Debitum Review Summary

Debitum (previously Debitum Network) is a regulated Latvian platform that offers investments in small and medium-sized enterprises (SMEs). However, it has a controversial history. The company has been criticized for concealing information about its origins and defaulted loans from Ukraine.

Main takeaways from our Debitum review:

- Easy-to-use platform

- Not suitable for conservative investors

- Nontransparent communication

Read our Debitum review to learn more.

What is Debitum?

Debitum is a regulated Latvian platform offering asset-backed securities investments starting from just €10. Investors on Debitum can earn up to 15% annually.

Pros

- Intuitive investment platform

- Regulated in Latvia

Cons

- The community founded Debitum Network through a Token Generation Event (TGE), and the platform didn't honor its plans to develop usability for the DEB token

- No secondary market

Disclaimer

We are not affiliated with Debitum or any of its previous legal entities. This overview highlights key aspects of the platform’s development over the years.

Investors are encouraged to verify the information presented, as we do not continuously monitor the platform. As a result, we have removed the rating.

Nothing on this page should be considered investment advice. For transparency, we have included additional feedback from the management, who dispute some of the information provided.

Our Opinion Of Debitum

Debitum isn't suitable for conservative investors.

Origins

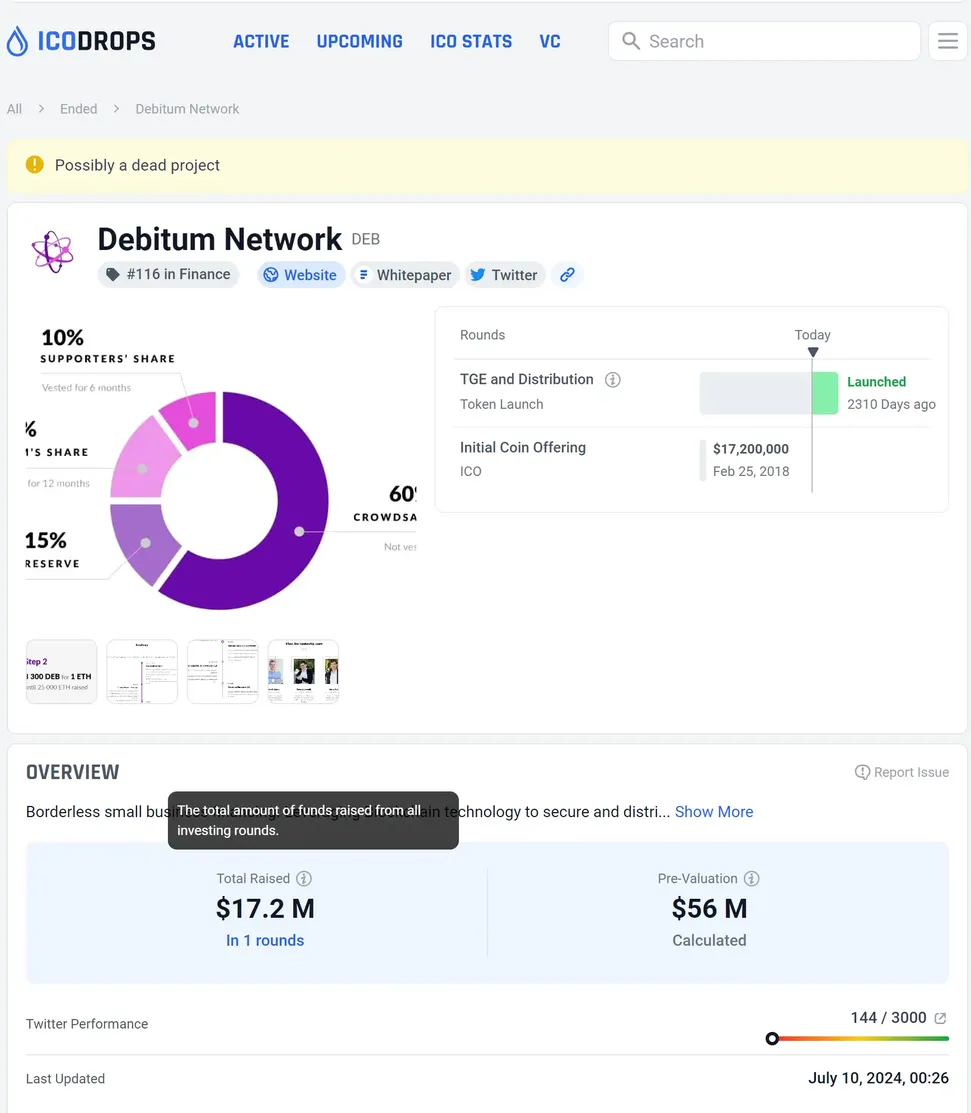

On March 13, 2018, the company—then operating under the brand name Debitum Network, managed by Prosperitu SIA—raised $17.2 million from backers. However, the company failed to deliver on the original promises outlined in the Debitum Network whitepaper.

Unfulfilled Promises

Debitum Network is committed to creating utility for the DEB token, providing holders with additional value. While the platform initially offered a few minor services where users could use the tokens, these offerings were limited in scope and impact.

Despite raising over $17 million—sufficient funds to launch in over ten countries—the company failed to expand as promised. This raises a critical question: where did the money go?

Management Changes and Lack of Transparency

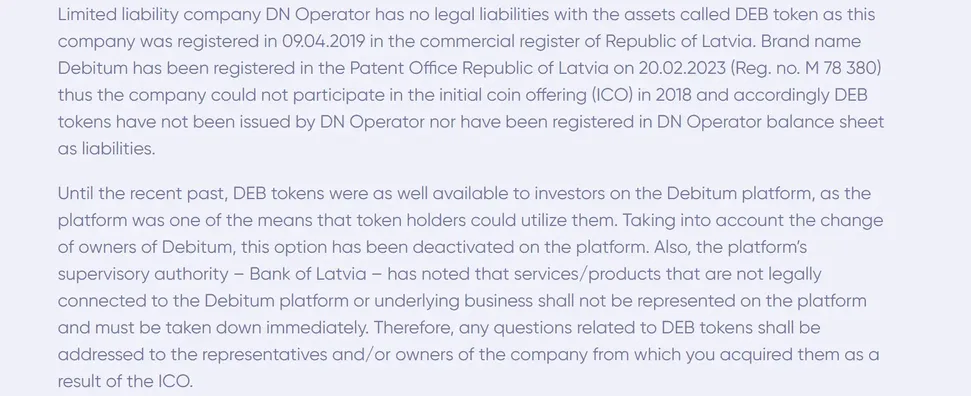

Over time, Debitum Network removed information about the DEB token from its website. The company rebranded from Debitum Network to simply Debitum, and in 2019, the platform operator was changed to a newly established entity, "SIA DN Operator," which had no connection to the external financing secured in 2018.

In July 2023, the former owner, Martins Liberts, sold the company "DN Operator SIA" to new owners: Henris Jansons, Ingus Samins, and Eriks Rengitis. During the transition, the new management explicitly stated that they were not liable for the DEB token asset. This action was approved by the Latvian regulator, raising concerns about potential regulatory cover-up.

Debitum's new management conducted an independent review of "SIA DN Operator," the current operator of the platform, which found no evidence of external financing. However, the review did not extend to other legal entities involved in the platform's development. You can view the new management's statement in this interview.

Feedback from the New Management

The legal entity behind the platform, Debitum Investments (DN Operator LLC), has no connection to the 2017 ICO or the DEB Token. This has been confirmed by our regulator, the Bank of Latvia, as part of the licensing process. The auditor Grand Thornton verified that Debitum Investments never used any funds related to the ICO and holds no liabilities associated with it.

Investor Concerns

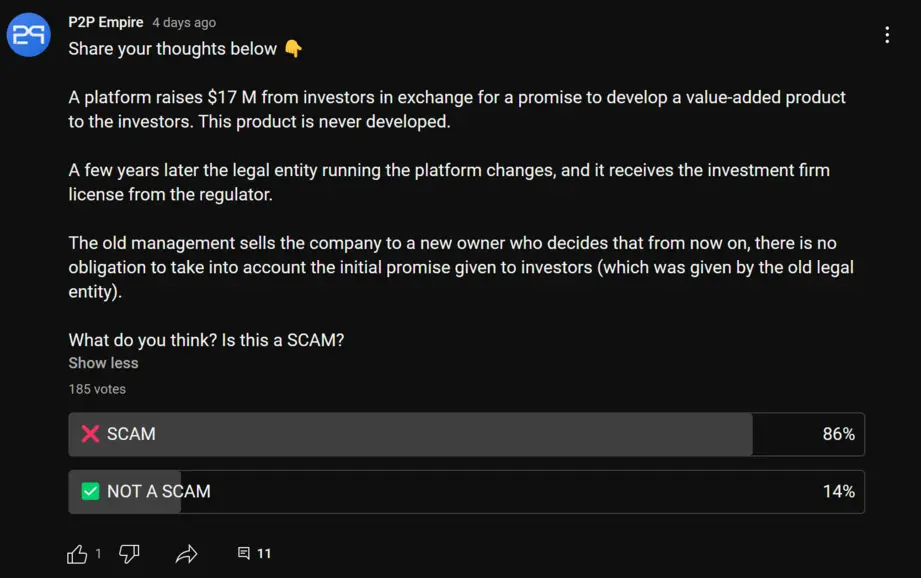

We surveyed our community of investors regarding Debitum's business practices, and 86% of respondents believe that Debitum is a scam.

As of month year, while Debitum has fulfilled its contractual obligations to P2P investors, it has neither returned the funds nor developed any value-added features for the original backers who funded the Debitum Network's development.

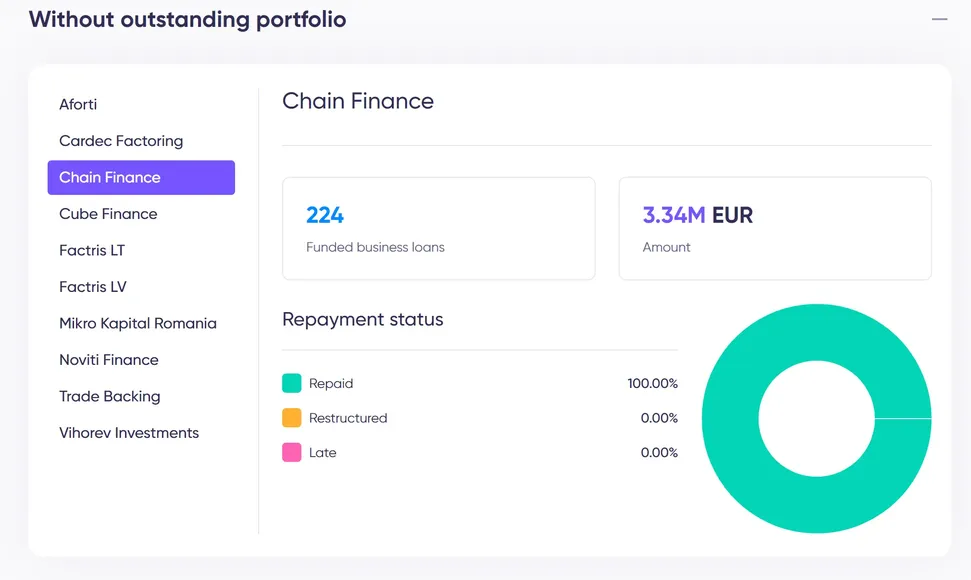

To our knowledge, €1.75 million of investors' funds remain trapped in Ukraine, despite Debitum's claim that all funds have been repaid. This is inaccurate.

In March 2025, Debitum added a disclaimer to the information about Chain Finance and its restructuring process.

Feedback from the New Management

Fact: War-affected Ukrainian loans are neither in default nor overdue. These loans have been legally restructured, with a legal opinion confirming our right to implement this process on behalf of investors.

Recent Developments

In July 2023, Debitum announced a restructuring of the debt in Ukraine via a three-party agreement through SIA DN Funding Alpha (owned by Debitum). The platform introduced a wishful repayment plan that would pay out the outstanding principal within six years after the war in Ukraine was over.

In a June 2024 interview, the new CEO mentioned that an external investor is interested in purchasing claim rights in Ukraine from affected investors at a 40% discount.

In February 2024, Debitum rebranded again to "Debitum Investments" and moved to a new domain, seemingly to distance itself from the negative reputation of Debitum Network.

Given the issues outlined above, we strongly discourage investors from using this platform.

However, if you choose to disregard the platform's history and practices and believe the new management has good intentions, you may continue reading.

Is Debitum Safe?

You should do your due diligence when choosing a new P2P lending platform.

Why?

We dug deeper than most financial bloggers, who are happy to praise Debitum for short-term commissions. Here is the result of our due diligence on Debitum.

Origins of Debitum Network

Debitum Network was founded by three Co-Founders Martins Libert, Donatas Juodelis and Justas Šaltinis.

All of them are connected to the Latvian factoring company Factris, which acquired another invoicing company Debifo back at the beginning of 2019.

According to the LinkedIn profiles of the co-founders Donatas Juodelis and Justas Saltinis, they are no longer active in developing the Debitum Network.

The three co-founders raised USD 17.2 M worth of Ethereum via a token generation event by issuing the so-called DEB token, which should have provided the users with potential returns.

Shortly after the issuance, the co-founders converted the raised crypto into fiat and funded the platform's development. None of the backers have ever seen a refund or benefit from the DEB token, which essentially funded the platform.

Who leads Debitum now?

Eriks Rengitis is the current co-owner and CEO of Debitum.

In 2023, the company was sold from the previous management to Mr. Rengitis. During the transaction, the management ensured that any trace of the DEB token would be erased to cover the ICO pursued by the initial founders.

Potential Red Flags

- Debitum Network raised millions from investors through the DEB token to fund the platform's development. None of the funds were ever returned.

- The platform changed its operators to hide their obligation towards its initial backers, who provided $17 million in initial funding.

- Information about the outstanding portfolio from the Ukrainian lender Chain Finance is not well represented on the platform.

- The platform presents a 0% default rate, which is inaccurate by industry standards.

Debitum's ICO and the DEB Token

Experienced investors may recall that Debitum Network participated in a Token Generation Event (TGE), where the platform sold DEB Tokens, a type of utility token, to contributors. The funds raised from this event were intended to build the platform and expand the business.

According to Debitum’s whitepaper, the platform was designed to address the credit gap for small and medium-sized enterprises (SMEs). The founder has confirmed that this goal remains a priority for the platform.

For more details about the Initial Coin Offering (ICO) and the intended utility of the DEB token, we recommend watching our full P2P talk. At the 13:45 mark, the former CEO stated that the platform raised nearly $18 million, which was used to develop the platform. At mark 15:48 the founder explained that the raised funds were used to build the platform, cover marketing and business development expenses.

The CEO also made a commitment to further enhance the utility of the DEB token—a promise that ultimately was not fulfilled.

Debitum Alternatives

Debitum is undoubtedly not the best platform in the industry. The company's troubled history suggests that conservative investors should steer clear of it.

While the loan availability on the best P2P platforms is limited, the risk of losing your hard-earned money is much lower.

Here are a few suitable Debitum alternatives.

Fintown

Fintown is a Czech-based crowdfunding platform raising funds to refinance the equity of the Vihorev Group, which is developing rental properties in Prague. If you invest in operational rental properties, you can expect monthly rental income, increasing your cash flow from P2P loans.

The company backing Fintown has a good track record and excellent payment morale. Learn more about the platform in our Fintown review.

Esketit

Esketit is a Latvian P2P lending marketplace run by the experienced founders of AvaFin, a well-known lending group in Europe. The platform offers various investment opportunities with reasonable risk levels. Since 2021, it has paid its investors over €8 million in interest.

Learn more about Esketit in our Esketit review.

Nectaro

Nectaro is a regulated P2P lending platform based in Latvia, offering investment opportunities in loans from Moldova and Romania. With loan terms ranging from two to five years, Nectaro provides higher loan availability compared to some other platforms. All loans are backed by a buyback obligation, offering an added layer of security for investors.

Learn more about Nectaro in our Nectaro review.