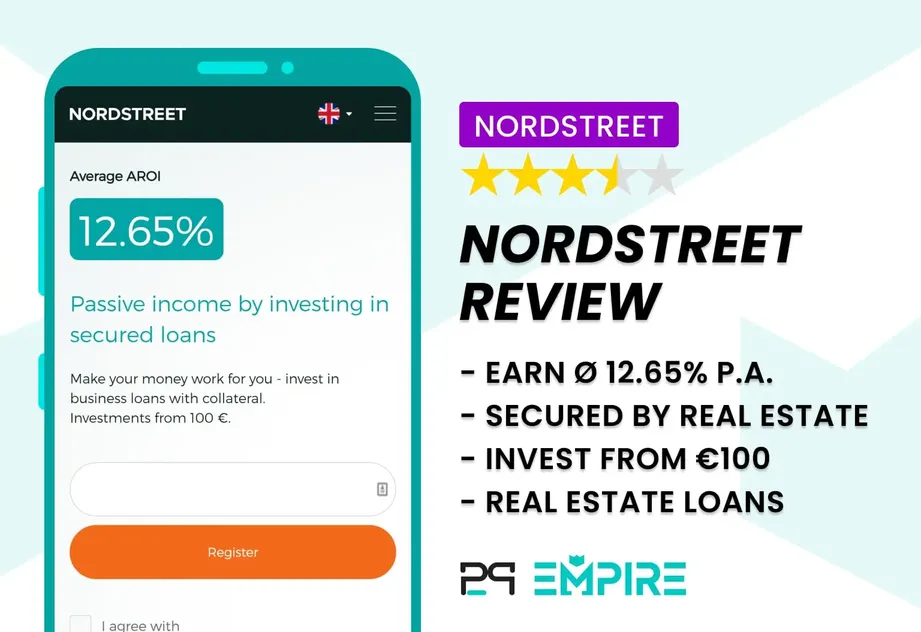

Nordstreet Overview

Nordstreet is a small real estate crowdfunding platform from Lithuania. The P2P platform lists real estate and business loans from and around Vilnius which are backed by collateral or guarantees. Investors earn on average around 12.65% interest per annum. Nordstreet is also one of the few platforms that are regulated by the Bank of Lithuania. Find out whether you should join Nordstreet in our comprehensive Nordstreet review.

Requirements

In order to invest in Nordstreet you need to be over 18 years old and have an active Paysera bank account.

Paysera is an e-money licensed institution that provides bank services to many of the European P2P lending sites. You can register your free account here.

To complete your registration, you need to fill out some personal information such as your address and phone number. You also need to accept the loan agreement as well as the terms of the platform, which we will look into later.

If you have a Paysera bank account already, the registration and verification are quite fast. In the last step of the verification process, you are required to answer Nordstreet’s anti-money laundering questions.

The setup with the Paysera bank account certainly adds more security to your funds as they aren’t stored in a separate platform’s account but managed by a licensed third party which is regulated by the Bank of Lithuania.

Risk & Return

Your investments on Nordstreet are backed by a first-rank or second-rank mortgage. According to the website’s statistics, the average Loan-to-Value is only 33%.

If this is correct, it would mean that the value of the collateral must drop on average by 33% for you as an investor to make negative returns.

There are, however, more factors to consider.

Valuator

The evaluation of the property is conducted by a licensed real estate evaluation company.

As we write this Nordstreet review, there is only one real estate project available for funding. The valuator of the collateral is Nill Nill UAB. Unfortunately, the evaluation is only available in Lithuanian. You can have a look at the document here.

The report looks quite convincing, however, we could not find any presence of the Nill Nill UAB on the internet. Typically, we would expect to find a website, where the company presents its services and licenses.

Do Your Research

Before investing on Nordstreet, you should conduct your own due diligence about individual projects and evaluate the collateral.

Project Inspection

When investing on Nordstreet, you have to pick your investments manually, which is very typical for real estate investments overall.

The project description of Nordstreet projects is well structured. All of the aspects of the loan are well explained and clear.

We have to point out that some platforms like Flender or Bulkestate hide important project information from users who didn't invest in a real estate project.

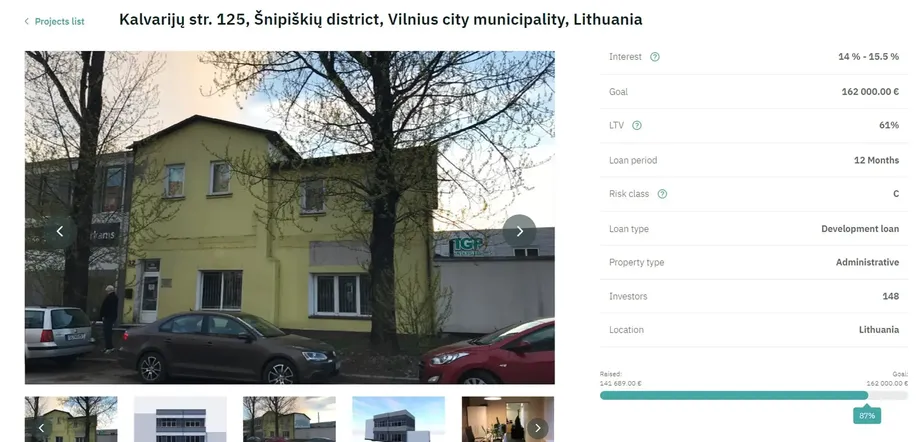

In this case, the loan has a loan term of max. 12 months, whereas the borrower may not repay the loan sooner than in six months. If that would be the case, the borrower will need to pay at least six months of interest.

This is a rather positive clause that most real estate platforms don’t mention.

This concrete real estate loan is secured by a first-rank mortgage. Investors that invest a higher amount of capital can increase their interest rates by up to 1.5% per annum.

Find out here how the bonus is structured:

- When investing from €100 - interest 14%

- When investing from €5,000 - interest 14.5%

- When investing from €10,000 - interest 15%

- When investing from €30,000 - interest 15.5%

Nordstreet also informs its investors about the financial aspect of the loan such as the LTV and repayment plan. In this particular case, the interest is being paid on a monthly basis, whereas the loan principal is due at the end of the loan period.

In the P2P lending industry, we refer to this loan type as a “full bullet loan”.

To sum it up, the project description gives you a good overview of the loan terms, however, there are two sections that could be improved.

Project Developers

The section about the borrower is very short and not particularly meaningful. As investors, we would certainly appreciate more information about the borrower rather than two sentences.

You can find more information about the project developers in Lithuania by reading the evaluation report, which does not make Nordstreet a very user-friendly platform.

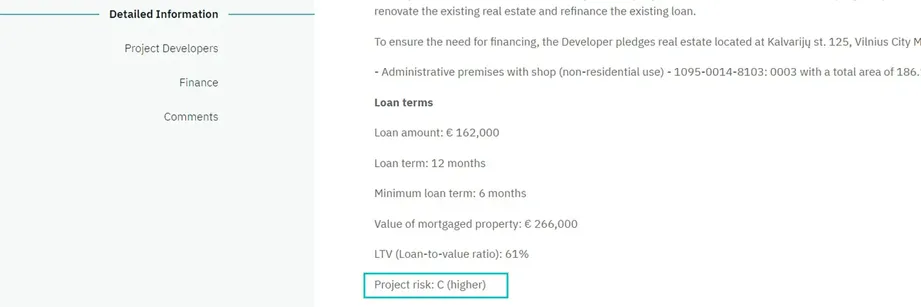

Project risk

The second remark that we have is regarding the project risk rating by Nordstreet.

We are aware that Nordstreet does their final due diligence based on the data they receive about the borrower, however, there is no explanation about the different risk levels and why this borrower received a project risk grade of C.

More transparency in this field would be certainly appreciated.

Is Nordstreet safe?

The safety of your investments on Nordstreet is also affected by the terms and conditions as well as Nordstreet’s management.

Who Leads the Team?

If you want to get to know the people behind the platform, you won’t be able to find them on Nordstreet’s websites. We had to look at EvoEstate to find out that Nordstreet’s CEO is Tadas Budrikis.

We have no idea why he and his team isn’t presented on the platform’s website and his LinkedIn profile also doesn’t give much information about his previous experience either.

Who Owns Nordstreet?

Nordstreet was co-founded by Tadas Budrikis and Linas Kliukas. While we haven’t found much information about Tadas, according to LinkedIn Linas is also the managing partner of a recruitment company called ‘We Rabota’. Neither gentleman is mentioned on any page of the website or in their terms and conditions. We are not aware of other shareholders of Nordstreet.

Nordstreet didn’t explain why this is the case. Apparently, they will be mentioned on the platform in the near future.

Are There Any Suspicious Terms and Conditions?

After reviewing more than 30 P2P lending platforms we have developed a good sense of spotting suspicious terms and conditions that might have a negative effect on your investments. Let’s have a look at what we have learned about Nordstreet’s terms and conditions.

Clause 3.3 - Investment rules

It’s important to mention that the loans on Nordstreet aren’t pre-funded, which means that in order for you to invest in a loan, it needs to be funded first.

In the case where the real estate loan could not reach the funding target, all of your reserved funds will be unlocked for further investments.

Clause 4.1 - Separated Funds

Nordstreet does not have any right to access your funds in your Paysera account unless it aligns with the terms and conditions of the loan agreement.

Your funds are stored in your Paysera accounts and Nordstreet doesn’t have access to it unless you give the platform the consent by entering into a loan agreement.

This setup is much safer as compared to the way other platforms handle the transactions and storage of your funds.

Clause 8.2.2 - Additional Safety

Every time a project developer (borrower) enters into a contractual agreement, the company needs to declare that all the provided information is accurate.

This clause gives some additional legal security that most platforms don’t mention in their terms and conditions.

Clause 11.5 - Amendments

And here we go again.

Like many other platforms, Nordstreet reserves the right to amend the terms and conditions without prior notice.

If you have read our other reviews, you should know by now that we dislike this type of clause as they typically have a negative effect on the investors.

To be fair, Nordstreet also states that any changes won’t apply to your previous loan agreements, which gives you more legal ground in case things go sideways.

Do Investors Have Access To Individual Loan Agreements?

Investors have access to individual loan agreements in their profiles. Unfortunately, Nordstreet doesn’t provide a template, so unless you invest you cannot analyze the document but need to rely on information in the general terms and conditions.

Apart from very little information about the co-founders and CEO of the platform as well as the right to amend the terms and conditions, we haven’t found any suspicious information.

There is certainly a lot of room for improvement when it comes to the transparency of Nordstreet. Currently, the platform is very secretive about the shareholders and the team which is why we decided not to invest our money on Nordstreet at the moment.

Potential Red Flags

- No information about the team

- No information about the financials of Nordstreet

- Right to amend the terms and conditions without prior notice

Nordstreet is regulated by the Bank of Lithuania which gives more credibility to Nordstreet's operations compared to non-regulated platforms. The lack of transparency on Nordstreet's website is something that concerns us. We have decided to not invest on Nordstreet until this is resolved.

Usability

When it comes to the usability of the platform, Nordstreet offers several useful features such as the Auto Invest, a Secondary Market or an account statement.

Auto Invest

Nordstreet has recently launched its Auto Invest, which allows you to automate your investment strategy. The tool enables you to invest in business loans or loans secured by real estate pledge.

You will also be able to choose the investment amount, loan duration, interest, risk class, collateral as well as the country in which you would like to invest.

Nordstreet could be compared with Profitus, which is also a Lithuanian real estate crowdfunding platform. Profitus tends to have a higher availability of loans which are mostly used to finance real estate projects in smaller Lithuanian cities as compared to Nordstreet, which lists projects in and around Vilnius.

Personally, we prefer to invest in metropolitan areas as the volatility of the property value tends to be more stable even during more turbulent economical cycles.

Availability of Loans

As we had notified you at the beginning of our Nordstreet review, the average investment size is quite high. Nordstreet lists new loans on a daily basis which means that you won't suffer from cash drag.

Liquidity

If you are just starting out, liquidity is something you should prioritize until you get more familiar with P2P lending.

Nordstreet won’t give you the liquidity you might be looking for. The real estate loans on Nordstreet tend to have a loan duration between 12 and 21 months.

During this time, your money is locked but you have a chance to exit your investment on the secondary market.

Currently, we are not active on Nordstreet which is why we can't comment about the action on the secondary market. We are, however, active on EvoEstate where you can also invest in loans from Nordstreet and liquidate your position within a few days.

The benefit of EvoEstate is also the fact that you can resell your investments on the secondary market and withdraw your money before the end of the loan term, should you need it.

If your goal is to build a well-diversified real estate crowdfunding portfolio, EvoEstate is certainly worth the consideration.

Support

Nordstreet has a Live Chat function and you can also reach them by contacting support via email. During our analysis of the platform we sent eleven questions to Nordstreet and the support got back to us within 24 hours.

The quality of the answers was in most cases ok, however, Nordstreet avoided sharing information about its shareholders and for some of the answers, we would expect a bit more in-depth information.

Nordstreet Review Summary

Nordstreet is an interesting alternative to EstateGuru.

Here are the main takeaways from our Nordstreet review:

- Nordstreet is suitable for long-term investors that want to invest in property-backed loans in Lithuania

- Most investors would prefer to invest in Nordstreet's projects through EvoEstate due to the higher liquidity

- The availability of loans is rather impressive

While Nordstreet can be an alternative to other real estate platforms, we have a hard time understanding the added value investors would get by investing in Nordstreet as compared to other real estate P2P platforms.

Not quite convinced yet? Try other real estate P2P platforms instead.