CrowdedHero Review Summary

CrowdedHero is a regulated Latvian crowdfunding platform offering investment opportunities in growing companies. The expected annual return ranges from 10% to 20%. Investors can expect regular dividend payouts or capital gains after the funded projects have been sold.

Key takeaways from our CrowdedHero review:

- Higher risk due to little track record

- Limited investment opportunities

- Suitable for experienced or professional investors

- Lower liquidity

- Lower liquidity

What is CrowdedHero?

CrowdedHero is a regulated Latvian investment platform that offers investments in debt securities or the equity of established companies with growth potential.

Investing in CrowdedHero can be a lucrative venture. The return depends on the individual project and the type of investment. For instance, the latest debt security project, “Simpleros” is expected to generate a promising 14.25% annual return.

Pros

- Regulated investment platform

- Comprehensive key investment information sheet

- Disclosure of financial information

- Investments in established companies with potential for growth

Cons

- Little track record

- Entry and success fees

- Lower liquidity

- Somewhat unpredictable return

Our Opinion of CrowdedHero

CrowdedHero is a very small platform that has raised just about €600,000 for two companies in three years; hence, their track record is limited.

The platform isn’t suitable for passive investors or users with little to no experience in the crowdfunding space.

While the platform provides potential investors with all the information required to make an educated investment decision, the investor makes the final assessment.

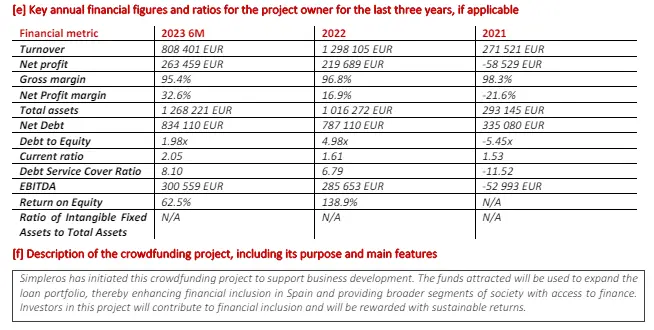

Here is an example of the information that you can find in the Key Investment Infomation Sheet.

Investing on CrowdedHero can be compared to investing in individual stocks. The difference is that CrowdedHero pre-selects companies with growth potential and provides a comprehensive analysis that you can use to evaluate your investment decision.

This isn’t always the case for non-sophisticated investors on the stock market or in the traditional P2P lending scene, where investors often lack the proper information to make educated decisions.

This type of equity crowdfunding can potentially yield higher returns but at the cost of lower liquidity, lower cash flow, and no securities.

None of the funded projects on CrowdedHero have been exited yet, making it difficult to evaluate the actual return generated by investors.

Therefore, the platform is only suitable for experienced investors who are willing to do their research and commit their funds for a longer period.

CrowdedHero Promo Code

CrowdedHero doesn’t offer promo codes or cashback bonuses, but it does offer investments in vetted companies with a good chance of growth and expected annual returns between 10% and 20%.

User Requirements

To generate yield on CrowdedHero, investors must register as individuals or via a legal entity (company).

To register as a non-sophisticated investors, the user needs to submit two separate identification documents and pass the knowledge test.

Additionally, the investor must submit a bank statement to verify the bank account information.

The registration process takes approximately 25 minutes. After you submit your information, the platform may take up to one day to verify your account.

If you register as a sophisticated investor, the registration process takes just 5 minutes.

Investors can transfer funds via bank card or wire transfer to invest in the presented investment opportunities.

The funds will be deposited into the payment account on behalf of the project owner.

Only after all the funds have been raised and the shares have been registered in the investors' names are the funds transferred to the project owners’ corporate account.

CrowdedHero collaborates with Lemonway, which manages bank accounts.

Unlike other platforms, CrowdedHero doesn’t ask investors to top up their investment accounts but instead facilitates investments directly in dedicated projects. This decreases the risk of fraud or embezzlement.

Risk & Return

Investing on CrowdedHero is suitable for more experienced investors who understand the benefit of investing in the equity of growing companies.

Investment Models

CrowdedHero offers two types of investment models:

- An indirect investment model is used via a special purpose vehicle where every investor will appear as a shareholder in the SPV. The SPV will become a shareholder of the company owned by the project owner.

- A direct investment model eliminates using a special purpose vehicle, and the investor becomes a shareholder in the project owner’s company.

In both scenarios, inventors can receive dividends, interest payouts, or capital gains upon a successful exit.

For most projects, CrowdedHero involves an angel investor contributing funds alongside the crowd. As an investor, you acquire B-class, preferential shares that don’t come with voting rights.

Potential Return

Your return on CrowdedHero varies depending on the company in which you have invested. Every project has different terms and conditions, which you should study before investing.

While one company wants to acquire funds via debt security for a fixed term, with semi-annual interest payments, another project might wish to raise further equity with less predictable dividend payouts or exits.

Investors on CrowdedHero should not expect monthly or quarterly interest payments, as with other platforms that fund payday loans or business loans.

On the other hand, CrowdedHero is seeking to fund lower-risk investments in cash-flow-positive businesses and high growth potential. Those investments should yield a higher return from 10% to 20% annually.

As the projects on CrowdedHero vary, it’s essential to read through the project descriptions and familiarize yourself with the presented dividend payouts or exit plans.

Fees

CrowdedHero is not your typical platform seeking to raise funds to fund its loan book. It’s a platform primarily focused on raising equity capital for growing third-party companies.

This business model has to generate revenue to sustain the administration of your investments and the due diligence of projects. To ensure the platform is prioritizing investors’ interests, it has introduced the following fees:

- 1.25% processing fee, which will be charged from your invested amount into a single project. This fee will be refunded if you decide to withdraw from the investment during the pre-contractual reflection period.

- 5.5% dividend fee, which will be deducted from the payout.

- 9% exit fee, which will be deducted from your capital gain.

As you can see, the 1.25% covers the administration of your investment and the costs connected to setting up the transfer of shares.

The 5.5% and 9% fees are “win-win fees,” which will be deducted from your income only if you receive dividends or capital gains.

This fee structure ensures that CrowdedHero represents investors rather than borrowers (third-party companies).

Potential Risks

The availability of projects on CrowdedHero is limited, as the platform is looking to onboard only cash-flow-positive businesses with promising growth potential.

CrowdedHero is conducting thorough due diligence, which consists of the following steps:

Preparation Phase

- Assessment of the financial health, understanding of the company’s market position, and identifying potential risks and growth opportunities.

- Collection of all necessary information, including financial statements, shareholder reports, and market analyses.

Financial Analysis

- Examination of the balance sheet, income statement, and cash-flow statement for the past 2 - 3 years.

- Year-over-Year Growth Analysis: Evaluation of the growth rate, key financial metrics, and EBITDA.

- Calculation of the debt-to-equity ratio, return on equity and return on assets.

- Assessment of the company’s ability to meet short-term liabilities.

Market Analysis

- Evaluation of the company’s position within the industry and its market share, including trends and competition.

- Evaluation of the market to estimate the market potential of the company’s products and services.

Risk Assessment

- Evaluation of currency risks, interest rate risks, credit risks, and liquidity risks. Assessment of the company’s exposure to those risks and risk mitigation practices.

- Analysis of market-related risks such as competition, regulation, volatility, and the company’s ability to adapt to market changes.

Growth Opportunities and Valuation

- Evaluation of potential growth opportunities, including new markets, product lines, and services.

- Calculation of the fair value with methods such as discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

- Review the shareholder structure to identify significant stakeholders and any potential conflicts of interest.

Examination of Financials

- Analyze the company’s debt levels, terms, and conditions. Assess the sustainability of its debt and potential financial distress.

- Review significant assets for their valuation, liquidity, and contribution to the company’s strategy.

- Evaluate the company’s investments in CapEx to understand its growth strategy and the efficiency of its capital allocation.

Legal Due Diligence

- Review of copies of criminal record certificates for members of the management board.

- To understand the decision-making process, it is necessary to review the minutes of the shareholders' meetings over the past two years in detail.

- Investigation of potential pledges on assets, legal restrictions, or encumbrances that could impact the company’s operations or financial standing.

The report from CrowdedHero’s due diligence is presented to investors on the project page with supporting documents such as financial statements and key investment information sheets.

Here is an example of the key investment information sheet for a recently published project.

CrowdedHero’s due diligence gives you a good idea about how the platform evaluates businesses.

The difference between CrowdedHero and other platforms in the industry is that you can assess all the documents and make your own assessment of the company seeking to raise capital.

This is hardly the case on other platforms, where you often barely get an idea of what exactly you are funding, which increases your chances of losing money.

Outside of risks connected to individual projects, which you should review independently, there is also the risk associated with CrowdedHero and its inability to service your investments in the future.

We have discussed these potential scenarios directly with the CEO, which you can watch below.

When investing on any platform, you want to ensure it is still around when you exit your investment.

Is CrowdedHero safe?

When investing in the equity of non-listed companies in growing phases, you must consider risks that might impact individual businesses. Outside of those risks, you should also consider the risk that CrowdedHero might go out of business.

Who leads the team?

Janis Blazevics is the CEO and co-founder of CrowdedHero. According to his LinkedIn profile, he is a member of the Latvian and Lithuanian Business Angels Network. He works part-time as a financial analyst at BIOSAN SIA and as an investment manager at Eventus Capital.

He worked as a private banker for almost nine years at the BlueOrange Bank.

Janis surrounded himself with former colleague Svetlana Skeneva, who previously worked at BlueOrange Bank and is currently the COO at CrowdedHero. The Chief Investment Officer is Sandris Rugums, who is also the Managing Director of Eventus Capital, a consulting firm that focuses on mergers and acquisitions.

As of the writing of this CrowdedHero review, the platform is run by five people who are listed on CrowdedHero’s “About us” page.

Get personal with the CEO and watch his answers to critical questions in our one-to-one interview.

Who owns the platform?

The platform was co-founded by Janis Blazevics and Sandris Rugums, who are still the owners of CrowdedHero Latvia SIA.

Are there any suspicious terms and conditions?

CrowdedHero is a licensed crowdfunding platform, meaning it has to follow a strict disclosure policy.

It’s crucial to study the risk warnings and to comprehend the investment you are about to make fully. The platform suggests that investors should not invest more than 10% of their net worth into this asset class.

You should also comprehend that the liquidity on the platform is limited.

One of CrowdedHero's positive aspects is that the platform does not make investment opportunities appear better than they are. The platform clearly states that there is no guarantee of any returns and that investors might lose money.

Protection of non-sophisticated investors via revocation

CrowdedHero is unique in the industry because it allows non-sophisticated investors to withdraw from any investment within four days of making it.

Storage of Funds

When investing via CrowdedHero, you are not sending money to their account but to a segregated account operated by Lemonway, a regulated payment institution that manages your funds.

Amendments

The platform can change the terms and conditions anytime. Investors should be notified about the changes as stated in their terms.

Access to legal documentation

Upon investing, you can review the shareholder agreement, which clearly states the terms and conditions between the investor and the company.

Potential red flags

During our initial research, we did not identify any platform-related red flags.

Usability

CrowdedHero isn’t the most user-friendly platform in the industry. The company has to comply with the Latvian regulations, meaning it has to collect more personal information and verify the users’ ability to access risk.

Opening an investment account can, therefore, take slightly longer than on non-regulated platforms.

When investing, investors can review individual investments and the key information investment sheet, highlighting the risks.

The investments are made via direct bank transfer or card payment directly to the bank account in the project owner’s name, which is used to collect the funds from the crowd. Only after successful project funding are the funds transferred to the corporate account of the project owner.

During the project timeline, investors are informed about critical updates or the latest financial reports.

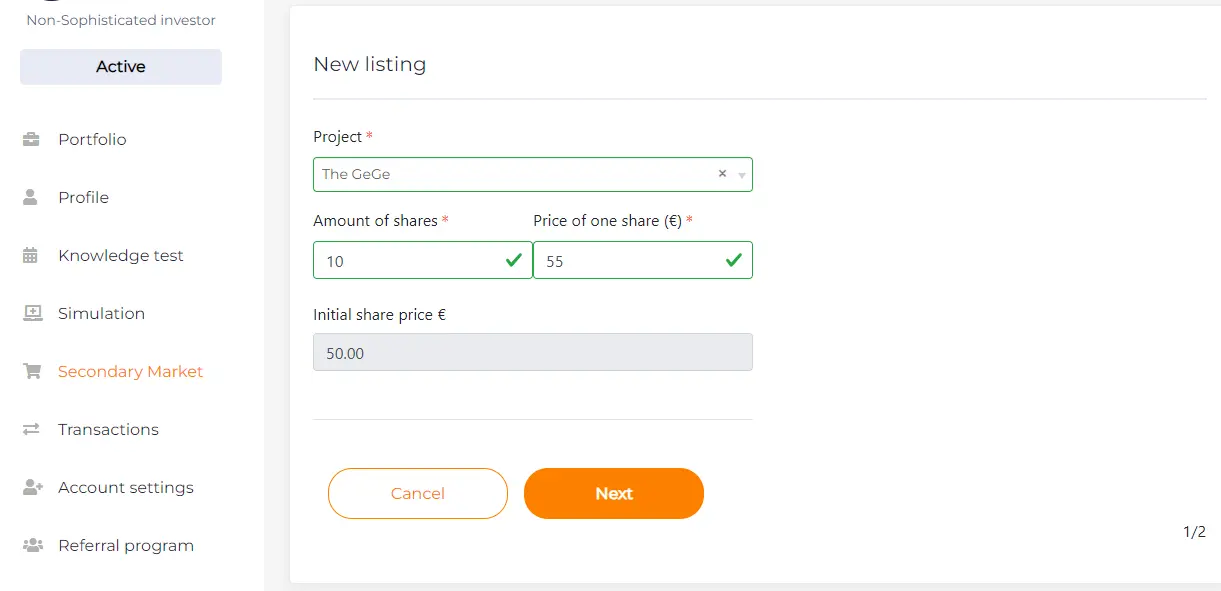

Liquidity

If you expect to have access to your funds at any time or within a short period, CrowdedHero isn’t the right platform for you.

As of writing this CrowdedHero review, the platform has essentially funded only one project, which hasn’t been exited yet.

The platform allows investors to sell or buy shares on the secondary market. However, this option is somewhat limited as there aren’t many active investors on the platform.

If you plan to invest your money on CrowdedHero, you should almost always expect to have your funds locked for at least the listed project period, which can vary between two and five years.

While there is always the chance that a project will repay the funds earlier than expected, it is not guaranteed.

Support

During our initial platform review, we contacted support with additional questions. The platform provided comprehensive answers within three days.

So far, we have only spoken with the CEO, who was willing to provide us with additional information that is unavailable on the platform’s website.

CrowdedHero Alternatives

CrowdedHero is a regulated platform with exciting investment opportunities. However, investors may find the lack of a track record discouraging. Here are some suitable alternatives if you want to earn interest by investing in loans.

Esketit

Esketit is one of the best P2P lending platforms of year. The company offers attractive investment tools with increased liquidity if you invest using the offered investment strategies. On Esketit, you can expect to earn around 10% interest per year, depending on the specific loans that you invest in. Learn more about Esketit in our Esketit review.

PeerBerry

PeerBerry is another excellent platform that should be part of your P2P lending portfolio. The company manages over €100 M of investors' assets with no capital loss. This P2P lending platform is also known to be one of the top-performing companies in the P2P lending space. While the loan availability may be limited, the lower risk that comes with investments on PeerBerry is just one benefit of why investors choose to invest in loans on the platform. Learn how to earn up to 11% interest annually by reading our PeerBerry review.

Fintown

Fintown is one of the fastest-growing platforms in the P2P lending space. The company is refinancing its equity in exchange for interest generated through rental properties in Prague. You can earn between 8% and 14% annually by investing in rental projects with variable loan periods. Learn more about Fintown in our Fintown review.