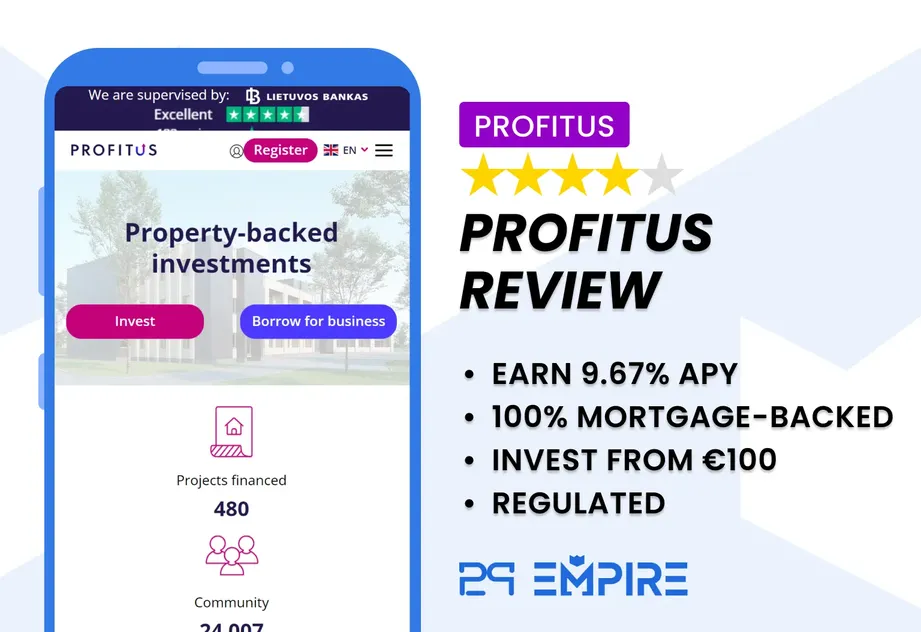

Profitus Review Summary

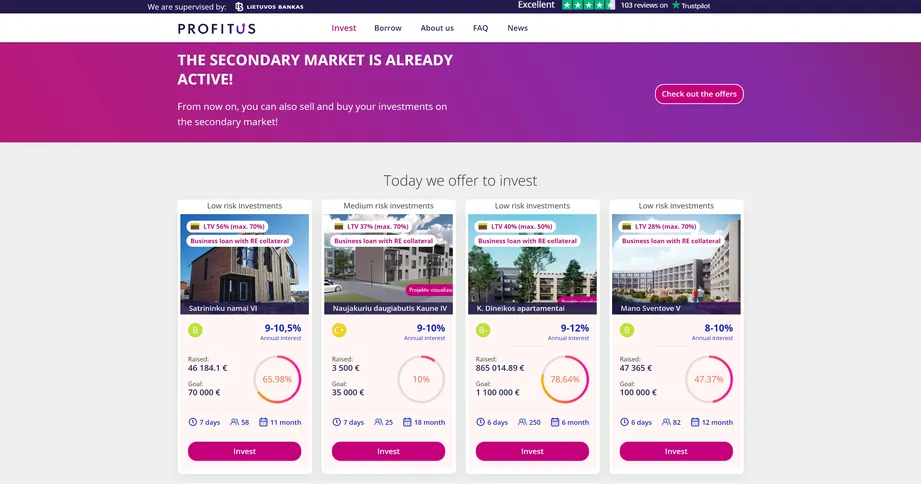

Profitus is a promising platform that helps investors invest in Lithuanian real estate projects. Most of the projects on Profitus are funded with an LTV of below 70%, which makes the investments less risky.

Suppose you are looking for a reliable and regulated crowdfunding platform with exposure to real-estate-backed loans in Lithuania. In that case, Profitus is currently the best option on the market, with an excellent track record.

Main Takeaways From Our Profitus Review:

- Regulated crowdfunding platform

- Low LTV

- Low default rate

- Active in Lithuania, Estonia, Latvia and Spain

What Is Profitus

Profitus is a real estate P2P lending platform in Lithuania. Investors use Profitus to fund mortgage-backed real estate projects in Spain and the Baltics.

Most of the listed projects have an investment term between 3 and 18 months. On average, investors earn 12.14% interest per year. Find out more about this platform in this Profitus review.

Pros

- Regulated platform

- Relatively low default rate

- Mortgage-backed investments

Cons

- Financial reports aren't disclosed

- Secondary market fees

Profitus Bonus Code

At the moment, Profitus doesn't offer any bonus codes for our readers. Should the platform change its terms in the future, we will update our Profitus review.

User Requirements

Profitus users can register either as private investors or as companies. They must be at least 18 years old, however, Profitus also supports accounts for children as long as parents manage it.

The registration process is very straightforward; type in your name, email, and phone number and verify your email address. After verification, you will need to confirm your identity.

There are two ways you can complete this step.

- Use the Know Your Customer (KYC) verification service, Ondato. This method requires you to take a selfie and a photo of your passport or ID card.

After you have been verified (which, in our experience, takes no more than five minutes), you can top up your Profitus account.

To top up your Profitus account, you can do so by credit card or bank transfer to your personally created

Profitus account.

Profitus partners with Lemonw, a payment service provider regulated by the Bank of France (ACPR). The company offers the possibility to create a personal e-wallet, dedicated to the investor, with a separate IBAN, where the funds used for investment

will be stored.

The money is separated from Profitus's activities and is stored at BNP Paribas.

Risk & Return

When investing in P2P loans or any other crowdfunding projects, you should be aware of the risks connected to your investment.

When investing on any platform, you risk losing some, if not all, of your money. The probability of this situation occurring highly depends on several factors. One of these factors is the loan type that you choose to fund.

While many platforms like Mintos, PeerBerry or Robocash offer investment opportunities in unsecured personal loans, Profitus offers mortgage-backed investments, which means that a first-rank mortgage secures 100% of the loans.

How Does Profitus Protect Your Investment?

Many factors influence the risk of default, most of which investors have no control over.

Let’s start by breaking down Profitus’s protection scheme so you can get an idea of how your investment is protected.

Here are the companies Profitus collaborates with to increase the protection of your investments.

- Bank of Lithuania, which ensures Profitus complies with national laws

- Trustly, which manages investors’ funds, because they are separated from Profitus’s operational bank accounts

- Sorainen, a law firm that helps to create contracts

- Creditinfo, which completes risk assessment of real estate projects

Profitus uses data from registries and credit score companies like Creditinfo to assign a risk rating (AAA+, AA+,AA, A-,A+,A, BBB+, BBB, BBB) to individual real estate projects.

You should know that Profitus only acts as an intermediary between the borrowers and investors.

When you invest in a project listed on Profitus, you close a loan agreement with the borrower, not the platform. This means that if Profitus goes out of business, by law, the assets (mortgage) remain with investors.

Profitus facilitates those transactions and handles the paperwork. It also allows investors to invest in real estate projects for as little as €100.

If the borrower fails to repay the debt, Profitus will initiate the debt collection process. The real estate will be sold and the revenue will be proportionately distributed among the investors.

How About the Returns on Profitus?

Regarding returns, investors' average interest rate from investing on Profitus is 12.14%, slightly lower than on platforms like Crowdpear or Fintown.

This might be due to the higher demand for investment opportunities, lower interest due to higher securities, or lower loan-to-value (LTV).

The average LTV on Profitus is just 65%.

The returns are highly dependent on the projects you choose to invest in, however, overall the interest is slightly lower than it is on other market players.

Is Profitus Safe?

At P2P Empire, we aim to provide the most value to our readers, so we examine the management team, history, and terms and conditions of every platform we review.

Who Runs the Company?

Profitus is led by Viktorija Cijunskyte, the company's Founder and Director, who has over 12 years of experience in the real estate industry.

During our research, we also found out that Viktoria co-founded the real estate agency Citus, which took 4th place within the Lithuanian real estate market within only a few years. You can read more about the company’s success on Viktorija’s CrunchBase profile.

According to Profitus’s website, the company employs 30 people. The legal owners of Profitus is Viktorija and Mindaugas Vanagas.

Are There Any Suspicious Terms & Conditions?

At P2P Empire, we are pretty sure that most investors don’t read the terms and conditions. And we don’t blame you; it’s a very laborious task... But, it is essential to understand your rights, especially when a third party is dealing with your money.

Let’s have a look at the terms and conditions from Profitus to see if there’s anything that new users should be aware of:

The first point is that Profitus holds your funds in separate bank accounts. While many platforms mention this in their marketing copy, it’s good to see it referenced in Profitus’s terms and conditions.

Profitus also mentions the legal process of debt collection.

We also like that Profitus informs its users about any changes related to the contracts between the investors and the platform or borrowers.

As you might expect, Profitus, is not liable for any losses from investing on the platform. This is true of all P2P lending sites.

We have not found any suspicious terms and conditions.

Do Investors Have Access to Individual Loan Agreements??

Before investing, you can read the project description and terms. You should also be well aware of the company's terms and conditions. As soon as the entire project is financed, the investors receive a loan agreement, which they can access from their investor’s profile.

Usability

Profitus is one of the most user-friendly real estate P2P lending platforms. Unfortunately, we cannot say the same about the platform's functionality.

If you have some experience with real estate P2P lending platforms, you might be aware of the issues that newer real estate platforms face.

Regarding usability, Profitus offers all you can ask from a regulated European crowdfunding platform.

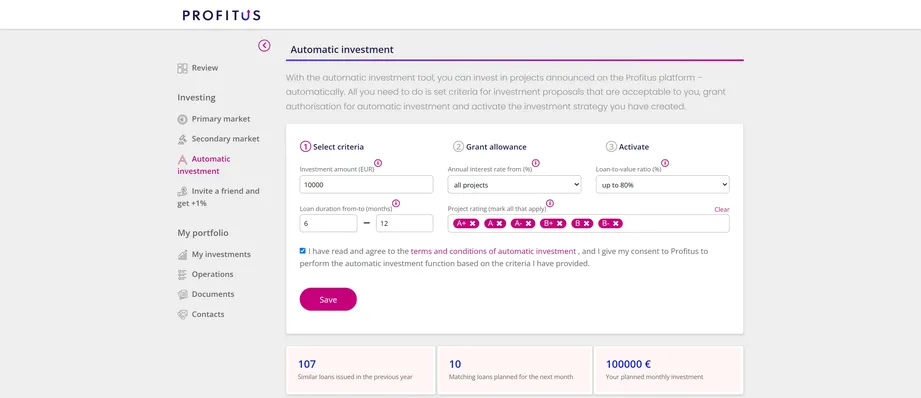

The investment website offers a primary and secondary market, where you can invest in various mortgage-backed loans manually or the Auto Invest, which is a tool where you can define your investment criteria and automate your investment process – a real-time saver if you ask us!

Auto Invest enables you to define the investment amount, desired interest rate, LTV ratio, loan duration, and project risk ratings.

Below the main view, you can review the previously listed loans that match your criteria and the expected number of loans listed on the platform in the upcoming weeks.

🧾Does Profitus deduct taxes?

Profits is a Lithuanian platform that is legally obliged to deduct 15% of personal income tax on your interest payments. If you are a non-Lithuanian resident, you can complete a DAS-1 form and reduce your taxes to 10% or 0%.

You can request the prefilled form directly from Profitus via their Live Chat. You must fill out the form and send it back to support@profitus.lt.

Remember that as long as your country of residence has a double taxation treaty with Lithuania, you won't have to pay your income tax twice.

Any tax you pay in Lithuania will be reduced from the income tax you pay on your earnings in the country where you are a tax resident.

Liquidity

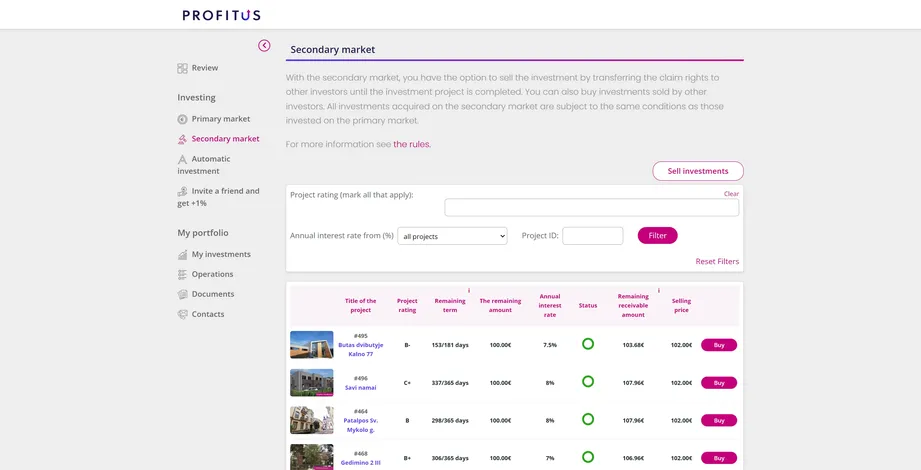

In terms of liquidity, you can access your funds either at the end of the loan term, when the project has been repaid, or when you sell your investments on the secondary market.

You can sell your investments with a premium or a discount anytime. Remember that Profitus charges a 2% secondary market fee for sellers. Buyers can buy discounted projects on the secondary market for free.

You should know that selling your portfolio might take a few days or weeks. The secondary market is an excellent option to liquidate your investments, should you need it.

If you want access to your money, we suggest using other P2P lending platforms.

Esketit and Bondora are two platforms that allow you to instantly withdraw most, if not all, of your investments.

Customer Support

Our experience, Profitus support, has been very positive. We have been in touch with the company several times, and each time, the platform has provided all of the requested information within one business day. If you have any questions regarding Profitus, we suggest reading their FAQ section before contacting their support at info@profitus.lt

Profitus Alternatives

If you don't think that Profitus is the right fit for you, you might consider some alternatives that provide a slightly different investment experience.

Crowdpear

Crowdpear is a direct competitor to Profitus. This regulated platform specializes in listing investments in mortgage-backed loans from Lithuania. Crowdpear is run by the same team as PeerBerry, often considered one of Europe's best P2P lending marketplaces.

Projects on Crowdpear tend to come with higher interest rates and bonuses than Profitus. As of month year, Crowdpear has a lower default rate than Profitus, which means their portfolio performance is superior.

Fintown

Fintown is a Czech-based crowdlending platform raising funds to fund development loans from VIHOREV Group, which owns the platform and manages several properties in Prague. The difference between Profitus and Fintown is that the Fintown is directly linked to the borrower. No third-party lenders are involved, which increases the safety of your investments.

Fintown's products are somewhat more flexible as you can fund FLEXI projects, which come with a 30-day lock-up period. This increases the liquidity of your investments compared to Profitus, where you need to wait until the end of the loan term or sell your loans on the secondary market.