If you've been considering investing in Loanch or simply exploring new P2P lending opportunities, it's time to hit the brakes. Loanch might present itself as a promising investment platform, but after a closer look, there are several red flags that investors should be aware of.

What Loanch Claims to Be

Loanch positions itself as a loan marketplace, implying that it offers access to a variety of lending opportunities. However, the reality is quite different.

The platform only provides investments in two lenders: Ammana from Indonesia and Tambadana from Malaysia. Here’s the kicker—both of these lenders are owned by the same parent company, Fingular.

Fingular, in turn, owns Loanch. This makes Loanch more of a fundraising arm for its own companies rather than a true loan marketplace. While many P2P lending platforms fund their own affiliated companies, the issue with Loanch goes much deeper.

The Fingular Connection

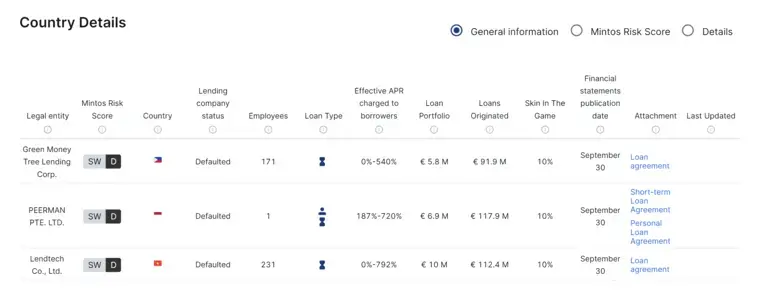

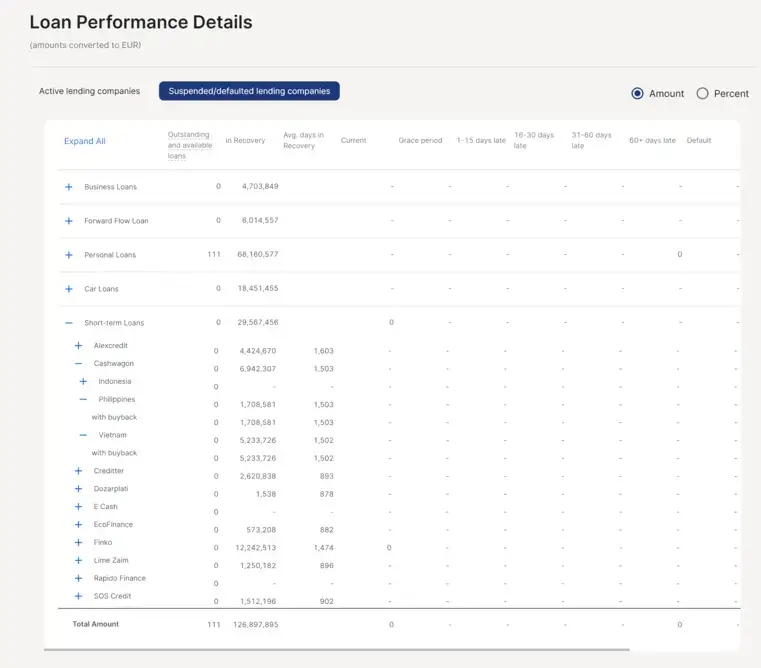

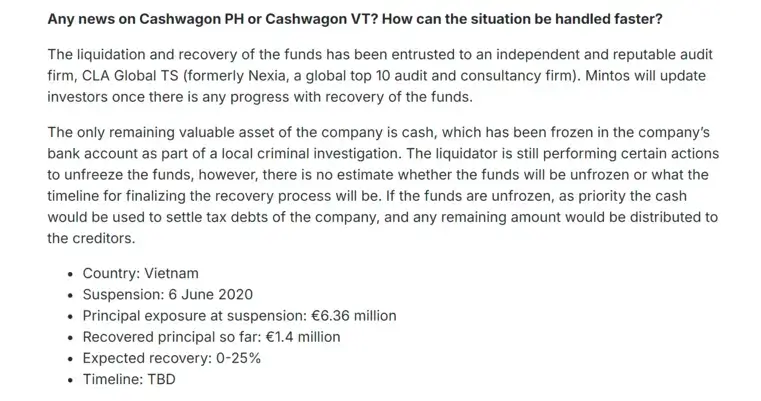

Fingular is owned by Russian entrepreneur Maxim Chernushenko, who has a controversial history in the P2P lending world. If the name Cashwagon rings a bell, you might remember it as the ill-fated platform that operated in the Philippines, Vietnam, and Indonesia. Cashwagon raised money for several lenders in these countries, but all three lenders defaulted in 2020, leaving investors in the lurch.

As of today, investors are still waiting on over €6.9 million in unpaid loans.

The last update from Mintos, a well-known P2P lending platform, in March 2023 estimated that investors might recover anywhere between 0% and 25% of the funds. Not exactly promising.

Cashwagon’s Troubled Past

Cashwagon’s problems didn’t stop at defaulted loans. Its Vietnamese office was raided by police due to allegations of charging exorbitant interest rates and using aggressive debt collection tactics.

Despite this troubling history, Maxim Chernushenko is back, this time with Fingular and Loanch, setting up operations in Malaysia, Indonesia, and Sri Lanka.

The question is: should we really trust him with another round of investments?

The Affiliate Promotion Problem

What makes this situation even more alarming is that certain P2P promoters are actively endorsing Loanch as the "next big thing." These promoters stand to gain commissions through affiliate links when new investors sign up based on their recommendations.

A well-known German blog that frequently covers P2P platforms has also raised concerns. Despite identifying several red flags and even calling the platform "most likely a scam," the author still chose to invest his personal funds.

More concerning, however, is that the author continues to promote Loanch's cashback bonus campaign, seemingly prioritizing affiliate payouts over investor safety.

It’s worth noting that Loanch is offering some of the highest commissions seen in the P2P lending space—raising questions about the motives behind these promotions.

Fortunately, Loanch hasn’t gained significant traction yet. However, the high commissions and aggressive affiliate marketing suggest that this could change if more investors aren’t careful.

Final Thoughts: Protect Your Investments

As with any investment, it’s crucial to do your own research. Platforms like Loanch may seem appealing at first glance, but once you dig deeper, the risks become all too clear. Always be on the lookout for red flags, and remember—no one else will protect your investments for you.

In summary, our advice is simple: avoid Loanch. There are far better, more transparent platforms available for your P2P lending portfolio.

Loanch Alternatives

If you're not a risk-taker, Loanch might not be the right platform for you. Instead, consider exploring legitimate P2P lending platforms with established track records. Below are some top-rated Loanch alternatives that offer reliable and profitable investment opportunities.

Esketit

Esketit, a Latvian-based P2P lending marketplace, stands out by offering investments through carefully vetted lenders with proven business models. With annual returns ranging from 9% to 12%, Esketit provides a strong earning potential.

The platform also includes automated investment strategies that enhance liquidity and minimize the risk of cash drag. Currently, Esketit is one of the top-performing platforms in the industry. To dive deeper, check out our comprehensive Esketit review.

PeerBerry

PeerBerry is frequently recognized as one of the best P2P lending platforms available today. It offers a wide range of investment options, with returns between 9% and 12%, especially if you take advantage of their loyalty program.

The platform also features enhanced security measures to safeguard both invested and uninvested funds, making it an excellent option for investors seeking a secure and passive income stream. For more insights, read our detailed PeerBerry review.

Fintown

Fintown focuses on investments in operational rental units located in Prague, Czech Republic. After thorough research and an in-person visit to their headquarters, we believe their business model is sustainable and reliable.

If you're looking to avoid payday loans and prefer earning interest through rental yields, Fintown is an attractive alternative. Learn more in our Fintown review.

These platforms offer trustworthy alternatives to Loanch, ensuring you can invest with greater peace of mind while still enjoying competitive returns.