Afranga Review

Afranga is a Bulgarian P2P lending platform that lets you invest in business loans from various lenders, including Stikcredit. This P2P lending platform allows you to earn 10% to 13% interest per year by investing in loans secured by a company's assets. Find out more about this platform in our Afranga review.

The following video offers you an introduction to Afranga. Keep in mind that this video was recorded before Afranga receiving the crowdfunding licence. To learn more about the platform's current state, read our Afranga review.

Pros

- Reliable platform with a good track record

- High interest rates

- Easy-to-comprehend loan structure

- Regulated

- High level of transparency from all lenders

- Individual Lemonway accounts for investors

Cons

- Limited diversification

- Features such as the auto invest and secondary market are not available yet

Our Opinion of Afranga

Afranga is a smaller but well-established P2P lending marketplace based in Bulgaria. It serves as one of the funding channels for its lending partner, Stikcredit, which has been active in the consumer lending sector since 2013. You can review the financial statements from Stikcredit and other lenders on Afranga in our "Loan Originator" section above.

From a legal and operational standpoint, the newly relaunched Afranga platform offers improved investor protection. It now operates under a direct loan structure, utilizes individual Lemonway accounts, and has enhanced transparency around risk disclosures.

Although the platform now operates within a regulated framework, key features such as auto-invest and a secondary market are still missing. In our view, Afranga remains underdeveloped technically. That said, both features are expected to be reintroduced in the near future.

Strategically, Afranga aims to expand into a pan-European marketplace for business loans from various external lenders. This ambition comes with increased risks.

Unlike with Stikcredit, where Afranga has complete insight into the loan book, the platform will have less oversight and control over third-party lenders. Investors should approach such listings with greater caution.

The main appeal of Afranga lies in its above-average interest rates, which are generally higher than those offered by more established competitors. However, these rates are not guaranteed to last.

You can review our position on Afranga in our P2P portfolio.

Afranga Bonus

Readers who sign up through our partner link will receive a 0.5% cashback bonus on all investments made within the first 90 days after registration. You don't need any special Afranga referral code to redeem your bonus.

Requirements

You need to meet specific requirements to earn interest by investing in loans on Afranga.

- Be over 18 years of age

- Have citizenship in an EU / EEA country

- Have a bank account in an EU / EEA country

- Be a resident in a country with equivalent AML/CFT standards, like in the European Union.

- Pass the verification process.

Afranga lists loans in EUR, so we recommend depositing money from your EUR account to avoid currency exchange fees. Afranga advises only transferring EUR to your account.

Risk and Return

Afranga began its operations in early 2021. The platform is backed by the Bulgarian lender Stikcredit, a name familiar to many experienced investors.

Until March 2025, Afranga operated without formal supervision. It has since relaunched as a regulated platform, now offering business loans issued by Stikcredit.

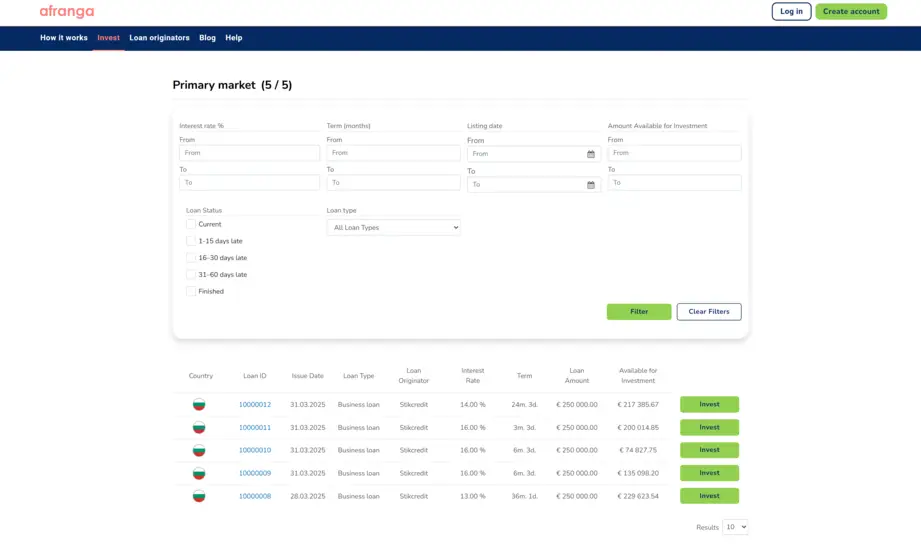

Loan durations range from 6 to 36 months, with interest rates between 11% and 16%. Repayments are made monthly and cover both interest and principal. You can find Stikcredit’s latest financial report in the statistics section above.

Stikcredit AD is licensed and regulated by the Bulgarian National Bank, while Afranga falls under the supervision of the Bulgarian Financial Supervision Commission.

Afranga has recently onboarded several lending companies with strong financial performance, giving you a broader range of investment opportunities with different rates and loan terms. You can review the financial metrics in our "Loan Originator" section above.

Secured by the company's assets

Business loans on Afranga offer enhanced security and transparency for investors. Unlike platforms where investments are made through SPVs acting as intermediaries, Afranga uses a direct loan structure.

This setup provides clearer documentation of the loan agreement, making it significantly easier to prove the amount owed in the event of borrower default. Investors hold a direct claim against the loan originator, which simplifies legal recovery and enables both individual and collective legal action if necessary.

The introduction of a regulated framework has further strengthened investor protection. Borrowers are now fully liable for the loan with all their company assets. This marks a notable improvement over the previous structure, where investors held fragmented claims across individual loans—often making it difficult to assess the exact exposure and recovery potential.

To properly assess risk, investors should review the loan originator's financial reports. As of the end of 2024, Stikcredit reported total assets of €28.3 million.

In our recent discussion with the CEO, it was emphasized that Stikcredit has consistently honored its obligations, with no reported payment delays—highlighting its reliability as a lending partner.

Stikcredit's Loan Book Performance

In 2023, the net impairment costs for loans and receivables totaled approximately €3.63 million (BGN 7,098 thousand), representing a decrease of approximately €1.02 million compared to 2022, when impairment costs reached €4.66 million (BGN 9,103 thousand).

In 2024, however, impairment costs rose again to around €5.07 million (BGN 9,911 thousand). This increase corresponds with the growth of Stikcredit’s loan portfolio but also indicates a rising share of non-performing loans.

According to the CEO of Afranga, Stikcredit’s default rate currently represents about 12% to 15% of its loan book. While the platform has scaled its lending activities, this level of defaults highlights the importance of continuously monitoring credit risk as the portfolio grows.

You can learn more about the CEO and the company’s vision in the exclusive interview below.

Is Afranga Safe?

If you are considering investing in loans, you should thoroughly research the platform’s management and the terms and conditions.

Who Leads the Team?

Afranga is led by Svetlin Sabev, who co-founded the platform in 2021 and now serves as its sole shareholder. With eight years of experience in the lending industry, Sabev launched Afranga out of frustration with the inefficiencies of working with other marketplaces. His main goal was to create a reliable funding channel for Stikcredit.

The platform is supported by a team of professionals, although their profiles are not currently listed on Afranga’s About Us page. We’ve raised this point with the CEO, so it’s possible that a team introduction will be added in the near future.

Who Owns the Platform?

Afranga was founded in December 2020, is funded by StikCredit, and is owned by Stefan Topuzakov, Kristian Kostadinov, and Svetlin Sabev. In 2023, Svetlin Sabev acquired 100% of the company and is since then the sole owner.

Discover more about the CEO and the platform's future plans.

Usability

Afranga is a straightforward platform to use. The design is clean and you can easily navigate to all the essential information that you might require. It’s much easier to navigate than IUVO’s platform, an unregulated P2P marketplace based in Bulgaria.

Primary Market

The recently relaunched Afranga platform currently does not offer an auto-invest feature. Currently, investments can only be made manually on the primary market. According to the CEO, the auto-invest will be reintroduced in the upcoming weeks.

Afranga SaveSmart

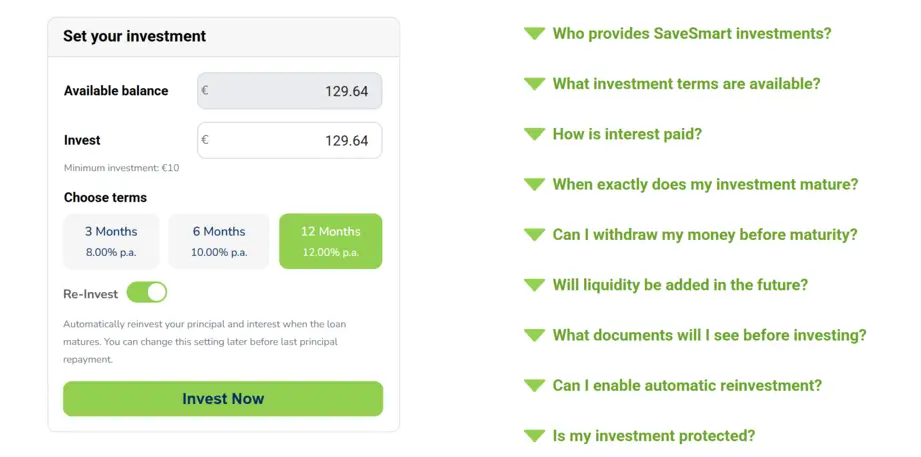

Afranga has launched SaveSmart, a fixed-term investment product offering predictable returns with locked maturities.

Investors can currently choose between three terms: 3 months at 8%, 6 months at 10%, and 12 months at 12%. Interest is paid monthly, while the principal is returned at maturity. If enabled, the principal can be automatically reinvested into a new SaveSmart term.

SaveSmart is not a savings account or bank deposit. Structurally, investors provide a private loan to the loan originator (currently Stikcredit), facilitated by Afranga. This means capital is exposed to loan-originator risk and is not protected by any deposit guarantee scheme.

Liquidity is not available at launch. Investments cannot be withdrawn early, and the maturity may extend slightly beyond the nominal term (up to one additional calendar month). Afranga states it may introduce liquidity features in the future, but no timeline is confirmed.

From a regulatory perspective, investments fall under the ECSP framework, and investors receive standard documentation such as the KIIS and loan agreement before investing.

In practice, SaveSmart resembles fixed-yield products offered on other P2P platforms: predictable returns, simple structure, but full exposure to originator credit risk and platform risk.

🧾Does Afranga deduct taxes?

According to Bulgarian law, the withholding tax rate for income from interest on loans is 10%. If you earn €100 in interest income, Afranga must withhold 10% (€10) and report it to the national revenue agency. Investors will have access to a tax statement they can use for their annual tax filings.

Liquidity

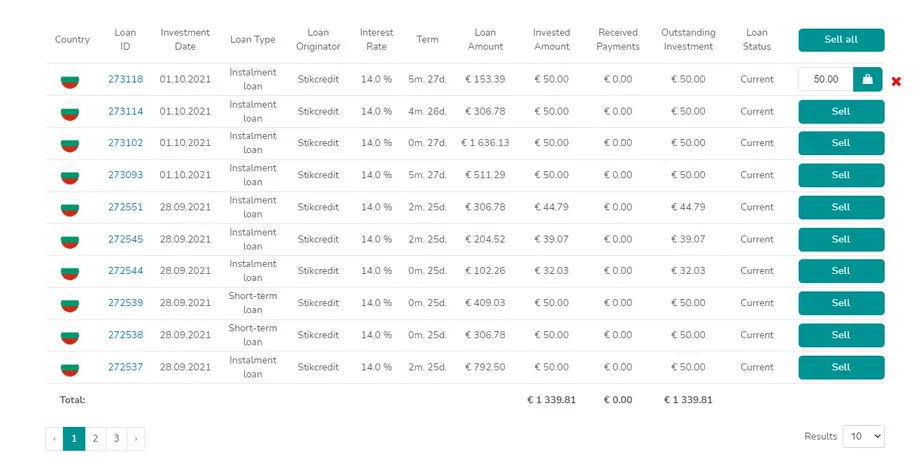

Afranga previously offered access to a secondary market, allowing investors to sell their loans. To do so, you would navigate to My Investments, select the loans you wish to sell, and confirm your selection.

You would then be redirected to the secondary market view, where you could set a premium or discount for each loan.

The time it takes to sell a loan depends on the loan amount and the current investor demand on the platform. Some users have reported successfully selling loans within a day.

At the time of writing this Afranga review, there is no fee for using the secondary market.

Please note: If you're expecting to receive accrued interest, you will need to wait until the loan is fully repaid.

Currently, this feature is not yet available on the newly launched version of the platform.

Support

Afranga’s support is very responsive. The platform answered our questions within 24 hours. Afranga didn’t hesitate to provide further details that are not publicly available on the website, which we appreciate.

You can reach out to Afranga during business hours at support@afranga.com.

Afranga Alternatives

While Afranga offers competitive interest rates, you might want to prioritize platforms that offer a technically better platform, with a larger variety of loans.

Income Marketplace

Income Marketplace is an Estonian P2P lending platform that allows investors to diversify across lending companies from Europe, Asia, and the Americas.

All loans come with a buyback guarantee, and many lending partners also pledge their loan books as additional security—offering an extra layer of protection for investors.

With returns of up to 15% per year, the platform provides an attractive option for those seeking high-yield opportunities. To learn more, check out our detailed Income Marketplace review.

LANDE

Based in Riga, LANDE is a Latvian investment platform focused on agricultural loans secured by grain, insurance, or other forms of collateral.

The platform stands out for its transparency and strong track record in safeguarding investors’ funds. If you're looking to invest in collateral-backed loans, LANDE ranks among the top choices in 2026. For more insights, read our full LANDE review.

Nectaro

Nectaro is a regulated Latvian P2P lending platform that primarily offers high-yield investments sourced from EcoFinance, operating in Romania, Moldova, and the Philippines. The platform features a modern interface and frequently offers cashback to investor, boosting your overall returns.

With interest rates of up to 14% per year, Nectaro is an appealing option for yield-focused investors. Explore more in our in-depth Nectaro review.