Nibble Overview

Nibble is a relatively new P2P lending platform launched in February 2020. The company is registered in Estonia, although its team operates from Barcelona, Spain. The platform allows you to invest in consumer loans offering between 8% and 12% annual interest, all backed by a buyback guarantee. Before investing, we strongly recommend reading our full review.

What’s Our Opinion About Nibble?

After reviewing the platform in detail, we decided not to invest in Nibble.

Beyond the red flags mentioned above, we also could not find financial data for all loan originators.

Additionally, the website contains numerous mistranslations and grammatical errors.

This does not inspire confidence in Nibble’s services, regardless of who stands behind the platform or how “well-performing” the parent group claims to be. The poorly executed voice-over in the introductory video featuring Nibble’s founder, Maxim Paschenko, does not help either.

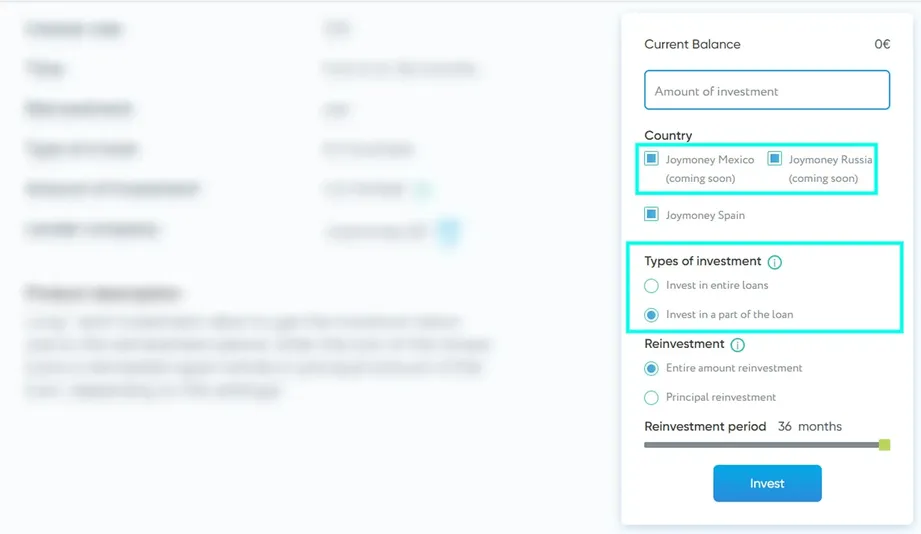

Nibble’s website gives the impression that you can invest in loans from Russia and Spain.

At the moment, this isn’t accurate — you can only invest in loans from Joymoney Spain.

This makes the financial overview of Joymoney Russia, which is displayed on Nibble’s site, largely irrelevant, especially since no financial report is available for the Spanish lender.

Nibble claims to value transparency, professionalism, and innovation. Based on our research, we cannot confirm any of this.

The platform feels hastily assembled to gain quick access to investor capital, without a clear long-term strategy or meaningful value proposition.

We have received several requests from Nibble to review their platform. After doing so and sending them follow-up questions, we never received a response.

We cannot recommend Nibble. There are far more reliable platforms available. Take a look at our list of the best P2P lending sites.

Still reading?

Here’s what else you should know about Nibble.

Nibble Requirements

To invest with Nibble you must be over 18 and a resident of Europe. While Nibble does not explicitly state that you need a European bank account, it is almost certainly required to comply with anti-money-laundering regulations.

No EUR bank account? No problem

- 💳

- 💳

To access all platform features, you must complete their verification process.

Risk and Return

Investing in microloans on a new platform carries significant risks. You are investing in unsecured payday loans backed by a buyback guarantee.

While Nibble emphasizes this guarantee, it is only as reliable as the financial health of the loan originator — and Nibble does not provide this information.

You should be fully aware that Nibble is not responsible for any losses you may incur when investing through their platform.

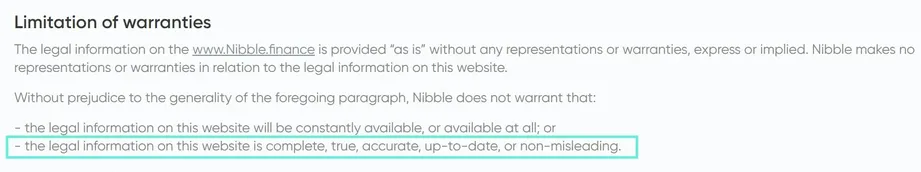

In fact, they are not even liable for inaccuracies in the information they publish.

How is that possible? Keep reading.

Is Nibble Safe?

To avoid P2P lending scams, you should always conduct your own due diligence before investing. We did this work for you — and here’s what we found:

Who Leads the Team?

Nibble’s CEO is Marina Smirnykh, also employed at IT Smart Finance. She previously worked for major Russian banks such as Home Credit Bank and Sberbank. Since 2014, she has led Joymoney, a lender active in the Russian consumer loan market.

Who Owns the Platform?

Nibble was founded by Maxim Pashchenko. Information about him is limited, beyond his connection to Joymoney and IT Smart Finance.

We contacted Nibble for clarification regarding the shareholder structure, but received no response.

Are There Any Suspicious Terms and Conditions?

If the safety of your investments matters to you — and it should — you must take a close look at Nibble’s terms and conditions.

Limitation of Warranties

Nibble states that it is not liable for any information presented on its website.

This is not the first — and unfortunately not the last — P2P platform to include such a clause.

This is extremely dangerous. It leaves you with no legal protection if things go wrong.

If Nibble provides incorrect information and you lose money as a result, the platform accepts no responsibility.

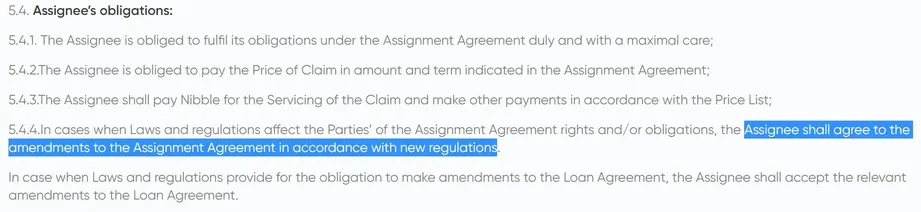

Clause 5.4 — Your Obligations

If applicable law or regulation requires changes to Nibble’s terms, you must accept them.

Nibble is not a regulated business, so this clause could be used at any time — and you would have no protection.

Missing Information

Nibble’s terms and conditions are incomplete. Key information is missing:

- No details on how investor funds are safeguarded

- No clear explanation of how contract changes are communicated

- No templates or examples of individual loan agreements

Usability

When it comes to usability, Nibble offers nothing better than what is already available elsewhere — and in many cases, it performs worse.

Investing on Nibble

Nibble uses the same approach as Robocash: manual investing is not possible, and all investments must be made through Auto Invest.

For platforms where the loan originator is part of the same holding group, limiting manual investments can make sense — but not in this case.

Auto Invest is common in payday-loan investing, but Nibble’s version offers no real value.

Nibble’s Auto Invest

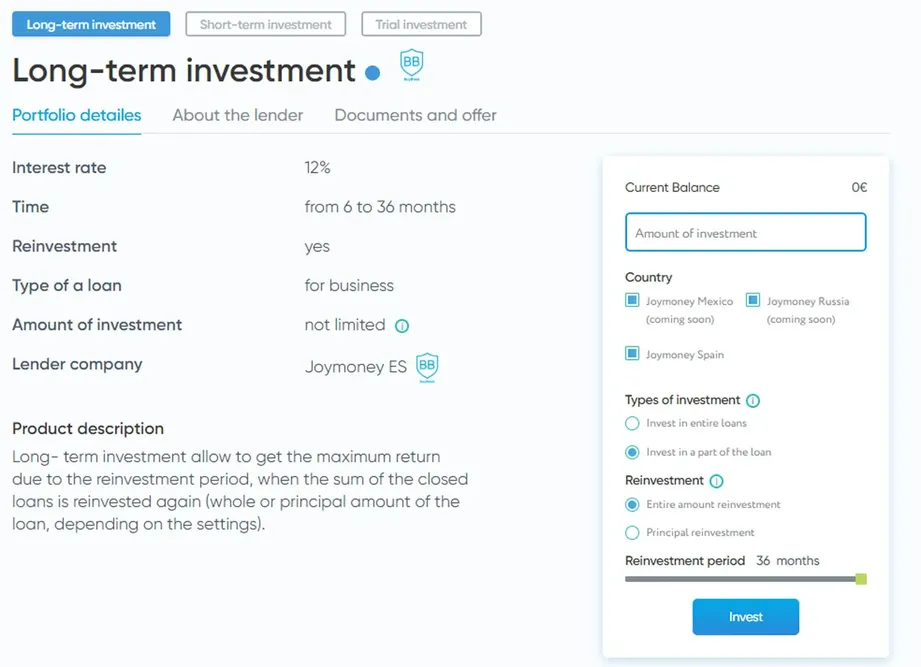

Nibble offers three Auto Invest “strategies”:

- Long-term investment

- Short-term investment

- Trial investment

In reality, they are identical: all three invest in 30-day payday loans. The only difference is whether your repayments are reinvested.

In the P2P industry, “long-term investments” usually refer to consumer loans, car loans, business loans, or real estate loans with 12–36 month durations. Calling 30-day loans a long-term product is misleading.

Loan Description and Settings

Nibble’s loan descriptions lack meaningful information. Payday loans are incorrectly labeled as “business” loans.

The line “amount of investment = not limited” adds no real value.

Under the “About the lender” tab, you would expect financial data — but instead you only find a generic note about the buyback guarantee.

The “Documents and offer” tab takes you to the user terms, not the actual assignment agreement.

Even more confusing: the Auto Invest settings include loan originators that are not even available on the platform.

You should never invest in lenders that are not presented on the website and do not publish financial reports — the risk is far too high.

The platform also fails to explain why you must choose between investing in the full loan or just a part of it.

Nibble’s Auto Invest is not something you should feel comfortable using.

How Fast Can You Cash Out?

Wondering how quickly you can withdraw money from Nibble?

Most of your portfolio should become liquid within 30 days, which corresponds to the maximum loan term.

This period may extend if you invest in 90-day loans.

In theory, liquidity on Nibble is higher than on real-estate platforms or P2B platforms.

Support

Nibble’s support adds little value. If you are new to P2P lending, we strongly recommend avoiding this platform, as the information presented is inconsistent and often misleading.

Nibble Review Summary

Nibble did not pass our due diligence checks, and we cannot recommend it. We identified several major red flags that you should take seriously.

Main takeaways from our Nibble review:

- Misleading information on the platform

- Customer support offers no value

- Numerous grammatical and translation errors

- Key elements missing in the terms and conditions

If you are looking to start with P2P lending, there are many more established and safer platforms that offer stronger protection and a far better user experience.

Looking for an alternative?

Compare Platforms