VIAINVEST Review Summary

VIANVEST is a regulated platform offering investments in asset-backed securities, which generate an annual yield of 12%. The platform is suitable for investors willing to invest in consumer loans from Sweden, Czech Republic or Latvia. P2P Empire rates the platform 3.5/5 as the company doesn't always act in the best interest of the investors.

Key Takeaways From Our VIAINVEST Review:

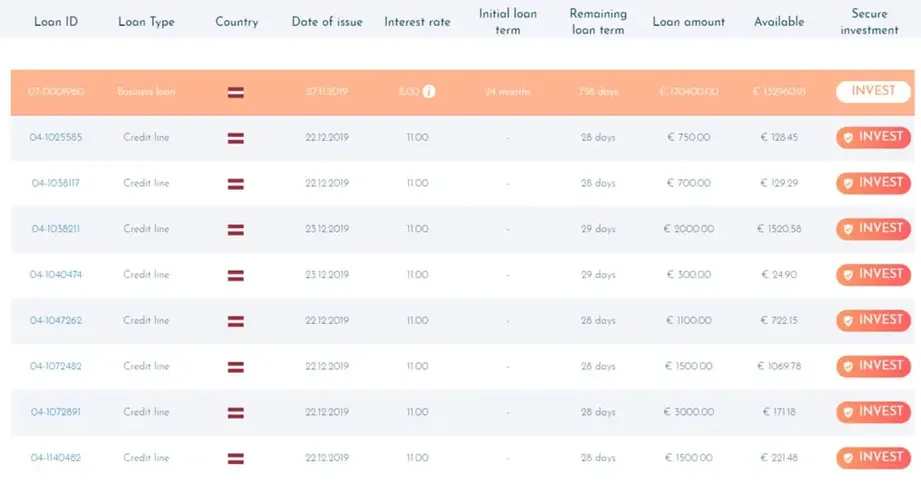

- High availability of loans

- Regulated platform

- High interest rates

What is VIAINVEST?

VIAINVEST is a Latvian peer-to-peer (P2P) lending platform that lists unsecured personal and business loans backed by a buyback guarantee. Investors can earn up to 12% interest annually by investing in asset-backed securities. Learn more about the platform in our VIAINVEST review.

Pros

- No cash drag

- 12% interest rate

Cons

- Not always acting in the best interest of investors

- Outdated design

- Exposure to markets with higher regulatory risks

Our Opinion of VIAINVEST

Overall, our due diligence on VIAINVEST did not raise any red flags. The platform’s terms and conditions are transparent and fair, offering stronger legal protection than what we've seen on many other P2P platforms, which provides a solid foundation for investors should any disputes arise.

While we have thoroughly tested VIAINVEST in the past, the platform's outdated usability and lack of liquidity left much to be desired. The transition from investments in claim rights to loan securities led to the removal of the buyback guarantee, leaving investors locked into credit lines that extended for over two years. As of May 2024, VIAINVEST has repaid 60% of these credit lines, with a commitment to fully repay by June 2024.

This lengthy resolution highlights that the platform prioritizes its own interests over those of its investors. Many investors reported that their auto-invest settings were altered without their consent during the transition, which added to the frustrations experienced throughout the process.

VIAINVEST’s interface feels outdated and lacks crucial performance-oriented data about the loan book quality, making it difficult for investors to make informed decisions about the loans they are investing in. While the platform offers regulated investment opportunities with consumer loans, particularly in Latvia and Sweden, with durations of at least 180 days and interest rates of 12%, other platforms in the space provide a more modern experience without the added burden of handling tax certificates.

Although the platform has yet to cause any financial losses to investors, you should be cautious. Any unexpected regulatory changes could negatively impact liquidity or increase risks. If you choose to invest with VIAINVEST, be prepared for potential delays and complications when navigating these evolving circumstances.

Requirements

To invest on VIAINVEST, you need to meet the following requirements:

- Reside in Europe

- Have a European bank account

- Be over 18 years old

- Fill out the appropriateness questionnaire

No EUR bank account? No problem

- 💳

- 💳

The minimum investment amount on VIAINVEST is only €50, and you can use SEPA transfers to deposit funds to your VIAINVEST investor account.

Please note that the transfer to your bank account might take up to two days. Make sure to upload a copy of your ID in compliance with the KYC (know your customer) regulations. This is especially important when withdrawing money from VIAINVEST.

VIAINVEST also allows you to register as a business if that’s what you want.

Risk & Return

Awareness of the risks of investing in a particular P2P lending platform is essential. As an investor, you should be mindful of the protection scheme for your investment.

Investing in ABS

VIAINVEST is a regulated investment firm, meaning you won't invest in assignment agreements or claim rights but in asset-backed securities.

An asset-backed security is a financial instrument comprising a bundle of loans with similar characteristics.

There are no substantial benefits for investors investing in ABS instead of loans. The risk of a particular investment in a bundle of loans remains the same.

Unsecured Consumer Loans

On VIAINVEST, you primarily invest in consumer loans with a loan duration of at least 180 days. Most of the listed loans originated in Latvia and Sweden.

According to the Key Information Sheet that VIAINVEST provides to its investors, this financial product is 5 out of 7 on the risk scale, which is a medium-high risk class. This rates the potential losses from future performance at a medium-high level and poor market conditions will likely impact the capacity of borrowers to repay the loans.

Buyback Obligation

According to VIAINVEST, if the borrower fails to repay the loans for more than 60 days, the loan originator will repurchase the loan from the investors and repay the principal and the interest.

Based on our experience with VIAINVEST, we can confirm that any offered buyback obligation from this platform isn't a reliable protection scheme. VIAINVEST has previous disabled the buyback obligation for credit lines which were extended for over two years.

20% Tax Deduction

As a regulated investment firm, VIAINVEST is legally obliged to deduct 20% tax from your earnings on the platform. The tax rate can be deducted to 10% or 0% depending on the country where you are a tax resident.

To apply a lower tax rate, you must upload a verified tax certificate in your profile settings. Click here to find out which tax rate applies to you upon submission of the tax certificate.

If your country has a double-taxation agreement with Latvia, the taxes you pay in Latvia will be deducted from the taxes you owe in your country. That way, you won't be taxed twice.

For further details, consult a certified tax advisor in your area.

Is VIAINVEST Safe?

VIAINVEST has been around since 2016. The platform is operated by its parent company VIA SMS Group, a profitable lending company operating in five European countries. VIA SMS Group was founded in 2009.

We at P2P Empire conduct our due diligence about the team and the platform’s terms and conditions to better understand our legal rights and the people managing our investments.

Who Runs the Company?

VIAINVEST is run by Eduards Lapkovskis, also a Member of the Board at VIA SMS Group, the parent company of the VIAINVEST investment platform. On VIAINVEST’s website, Eduards is also listed as a Member of the Board for the VIAINVEST platform. According to his LinkedIn profile, he supervises all business processes, financial planning, and decision-making.

Eduards has been with the company since 2010, and he has worked for several years in the banking industry in Russia.

Who’s the Company’s Legal Owner?

VIA SMS Group’s main shareholder and co-founder is Deniss Sherstjukovs, who is also involved with day-to-day business and product development.

Our research found that there is also a second shareholder, Georgijs Krasovickis, who also happens to be a Board Member.

Are There Any Suspicious Terms and Conditions?

Having a look at the T&C should be part of your due diligence. VIAINVEST’s user agreement is only 15 pages long, so it shouldn’t take too long to wrap your head around the most important clauses. Here is a summary of our research.

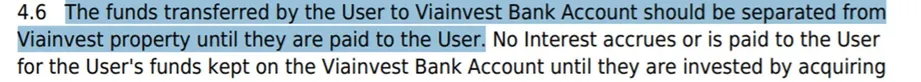

Clause 4.6 - Storage of Funds

Your uninvested funds on the platform are stored in separate bank accounts and do not belong to VIAINVEST’s property.

This gives you good legal ground in case you encounter any withdrawal difficulties. Section 4.4, VIAINVESTs claims that the company shall process your withdrawal request within two business days.

Clause 13.2.3 - Liability

P2P lending isn’t risk-free, and the P2P lending marketplace VIAINVEST isn’t liable for any losses from investing on the platform.

This is a standard clause that’s used by every P2P lending site. Please educate yourself about the risks and business model of the investment platform and evaluate whether the returns are worth it before signing up and investing your money.

Clause 9.1.3 - Amendments

VIAINVEST is entitled to unilaterally at any time amend and supplement the

valid order execution procedure without notifying the Customer.

Potential Red Flags

- VIAINVEST can amend the terms anytime without notifying the users

- The platform has removed the "initiate buyback" button from its credit lines

- VIAINVEST has amended the Auto Invest settings for investors without prior consent

- The buyback obligation is not always being honored

Usability

The P2P platform consists of valuable and essential features that you might already be familiar with if you invest on other P2P lending sites.

You can either invest in available loans manually or automate your investments based on your preferences.

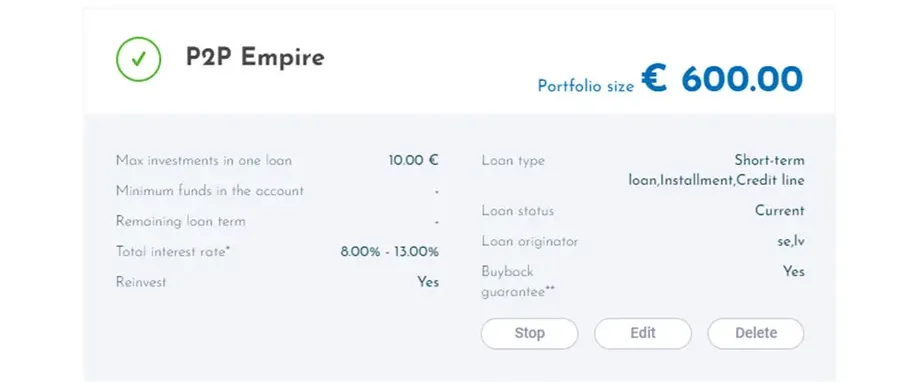

Auto Invest

This platform’s Auto Invest tool is a great feature you are most likely already aware of. Setting up your Auto Invest on VIAINVEST is simple and will only take a few minutes.

You can choose between various settings aligned with your investment strategy. Note that the availability of loans from specific loan originators depends on market conditions.

In year, the minimum investment per asset-backed security is €50.

Liquidity

If you want to withdraw your money from VIAINVEST, you’ll need to wait until the end of the investment period, as there is currently no secondary market for selling your investment. As most of the loans listed on the platform come with six months, you should expect to be unable to access your funds for at least six to eight months.

If liquidity is important to you, investing on platforms that list short-term loans is currently the best solution.

Products such as Bondora's Go and Grow, which promise high liquidity, aren't always reliable, and using them will often expose you to higher risk.

Support

VIAINVEST’s customer support is very responsive; whenever we’ve contacted them, we receive an answer within a few hours.

You can reach the customer support team via their website’s live chat or email at support@viainvest.com. You can also call them at +371 66102939 on weekdays from 8 a.m. to 5 p.m. (Fridays until 4 p.m.).

VIAINVEST Alternatives

While VIAINVEST eventually resolved most of the critical issues that caused investors a lot of frustration in the past few years, it may not be the best platform if you are looking for a hassle-free investment experience. Some of the following platforms may be more reliable options.

Esketit

Esketit is a Latvian-based P2P lending marketplace owned by the founders of AvaFin, an established lender in Europe. The platform has been operating for several years without any issues. Investors can invest in a broadly diversified lending portfolio, earning up to 11% annually. Esketit offers automated investment strategies that enable investors to exit a portfolio quickly rather than wait until the end of the loan period. Read our Esketit review to learn more about the platform.

PeerBerry

PeerBerry is considered the most sustainable platform in the industry. Thanks to the company's group guarantee, more than 94% of the war-affected loans from Russia and Ukraine were repaid. This is not even close to what other companies such as TWINO, Debitum or Mintos repaid to its investors. While the loan availability can be low on PeerBerry due to the high demand from investors, it's certainly a platform to consider if the protection of your funds is essential to you. Learn more about PeerBerry in our PeerBerry review.

Crowdpear

Crowdpear is a regulated Lithuanian platform offering mortgage-backed investments. It's run by the team behind PeerBerry, and so far, the platform has not experienced any defaulted loans, which means that the terms and conditions are being honored. You can earn up to 12% by investing in secured loans. Learn more about this platform in our Crowdpear review.