Crowdestor Review

Crowdestor is a small crowdfunding platform from Riga, that helps to fund business projects from different sectors. This peer-to-business (P2B) lending platform is gaining popularity, mainly due to high annual returns of up to 28%. Higher returns, however, always come with higher risks. Read our Crowdestor review to learn more about this P2B lending platform.

Crowdestor's CEO answers critical questions:

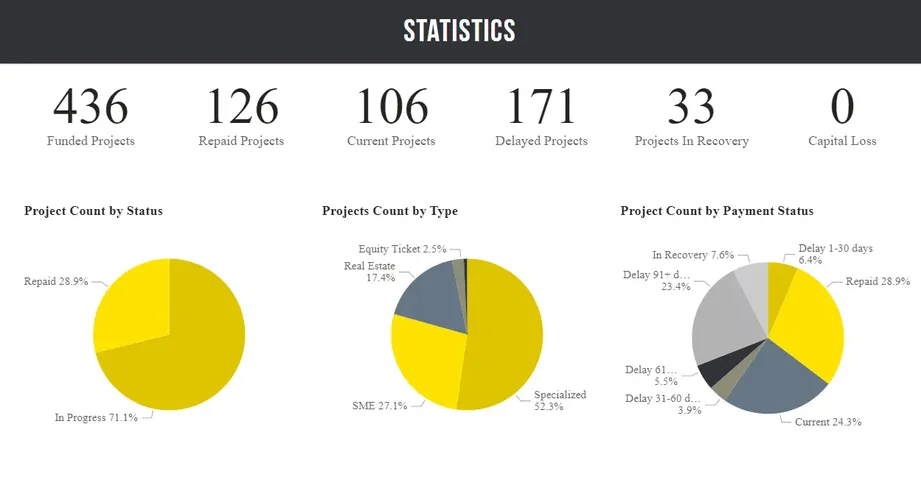

Crowdestor in Numbers

It’s always good practice to look at a platform's previous performance before signing up and investing money. If you can’t find a platform’s basic statistics, you should almost certainly treat this as a red flag.

When searching for initial information about Crowdestor, we found some basic stats on the platform's website.

The statistics on Crowdestor's website aren't very insightful as you can't download the loan book to see the full amount which is currently in recovery. As of writing this review, Crowdestor has 107 current projects, 161 delayed projects, and 26 projects in recovery.

This means that a vast majority of the projects are not performing according to the expected loan schedule.

Poor performance of loans can negatively affect your portfolio on Crowdestor, even though you have diversified across multiple investments.

Judging by the low level of transparency, poor project updates, and dubious securities, the recovery rate of the delayed projects as well as projects "in recovery" won't make many investors happy.

Despite Crowdestor not being very transparent, the platform does publicly share its financial reports which you can download in the statistics section above.

Crowdestor Bonus

Some of the crowdfunding platforms, Crowdestor included, offer special promo codes that reward new investors with a cashback bonus. As Crowdestor was voted one of the worst platforms by our community, we strongly encourage you to not engage with Crowdestor's offers as the chance that you will lose your money is high.

Crowdestor’s New User Requirements

Much like most P2P lending platforms, Crowdestor requires its investors to be over 18 years old and to transfer funds from their European bank accounts. Note that you need to reside within Europe to be eligible to invest. This means that investors from the U.S. and Canada are not qualified to invest on Crowdestor.

No EUR bank account? No problem

- 💳

- 💳

If you are looking into a digital bank account with fast and free SEPA transfers, the N26 account might be a good option for you. It takes a maximum of two days to deposit money into your investor’s account.

Risk and Returns

When reviewing the risk of an investment on a specific P2P lending platform, you first need to look at the securities that come with the investment.

You can find some information about the securities of a specific investment in the project description.

From an investor’s perspective, the information Crowdestor provides regarding the security of your investment is less than sufficient.

On platforms like Mintos or PeerBerry, you can really only rely on the buyback guarantee. On EstateGuru your investment is protected by a mortgage. Find out more in our EstateGuru review.

Here’s a breakdown of the safety that comes with Crowdestor investments:

- Guarantee by borrower

- Intellectual property and copyrights of an online game developed by the borrower

- Commercial pledge on assets and agreements

- Provision fund

In most cases, there is not much additional information about the security of your investments, which could easily lead to confusion regarding the actual securities that come with P2P lending on Crowdestor.

And the confusion doesn’t stop there! The project descriptions don’t seem to follow a particular structure or format like those on other European P2P lending platforms like EstateGuru.

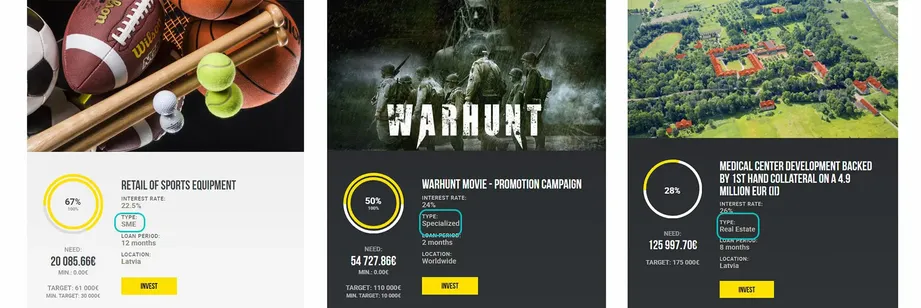

The reason for this is that Crowdestor offers investment opportunities in three different segments.

- SME

- Specialized

- Real Estate

SME - Small & Medium Enterprises

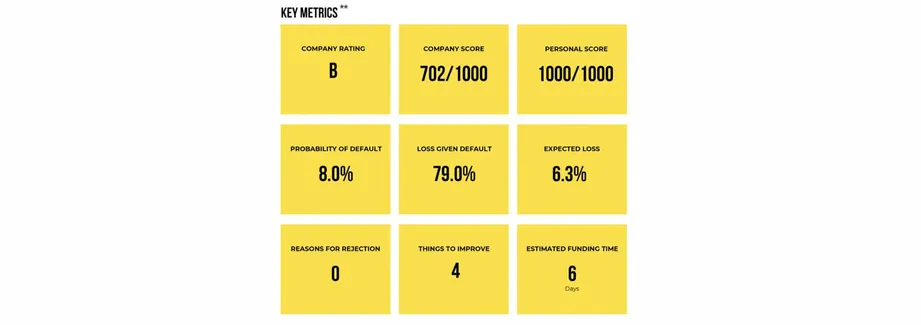

For all SME projects, you are able to view a credit report that gives you a good overview of the creditworthiness of the borrower.

Download the individual credit report on the project overview page to receive more information about individual metrics.

In our latest talk with CEO Janis Timma, we have learned that this report will only be available for projects from the SME segment. Those projects are typically secured only by the private guarantee of the borrower.

Specialized

Specialized projects come from various industries such as the energy industry, gaming industry, movie production industry, or farming industry.

Those projects are typically secured by a commercial pledge on the business assets or copyrights on intellectual properties.

Real Estate

The third segment on Crowdestor is the real estate segment. As the name already says, you are funding real estate projects. A first-rank mortgage typically secures those types of loans.

Note that many loans are repaid at the end of the loan term. The interest payments vary depending on the individual deal. Sometimes both, loan principal and interest is repaid at the end of the loan term.

Additionally, to the securities mentioned above, Crowdestor also provides an additional protection layer - the provision fund.

Provision Fund

Crowdestor has recently upgraded its buyback fund. From now on, it’s called a “provision fund”.

Additionally to the collateral, which is the actual protection of your investments on Crowdestor, you can enjoy the protection of Crowdestor’s provision fund.

Crowdestor pays a 0.5% commission of every project to this fund. The status of this fund is updated every month.

How does it work?

The provision fund “covers” the entire loan portfolio on Crowdestor. This means the size of the fund will be split according to the loan amount of the outstanding loans.

And here goes the calculation (example):

Total loan portfolio: €20,000,000

Average default rate: 10%

Individual project: €100,000

Provision fund size: €360,000

360,000 x (100,000 / (20,000,000 x 10%)) = € 18,800

In short, if you invest in a loan of €100,000 and it defaults, a total of €18,800 will be distributed across all investors.

This is in addition to the collateral which will be sold to cover the loss.

Is Crowdestor Safe?

Crowdestor offers high-yielding investments in business projects. In short, Crowdestor connects business owners with the crowd that helps fund their business ideas. In theory, this is a great initiative to support small and medium businesses in Europe, as you can invest from only €50.

Past experiences with similar business models show that investing in business loans is risky. Retail investors have already lost millions by investing in seemingly identical platforms such as Monethera, Grupeer, Envestio, and Kuetzal.

Let’s have a look at the team behind Crowdestor, their terms and conditions, and whether we can spot any red flags.

Who Runs the Company?

Crowdestor was co-founded at the beginning of 2018 by Janis Timma and Gunars Udris. Both gentlemen are described as entrepreneurs by heart.

Janis runs at least two more companies Eco Energy Riga and the Heat and Power Plant Association of Latvia. Janis owns a power plant by himself, which helps fund the expenses of the crowdfunding platform.

Gunars was previously the managing director at FUNDEA before he joined Crowdestor as the COO. Our quick research showed that FUNDEA is a microfinance company from Guatemala. We aren’t, however, sure whether this is the company Gunars previously worked for.

From fall 2020 to spring 2021, Crowdestor was joined by Artur Geisari who was previously the CEO and co-founder of Monify which is a defaulted lender that still owns money to P2P investors. Crowdestor stopped the collaboration with Mr. Geisari in March 2021.

Who is the Legal Owner of the Company?

Crowdestor OÜ is registered in Estonia; however, their HQ is based in Riga, Latvia. We found that Janis Timma is the only registered management board member in the Estonian business registry.

Are There Any Suspicious Terms and Conditions?

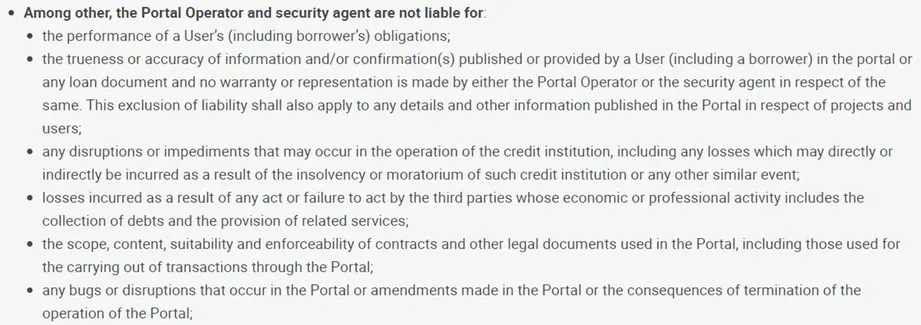

Crowdestor is funding a broad spectrum of projects from all around the world. It’s essential to be aware of the terms and conditions and know your legal rights if something goes sideways.

First and foremost, Crowdestor is only a service provider that connects borrowers (businesses) with investors. The company itself does not provide any legal or investment advice. You, as an investor, lend money to the business, which is also your contractual partner.

Liability

Crowdestor isn’t liable for any losses that might occur from any of your investment activities on the platform.

This is a standard clause used by all P2P platforms. As an investor, you should do your due diligence about every project and evaluate whether you are willing to take the risk and invest.

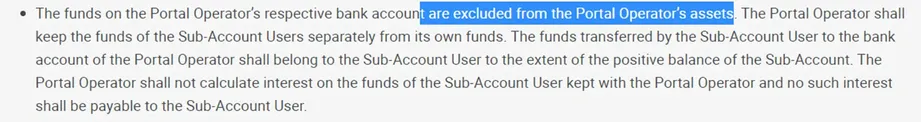

Separated Funds

In Crowdestor’s terms and conditions, you learn that your uninvested funds are excluded from Crowdestor’s assets, which means they belong to you. Crowdestor can only use them in line with the terms and conditions - to invest in projects of your choice.

This gives you good legal ground. We are not aware of any withdrawal delayes as of right now.

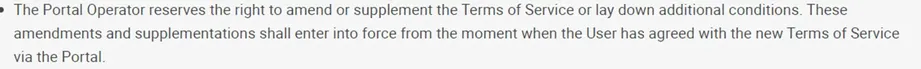

Amendments to the terms and conditions

Crowdestor can amend the terms and conditions at any time without prior notice.

If you disagree with the changes, you won’t be able to continue using the platform. The positive balance will be paid out to your bank account within 10 working days.

In case you have ongoing investments, you will need to wait until the borrowers repay their loans in order to exit Crowdestor completely, as there is no early exit option currently available.

Do Investors have Access to Individual Loan Agreements?

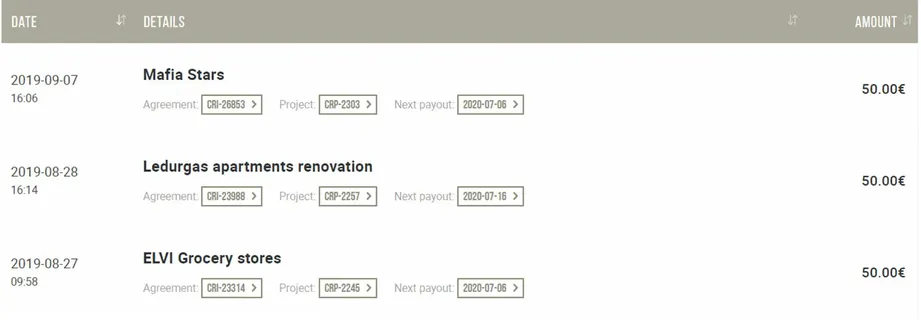

Investors have access to all loan agreements. Click on My Investments's left menu and choose the individual contracts.

Crowdestor’s loan agreement isn’t publicly available. You can either view it before deciding to invest in individual projects or your investor’s dashboard afterward.

Curious about what else we look at when conducting our research?

With our ✅ workbook, you will be able to spot red flags 🚩 and protect your investment.

Protect Your Money!

Potential Red Flags

- Crowdestor can amend the terms and conditions without prior notice

- The platform fails to communicate updates regarding delayed projects

Learn more about possible red flags in our guide about how to avoid investing in P2P lending scams.

What’s our opinion about Crowdestor?

Crowdestor is not suitable for beginners or more conservative investors. The platform is for investors willing to take more significant risks in exchange for potentially higher returns.

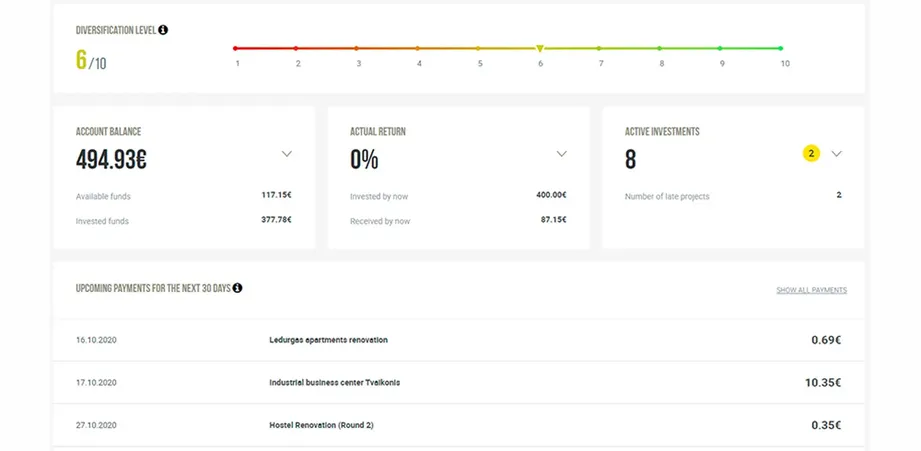

We have had an active portfolio on Crowdestor since 2018, and our return was at around 16% before 40% of the projects we have invested got delayed by more than six months.

By looking at the statistics and Crowdestor’s portfolio performance, you can expect a significant part of your portfolio to be delayed. As Crowdestor has no proven track record in recovering the debt, you should not put your expectations too high.

While Crowdestor’s founder Janis Timma is a successful entrepreneur, the platform often receives negative press, and previously, it was also a victim of a cyber attack. The project description and the securities various borrowers offer do not inspire much trust in Crowdestor’s services.

By investing on Crowdestor you are exposing yourself to unnecessary risks, which are not justified by the potential return. The actual return from your investment on Crowdestor can be very low or even harmful. This is something that you should keep in mind.

If Crowdestor manages to retrieve some of our delayed investments, it’s going to be a pleasant surprise, we won’t, however, continue investing on this platform as there are much better alternatives with more predictable returns on the market.

We don't believe that the risk and return ratio on Crowdestor is correct for most retail investors.

Crowdestor is not aiming to become a regulated platform, which you should consider when choosing the best P2P platform.

We will further monitor the development of Crowdestor and report about new changes in this Crowdestor review. We do, however, not recommend the platform!

Curious about other platforms? Head over to our ⚖️ P2P lending platform comparison to get a quick overview of the currently available platforms.

Usability

Crowdestor is relatively easy to use. The dashboard overview allows you to track your portfolio performance.

Currently, Crowdestor investors still can either invest manually or set up their own parameters and use the Auto Invest feature.

We’ve had no issues with adding and withdrawing funds, with the deposit of funds taking no longer than two days.

Although there is certainly room for improvement, for most investors (who aren't concerned with the safety of their investments) the current features will suffice.

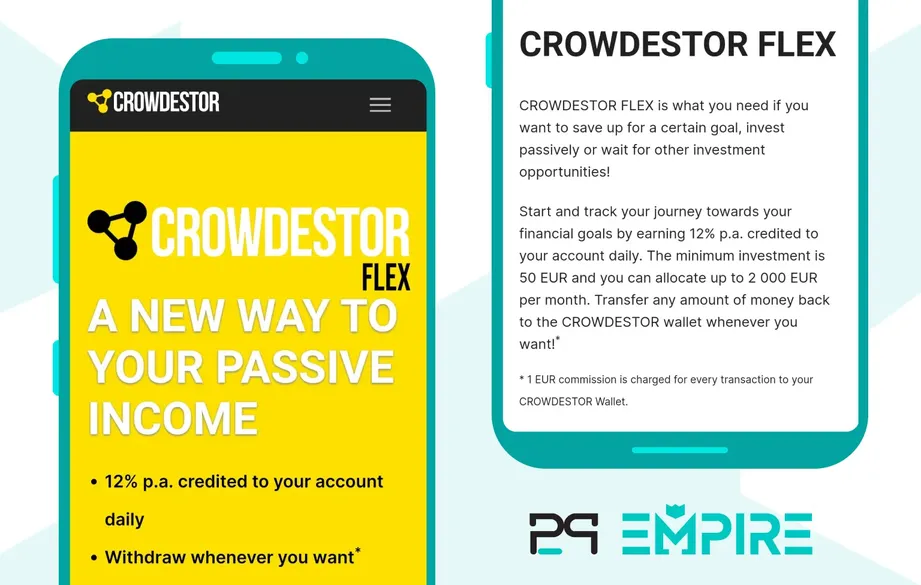

Crowdestor FLEX

Crowdestor is trying hard to make its platform more attractive. One of the strategies to achieve this goal is the newly introduced product CROWDESTOR FLEX.

This new investment product is a copy of Bondora’s Go & Grow with some additional perks.

- You can set up your savings goals

- Earn fixed return of 12% p.a. - added daily

- Invest up to €2,000 per month

- Instant liquidity with a €1 commission fee

The idea is to make investments “easier” for the investors. There are, however, a few things to consider.

Which loans are you going to be funding?

Crowdestor explains that only loans that are able to generate sufficient cash flow will be added to the FLEX portfolio. Keep in mind that the overall quality of Crowdestor’s portfolio is poor. As of July 2021 only around 25% of the entire portfolio is current. Only time will tell whether Crowdestor can offer this interest rate in the long run.

How good is the liquidity buffer?

Crowdestor reserves 10% to 20% to pay out the withdrawals. If the reserve isn’t sufficient, a partial principal payout method is implemented for a maximum of 180 days, while the interest from the outstanding amount will be paid daily.

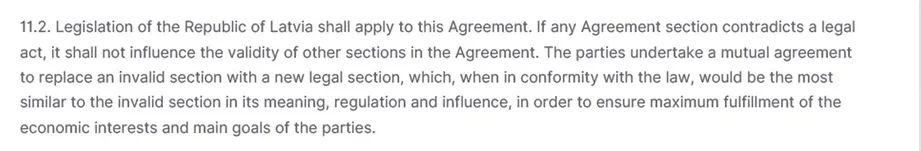

Questionable Terms?

We have read the terms for the FLEX product and noticed that the Legislation of the Republic of Latvia shall apply to the Agreement, while Crowdestor is officially registered in Estonia.

So by using FLEX you are going into an agreement with an Estonian company that refers to Latvian laws 🙄.

Liquidity

Liquidity is becoming an essential factor for P2P investors, mainly when there is uncertainty in the financial markets.

Due to the fraudulent behavior of P2P lending sites such as Envestio and Kuetzal, the P2P lending market experienced reputational damage.

Many investors requested to add an early exit option on Crowdestor - and Crowdestor delivered.

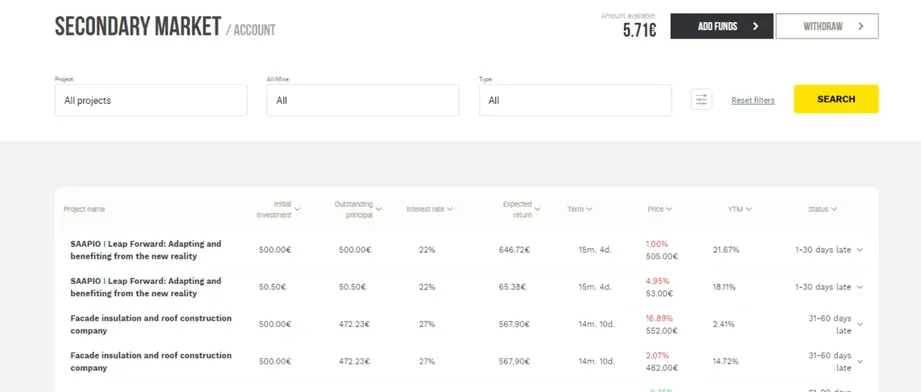

As we are updating this Crowdestate review, there are over 4,000 loans listed on the secondary market. In our recent interview with Crowdestor’s CEO, we have learned that currently only around 4% of the entire loan book is listed on the secondary market.

You can list your projects for sale at a premium or discounted price. The premium or discount is, however, calculated from the expected return, rather than the current value. We have informed Crowdestor about this issue and Janis Timma promised to amend the calculation.

We have tested Crowdestor’s secondary market and sold two, out of six delayed projects with a discount of 10% (from the expected return) within four days.

You should know that seller is paying a 2% secondary market fee. The buyer's commission depends on the discount. If the discount is smaller than 10% there is no fee, if the discount is higher, then the fee will be 10% of the difference between the discount value and 10%, but not higher than 2%.

If you want to be able to access your money fast, we suggest you invest on PeerBerry or Bondora.

Crowdestor’s Customer Support

We have reached out to Crowdestor several times, requesting more statistical data and their financial reports, without success.

If it is hard for us to get a response, it might be troublesome for new investors to get any additional information as well.

There is one way to get in touch with Crowdestor, and that’s via a private Facebook group. To join this group, you must be a registered member of Crowdestor. If you are a new user who would like to get some information before signing up, you might not be able to get it anywhere.

Crowdestor Review Summary

Crowdestor offers high-yield business loans with interest up to 30%. The popularity of Crowdestor is driven by investors who chase high interest rather than safe investments. Crowdestor, however, fails to resolve fundamental transparency concerns which make investing in Crowdestor very risky.

Main takeaways from our Crowdestor review:

- Invest in high-yielding business loans

- Invest across various industries

- Lack of tangible securities

- Lack of transparency and poor communication

Note, however, that Crowdestor isn't suitable for more conservative investors. The promoted return isn't the actual return that you will be earning on the platform.

If you want to earn a yield on your money, we suggest exploring other P2P lending sites.

Warning

Crowdestor is one of the least transparent platforms on the market. The company doesn't provide any customer support, and no performance updates regarding the defaulted projects. Note that we stopped monitoring Crowdestor's activities, due to the extremely disappointing services the platform is providing.