Crypto.com Earn Overview

Are you keen to earn interest on your crypto? If so, you have likely heard about Crypto.com Earn, a service from one of the largest crypto exchanges in the world. Crypto.com lets you deposit your cryptocurrency in exchange for interest payments. In this Crypto.com Earn review, you will find out whether it’s worth depositing your crypto on a crypto interest account and what risks you should consider.

Is Crypto.com safe? Find out now.

Crypto.com in Numbers

If you’ve read our other P2P lending platform reviews, you might know that when performing our due diligence, the first thing we check out is the site’s statistics page and create a table with all the essential figures.

Unfortunately, we couldn’t find either statistics or an About Us page on the Crypto.com website, so this review’s table is looking pretty bare...

Crypto.com is one of the largest crypto exchanges in the world. The company also offers the Crypto.com credit card which is the most widely accepted credit card issued by a crypto company.

Crypto.com uses credit cards to generate revenue through its own Crypto.com token (CRO).

The company claims to currently serve more than 10 million customers from all over the world. While this is a very impressive achievement, we aren’t as impressed with non-disclosing important statistics.

Learning more about the company's financials, the average portfolio size (at least the amount of deposits for Crypto.com Earn), and the total earnings from this service would undoubtedly bring more transparency to anyone interested in earning interest on their cryptos.

Crypto.com Users Beware

The lack of transparency is common amongst crypto companies worldwide. Crypto.com, like many other crypto exchanges, pumps millions of $ in advertising and sponsorships, which allows them to acquire customers without any audits or disclosures about its reserves and risk management.

Due to the collapse of FTX, Crypto.com has made additional efforts to provide insights into its reserves. Users can review some of the wallet addresses of Crypto.com here.

Crypto.com Requirements

To use the Crypto.com app, you will need to download it from the Google Play Store or Apple Store. Alternatively, you can also download the Crypto.com mobile wallet, as Crypto.com doesn’t store your coins on the exchange.

To be able to do that, you will need to:

- Be over 18 years old

- Have a valid ID or passport to verify your identity

- Have a mobile phone to take a selfie and use the mobile apps

- Pass the KYC procedure

- Verify your email address

The signup process on Crypto.com is very simple, and should not take you more than 15 minutes.

Risk and Return

First and foremost, you should distinguish between Crypto.com Earn and Crypto Compound Lending through the decentralized wallet on your phone (DeFi Earn).

Both products offer different features and securities, which you should evaluate before depositing your crypto with those services.

When lending your crypto via DeFi Earn you don’t rely on a third-party custodian but instead manage everything through your app. The number of supported coins on DeFi Earn is also more limited compared to Crypto.com Earn.

In this Crypto.com review, we will mainly focus on the Crypto.com Earn product, a centralized feature that allows you to “stake” (lock) your crypto for a specific amount of time in exchange for interest.

As soon as you deposit your cryptos on your Crypto.com wallet in your mobile app (not the DeFi wallet), you don’t own your private keys anymore, which means that you are no longer the owner of your coins.

Crypto.com doesn't disclose what they do with your digital assets as they are not a typical crypto lending platform, we guess that they use it to increase the liquidity of their trading platform and generate more income through the fees they charge to their traders.

We will be covering the terms and conditions of Crypto.com Earn later, but first, let’s look at the returns you can expect by staking your cryptos.

The interest rates from Crypto.com Earn depend on two factors:

- Your amount of CRO tokens

- The lock-up period (Flexible, Fixed for 1 month, Fixed for 3 months)

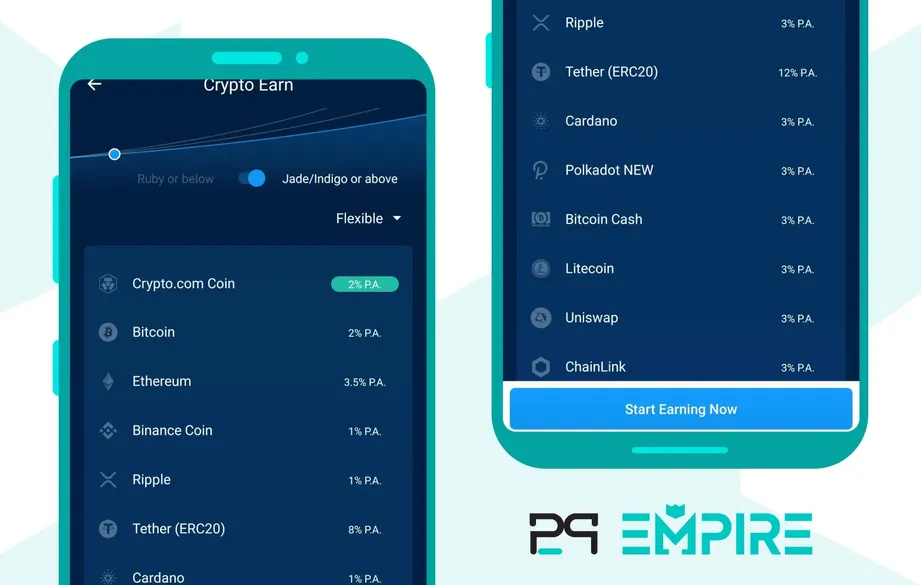

In your Crypto.com Earn App interface, you can review the current rates, based on your current holdings of the CRO tokens.

Note that the interest rates vary depending on the amount of CRO tokens you hold. If you are interested in receiving the interest rate that applies for Jade/Indigo Credit.com Credit Cardholders, you will need to stake at least $4,000 / €3,500 worth of CRO tokens.

To review the rates for anything below this amount, you need to untick the radio button in your app.

Now, if you don’t hold any CRO tokens and you don’t want to lock your coins, you can use the flexible plan which offers the lowest interest rates.

For Ruby Cards or below

| Coin | Flexible | 1 Month Term | 3 Month Term |

|---|---|---|---|

| Crypto.com Coin | 2% p.a. | 4% p.a. | 6% p.a. |

| Bitcoin | 1.5% p.a. | 3% p.a. | 4.5% p.a. |

| Ethereum | 2.5% p.a. | 3.5% p.a. | 4.5% p.a. |

| Binance Coin | 0.5% p.a. | 1% p.a. | 2% p.a. |

| Ripple | 0.5% p.a. | 1% p.a. | 2% p.a. |

| Tether | 6% p.a. | 8% p.a. | 10% p.a. |

For Jade & Indigo Cards or above

| Coin | Flexible | 1 Month Term | 3 Month Term |

|---|---|---|---|

| Crypto.com Coin | 2% p.a. | 4% p.a. | 6% p.a. |

| Bitcoin | 2% p.a. | 4.5% p.a. | 6.5% p.a. |

| Ethereum | 3.5% p.a. | 4.5% p.a. | 5.5% p.a. |

| Binance Coin | 1% p.a. | 2% p.a. | 3% p.a. |

| Ripple | 1% p.a. | 2% p.a. | 3% p.a. |

| Tether | 8% p.a. | 10% p.a. | 12% p.a. |

Note that Crypto.com supports around 30 different coins. The interest for the flexible plan can change at any time prior to any notice, and the interest payments are repaid on a weekly basis.

What’s also interesting is that the Crypto.com Earn feature doesn’t allow compound interest, meaning that all of the interest is repaid on your Crypto.com hot wallet.

What is also worth mentioning is that you need to deposit a minimum amount of every currency to be eligible for the Crypto.com Earn feature. This is something that the competing crypto lending platform Celsius Network isn’t demanding.

Staking your cryptocurrency with Crypto.com Earn is not risk-free. As the cryptocurrency is not legal tender and it’s not backed by FDIC or any other insurance, there is always the risk that you will lose your money.

The counterparty risk is even higher with Crypto.com as the company isn’t publicly sharing its financial reports so you cannot evaluate the financial health of the platform.

Is Crypto.com Earn Safe?

In this section of our Crypto.com Earn review, we will look at the management, the legal setup, and the terms and conditions of the Crypto.com Earn feature.

Who leads the team?

Crypto.com is led by the CEO and Co-founder Kris Marszalek, who has been engaged with various startup companies from Hong Kong in the past. Crypto.com is also based in Hong Kong.

The Crypto.com website seems to be frequently changing the name of its legal company. Currently, the company is operating under the FORIX DAX KY Group, which is incorporated in the Cayman Islands.

The group is also known to operate under MCO Malta DAX Limited, Foris LTD, MCO Pay Limited, MCDO Digital Assets, Foris Asia Pte Ltd.

The platform doesn’t publicly share the address of its headquarters. According to some sources, Crypto.com is based in Sai Wan, Hong Kong Island, Hong Kong.

We guess that Crypto.com used its entity in the Cayman Islands to generate the CRO token. Their branch in Switzerland was used to raise $26 M through their token sale event.

Crypto.com restricts the usage of their service to residents of countries where they have some legal setup, such as Malta, Switzerland, and Hong Kong (onshore).

What regulatory requirements should you consider?

You can use Crypto.com in all countries apart from Switzerland, Hong Kong, Malta, and the state of New York.

We are not aware of any license from a regulatory body that would decrease the counterparty risk. Crypto.com and many other crypto platforms are “self-regulated,” which means they follow the "highest security standards" to ensure the safe usage of their products.

According to Crypto.com, the platform stores all fiat from U.S. users on regulated custodian bank accounts. If you are from the U.S., your fiat is covered up to $250,000 by the FDIC.

While for fiat, you as the user remain the owner, for crypto it’s not the case if you store your currencies on the Crypto.com App wallet.

In this scenario, the owner of your coins is Crypto.com which stores your coins on cold storage which is insured for up to $360 M. The custodian of your crypto is Ledger.

Are there any suspicious terms and conditions?

You should certainly read the terms and conditions of Crypto.com Earn to fully understand your rights.

We read it all, and here are a few important points worth mentioning:

- By using the Crypto.com Earn Fix Plan, you are not able to withdraw your crypto before the maturity date

- The interest for your Flexi Plan may change at any time

- You alone are responsible for the taxes

- Crypto.com reserves the right to terminate your access to Crypto Earn

- The digital assets in your Crypto Earn account are not protected by any insurance

- Crypto.com can amend the terms and conditions at any time

- Crypto.com may freeze your account for an indefinite period of time

By using Crypto.com Earn, you are accepting the clause that you might lose your money and that Crypto.com isn’t responsible for your losses.

That is the case with any peer-to-peer lending platform or crypto lending platform. By investing your fiat or coins, you are always taking certain risks.

If your goal is to keep your crypto safe, we recommend storing your like 🔒 , which is one of the best wallets out there.

Potential Red Flags

- Crypto.com can freeze your account at any time as you are not the owner of your coins

- The platform may change terms and conditions at any time

- The platform prohibits the usage of their companies from users that are residents in their onshore markets

- Crypto.com isn’t transparent about its legal address and its legal setup is too complex

- Crypto.com has accidentally send millions of $ to third-parties

What’s Our Opinion On Crypto.com?

Crypto.com is undoubtedly one of the largest companies in the crypto space, offering a wide range of services. The platform makes most of its money by charging its users fees on their crypto exchange.

The platform is trying to capitalize on everything related to crypto. The Crypto.com ecosystem is expanding, and many of the platform’s features are directly connected to the Crypto.com credit card or their CRO tokens.

Like Celsius Network, Crypto.com also uses utility tokens to generate further income. You can trade the CRO token on various exchanges such as Bittrex, Kucoin or directly on Crypto.com.

The platform offers a wide range of services. Crypto Earn might sound like an excellent option to earn additional income on your crypto. Note, however, that by using the Fixed Plan, you have no option to liquidate your assets in the case of a market crash.

To benefit from higher interest rates, you would need to stake a large amount of CRO tokens which, again, will cost you at least $3,500.

Crypto.com doesn’t disclose what they do with your coins when you stake them with Crypto.com Earn which increases your risk significantly.

We don't believe that Crypto.com Earn is a feature that would be beneficial for most users. The lack of regulation and transparency about Crypto.com's revenue streams are two key elements that make using Crypto.com Earn produce rather unattractive.

Crypto users, who prefer to deposit some of their cryptos on more transparent platforms, can navigate to our reviews about YouHodler, Yield App or Haru Invest, which are platforms that focus only on yield-generating activities and can disclose their trading/lending strategies.

Do you appreciate this review? Invite us for a coffee ☕

Usability

Crypto.com is one of the apps in the crypto space with most of the features. The app is primarily an exchange; however, you can also use it in connection with your Crypto.com credit card, earn interest with Crypto.com Earn or even get a loan when depositing your crypto as collateral.

Apart from the Crypto.com app, the platform also offers a decentralized mobile wallet.

When it comes to the usability of the Crypto.com Earn feature, it is quite straightforward:

- You choose your CRO staking level

- You choose the flexi or fixed plan for 1 or 3 months

- You choose the coin on which you want to earn interest

- You deposit the minimum amount on your Crypto.com Earn space

- You earn weekly interest on your principal until the end of the agreed period

When using fixed plans, you are not able to withdraw your money before the end of the period. As mentioned above, you also do not benefit from the compound interest as the interest is paid out to your Crypto.com wallet. After the end of the savings period, your principal will be returned to you, and if you wish to extend your savings period, you will need to set up another plan.

What’s also worth mentioning is that Crypto.com is only available as a mobile app. So if you are interested in managing your crypto on your PC monitor, Crypto.com isn’t the best fit for you.

Liquidity

The liquidity of your investment on Crypto.com depends on the service that you are using. If you trade crypto, you can liquidate your position immediately. Using the Crypto.com Earn feature, you can withdraw your coins after 1 or 3 months using the fixed plan.

The Flexi plan allows you to withdraw your coins anytime.

Note that by staking your crypto, you might not be able to sell your coins in the case of a market crash, which can lead to significant losses of the value, which won’t be covered by the very low interest that you get in exchange for depositing your crypto on Crypto.com.

Support

Like many other crypto lending platforms, Crypto.com isn’t famous for its support. The platform offers a dedicated Help center, and you can also resolve your issues using the live chat function on their website. The typical response time is one day.

Alternatively, you can also contact the support by dropping them an email at contact@crypto.com.

Crypto.com Review Summary

Crypto.com is a multipurpose app that enables you to use various services in the crypto space. The Crypto.com Earn feature allows you to even earn interest on your deposits. As with any other crypto exchange, the platform takes a maker-and-taker fee. Be aware that you must pay a withdrawal fee when moving your digital assets from your Crypto.com wallet.

Key Takeaways From Our Crypto.com Review

- Easy to use

- Complex reward scheme

- Minimum deposit limits

- Fixed lock-in period

- Lower interest rates

- Unknown yield generation activities

Crypto.com isn't a transparent company, and we don't recommend using this platform due to the questionable business model and the recent events surrounding Crypto.com. Head over to our review section to find a better fit for you.