Reinvest24 Review Summary

Our community has selected Reinvest24 as one of the worst platforms in the industry. Due to various disputes, the portfolios from Moldova and Spain are not performing, resulting in over €26 M in funds in recovery.

As of month year, the platform is no longer raising funds on the platform as the regulator forbids this type of activity.

With unfinished development projects, disputes with the company's shareholders, unclear ownership of SPVs in Spain, and non-transparent communication about recovering the remaining funds, it's unclear whether the investors will ever see their money back.

Follow our newsfeed to get notified about any upcoming announcements from Reinvest24.

Main takeaways from our Reinvest24 review:

- Lack of communication

- Questionable funding practices

- Not regulated

- Non-performing loans in Moldova and Spain

Pros

- N/A

Cons

- The platform blocked withdrawals

- The platform continued raising funds for several months despite being not regulated

- Not regulated

- Dispute between shareholders

- Suspicion of fraud in Spain

- The platform doesn't share much information about it's delayed or defaulted projects

Our Opinion Of Reinvest24

As of month year, we believe Reinvest24 is not a suitable investment option for risk-cautious investors, mainly due to the legal actions between Reinvest24 and its shareholder KIRSAN, which was raising funds to finance its development projects in Moldova.

KIRSAN has an 18% stake in Reinvest24 Holding, which operates the investment platform. At the beginning of 2023, Reinvest24 stopped funding loans in Moldova due to KIRSAN's loan non-performance.

KIRSAN owes investors close to €6 M. According to the investigative article from ZDG in Moldova, KIRSAN has also embezzled funds from apartment buyers. The prepurchased apartments were not completed. Several companies under the umbrella of KIRSAN are reported to be in the insolvency process.

KIRSAN has, therefore, embezzled funds from apartment buyers and investors on Reinvest24.

Additionally, based on research from concerned investors, it is suggested that Reinvest24 raised funds in Spain for projects that weren't realized.

This would indicate fraudulent behavior. The platform didn't share anything about the performance of its Spanish portfolio, resulting in further speculation in the community.

Learn more about questionable companies in our article about the worst P2P lending platforms.

Who runs the company?

Reinvest24 is led by CEO Tanel Orro, who has been with the company since its inception. Before working with Reinvest24, Tanel worked at LHV bank as a sales manager. The CTO of Reinvest24 is Kirill Tripolski, who was involved with dubious business practices in the past.

Who is Reinvest24’s Legal Owner?

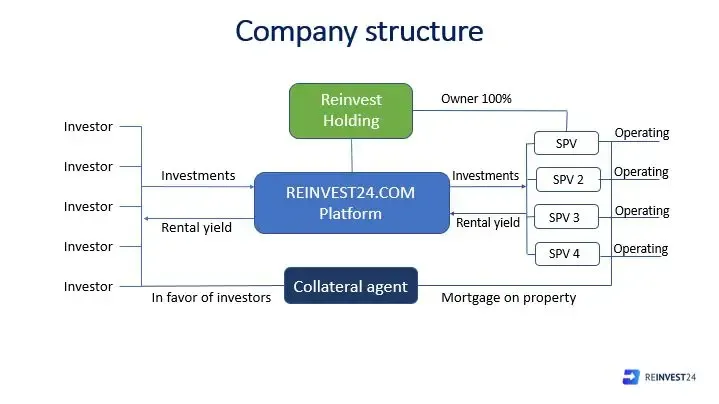

The Reinvest24 platform is owned by Reinvest24 Holding, which is owned by JoinEstate OÜ (72%) and Kirsan (18%).

Potential Red Flags

- Some selected properties don't have an appraisal report, so investors cannot evaluate whether Reinvest24 is raising the needed amount.

- The dispute between Reinvest24 and KIRSAN (Reinvest24's borrower and shareholder) can lead to financial losses for investors.

- It's unknown how many of the Spanish loans are not performing.

- Concerned investors believe that Reinvest24 has embezzled funds in Spain.

- Reinvest24 is raising funds to cover legal fees against the company's shareholders.

Learn more about possible red flags in our guide about how to avoid investing in P2P lending scams.

Reinvest24 Alternatives

Reinvest24 is one of the worst-performing platforms, mainly due to issues with KIRSAN, a borrower and shareholder. Resolving the situation might take years, so you should consider investing on better-performing platforms instead.

Crowdpear

Crowdpear is a Lithuanian-based regulated crowdlending platform raising funds to fund real estate projects in and around Vilnius. The team runs the platform behind Peerberry, one of Europe's best-performing P2P lending platforms.

By investing on Crowdpear you can expect to earn between 10% and 11% interest per year. A mortgage secures all the loans, and the interest is paid out typically every quarter.

To learn more about Crowdpear, read our Crowdpear review.

InRento

InRento is one of Lithuania's best-performing platforms for investing in rental properties. The company is regulated, and as of today, there are no delayed or defaulted projects, meaning investors receive the advertised return. By investing in lucrative rental projects, you can expect to earn at least 8% per year.

Find out more about InRento in our InRento review.