MyConstant Overview

MyConstant was a P2P lending platform that offered investments in crypto-backed loans. On November 17th, 2022, the platform disabled withdrawals. MyConstant claimed that your investments were secured by collateral or a buyback guarantee which isn't true. Some users speculate that MyConsant and its custodian, PrimeTrust will be brought to court for fraud and embezzlement. We could not confirm this information.

Potential Fraud - Submit Your Complain

If you are an affected user of MyConstant, you can submit your complaint to the Financial Institution Division in your state or the U.S., the Office of the Attorney General or the Department of Homeland Security.

Continue reading our assessment of MyConstant before the platform default.

MyConstant Referral Scheme

MyConstant did not offer any bonuses for new investors; however, it paid a hefty commission to promote this crypto-backed P2P platform. This enabled the company to create a positive buzz around its brand.

If you prefer to invest on a more transparent platform, head to our cashback bonus section on P2P Empire to grab your P2P lending bonus for new investors.

Risk and Return

Investing in P2P loans is always risky, especially when the platform fails to address basic due diligence questions.

First, you should know that MyConstant is not a bank, deposit account, or regulated financial institution.

While the P2P lending site claims that overcollateralized assets protect your money, there’s no guarantee that you will receive any interest or money back after you deposit funds.

So now, you know what kind of returns you can expect. Let’s look at the risk factors.

On Constant, you don’t have access to any borrower data. You know the borrower must deposit its crypto assets to get a loan. There’s no credit scoring of borrowers. However, borrowing is backed by 200% collateral. If the borrower defaults, the collateral is sold to pay your investment back.

It’s a very similar setup to P2P crypto lending sites like Nexo or Coinloan. All websites promote a “savings account” as an investment product, which is misleading.

P2P lending cannot be compared with savings accounts backed by bank deposit schemes as an asset class. Constant is an unregulated provider that allows you to invest in loans.

What Does MyConstant Insurance Cover?

The platform offers the MyConstant guarantee. While the platform quickly lets the investor know that this is not an insurance policy covering your funds, it provides some user protection.

The MyConstant guarantee is a fund made up of cash and crypto stored across hot and cold wallets and worth $10 million.

It is set aside to repay investors in the case of theft or loss of your cryptocurrency, stablecoins, or USD while in MyConstant’s custody or third parties related to MyConstant.

Whether this insurance is of any real value is questionable. Users of MyConstant should not rely on it.

How Does MyConstant Make Money?

MyConstant lends investors funds to collateralized borrowers, liquidity pools, and decentralized exchanges. In return, the platform accumulates interest which it passes on to its investors.

You should know that MyConstant does engage in rehypothecation.

Is MyConstant Regulated?

MyConstant clearly states on its website that it is not a regulated entity. This means that neither the platform, government, nor a third party will help you recover your funds if the company was hacked or disappeared overnight in a Ponzi scheme.

Technically, the platform could run away with your money, leaving you empty-handed. Cryptocurrencies can also be volatile, and there is a chance the market could crash.

How Is MyConstant Secured?

MyConstant uses Prime Trust as its custodial partner, an accredited US financial institution. It specializes in being a cryptocurrency and fiat custodian. Prime Trust holds all USD in multiple bank accounts and has an indemnity limit of $100 million.

On the other hand, Assets are stored in cold wallets, again through Prime Trust or within a web wallet on a dedicated server that only the CEO and CFO can access. This helps to protect your funds from inside theft.

MyConstant also uses 2FA to protect users from fraud but doesn’t use whitelisted addresses. Whitelisting helps protect users by allowing them only to withdraw funds to addresses they’ve previously listed as safe.

Your Return On MyConstant

MyConstant offers the following four products:

- A MyConstant account with 4% APR, unlimited and free withdrawals, and compounded interest every second without a minimum deposit - in this case, you invest in crypto-backed loans originated by Constant.

- A direct investment account with an APR of up to 7%, a minimum deposit of $50 and an investment period of 30, 90, or 180 days. Crypto-assets back all loans, and you will earn between 6% and 7% APR, depending on the loan term.

- An MCT investment account with 12% APR which pays out between 8% and 12% APR based on how long you invest your MCT. There are options to invest for 30, 90, or 180 days and support the MyConstant blockchain network.

- A crypto investment account with APR of 12.5%. Instead of investing in USD, you are funding loans with your cryptocurrencies. You can lend in13 different digital currencies, including BTC, USDC, and USDT. Users can get the best returns from lending USDT and USDC, which both have rates of 12.5%.

It’s worth noting that MyConstant will convert your USD funds into USD-backed stablecoins, which are then lent to borrowers. The borrower can then convert this into fiat currency and withdraw the money.

It’s important to consider fees when talking about returns on a platform. High prices can eat into your profit, reducing your overall returns.

The platform is transparent about its costs, and there is no one size fits all approach to charging for withdrawals.

It is free to withdraw fiat and users can expect their money in 3-5 business days. Tether and USDT are charged based on the network. The cheapest network is BSC which charges 0.60 USD and the most expensive is ETH, for which the charge is 10 USD. For all other networks, there is a flat fee of 1 USD.

The platform charges fees for late payments, and for borrowing. The borrowing fee is 3.5%.

Is MyConstant Safe?

MyConstant lacks transparency about its team.

Who leads The Team?

MyConstant is led by the CEO and co-founder, Zon Chu. Zon has a history in social networking and e-commerce, working in several roles, including full-stack development and project management. He worked for companies in both the U.S and Vietnam before co-founding MyConstant.

Crunchbase tells us that the company has 51-100 employees, and the core team is introduced on the website's about page.

There was no information about Zon Chu or his leading team anywhere on the website, which was a red flag.

Where is MyConstant based?

MyConstant’s headquarters are in Riverside California, at 21800 Opportunity Way, Riverside, CA 92518, USA.

The platform also has satellite offices in South East Asia, although we could not gain more exact information.

Are there Any Suspicious Terms and Conditions?

As with any P2P lending site, we advise you to read and understand the terms and conditions. You should be looking at how the platform stores your funds, their liabilities, and rules regarding amendments within the terms and conditions.

Storing your Funds

According to MyConstant, your funds are stored at Prime Trust LLC, which is a licensed custodian.

That’s a more secure approach as MyConstant is not licensed by the authorities to store digital assets.

Be aware, however, that as soon as you choose a dedicated savings product on the platform, your funds will be lent to borrowers so they aren't protected by the custodian anymore.

Liability

Constant is not responsible for any losses you might suffer from investing on the platform.

This is a standard clause that all crypto lending sites use. Therefore, you should take claims like “fixed return” or “safe investments” with a grain of salt. There are no guarantees that you will receive your money back.

Amendments to T&C

MyConstant may amend the terms and conditions at any point in time without prior notice.

This puts you in a disadvantageous position.

Rehypothecation

The platform can use your funds for rehypothecation.

Do you have access to individual assignment agreements?

We are unaware of any way to access individual assignment agreements. You are investing in a black box and hoping that Constant will deliver on its promises.

Potential Red Flags

- T&C can be changed at any time

- Platform uses rehypothecation

- Potential fraud

Our Opinion of MyConstant

Anyone with some experience in P2P lending and doing their due diligence will conclude that investing on Constant's risk and return ratio is not worth it even though crypto-collateral backs your investments. Other P2P platforms offer more for European investors and even investors from the U.S. who want to invest in P2P loans.

You can easily earn 10% APR by investing in a real-estate-backed P2P lending site like EstateGuru. A great way to start investing is PeerBerry, where you don’t need to spend hours trying to find out who’s behind the platform.

From an investor’s perspective, MyConstant offers nothing special besides referral commissions for publishers.

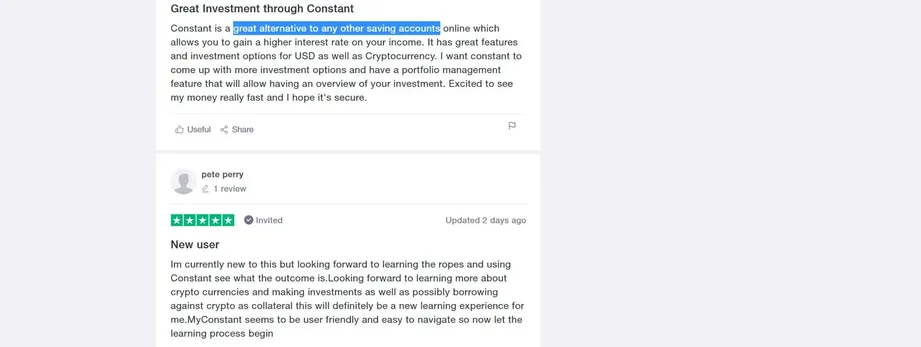

Although MyConstant has a TrustPilot review rating of 4.5*, when reading through the Trustpilot reviews about Constant, you will get the impression that they were written by someone with no prior experience with investing.

Most of the 5* reviews about the platform came from users who had only registered one review and had no profile picture, which increases the chance of fake reviews. This also decreases trust in the platform.

We are left with the same impression when watching some of the testimonials on Constant’s YouTube channel.

Be aware that several depositors reported major issues when withdrawing their assets. This is a huge red flag as it increases the risk of a Ponzi scheme 🚩.

Other platforms also offer more cryptocurrencies for users to earn interest on, whereas you can only earn on 13 crypto coins with MyConstant, including its own token.

How Fast Can You Withdraw Your Money?

As Myconstant has disabled withdrawals, users can't access their funds.

Customer Support

If you have any questions, you can email MyConstant’s support at hello@myconstant.com. A help section also addresses many FAQs and a live chat option on the website. Unusually, MyConstant has a public channel where you can see what issues others are contacting the platform for and a private channel.

Given the current situation, users should not expect feedback or support from MyConstant.

MyConstant Review Summary

MyConstant’s lack of transparency is a cause for concern. Several U.S.-based agencies are currently investigating the platform.

Main takeaways from our Constant review:

- The platform acquires investors through referrals

- MyConstant lacks transparency

- MyConstant is not regulated

- T&C can be changed without prior notice

After our in-depth review, we cannot give MyConstant a positive recommendation. Instead, we suggest you look at more established crypto lending platforms.

Keen to try out other alternatives?

Compare Platforms