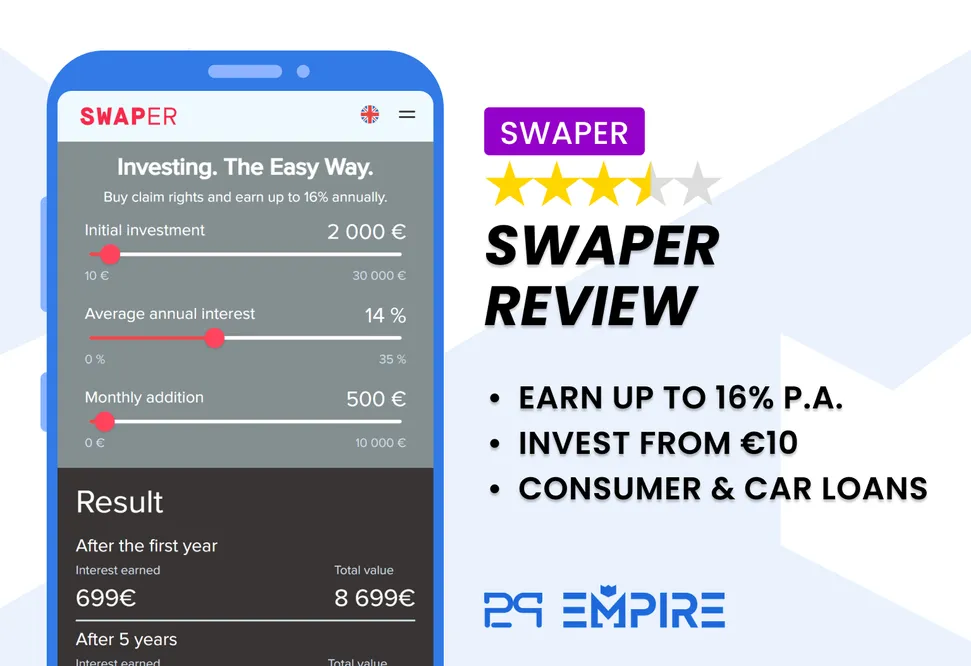

Swaper Review Summary

Swaper is an Estonian P2P lending platform offering short-term consumer loans with a 60-day buyback guarantee and annual returns of up to 14%. Backed by Wandoo Finance Group and One Leasing, it provides options to automate investments through an intuitive Auto Invest feature and offers a secondary market for early exits.

While Swaper has a solid track record of protecting investors' capital since 2017, regulatory changes in Poland have led to the use of an intermediary to fund loans, raising some concerns.

Investments in Latvia and Northern Macedonia remain unaffected by these shifts, making Swaper a convenient yet cautious choice for European investors seeking high-yield opportunities.

Main takeaways from our Swaper review:

- Lack of transparency

- Easy-to-use platform

- Responsive support

- Unsecured loans with a 60-day buyback guarantee

Does Swaper sound like your kind of platform?

Or explore other P2P platforms.

What is Swaper?

Swaper is an Estonian peer-to-peer (P2P) lending platform that lists pre-funded unsecured consumer loans from the Wandoo Finance Group and One Leasing from Northern Macedonia. Swaper offers a 60-day buyback guarantee and an Auto Invest feature.

Find out more about whether this P2P lending platform is a good fit for you in our Swaper review.

Our Opinion of Swaper

Swaper has successfully safeguarded investors' capital since its launch in 2017, navigating challenges such as the 2020 pandemic and the 2022 war in Ukraine without withdrawal issues.

A significant portion of Swaper’s loans originates in Poland, where regulatory changes in 2024 prohibit funding consumer loans via retail investors.

Unlike competitors that delisted Polish loans, Swaper introduced a workaround through SW Finance, an intermediary company licensed in Estonia. This intermediary offers business loans on Swaper to indirectly fund Wandoo Finance Group loans in Poland.

While the platform maintains a 14% interest rate and a 60-day buyback guarantee, the regulatory risks persist. If Polish authorities enforce the new rules, Wandoo Finance’s lending license could be at risk, increasing exposure for investors.

Swaper also provides short-term loans in Latvia and car loans in North Macedonia, both seemingly unaffected by regulatory shifts.

However, while Swaper has a history of protecting investors, this doesn’t guarantee future outcomes. Investors should remain cautious and consider the potential risks tied to evolving regulations.

Swaper Promo Code

Many P2P lending platforms offer new investors a cashback bonus or promo code. Swaper chooses a different bonus structure.

Active investors with an average portfolio size of over €25,000 over three months can receive a 2% loyalty bonus through an increased interest rate for their investments in Wandoo Finance and SW Finance loans.

You don't need any unique Swaper Promo Code to get your bonus.

Is this ticking your investment boxes?

Requirements

To sign up on Swaper, you must be over 18 and reside in the European Economic Area. You must also have a bank account listed in your name from your country of residence. You can also open a business account with Swaper if that interests you.

No EUR bank account? No problem

- 💳

- 💳

Transferring money to Swaper is equally quick and easy; it only took us one day to transfer our money from our N26 bank account using a SEPA transfer.

Risk & Return

When investing in P2P lending, you should be aware of the risks that come with it. Swaper has a business model similar to platforms such as PeerBerry or Robocash.

All platforms list primary loans from partners closely related to the founders of the P2P lending sites.

Swaper’s Buyback Guarantee

In cases where the borrower is late for their loan repayment by more than 60 days, the loan originators on Swaper will repurchase the claim that you (the investor) have with the borrower. This includes the invested principal and accrued interest.

Swaper’s buyback guarantee is the same protection scheme as many other P2P platforms.

Is Swaper Safe?

That’s one of every investor's most important questions before signing up and transferring funds to Swaper. In this section of our Swaper review, we will conduct due diligence about the platform’s team and their terms and conditions.

Let’s jump right into it.

Who Runs the Company?

In 2021, Swaper appointed a CEO, Indrek Puolokainen, to oversee the company's progress.

Who is the Company’s Legal Owner?

Finding the legal owner of Swaper required quite some effort as their website doesn’t provide any relevant information.

During our research, we found a name - Marina Tjulinova - in one of the Estonian business registries. She appears to be the platform owner, as stated in the latest financial report.

Marina Tjulinova owns Swaper Platform OU (Estonia), currently in the role of Head of Operations and an IT development company Neotech Development OU (Estonia).

The connection between Wandoo Finance and Swaper

Iveta Bruvele is the founder of Wandoo Finance SIA (Latvia) - which was involved in the launch of the Swaper platform.

Wandoo Finance SIA (Latvia) was seeking investments in 2017, and Neotech Development OU (Estonia) was willing to provide them, for which the company became a shareholder of Wandoo Finance SIA (Latvia).

Marina Tjulinova is, therefore, a partial owner of Wandoo Finance.

Wandoo Finance launched Swaper SIA (Latvia) to fund its loans. The company then moved to Estonia for regulatory reasons, and Swaper Platform OU (Estonia) emerged.

Are There Any Suspicious Terms and Conditions?

Look at what we found when reading Swaper’s terms and conditions.

Clause 3.10 - Separation of Funds

In section 3.10, you can read how your funds are kept. We were not content with how Swaper phrased this clause as it was unclear that the funds are kept in segregated bank accounts.

We contacted Swaper, who confirmed that the company has two bank accounts. One for the funds of investors and the second for operational purposes. From an accounting perspective, investors’ funds appear as Swaper liabilities on its balance sheet.

Clause 3.11 - Withdrawals

In section 3.11, you learn that Swaper shall fulfill your positive balance's withdrawal request at any time. This means that in case Swaper should encounter “problems” with withdrawals, they are legally in trouble.

It takes two business days to process your withdrawal request with Swaper.

Clause 4.4 - Liability

Like with any P2P platform, Swaper isn’t responsible for any losses that might result from investing in loans through the platform.

This is a standard clause that you will find on any P2P lending site. There is always a chance of losing all of your investments.

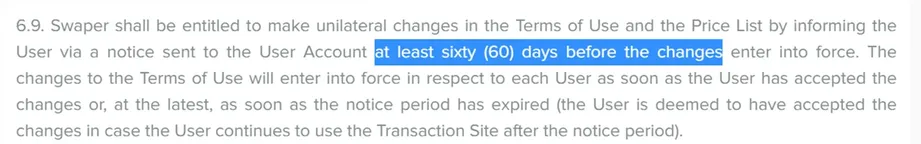

Clause 6.9 - Amendements to T&C

Swaper gives you sixty days' notice before changing any T&C. This should give you enough time to review the amendments and evaluate how it can impact your investments.

We see this clause as positive, as many platforms reserve the right to amend any T&C without prior notice, which disadvantages investors.

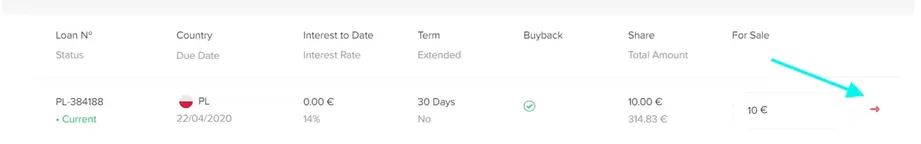

Do Investors Have Access to Individual Assignment Agreements?

You can only view the assignment agreement before you invest manually or setup your Auto Invest portfolio.

After you have invested in one loan, you can view the assignment agreement under My Investments. Then, click on the small red arrow to download the document.

Unfortunately, Swaper does not provide a template of the assignment agreement to unregistered users, so you can’t review it before creating and verifying your account.

Also, the platform doesn’t offer the availability to view loan agreements for already repaid investments, whereas other platforms give you this flexibility.

As the terms and conditions can change, we encourage our readers to review the agreements before investing.

Potential Red Flags

- Swaper uses a workaround to finance loans for the Wandoo Finance lending portfolio in Poland.

Usability

Swaper is very easy to use. The platform is aesthetically pleasing, with a modern look and all the essential features you’d expect. The navigation is intuitive, and you can find everything you need with a few clicks.

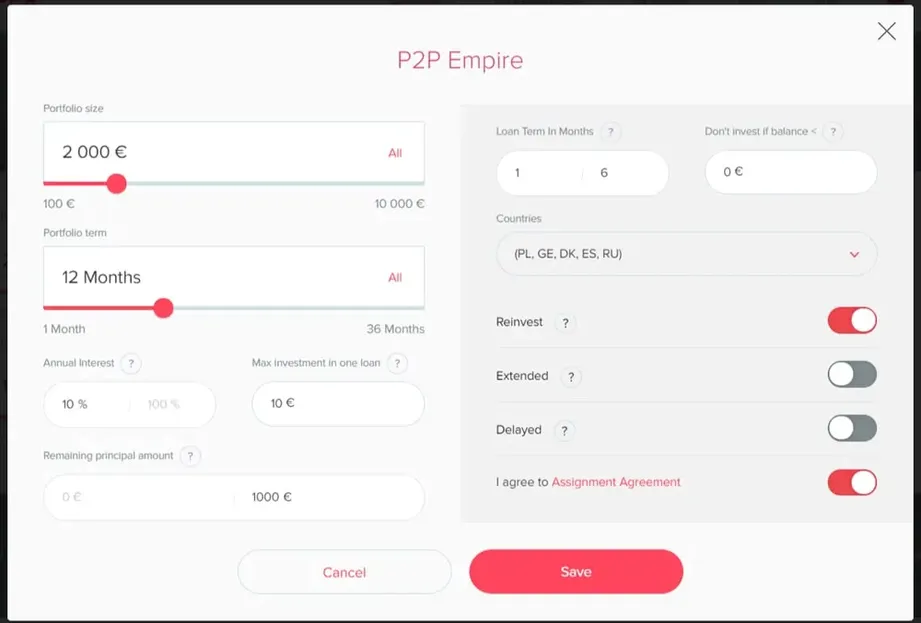

Auto Invest

Swaper, similar to many other P2P lending platforms, allows you to automate your investments. Setting up your Swaper Auto Invest feature takes no more than one minute. You can choose the following diversification options:

- Portfolio size

- Investment period

- Interest

- Investment amount per loan

- Minimum account balance

- Countries (Poland, Georgia, Denmark, Spain, Russia)

- Loan characteristics

You can also choose whether to reinvest your returns. After you have defined your preferences, save your settings and let Swaper do the rest.

Swaper App

If you prefer to use native apps for Android and iOS, you can download the Swaper mobile app and manage your investments from anywhere.

🧾Does Swaper deduct taxes?

Swaper doesn't deduct taxes from your earnings. You can download an income statement for the chosen period, which you can submit to your tax authorities when you file your taxes in the country where you have your tax residency.

Liquidity

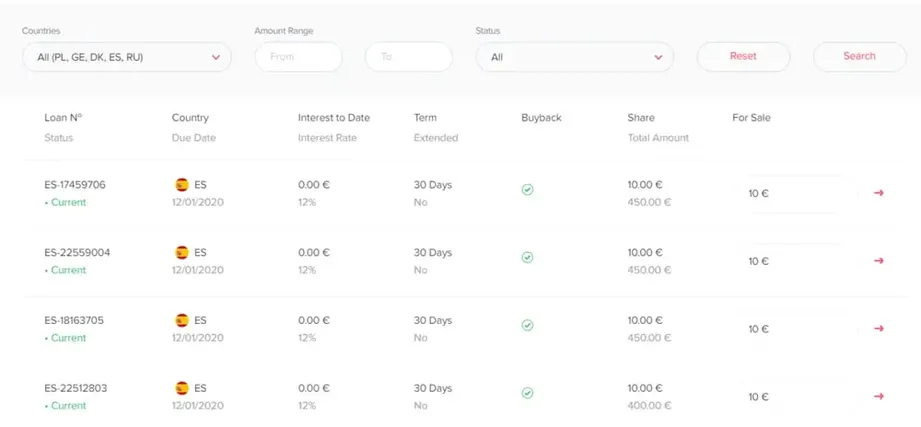

Swaper offers the option to exit the platform before the end of the loan term with its secondary market.

Secondary Market

Swaper makes withdrawing your money easy. You can sell your investments on the secondary market if you wish to withdraw your money before the end of the loan period.

However, note that trading on the secondary market isn’t something that you should practice regularly, as you’ll often sell your claims for a discounted price.

Support

Swaper’s customer support is very responsive. When we contacted the team, they responded within one hour.

Swaper’s customer support team can be contacted via live chat on their website browser or by email at info@swaper.com. If you prefer to chat over the phone, call them Monday through Friday from 9 a.m. to 6 p.m.

Swaper Alternatives

While Swaper offers attractive returns and has managed to protect investors' interests so far, the platform isn't very transparent about its lenders' financial performance, nor is it regulated. Those are just a few reasons you should consider some suitable alternatives.

Fintown

If you want to secure a higher interest over a longer period, Fintown might be a good fit. The Czech-based platform uses your funds to develop real estate rental properties in Prague.

The yield you receive is generated through rental income and is not affected by harsh regulatory rules like lending portfolios in Poland.

Learn more about how to earn up to 14% interest annually in our Fintown review.

Esketit

Esketit is one of the best-performing P2P lending platforms in Europe. Since 2020, it has paid more than €8M in interest to its investors with no capital loss.

The platform offers broad diversification options and attractive interest rates of up to 12% annually. Learn more about this platform in our Esketit review.

LANDE

If you want to invest your funds on a regulated platform, LANDE might be just the right option. This Latvian platform secures your investments with collateral, which can be liquidated if the borrower doesn't repay the loan.

The platform offers a variety of investment opportunities that yield up to 12% per year. Learn more about LANDE in our LANDE review.