minimum holding period of six months.

Most loans are expected to have a two-year maturity, which should be considered the base-case investment horizon.

Support

During our review of Triple Dragon Funding, we were in regular (often daily) contact with the CEO, Vitalijs Zalovs, whom we already know from his previous role at Esketit.

He addressed our questions promptly and professionally, with response times typically within a few hours. Based on this experience, we assess the communication at the management level as reliable and efficient.

That said, investors should not automatically expect the same level of responsiveness from standard platform support. For general inquiries, the support team can be contacted via email at info@tdfunding.eu.

TD Funding Alternatives

TD Funding is a newly launched platform and currently operates without regulatory oversight.

If you prefer investing via regulated platforms with a longer operating history and established track records, the following Triple Dragon Funding alternatives may be more suitable.

Indemo

Indemo is a Latvia-based, regulated investment platform focused on discounted, mortgage-backed loans from Spain. Its key value proposition is the potential for above-average returns, currently targeting at least 15.1% per year.

Investors should note that these are recovery-focused investments, with an expected investment horizon of around two years. This means that, aside from possible cashback incentives, both interest and principal are typically received only after the recovery process is completed. You can learn more in our in-depth Indemo review.

LANDE

LANDE is a regulated crowdfunding platform specializing in agricultural loans from Latvia, Lithuania, and Romania. The platform has been operating for several years and has built a solid track record, supported by a relatively high level of transparency regarding loan performance and portfolio quality.

A well-diversified LANDE portfolio can generate average returns of around 10% to 11% per year. One notable advantage is the availability of a secondary market, which allows investors to exit positions before loan maturity. Further details are available in our LANDE review.

Nectaro

Nectaro is a well-known, regulated Latvian P2P lending platform offering investments in loans from Moldova, Romania, and the Philippines. The platform is known for strong loan availability and relatively high yields, typically ranging between 12% and 14.5% per year.

Although Nectaro does not offer a secondary market, most credit lines are short-term and tend to be repaid within approximately one year, which helps limit liquidity risk. You can find a full breakdown in our Nectaro review.