YouHolder Review Summary

YouHodler receives a 2.5 out of 5 rating on P2P Empire. While we previously had a positive experience with the platform, thanks to its attractive interest rates and responsive customer support, recent changes have raised some red flags.

The platform now promotes high-risk, speculative features that could result in serious losses. Additionally, many users have reported difficulties withdrawing their funds, often due to complex anti-money laundering (AML) procedures and ongoing technical problems.

- Solid legal setup

- Competitive rates

- Easy-to-use platform

- Earn interest on crypto

- Issues with withdrawals

If you're looking to earn interest on your cryptocurrency, YouHodler is one of the few platforms still offering this service, as many competitors have gone bankrupt. However, this also means there may be increased risks involved, and it’s important to stay informed.

We recommend taking the time to understand YouHodler’s full range of products, as some may carry higher levels of risk. Please note that we do not actively monitor developments related to YouHodler, so some information in this review may become outdated. Always double-check the latest details before making any decisions.

In this YouHodler review, we’ll highlight the key points you should know before using the platform.

What Is YouHodler?

YouHodler is a Swiss-based crypto platform regulated as a Financial Intermediary in Switzerland. Launched in 2018 with a focus on crypto lending, it initially attracted users by offering competitive yields on deposited cryptocurrencies. As of 2025, YouHodler has shifted its focus toward high-risk crypto trading, with most of its services now centered around leveraged trading features.

Pros

- Sustainable business model

- Options to swap between FIAT and crypto

- Wide range of supported coins

Cons

- High-risk trading features

- Withdrawal fees

- Strict KYC

- Yield limits for the crypto interest account

Watch our in-depth YouHodler review here 👇👇👇

Please note that this video was produced in 2021—at that time, YouHodler operated quite differently than it does today. Continue reading our YouHodler review to learn more about its current features and interest rates.

Our Opinion On YouHodler

YouHodler presents an appealing option for earning interest on cryptocurrency holdings. Based in Switzerland, the platform legally operates its crypto interest accounts through its entity in Cyprus.

While the European crypto lending space remains largely unregulated, YouHodler makes a clear effort to stay within legal frameworks, offering users a degree of protection. The company has also obtained a cryptocurrency provider license in Italy, signaling its commitment to regulatory compliance.

In our direct interactions with YouHodler’s support team, we received more transparent and informative responses compared to competitors like Nexo, providing better insight into the platform's policies and operations.

The platform offers a variety of services, with its crypto savings account standing out as one of the more straightforward ways to earn interest on Bitcoin. However, other features—such as Multi HODL, Loans, and Turbocharge—come with higher risks and fees that may not be immediately obvious.

Leveraging crypto deposits can seem attractive, but it’s crucial to fully understand the risks involved.

We strongly recommend reviewing the terms and conditions in detail before using these services, as failing to do so could result in unexpected losses.

One positive distinction is found in YouHodler’s terms and conditions: unlike many platforms that claim ownership of your crypto upon deposit, YouHodler allows users to retain ownership when using only the savings feature.

That said, since deposits are used to back loans, this ownership comes with limitations. While it may offer slightly better legal positioning, it's not without risk.

It’s also important to note that YouHodler reserves the right to void transactions at any time, meaning your withdrawal could be blocked without prior notice.

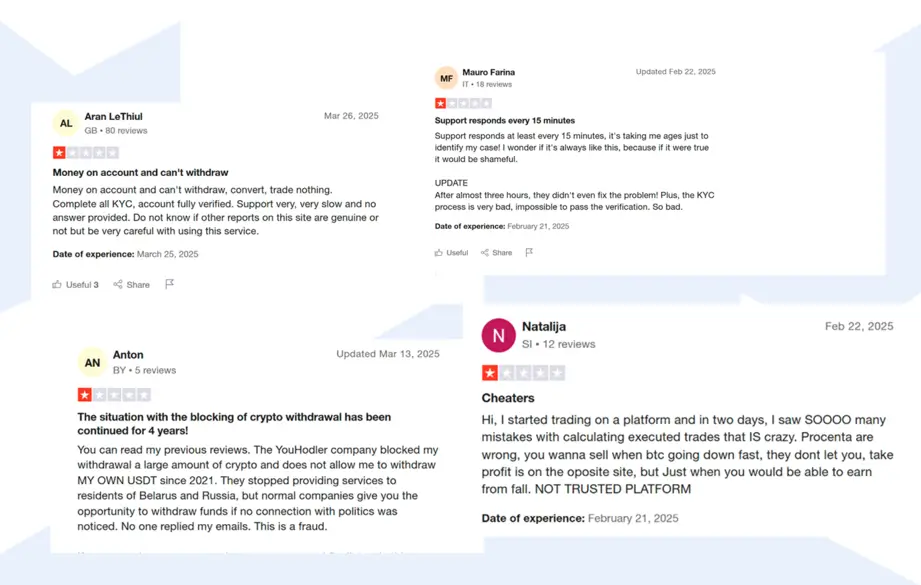

While some may dismiss this risk, assuming it won’t happen to them, many users have reported experiencing exactly this scenario, as reflected in recent one-star reviews on Trustpilot.

Typically, YouHodler responds with: “Our compliance team follows all legally required procedures. Please rest assured that all actions adhere to internal protocols to ensure the safety and security of our users. For assistance, contact our support team.”

However, these internal procedures change frequently. Even long-term users may face sudden re-verification requests, which can involve undergoing a full KYC process again—just to access their own funds.

This can turn into a frustrating experience, with some users waiting several weeks to retrieve their crypto.

As detailed in our review, YouHodler’s tiered account system favors active users with higher yields and extra perks. This model can disadvantage passive users by limiting their interest rates and yield caps.

If your primary strategy is to hold crypto and earn passive income with minimal interaction, YouHodler may not be the best fit.

For those prioritizing maximum security over yield, using a dedicated hardware wallet like remains the most reliable way to protect digital assets—offering peace of mind without the risks associated with centralized platforms and their variable single-digit APRs.

Ready to protect your crypto?

Our YouHodler Experience

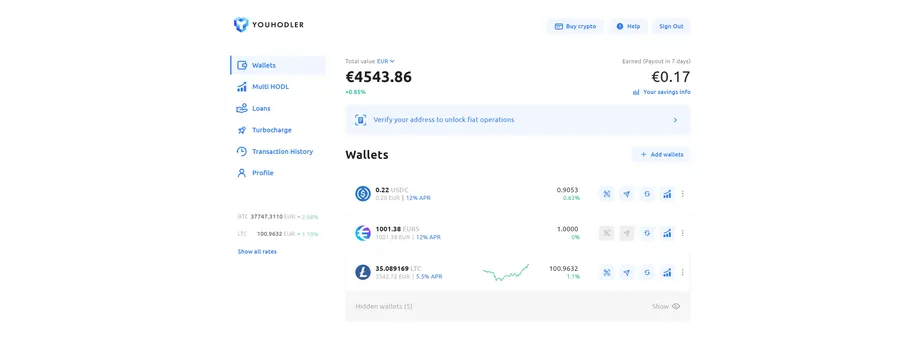

Since early 2021, we've actively utilized YouHodler's features, maintaining stakes between €2,500 and €8,500, influenced by daily market volatility

For users who engage regularly, YouHodler's crypto interest account stands out as an excellent avenue for earning passive income on crypto deposits.

The platform offers interest rates ranging from 5% to 20% on fiat-backed stablecoins like USDC and EURS, positioning it as a strong alternative to traditional P2P lending platforms.

However, it's important to note that YouHodler has implemented yield limits, which can restrict the maximum returns achievable on the platform.

These limits are tied to the user's loyalty level, which is determined by factors such as trading volume and account activity. As a result, passive users who prefer to hold their assets without frequent transactions may find their potential earnings constrained.

For those seeking to maximize returns, actively engaging with YouHodler's various features and maintaining higher account activity can lead to elevated loyalty levels, thereby increasing yield limits and potential interest earnings.

Conversely, users with a more passive investment approach might consider these limitations when evaluating the platform's suitability for their financial goals.

Youhodler experience in 2026

YouHodler offers a compelling way to earn interest on cryptocurrency holdings, with interest payments distributed weekly on Fridays. However, users should exercise caution when using high-risk trading features like Multi HODL and Turbocharge, which can lead to the total loss of invested funds.

While our overall experience with YouHodler has been positive over the past few years, recent developments have significantly impacted our perception of the platform.

These changes underscore the importance of maintaining full control over your crypto, preferably by storing assets in hardware wallets like .

As of mid-2025, we attempted to test the withdrawal process. After one day of “processing,” the transaction failed, without any notification appearing in our account. This led us to contact customer support.

The support team replied within one business day and informed us that our account required KYC re-verification. As long-time users, we assumed this would be a quick document upload. Unfortunately, the process was far more complex.

It took a total of 13 days and 27 emails to complete the verification. For the first seven days, we were unable to pass the required verification call due to technical issues on YouHodler’s platform.

Once the call was completed, we were asked to submit various documents, including multiple bank account details, proof of funds, and proof of residency. Since YouHodler’s support is unavailable on weekends, the process extended to nearly two weeks.

Ultimately, our account was re-verified and we managed to withdraw our funds—but the experience was frustrating and time-consuming.

In our view, YouHodler’s KYC procedures are excessive when compared to other financial institutions or even traditional banks. What’s more concerning is that YouHodler will not allow withdrawals unless you complete this process, even if you do not intend to deposit more assets or continue using the platform.

This practice, where access to funds is blocked until extensive verification is completed, poses significant risks to users.

When we asked what would happen if a user was unable to provide all the required documentation, YouHodler did not respond. It remains unclear whether funds would be indefinitely withheld in such cases.

We consider this lack of clarity a serious red flag and have adjusted our rating of the platform to reflect this experience.

YouHodler Promo

YouHodler runs various promotions. You can use our YouHodler referral code to get the most out of available bonuses. However, remember that the platform focuses on providing the best crypto trading product in the industry rather than offering the highest bonuses.

Requirements

Registering on YouHodler is straightforward. You need your email address to access your account. To use it, you must verify your identity with your ID and pass the KYC requirements, including submitting your personal information and a selfie.

- Be over 18 years old.

- Do not reside in the following countries: USA, Afghanistan, Bangladesh, China, Cuba, Germany, Iran, Iraq, North Korea, Pakistan, Sudan, Syria, Russia.

It’s important to note that the savings feature on YouHodler is not available to users in Switzerland. As the platform continues to evolve, additional restrictions may be introduced. We strongly recommend checking YouHodler’s website for the most up-to-date information, as policies and availability can change frequently.

Depositing funds on YouHodler to begin trading is relatively straightforward. However, users have reported potential issues when attempting to withdraw funds. Continue reading to learn what you should expect.

Risk & Return

When you deposit your funds with YouHodler, you take on certain risks that vary depending on your chosen products. For an in-depth understanding of YouHodler’s offerings, refer to our "Usability" section, where we break down how each service works.

Counterparty risk is an inherent factor across all YouHodler products. Once you deposit your crypto, you relinquish direct control of your assets in exchange for benefits such as earning interest or accessing loans. Although counterparty risk cannot be fully eliminated, there are ways to manage and potentially reduce it.

YouHodler stores client crypto assets in both hot and cold wallets. Cold storage is provided by Ledger Vault, YouHodler's custodian, which maintains an industry-standard crime insurance program covering up to $150 million through Arch UK Lloyds of London syndicate. By utilizing cold wallets, YouHodler helps minimize the risk of asset loss due to hacking.

In 2019, YouHodler experienced a data breach, though, according to CEO Ilya Volkov, no sensitive information—such as credit card details—was compromised. YouHodler is a member of the Blockchain Association, a self-regulatory body within the crypto community, yet it’s essential to recognize that no system can guarantee complete data security at all times.

Yield Rates

When depositing your valuable crypto assets, you naturally want to maximize your returns with competitive interest rates. YouHodler offers some of the best rates in the industry and currently supports 99 digital assets.

Here’s a quick overview of the rates for some of the most popular cryptocurrencies. Keep in mind that the exact interest rate depends on your account level, and you need to reach the Basic account level to open a crypto yield account.

| Coin | Jumpstart | Silver | Gold | Platinum | VIP |

|---|---|---|---|---|---|

| BTC | 2.5% | 3.5% | 4.5% | 6% | 11% |

| ETH | 2.5% | 3.5% | 4.5% | 6% | 11% |

| LTC | 7% | 10% | 11% | 12% | 16% |

| ADA | 2.5% | 3.5% | 4.5% | 6% | 11% |

| USDC | 8% | 9% | 11% | 14% | 20% |

To earn interest on your crypto with YouHodler, you must deposit at least $150 worth of cryptocurrency. Additionally, you need to meet specific monthly trading requirements to qualify for yield. To reach the "Jumpstart" level, for example, you must achieve a monthly trading volume of $1,000. This can include using the MultiHodl feature or swapping between crypto assets.

If you don’t plan to be active on YouHodler, you’ll be assigned the "Basic" level. This caps your interest-earning balance at $10,000 and offers low rates—just 2% on BTC and 5% on USDC. For most inactive users, the risk of giving up control over their crypto in exchange for these modest returns may not be worthwhile.

What’s likely the best feature of YouHodler is that you don’t need utility coins like the Crypto.com Earn or Nexo platforms to unlock higher rates. The reward scheme on YouHodler is relatively straightforward, and the list of supported assets is also comprehensive.

The interest rates offered on YouHodler can fluctuate, so active users seeking to maximize their returns should monitor their accounts for updates.

While YouHodler doesn’t publicly disclose detailed information on how they use customer deposits, they have confirmed that these funds are part of their liquidity pool to provide collateralized loans. Continue reading to learn more about YouHodler’s business model.

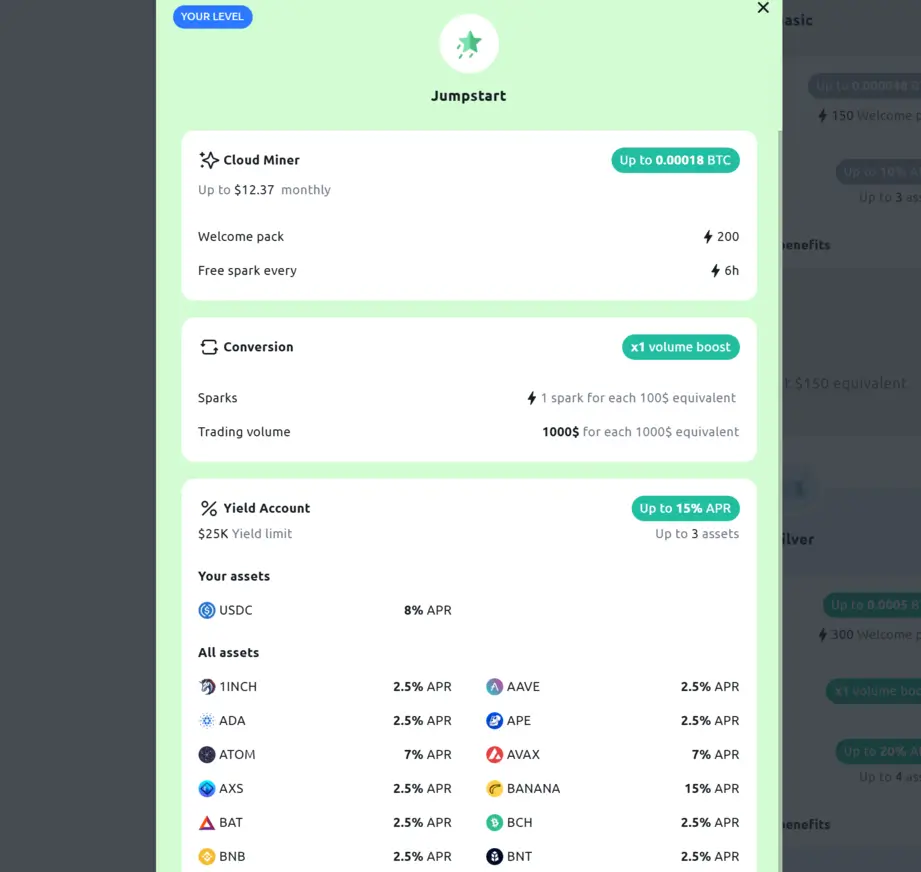

YouHodler Account Levels

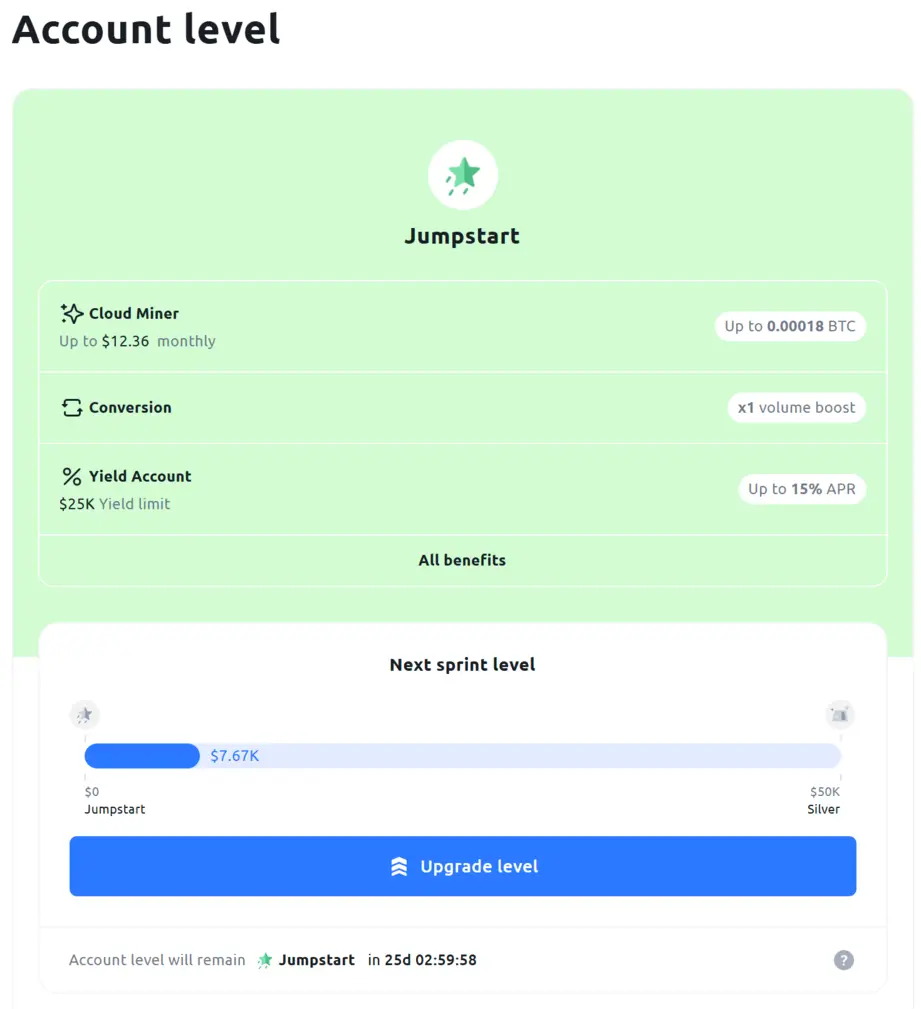

YouHodler employs a tiered loyalty program that enhances user benefits based on activity levels. As users engage more with the platform—through activities like conversions and MultiHODL deals—their account level increases, unlocking higher rewards and specific perks.

Elevated account levels offer increased yields on crypto deposits and additional Sparks, which can be utilized in YouHodler's Cloud Miner to generate free Bitcoin.

Below is an overview of the requirements and benefits associated with each account level:

| Account Level | Monthly Trading Volume Requirement | Yield Limit | Max. Yield Account APR | Cloud Miner Benefits |

|---|---|---|---|---|

| Newbie | $0 | $0 | 0% | 0 sparks |

| Basic | $150 | $10K | 10% | 150 sparks |

| Jumpstart | $1,000 | $25K | 15% | 200 sparks |

| Silver | $50,000 | $30K | 20% | 300 sparks |

| Gold | $150,000 | $60K | 22% | 400 sparks |

| Platinum | $500,000 | $80K | 25% | 500 sparks |

| Diamond | $2,000,000 | $100K | 30% | 750 sparks |

| VIP | $5,000,000 | $100K | 40% | 1000 sparks |

By actively participating in YouHodler's offerings, users can ascend through these levels, thereby maximizing their returns and access to exclusive features.

Upon registering with YouHodler, users are initially assigned the Newbie account level. To advance to the Basic level, a minimum deposit of $150 is required. Further progression to higher account levels necessitates engaging in conversions or trades totaling $1,000 within a 30-day period.

Elevating your account level unlocks enhanced benefits, including increased yields on crypto deposits and additional perks.

You can always verify your current account level under the Profile section of your YouHodler account.

How Does YouHodler Make Money?

YouHodler generates revenue primarily through its crypto-backed lending services. When users deposit cryptocurrencies, these assets are used exclusively within the platform to support collateralized loans. This means all loans are backed by collateral, helping to reduce borrower risk.

Unlike some other crypto-lending platforms, YouHodler does not invest user deposits in external financial activities such as DeFi protocols or speculative trading. This more conservative model offers greater transparency and a higher level of security for users.

However, it's important to be aware that YouHodler is increasingly gamifying its platform to encourage participation in high-risk trading activities. This can result in significant capital losses. The platform earns not only from trading fees but also from user losses on short-term bets involving the price movements of specific digital assets.

By contrast, platforms like Nexo are reported to use more aggressive strategies, including engaging in DeFi protocols and other speculative ventures, which may introduce additional risks to user funds.

YouHodler Fees

YouHodler makes money by charging fees to users who decide to use some crypto lending products apart from the savings account.

- Deposit Fees: Bank Wire = No FEES (except SWIFT 25USD), Credit Card = 1%, Crypto = NO FEES, Stablecoins = NO FEES

- Withdrawal Fees: USD SWIFT = 1.5% (min. 70 USD), EUR SEPA = 5€, EUR SWIFT = 55€, GBP,CHF = 0.15%, Crypto = NETWORK FEES ONLY

- Turbocharged: 0.5% - 2.1% for every loan up to 15 loans

- Multi HODL: 0.01% rollover fee, 0.3% - 0.4% profit share fee

- Loans: 1% - 8% fee

- Conversion fee: 0.2% - 2%

You can use YouHodler for FREE by transferring your crypto from your hardware wallet to YouHodler and earning interest on your deposits.

Unlike many other crypto lending platforms, YouHodler typically processes withdrawals within a few minutes—provided your account is fully verified. However, unexpected issues can occur. YouHodler may randomly require account re-verification, and in such cases, withdrawing your crypto could take up to two weeks.

Is YouHodler Safe?

Reading the terms and conditions and checking the management's background are key factors that influence the safety of your assets on a dedicated platform.

Who runs the company?

YouHodler’s CEO and co-founder is Ilya Volkov. His LinkedIn profile shows he has previous experience in the currency trading business under the Libertex Group in Moscow. In the past, Ilya also worked for Eurokommerz, a factoring company from Russia.

What regulatory requirements should you consider?

YouHodler is self-regulated, following industry standards and opinions from various lawyers in Cyprus (C.Samir & Co. LLC).

The platform’s CEO is also a member of the Crypto Valley Association, which promotes crypto adoption in Switzerland.

In our chat with YouHodler’s support, we learned that the company believes in intelligent regulation, so they also collaborate with regulators in Switzerland.

However, the services are still run under the NAUMARD Limited company, which is incorporated in Limassol, Cyprus. This company is the legal owner of the YouHodler trademark.

It's worth mentioning, however, that most of the management team operates from the headquarters in Lausanne, Switzerland.

Curious about how YouHodler operates? Watch our exclusive video from our visit to YouHodler's Lausanne, Switzerland headquarters.

Please note that we visited YouHodler at our own expense in mid-2022. The platform has continued to evolve since then, so some of the information presented here may have changed. Be sure to check for the most recent updates when reviewing this content.

Are there any suspicious terms and conditions?

When reviewing YouHodler’s terms and conditions, it’s important to examine both the general website terms and the specific terms for individual services like loans or savings.

These product-specific terms can be complex, and without legal expertise, it may be difficult to fully understand what you’re agreeing to. Additionally, these terms are subject to change, so it’s essential to review the most current version before using any of YouHodler’s services.

The Service Level Agreement offers more clarity and can help you better understand the platform’s obligations. We recommend reading it carefully, particularly if you plan to use YouHodler’s exchange feature.

The key takeaway from the terms and conditions is that once you deposit funds to YouHodler, you relinquish direct control over them. If the platform defaults or imposes withdrawal restrictions, accessing your assets may take longer than expected.

Potential Red Flags

- YouHodler may block your withdrawal at any time due to renewed KYC (Know Your Customer) verification requirements.

Learn more about possible red flags in our guide about how to avoid investing in P2P lending scams.

Usability

YouHodler isn’t just a crypto savings account, as the platform offers a variety of additional products and services. Here’s a breakdown of features that you can use on YouHodler.

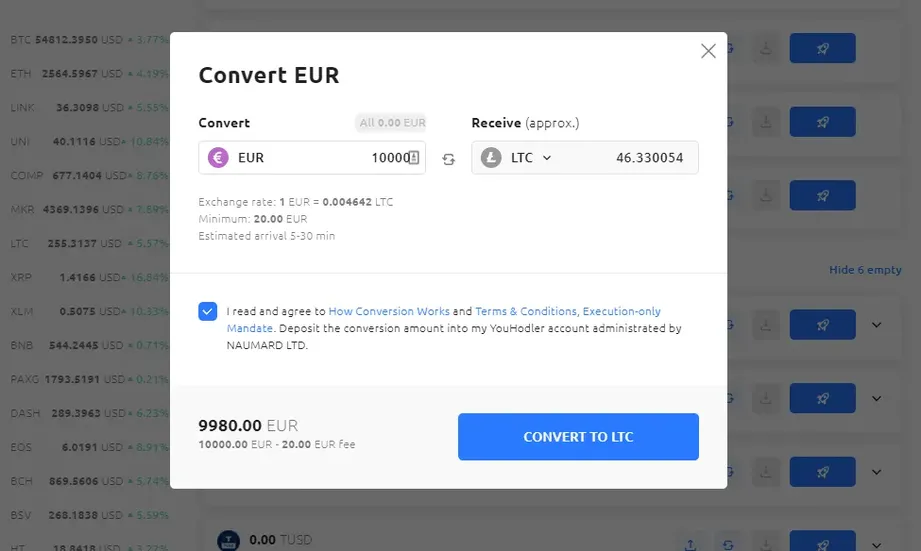

Exchange

Exchange is essential to YouHodler as the platform doesn’t offer any interest in your fiat currency.

To earn interest on your coin, you must either deposit your crypto (the cheapest option) or stablecoins to YouHodler or transfer fiat to the platform and exchange it for crypto.

As we conduct our YouHodler review, the platform supports the following coins:

| Supported Cryptos | Supported Stablecoins | Supported Fiat Currencies |

|---|---|---|

| BTC, ETH, LINK, UNI, COMP, MKR, LTC, XRP, XLM, BNB, PAXG, DASH, EOS, BCH, HT, REP, BAT, ADA, DOT and more. | USDT, USDC, PAX, TUSD, DAI, HUSD, EURS, and more. | EUR, USD, GBP, CHF |

Note that you will only earn interest on your stablecoins or cryptocurrencies.

When exchanging currencies, you must respect the minimum exchange amount and pay the exchange fee, typically between 1% and 2%.

Crypto Savings Account

To start earning interest on your crypto, simply deposit your assets into YouHodler’s wallet. Interest is automatically accrued on unused deposits every Friday, paid out in the same currency as your deposit. However, if you use your funds for features like Multi HODL, Turbocharge, or Loans, the interest-earning function will be paused.

All savings deposits are safeguarded by Ledger Vault and insured for up to $150 million, making YouHodler one of the top platforms for earning reliable crypto yields.

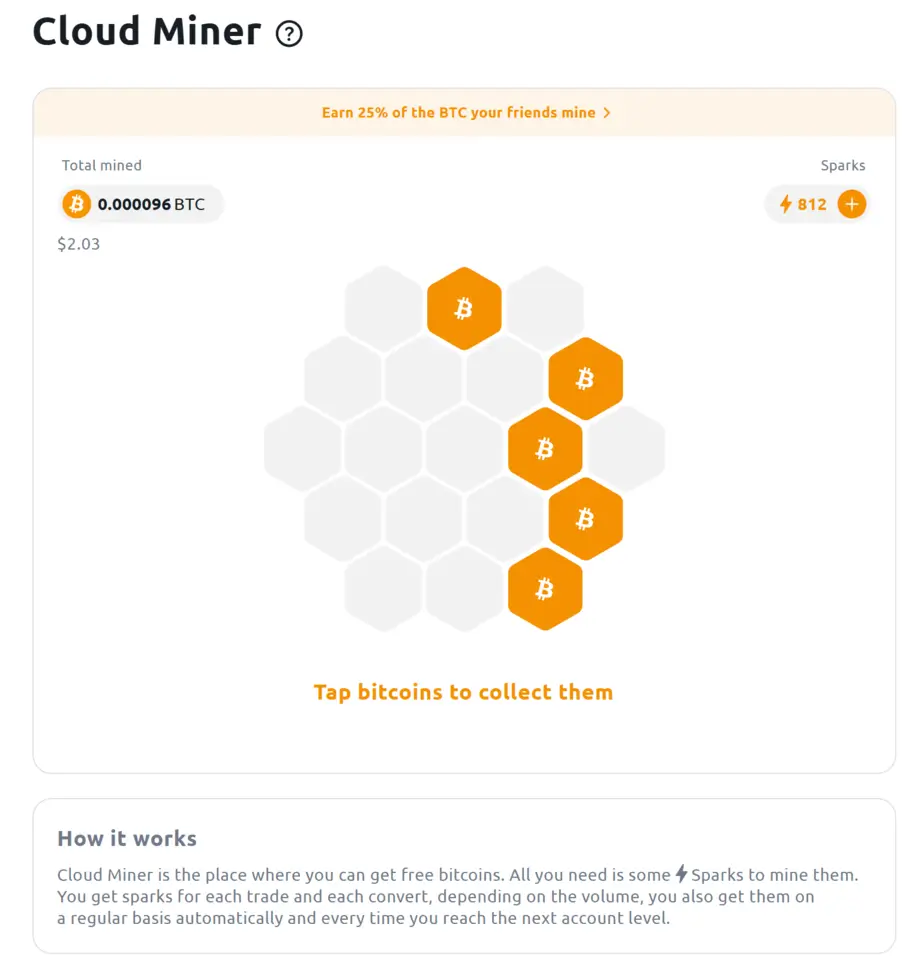

Cloud Miner

YouHodler's Cloud Miner is a gamified feature that allows users to earn Bitcoin by utilizing "Sparks," the platform's virtual credits. Sparks can be accumulated through various activities:

- Trading and Converting: Earn Sparks based on the volume of your trades and conversions.

- Regular Bonuses: Receive Sparks automatically at regular intervals.

- Account Level Advancement: Gain additional Sparks upon reaching higher account levels.

To use your Sparks, select the available mining blocks (octagons) on your screen. The mining process duration varies according to your account level. Once mining is complete, you can collect your Bitcoin rewards.

The amount of Bitcoin you can earn through Cloud Miner depends on your account level, with higher levels offering increased rewards. This feature provides an engaging way to enhance your crypto holdings without additional investment.

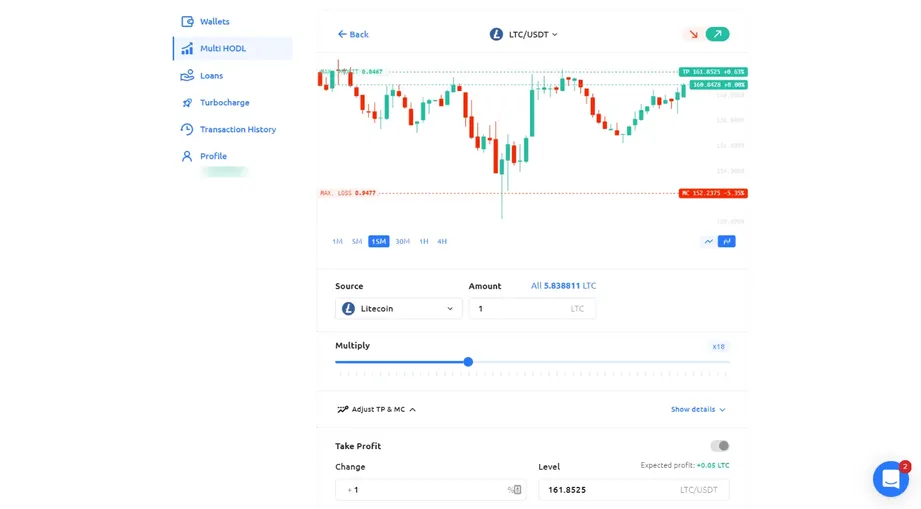

MultiHODL

MultiHODL is a distinctive feature offered by YouHodler that enables users to leverage a portion of their deposited funds to potentially amplify profits by speculating on the rise or fall of cryptocurrency values.

This process involves initiating a chain of loans, where your crypto assets serve as collateral to acquire additional crypto, repeating this cycle multiple times—up to 100 iterations, depending on your chosen settings.

You leverage your crypto holdings to increase your profit potential.

How does it work?

- You choose the currency pair.

- You choose whether you expect the price to go up or down

- You select the source of your deposits and the amount which you would like to allocate to Multi HODL

- You choose the “Multiplier” (the higher the multiplier, the tighter the margin call)

- You define when you want to take profit

- You define the maximum potential loss you are willing to take

- You accept the terms and start

YouHodler's MultiHODL feature enables users to leverage their cryptocurrency holdings by engaging in trading activities with various crypto pairs.

What’s the catch?

Leveraging your cryptocurrency holdings through tools like YouHodler's MultiHODL can be enticing, but it's important to recognize the associated risks. Our testing indicates that while MultiHODL offers the potential for amplified profits, it also carries a significant risk of losses.

To help mitigate these risks, YouHodler has introduced a Stop-Loss function within MultiHODL. This feature allows users to set predefined levels at which positions are automatically closed, aiming to limit potential losses.

Additionally, the Take Profit option enables users to secure gains when a specified profit threshold is reached. These tools provide greater control over trading strategies and can help manage the inherent volatility of leveraged trading.

IMPORTANT INFORMATION

At P2P Empire, we rigorously test various platforms and features to provide comprehensive insights—often putting our own funds at risk to ensure the quality and authenticity of our reports.

It's important to recognize that not every feature will suit your investment goals or risk tolerance. The MultiHODL tool, in particular, is a high-risk trading feature that can result in the complete loss of your invested funds. We strongly recommend conducting in-depth research and gaining a clear understanding of how it works, along with the associated risks, before using this or similar tools.

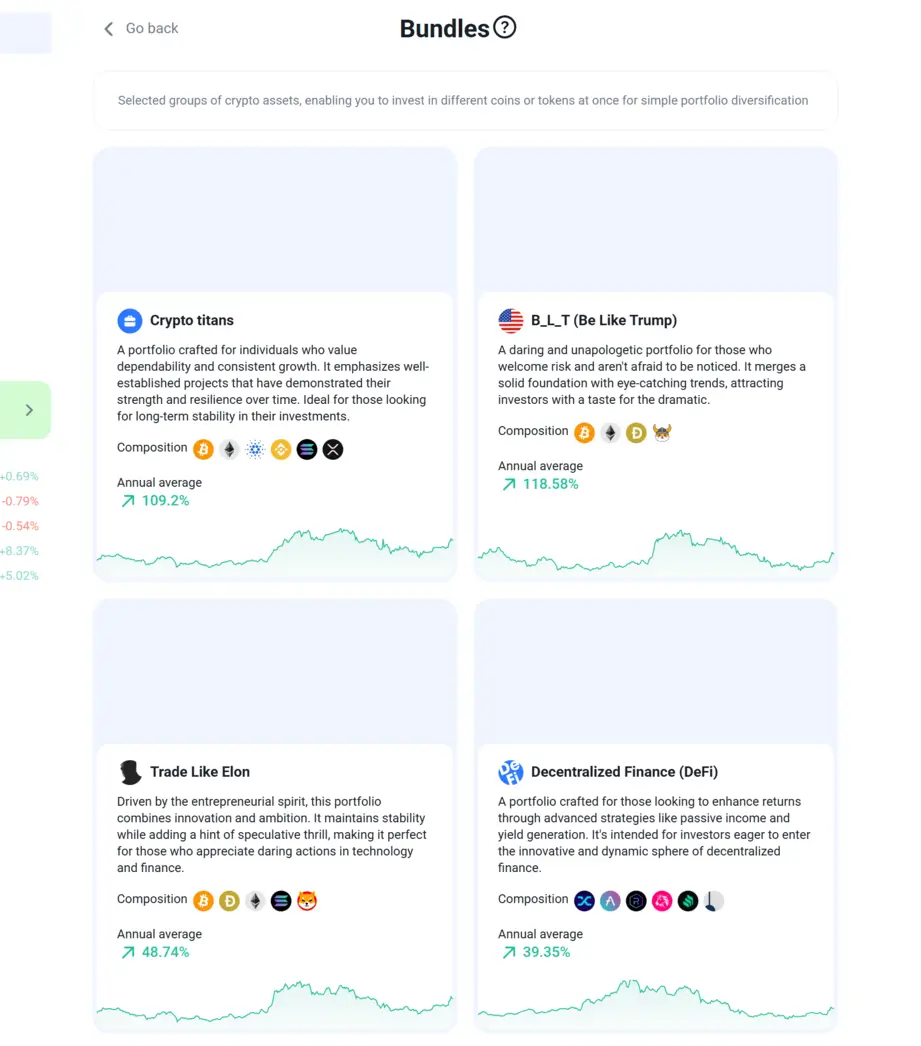

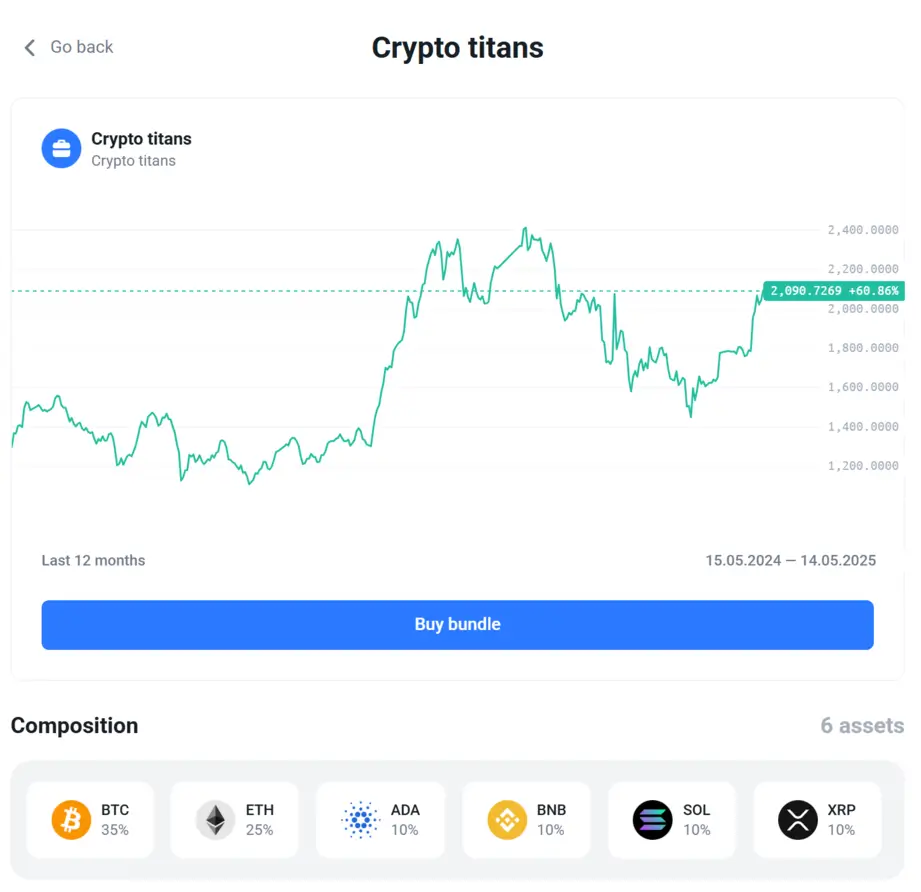

Bundles

In YouHodler’s portfolio section, users can now purchase pre-selected groups of digital assets called "bundles." Each bundle comes with a brief description and a year-over-year performance summary, providing insight into how that group of cryptocurrencies has performed over time.

The goal is to offer diversification, helping to reduce the impact of volatility from any single cryptocurrency on your overall portfolio.

Bundles can be bought and sold at any time, and YouHodler earns revenue by charging a fee on these transactions.

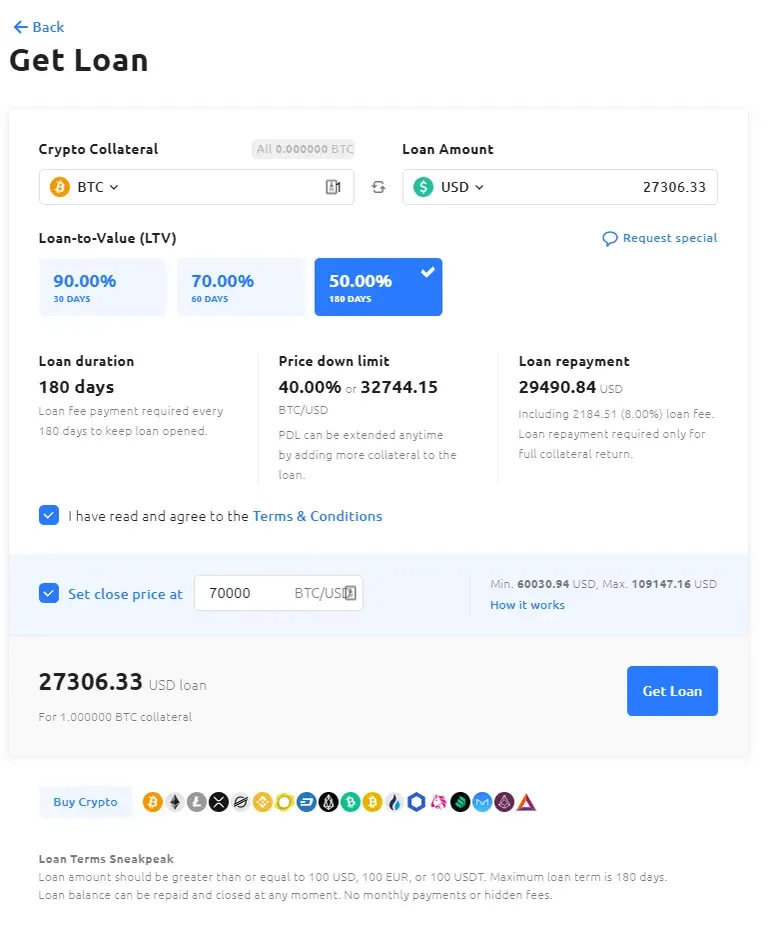

Crypto Loans

YouHodler offers crypto-backed loans, allowing you to use your cryptocurrency as collateral to obtain funds in USD or EUR. The platform provides three standard loan options:

- 90% Loan-to-Value (LTV) for 30 days: Borrow up to 90% of your crypto's value for a 30-day term.

- 70% LTV for 60 days: Borrow up to 70% of your crypto's value for a 60-day term.

- 50% LTV for 180 days: Borrow up to 50% of your crypto's value for a 180-day term.

A higher LTV means you can borrow more relative to your collateral but may come with higher fees and shorter terms. For instance, with a 50% LTV, you'll need to deposit crypto worth twice the loan amount you intend to borrow.

Loan fees vary between 2% and 8%, depending on the selected terms. For example, borrowing $27,306 for 180 days at a 50% LTV might result in a total repayment of $29,490, which includes a $2,184 loan fee over six months.

YouHodler also offers customizable loan conditions. You can set a "Take Profit" price, which automatically sells a portion of your collateral when its value increases to a predetermined level, covering your loan repayment. This feature provides flexibility to manage your loan based on market movements.

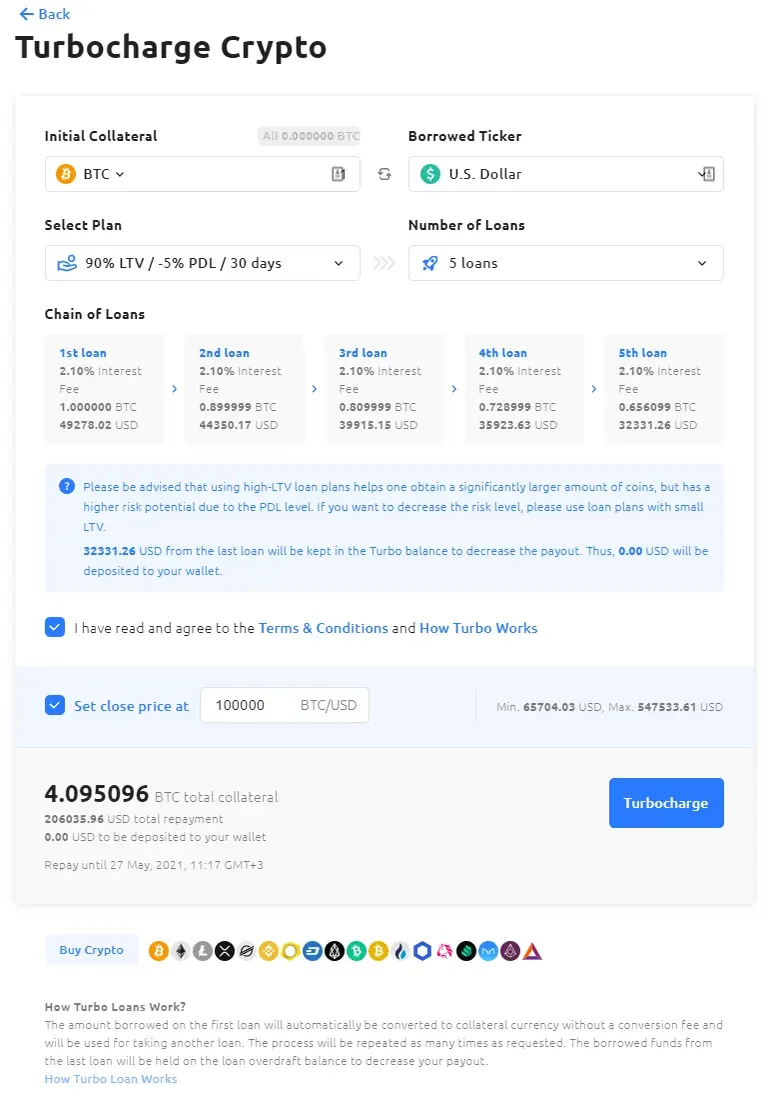

Turbocharge

Turbocharge is a feature that allows you to take an initial loan and use it as collateral to obtain additional loans, repeating this process up to 15 times. This compounding structure can increase your exposure to potential gains.

You can set a target price at which YouHodler will automatically sell your collateral to repay the loan, helping you manage potential profits. By clicking the "Turbocharge" button, you’ll see a detailed payment schedule for your crypto-backed loan.

However, leveraging your crypto assets through Turbocharge also increases the risk of liquidation if the value of your collateral drops. Pay close attention to the Price Down Limits (PDL). If the value of your crypto falls below this limit, all turbo loans will be liquidated, meaning YouHodler will sell off your collateral to cover the debt.

The minimum loan amount for Turbocharge is 100 USD, 100 EUR, or 100 USDT. Unlike standard loans, Turbocharge loans aren’t paid out to you directly; instead, they remain on the platform. If the currency value rises, you could exit your position, repay the loan, cover fees, and potentially profit. However, this strategy carries significant risk and should be approached with caution.

🧾Does YouHodler deduct taxes?

YouHodler doesn't deduct taxes from savings account earnings. The platform allows you to download a transaction report with the amounts of interest you earned. You can, however, only get this file by requesting it directly via YouHodler's live chat. You can use this file to report your income to your tax authorities.

Liquidity

When using any trading platform, liquidity is a critical factor to consider.

On YouHodler, withdrawing fiat or cryptocurrency comes with a small fee. For fiat withdrawals, SEPA transfers cost €5, while SWIFT transfers are charged at 5% for USD (with a minimum fee of $70) and €55 for EUR. The minimum amount for a wire transfer withdrawal is $500 or €500.

For crypto withdrawals, the minimum typically ranges from $10 to $50 (in crypto equivalent), while for stablecoins, it’s €5. These withdrawals are usually processed within minutes or hours, depending on the specific cryptocurrency’s network conditions.

However, only verified users can withdraw funds. Additionally, fiat withdrawals require proof of address and can take up to 24 hours to complete.

YouHodler’s fees may seem higher than those of some competitors, but they help support the platform’s growth and the rollout of new services.

As noted earlier, liquidity on YouHodler should be assessed regularly. If your account is flagged for KYC re-verification, access to your funds can be delayed by several weeks.

Interestingly, during this period, YouHodler still allows users to trade and deposit new funds, even though account re-verification has not been completed. Our liquidity rating for YouHodler takes this issue into account.

Support

YouHodler offers an average support experience compared to other crypto lending platforms. The platform features a comprehensive help section where users can find detailed information about terms, conditions, and how different products work.

For guidance on complex features like Multi HODL or Turbocharge, this help section can be particularly useful.

Support is available through live chat or by emailing support@youhodler.com, providing users with direct access to assistance. However, response times may vary depending on the nature of your issue.

It's also important to note that the support team does not operate on weekends, so replies should not be expected outside regular business hours.

YouHodler Alternative

We currently cannot recommend a suitable alternative to YouHodler for cryptocurrency enthusiasts. Many crypto lending platforms operate under non-transparent business models and resemble pump-and-dump schemes, making them risky for long-term investors.

While the overall risk profile of most exchanges is comparable, we advise serious users to avoid engaging in high-risk trading activities.

Assessing the long-term financial benefits of more stable platforms is a prudent approach for investors focused on sustainability and risk management.

Rather than chasing high yields through volatile crypto trading tools, users may benefit more from exploring platforms with a proven track record, clear regulatory oversight, and consistent performance.

At P2P Empire, we emphasize platforms that offer transparent operations, steady returns, and robust investor protections. Our tools and P2P reviews are designed to help you identify such opportunities.

For those looking to grow their wealth over time with less exposure to unpredictable market swings, this direction may offer greater peace of mind and financial resilience.