Capitalia Review Summary

Capitalia is one of Europe's most transparent peer-to-business platforms. The business model is comprehensive, and the risk assessment transparency is beyond anything other platforms offer.

If you are willing to invest a higher minimum amount per project, Capitalia is undoubtedly a suitable option.

Main Takeaways From Our Capitalia Review:

- Professional P2B platform

- Very low loan loss rate of just 0.07%

- Suitable for experienced investors

- Excellent functionality and support

Suppose you want to invest in sustainable business projects vetted by an experienced and professional lending company with no conflict of interest. In that case, Capitalia is the platform you should be using.

Ready to invest on Capitalia?

What Is Capitalia?

Capitalia is a regulated peer-to-business platform from Latvia. The company specializes in granting business loans to vetted companies in the Baltics. The platform provides regular performance-oriented statistics and quarterly financial reports so you can easily evaluate the financial situation and portfolio quality.

Read our Capitalia review to learn more about how to earn an average of 12.32% interest on Capitalia.

Pros

- One of the most transparent platforms

- Proven track record

- Investments in vetted companies

Cons

- Lower liquidity

- No regular interest payments

- Less user-friendly investment interface

Our Opinion of Capitalia?

Capitalia stands out as one of Europe's most professional peer-to-business platforms, excelling in both transparency and communication. Unlike many other platforms, Capitalia provides in-depth insights into its risk assessment process, giving investors a clearer understanding of the risks involved. This thorough approach is reflected in its impressive loan book performance, with a low capital loss rate of just 1.18%.

The platform's terms and conditions are fair, and Capitalia refrains from using misleading marketing tactics—something that is all too common among its competitors. Its commitment to clear, professional communication helps investors make informed decisions.

For those who value transparency and are willing to invest larger amounts, Capitalia is an excellent choice that prioritizes investor trust and thorough risk management.

Requirements

As a regulated platform, Capitalia has to follow strict AML regulations; hence, the investment opportunities are currently available only for investors who fulfill the following requirements:

- Be over 18 years old

- Own a bank account in the EU/EEA

- Submit two separate identification documents

- Upload a bank statement

- Pass the suitability test

No EUR bank account? No problem

- 💳

- 💳

After you have registered on the platform and submitted all the required documents, you will be able to top up your e-wallet from Lemonway and invest in loans. If you decide to invest in loans manually, you can do so for only €200 per loan. To activate the auto-invest feature, you must invest at least €1000.

Risk & Return

Evaluating the risk and return ratio for peer-to-business platforms is typically complex due to the lack of information that most P2B platforms provide.

However, this isn't the case with Capitalia, as the platform offers investors all the data required to make an educated investment decision. In addition, the platform is very transparent about its business model, which cannot be said about other players in the industry.

According to Capitalia, investors' net return ranges from 6% annually for the safest loans covered by the EIF guarantee and Capitalia's buyback obligation to up to 18% for the projects carrying the highest potential risks. On average, investors earn 12.23% per year, with an annual loan loss rate of 0.92%.

Capitalia’s Business Model

Capitalia offers a wide range of financial services for businesses, including loans, equity financing, company valuations, consulting, and the acquisitions and sales of companies.

Retail investors can invest directly into loans, which is the most profitable business segment for Capitalia.

Financing for small and medium enterprises

Capitalia is focusing on issuing underbanked SMEs that meet the following criteria.

Requirements:

- Min. 12 months operation, on average - four years

- Min. €10,000 turnover per month, average annual income €500,000

- Tax debt cannot exceed one month’s turnover

Business loans

Capitalia's loans are often used to improve cash flow, cover one-off expenses, refurbish the premises, or grow turnover.

Here is additional information about the characteristics of loans you can fund through Capitalia.

- From €10,000 to €2M

- Up to €50,000 without collateral

- Loan period between 3 and 36 months

- Amortization or bullet loans

- The interest is between 6% and 18% per year

Securities

As a critically thinking investor, you should constantly evaluate the securities that come with a business loan. Here are some statistics that give you an idea about how your investment in loans on Capitalia is secured.

- ½ is backed by collateral

- Personal guarantees back 99% of loans

- 5 out of 467 loans were issued without any securities

It’s worth mentioning that the approval rate is currently between 25% and 28% of all monthly applications.

In addition to the securities discussed above, some projects are backed by the European Investment Fund.

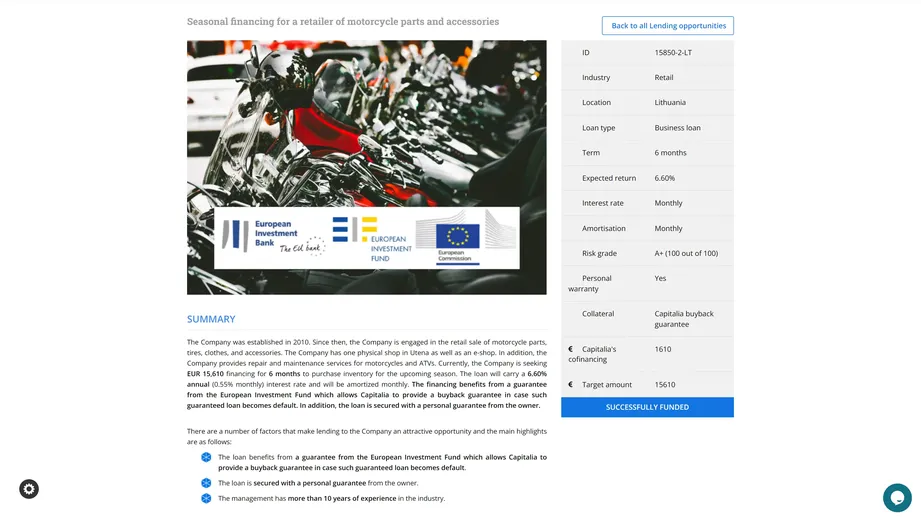

Buyback Guarantee by the European Investment Fund (EIF)

Here are some of the characteristics of loans that the EU backs:

- Microloans of up to €25,000

- Loan term from 3 to 60 months

This segment of loans offers a reduced interest rate and no collateral requirements. The EIF and a personal guarantee from the owner back the loans.

Requirements for borrowers to benefit from the EIF guarantee:

- A private or public limited company registered and operating in Lithuania, Latvia or Estonia

- Up to 9 employees

- Annual turnover or balance sheet is not larger than €2M

- The company does not work in any restricted sectors, such as the production of tobacco and alcoholic beverages, gambling, production and trade in weapons and ammunition, and other unethical business ventures.

- The company is not subject to insolvency proceedings

EIF Guarantee Explained:

Loans secured by the buyback guarantee will be repurchased from Capitalia after 30 days when the loan has changed its status to default. The buyback guarantee covers 100% of the loan principal and accrued interest of 90 days.

The EIF guarantees to repay Capitalia 80% of the loan principal and unpaid interest of up to 90 days. Capitalia covers any losses from the remaining unrecovered part of the principal amount.

How does Capitalia make money?

Every investor should understand how the P2B platform is making money.

Fees for borrowers:

- Business loans: 1-5% from the loan amount (min. €200); repeat customers get a 10% discount

- Invoice purchasing: 0.6% - 1.5% from the amount, min. €20

- Venture capital: 3% to 5% of the financing amount

- Early repayment fee

- Registration of pledge

- Fee for amendments in loan terms

- Fee for changes in mortgage agreements etc.

- Fees for valuation reports

Additional Stats:

- 84% of the clients are repeat customers

- €100,000 average loan amount

- 14 months average loan term

Risk Evaluation

Investments on Capitalia are suitable for more experienced investors who can evaluate borrowers' financial data and the operational aspects of their businesses.

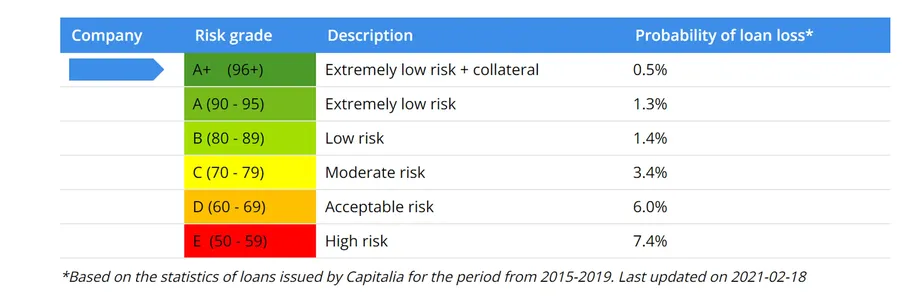

The platform evaluates more than 50 data points related to the risk of a business loan and categorizes every loan into various risk categories that directly impact the default rate.

The initial risk evaluation is essential to calculating the borrower's credit risk. A crucial part of every business loan is monitoring the borrower's financial performance.

Such monitoring measures include, among other things, controlling tax payment discipline, credit history, changes in official management, and official registration information.

Capitalia also informs investors that the company does not provide financing to any businesses with a conflict of interest with any employees or shareholders at Capitalia.

On top of that, Capitalia is disclosing the fees and commissions earned from every business loan to the investors, increasing the platform's transparency.

Risk of Default

Remember that while Capitalia applies vigorous credit risk assessments and monitors loan performance, there is always a chance that the loan will default, causing the investors to suffer a financial loss.

There are multiple risks, such as Market risk, Operational risk, Credit risk, Collateral risk, and Liquidity risk, which impact the performance of a business and, by extension, the performance of the loan itself.

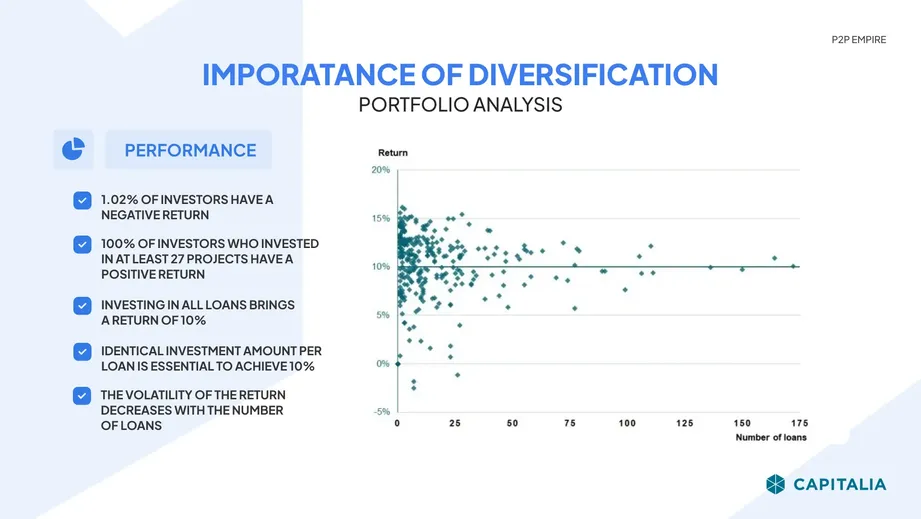

You can minimize all the risk by investing in at least 25 loans with the same investment amount.

Investors who spread their capital across various loans and risk classes achieved a return of more than 10% annually.

Is Capitalia Safe?

The risk disclosures and information related to evaluating the borrowers that Capitalia shares are beyond what most similar platforms provide.

Let’s look at the company's management and the terms and conditions to which you agree as an investor.

Who runs the company?

Juris Grišins and his 13 colleagues run the platform. Juris is very approachable. We interviewed him in 2021, when the company left the Mintos marketplace to launch its peer-to-business platform.

Capitalia is also following corporate governance standards by the NASDAQ Baltic stock exchange, which means that there is a supervisory board with three council members, Mārtiņš Krūtainis, Andrejs Strods, and Peeter Piho.

The company is owned by Juris Grišins 83% (founder and CEO) as well as other company employees.

How is Capitalia funded?

The company is primarily self-funded. Currently, Capitalia has three active bond issuances. The rest of the loan book is funded through smaller and larger investors.

Are there any suspicious Terms and Conditions?

When conducting your due diligence, you must review the terms and conditions to be fully aware of your rights and obligations.

Loan Agreement

Capitalia gives you access to individual loan agreements, which increases the trust towards Capitalia, as the likelihood of Capitalia listing “fake” loans decreases significantly.

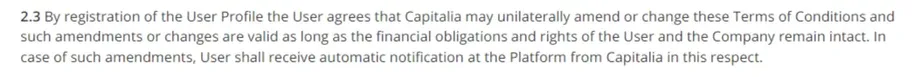

Amendments

The platform can amend the terms and conditions at any time, without prior notice, which is not beneficial to you.

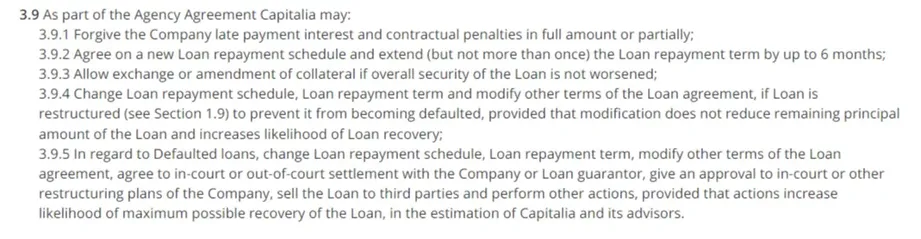

You should also be aware that Capitalia might change specific terms, if this helps to recover the loan faster.

This means that you should allow some flexibility regarding the repayment schedule. Remember that P2P lending is not a savings account.

Default Risk

Capitalia informs its investors that there is a chance that a loan cannot be recovered. This means that you bear the risk of default.

This is a standard clause that every platform uses to protect itself from potential complaints from investors.

Usability

When investing in loans, you want to use a user-friendly platform with straightforward and intuitive navigation.

Capitalia offers everything you need to manage your investments in business loans.

A fully functional auto invest is available, and you can download an account statement, making reporting your income to your tax authorities hassle-free.

Auto Invest

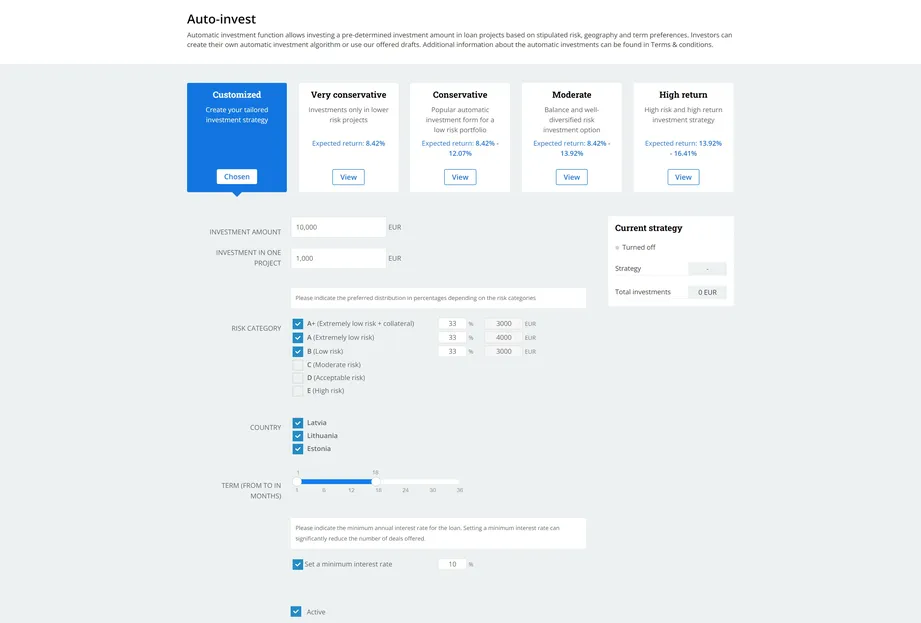

Capitalia’s auto-invest enables you to define your investment criteria or choose from predefined diversification settings.

You can choose between the following strategies:

- Conservative (Expected return 10.37%)

- Balanced (Expected return: 12.12%)

- High return (Expected return 14.26%)

You can also define your criteria. Capitalia suggests investing at least € 10,000, as the minimum investment is €1,000 per project.

To build a fully diversified portfolio with an average return of above 10%, we suggest allocating at least €25,000 and spreading the capital across various loans from different risk categories.

You can also define the share of loans within a risk category, a unique feature that most other Auto Invest tools don’t offer.

Remember that your strategy is directly linked to the “probability of loan loss,” which we highlighted in the risk assessment section. While loan issuance is growing, you should allow at least one or two months until your portfolio is well-diversified, unless you speed up this process by investing in the secondary market.

🧾Does Capitalia deduct taxes?

Capitalia doesn't deduct your taxes from your earnings. You can download an account statement and a tax report for the chosen period, which you can submit to your tax authorities when you file your taxes.

Liquidity

Liquidity is essential, especially in the peer-to-business loan segment. Most business loans are issued for a loan period between 12 and 36 months. This means you should be fine by committing your money for this time.

Secondary Market

Capitalia offers investors the option to sell their loans on the secondary market before the loan term ends.

This option increases the liquidity of your loan portfolio on Capitalia. On the other hand, you should be ready to pay a 2% secondary market fee if you decide to sell your loans.

Currently, Capitalia doesn’t support discounts or premiums for secondary market listings. The fee is also charged only to sellers, meaning you can buy loans on the secondary market for free.

Support

The customer support on Capitalia is very responsive and professional, which is a rarity in the P2B segment.

The level of professionalism is something we at P2P Empire appreciate a lot.

While there is a live chat option, we communicated via email with the platform, and the response time was always under 24 hours.

During our review process, we also had a call with the Chief Investment Officer, who answered our questions and objections without hesitation.